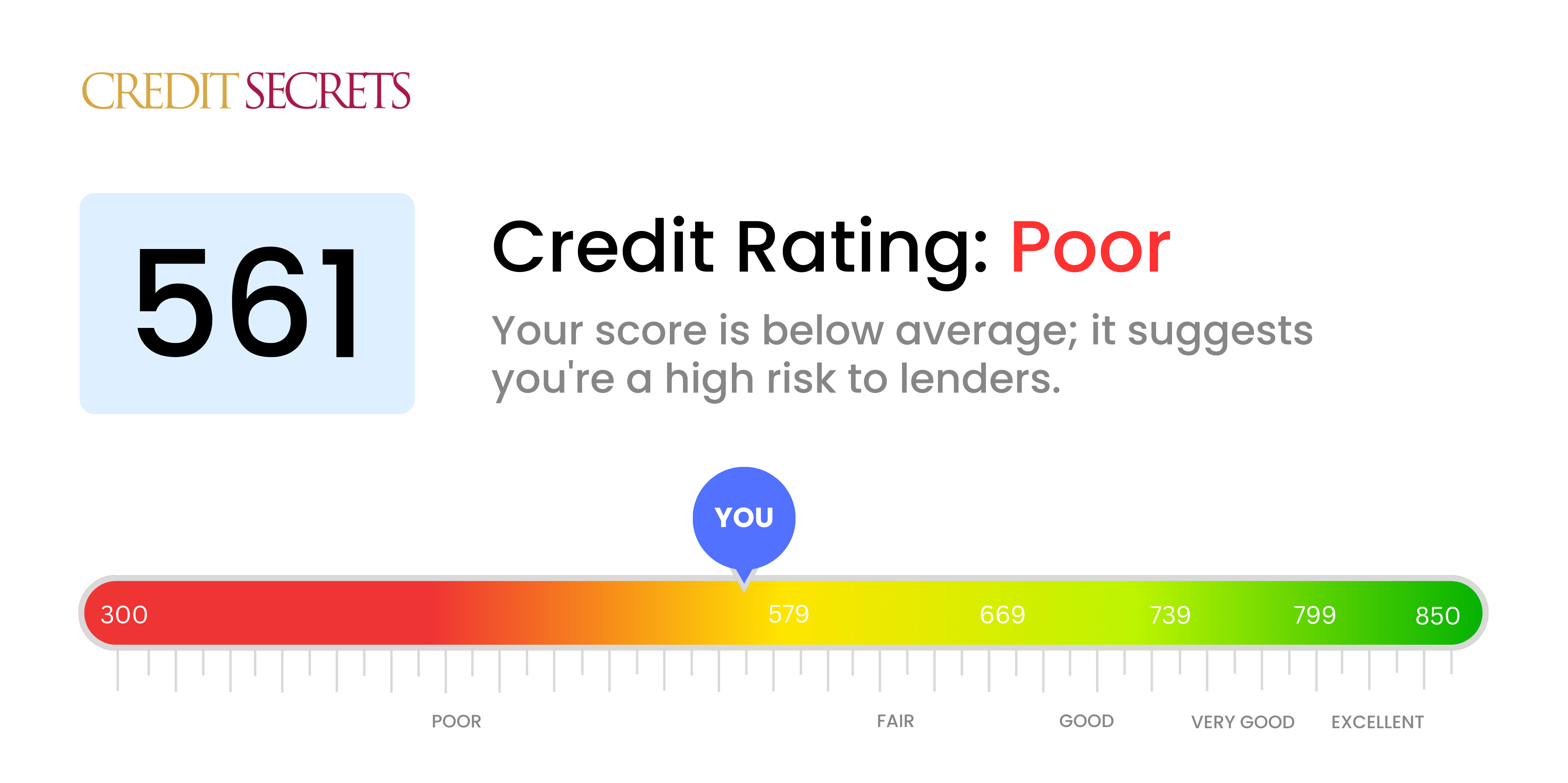

Is 561 a good credit score?

A credit score of 561 falls into the 'Poor' category, and it's understandably not where you'd like it to be. However, it's not the end of the world and there is room for improvement.

With a score like this, you may find getting approved for credit cards, loans and other forms of lending to be quite challenging. The interest rates on any credit you are approved for are likely to be higher, as lenders see you as a higher-risk borrower. However, this is simply a stepping stone to a better and brighter financial future.

You may have made some mistakes in the past, but remember that your credit score is not a reflection of your worth. It's simply a financial tool, and with the right steps and dedication, you can improve it over time. This score is not a life sentence – it's just a starting point.

Can I Get a Mortgage with a 561 Credit Score?

With a credit score of 561, I regret to inform you that it would be difficult for you to secure a mortgage approval. This score is significantly lower than what most lenders traditionally look for, which can indicate past financial issues, like defaulted loans or late payments. This may lead lenders to perceive you as a high-risk borrower.

In light of this, don't lose hope. There are alternative options. One possibility may be trying to secure a Federal Housing Administration (FHA) loan, as they often accept lower credit scores. Also, you could consider waiting and working towards enhancing your credit score. Remember, this will involve creating a consistent history of meeting repayments promptly and using your credit responsibly. Keep in mind that this is a long-term process, but every step in the right direction brings you closer to your financial goals.

