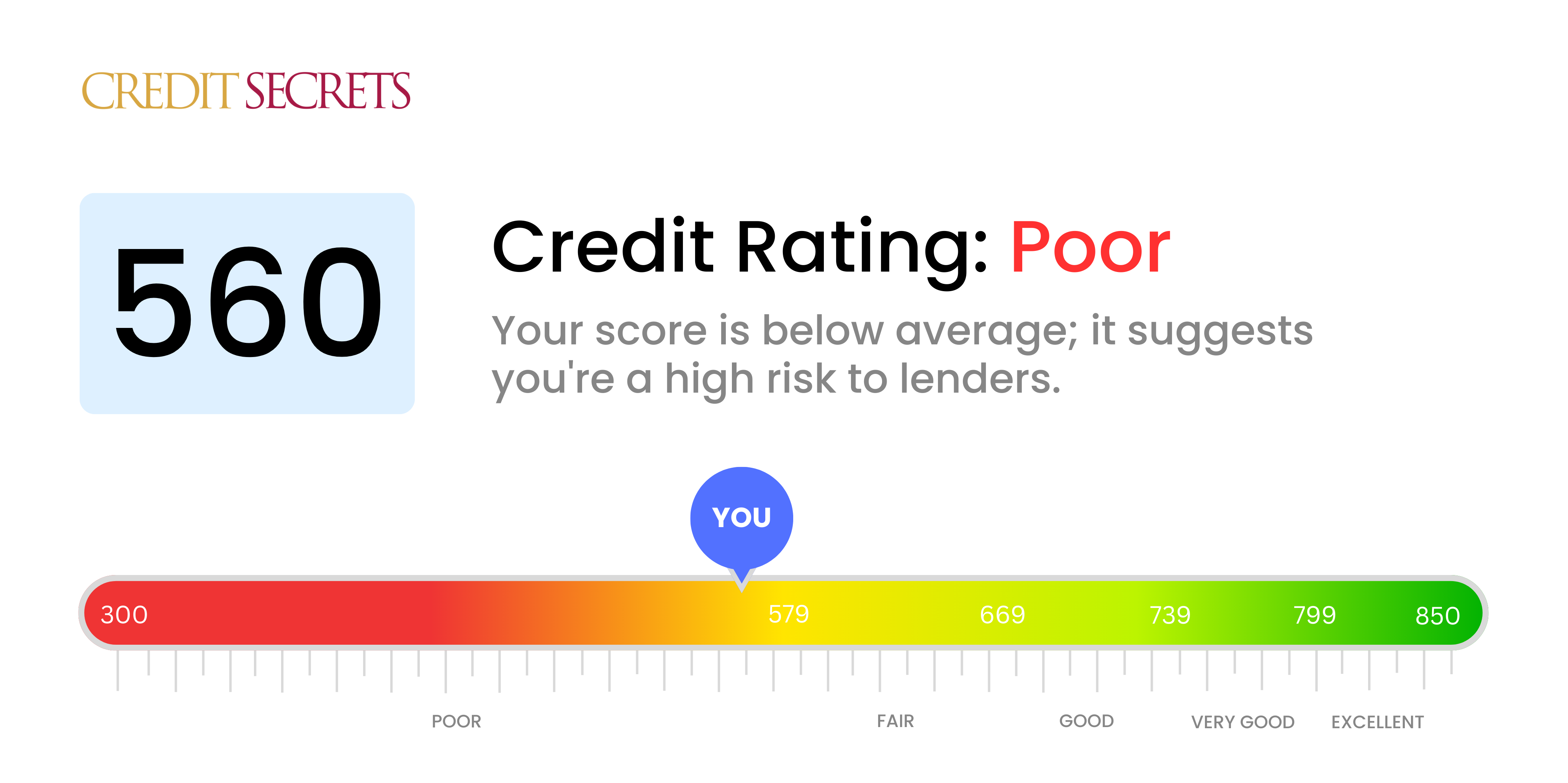

Is 560 a good credit score?

A credit score of 560 doesn't fall within the desired range, which means it is considered a poor credit score. This isn't the best news, but there's no need for despair, positive changes can be made to improve your score.

With a score of 560, you might face challenges like higher interest rates, difficulty in getting loan approvals and possibly even rejections from landlords. It's crucial to know that a poor credit score isn't permanent. By following responsible credit habits like paying bills on time, keeping credit balances low and regularly checking your credit reports for errors, you can take command and gradually increase your credit score. Remember, improving a credit score takes patience and consistency.

Can I Get a Mortgage with a 560 Credit Score?

With a score of 560, securing approval for a mortgage may prove difficult. This score is significantly below the threshold that most mortgage lenders typically require, suggesting past financial troubles such as delinquent payments or default on loans.

Although it may feel disheartening, it's important to note that there are alternate paths you can explore. If a conventional mortgage is not an option, you might consider options such as an FHA loan, which tends to have more lenient credit score requirements. However, keep in mind that such options might involve higher interest rates or require a larger down payment. It's crucial to be well-informed about the potential implications of these alternatives before taking any action.

