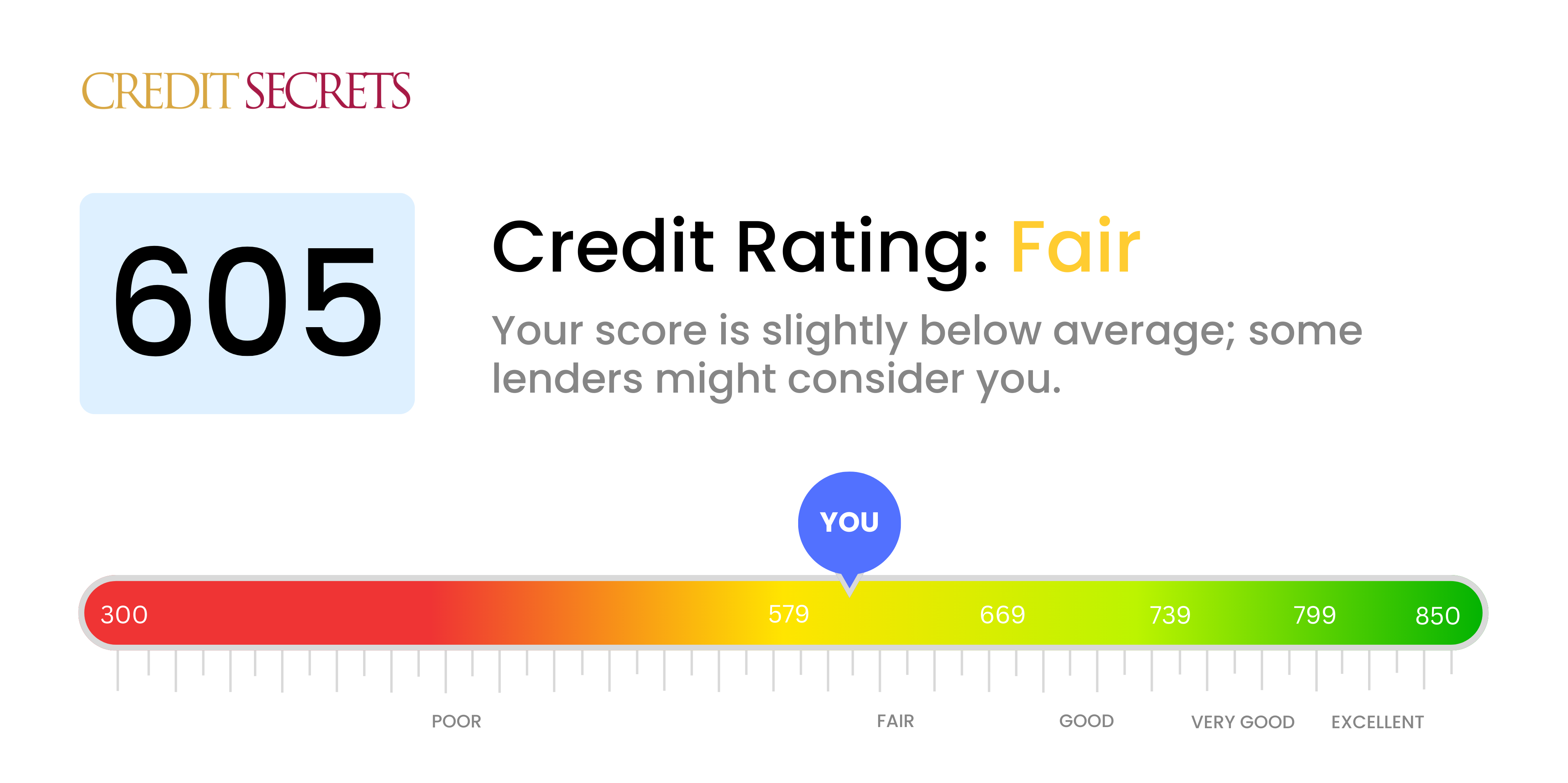

Is 605 a good credit score?

If your credit score stands at 605, it's considered in the 'Fair' category. Although this doesn't classify as a 'poor' score, it can make securing loans or credit agreements potentially more challenging, with higher interest rates often attached.

However, keep in mind that your situation is not bleak and there exist various manageable ways to uplift a 'fair' score. This includes maintaining your credit card balances low, making timely payments, and checking your credit report for errors. These helpful strategies can gradually boost your credit rating, making your financial journey smoother.

Can I Get a Mortgage with a 605 Credit Score?

With a credit score of 605, it may be challenging to secure mortgage approval. This is because most lenders typically look for credit scores that are at least in the 'good' range, which is generally defined as 670 or above. A score of 605 could indicate some past credit issues such as late payments or high credit card balances.

However, all hope is not lost. There are certain lenders who specialize in assisting people with lower credit scores. Though these loans may come with higher interest rates or stricter loan terms. The most important thing to remember is that credit scores are dynamic, they can and do change. Taking steps like timely payment of bills, reducing your debt load, and not applying for too much new credit can help improve your score over time.