Moreover, a low credit score not only affects your chances of getting approved. It can also cause you to attract higher interest rates if approved. This can add substantially to your costs over the life of the mortgage. Working to improve your credit score can help you secure better interest rates and save money in the long run.

Can I Get a Credit Card with a 561 Credit Score?

A credit score of 561 often poses considerable challenges when attempting to secure a credit card. This score suggests a history of financial difficulties. It's a hard pill to swallow, but confronting this is a necessary part of the journey towards better finances.

This lower-than-average score may lead to some doors being closed. However, alternative solutions do exist such as secured credit cards. Secured credit cards, which have credit limits equal to a deposit you make, can be a helpful stepping stone towards rebuilding your credit profile. Pre-paid debit cards or considering a trusted co-signer could also be an option. Remember that interest rates are typically higher for those with lower scores, as lenders see them as a higher risk. In your journey towards boosting your credit score, these options can be crucial tools, aiding in the creation of a stronger, more secure financial future.

Experiencing a credit score of 561 can make obtaining a personal loan quite difficult. Most traditional lenders see scores within this range as quite risky. With a credit score of 561, you may not likely receive approval for a loan through conventional means. It's hard, yes, but understanding what this credit score implicates for your borrowing potential is crucial.

Don't despair though, there are potential alternatives available. Secured loans, backed by an asset such as your car or home, are a possibility. Or, a co-signed loan, where a person with a higher credit score co-signs the loan, could also be an option. Even peer-to-peer lending platforms might be worth investigating as these often have more accommodating credit score requirements. Remember though, these types of loans can come with higher interest rates and less favorable terms, due to the increased risk for the lender.

Can I Get a Car Loan with a 561 Credit Score?

Holding a credit score of 561 presents some hurdles when looking to get approved for a car loan. Many lenders prefer a credit score above 660 to offer car loans with favorable terms. When your score dips below 600, it's often classed as subprime, which is where your score of 561 falls. Essentially, this could mean higher interest rates or even a declined loan application. The reason being is that lower credit scores signal higher risk to lenders, suggesting that there may be future difficulty in repaying the loan.

Nevertheless, remember that a lower credit score doesn't entirely eliminate the chance of acquiring a car loan. There are dealers who specialize in car loans for individuals with less than perfect credit, but proceed with caution. These types of agreements typically feature substantially higher interest rates. The increased rates compensate for the perceived risk by the lender and ensures their investment is protected. It might be a rocky journey finding a serviceable loan agreement, but through careful observation of the terms and conditions, a car loan is still achievable with a credit score of 561.

What Factors Most Impact a 561 Credit Score?

Recognizing the factors that influence a 561 credit score is an essential step towards better financial health. Understanding these factors can help guide you towards a brighter financial future. Each person's path towards financial growth is unique and presents its own set of lessons.

Payment History

One of the most critical influences on your score is your payment history. Late payments or defaults may be contributing to your score of 561.

How to Check: Scan your credit report for any late or missed payments. Consider if any late payments have potentially impacted your score.

Credit Usage

Utilizing too much of your available credit can detrimentally affect your score. If you have maxed out your credit cards, this could be a contributing reason.

How to Check: Examine your credit card statements. Are you frequently nearing or at your credit limits? Aim to keep your balances significantly below your limits.

Credit History Length

An abbreviated credit history can be a negative factor. People with newer credit histories often have lower scores.

How to Check: Investigate your credit report for the age of your longest-standing and newest accounts, as well as the average account age. Contemplate if any recent account openings could have impacted your score.

Variety of Credit and Recent Credit

Having a diverse mix of credit types can improve your score, as can responsibly handling new credit.

How to Check: Review your blend of credit accounts, such as credit cards, retail accounts, and loans. Reflect on whether you have been cautious when applying for new credit.

Public Records

Public records such as bankruptcies or tax liens can have a significant effect on your score.

How to Check: Peruse your credit report for any public records. Address any issues that might need resolving.

How Do I Improve my 561 Credit Score?

A credit score of 561 may seem daunting, but remember that improving your score is a journey comprised of small, manageable steps. For a score at this level, here are tailored, impactful actions you can immediately get started with:

1. Settle Overdue Debts

Sort out any lingering debts that are currently past due. These have a significant bearing on your credit score and clearing them will give your score an instant boost. Where necessary, don’t hesitate to engage your creditors to agree on a workable repayment plan.

2. Scale Down Credit Card Utilization

Credit utilization—the percentage of your credit limit that you actually use—is a key factor in your credit score. Strive to maintain your credit card balances below 30% of your available credit limit and eventually aim to keep it even lower, under 10%. Focus first on the cards with the highest utilization rates.

3. Investigate a Secured Credit Card

Applying for a regular credit card might prove challenging with your current score. Consider a secured credit card, which requires a collateral deposit acting as your credit limit. Use it responsibly to slowly build your credit over time.

4. Request to be an Authorized User

A trusted individual with a healthy credit score could help by adding you as an authorized user on their credit card. You’ll gain the benefit of their positive credit history. Make sure their card company reports authorized user activities.

5. Diversify Your Credit

After you’ve established a good track record with a secured card, consider other credit forms such as a retail credit card or a credit builder loan. This diversification can be viewed favorably by credit bureaus when done responsibly.

Remember, boosting your credit score is not a race, but a journey. Take one step at a time.