While improving your credit score might require time and disciplined financial habits, remember that every step you take towards this endeavor can lead to more favorable financial opportunities in the future.

Can I Get a Credit Card with a 560 Credit Score?

With a credit score of 560, getting approval for a traditional credit card can be a tough task. This score is usually seen as a sign of risk by lenders, indicating a past with financial hardship or missteps. It's not a pleasant position to be in, but it's crucial to face reality with understanding and patience. Acknowledging your credit position is an important step towards financial recovery.

The challenges associated with a low score like 560 means alternatives may be more fitting for your situation. For instance, secured credit cards, that ask for a deposit as your credit limit, might make for an easier option. These cards can gradually help to rebuild your credit score. Considering having a co-signer or making use of pre-paid debit cards can be other good options. While these alternatives don't settle everything right away, they can be instrumental on the path to a better financial status. Regrettably, expect any available credit to come with significantly high interest rates due to the increased risk perceived by lenders.

With a credit score of 560, obtaining a personal loan might be difficult. Traditional lending institutions see this credit score as quite risky and it can, unfortunately, lead to your application being denied. While the situation is tough, it's essential to understand what this credit score means for your financial future.

Despite this, there could be other avenues for you to explore. Secured loans, where some form of collateral is used, may be a viable option. Another possibility could be co-signed loans, this is when someone with a higher credit score vouches for your ability to pay back the loan. Peer-to-peer lending is also an alternative, they sometimes offer loans even if you have a lower credit rating. However, be careful as these options typically have higher interest rates and strict terms due to the increased risk perceived by these alternative lenders. Please remember to research each option well to better understand the terms and conditions before proceeding.

Can I Get a Car Loan with a 560 Credit Score?

With a credit score of 560, securing a car loan may prove more difficult than for someone whose score is above 660, the figure lenders usually prefer. However, it is important to remember that having a score of 560, which falls in the subprime range, does not completely eliminate all possibilities. It simply means that the terms of any approved loans may not be as favorable, with potentially higher interest rates or stricter repayment schedules due to the increased risk to lenders.

It's not all doom and gloom, though. Some lenders do focus on helping those with lower credit scores obtain car loans. But beware, these loans can often come with much higher interest rates. This is a protective measure for lenders, due to the perceived higher risk. So, while the path to securing a car loan may not be completely smooth, there's a good chance you can still achieve your car buying goals with careful planning and thorough review of any loan terms.

What Factors Most Impact a 560 Credit Score?

Gaining insight into a score of 560 is vital for charting a course toward better financial health. Recognizing and addressing the factors that have led to this score can set the stage for stronger fiscal resilience. Remember, each financial journey is distinct, full of chances for growth and learning.

Payment History

Your payment history plays a significant role in determining your credit score. Any missed or late payments can detrimentally impact your score.

How to Check: Browse your credit report for missed or late payments. Contemplate any periods where you might have fallen behind on payments as these might have compromised your score.

Credit Utilization Ratio

Excessive credit utilization can cause a decline in your score. If you're frequently maxing out your credit cards, this is likely dragging your score down.

How to Check: Verify your credit card balances. Are they nearly maxed out? Strive to maintain a low balance relative to your limit for a positive influence on your score.

Account Age

A relatively short credit history can have a negative impact on your score.

How to Check: Check your credit report to understand the lifespan of your oldest and newest accounts and the average lifespan of all your accounts. Ponder whether you've opened new accounts recently.

Credit Diversity and Recent Credit

Holding a range of credit types and managing them responsibly is fundamental for maintaining a good score.

How to Check: Scrutinize your assortment of credit accounts. Do they include credit cards, retail accounts, installment loans, and mortgage loans? Also, think about whether you have been applying for new credit cautiously.

Derogatory Marks

Derogatory marks from events like foreclosures or tax liens, can have a profound impact on your score.

How to Check: Look at your credit report for any derogatory marks. Take action on any items that may need to be resolved.

How Do I Improve my 560 Credit Score?

With a credit score of 560, you’re in an unfavorable credit zone but don’t fret – there’s a path to improvement by following these accessible and impactful steps:

1. Prioritize Outstanding Debts

Unattended overdue accounts can drain your credit score. To begin rectifying the situation, make it a priority to settle these debts. Start with the most delinquent accounts and devise a payment plan with your creditors if required.

2. Curb Your Credit Utilization

Excessive credit card balances can harm your credit standing. Strive to limit your credit card usage to under 30% of your available credit limit, and ideally aim for less than 10%. Focus first on the cards with the highest utilization.

3. Consider a Secured Credit Card

With a low score, obtaining a standard credit card may be tough. A secured credit card is a good alternative. It requires a refundable deposit which becomes your line of credit. Used wisely, it can help restore your creditworthiness over time.

4. Seek Authorized User Status

Find a relative or friend with good credit willing to add you as an authorized user on their credit card. This can enhance your credit score by embedding their credit habits into your report. Make sure the card issuer reports authorized user activities.

5. Expand Your Credit Portfolio

Diversifying your credit sources can aid in building a better score. Once a solid history is established with a secured card, responsibly explore other credit options like credit builder loans or store credit cards.