Can I Get a Credit Card with a 605 Credit Score?

Having a credit score of 605 falls into the category of fair, and while not the highest, it certainly isn't the lowest. Lenders may see you as a moderate risk, meaning approval for a traditional credit card might still be within reach, but can come with some challenges. It's important to face this reality head-on and use it as motivation to strive towards financial growth.

Credit cards suited for this range typically include secured cards. These cards require a security deposit, which essentially becomes your credit limit. A starter credit card is another good option; even though these often come with high interest rates and low credit limits, they can be a stepping stone towards a higher credit score. There may not be the luxury of premium travel cards or cards with high limits at this stage. Still, with responsible use and timely payments, upgrading to better options becomes increasingly possible. Remember, the pursuit of a better credit score is a marathon, not a sprint.

A credit score of 605 falls under the category of "bad" or "subprime" in typical lending standards. Lenders perceive a score at this level as a bigger risk, which might make it more difficult for you to get approved for a personal loan. It's essential to realize that your credit score is an important factor in your financial life, but don't lose hope. There are still options available.

While traditional personal loans may be challenging to secure with a credit score of 605, consider looking into alternatives such as secured loans where collateral is involved, or co-signed loans where a trusted individual with a higher credit score co-signs the loan with you. Peer-to-peer lending can also be a useful choice, as these platforms can be more flexible concerning credit scores. Nevertheless, bear in mind that these options often entail higher interest rates and possibly stricter terms due to the increased risk to the lender.

Can I Get a Car Loan with a 605 Credit Score?

In the world of financial lending, a credit score of 605 can present some hurdles, especially when trying to secure a car loan. Most lenders prefer to see credit scores of 660 or higher for more favorable loan terms. A credit score below 600 is often categorized as subprime, signifying a higher level of risk to lenders based on past behavior. Your score, at 605, is fuzzily lingering between the subprime and acceptable borrowers' category, which could mean higher interest rates or potentially being denied a loan. This is due to lenders needing assurance that their investment will be repaid on time.

Nevertheless, don't let this deter you from exploring your options. There are financial institutions known for working with borrowers who have lower credit scores. It's worth noting though, that the interest rates they offer could be higher as a measure taken to mitigate the additional risk they are undertaking. Thus, even though there might be a few bumps along the way because of your 605 credit score, getting a car loan is not entirely off the table. Remember to examine every detail of the loan terms so you can map out a clear path to achieving your car-owning dream.

What Factors Most Impact a 605 Credit Score?

Understanding the factors shaping your credit score of 605 is vital for your financial improvement journey. By knowing and working on these, you can pave the way toward a stronger financial status.

Payment History

Your payment history greatly impacts your credit score. Any late payments or defaults may be affecting your score.

How to Check: Review your credit report for any inconsistencies in payment. Reflect on your past payment habits and try to keep them timely moving forward.

Level of Debt

Excessive debt could be dragging down your score. If your total debt is high, this might be a key factor in your credit score.

How to Check: Evaluate your financial statements. See if your debt level is high, work on managing your expenses to reduce it.

Credit Age

If you have a relatively young credit history, this fact could be influencing your score negatively.

How to Check: Review your credit report. Check the age of your newest and oldest accounts and the average age of all your accounts.

Type of Credit You Carry

The variety of credit types also contributes to your credit score. The lack of a diverse credit mix could be a drawback.

How to Check: Look at your credit report. You should ideally have a blend of credit cards, retail accounts, installment loans and perhaps even a mortgage.

Past Financial Records

Any past financial issues such as bankruptcy or tax liens may significantly affect your score.

How to Check: Review your credit report for any negative public records. Treat any items that need resolution promptly to avoid further damage to your credit score.

How Do I Improve my 605 Credit Score?

With a credit score of 605, you’re not in great shape, but don’t worry—you can turn it around. Here’s your plan of action:

1. Scrutinize Credit Reports

Errors on your credit reports can drag your score down. Ensure all information in your credit reports is correct. If not, dispute the inaccuracies with the respective credit bureau.

2. Settle Outstanding Debts

Start by taming your outstanding debt. Track down all the debt you owe and devise a plan to pay it off. Begin with the highest-interest debt first, while keeping up minimum payments on your other accounts.

3. Time Your Credit Applications

Too many credit inquiries in a short time can harm your score. Apply for new credit cards or loans only when necessary, and aim to keep hard inquiries to a minimum.

4. Create a Sustainable Budget

Building a realistic and manageable budget can help you avoid missed payments, keeping your score healthy. Ensure this budget also includes a savings plan for unforeseen expenses.

5. Build Your Credit Age

The longer you manage your credit responsibly, the better your score. Continue using your oldest credit card to keep the account active and lengthen your credit history.

Though it might seem daunting now, by following these steps, you can gradually improve your credit score and attain financial stability.