Is 556 a good credit score?

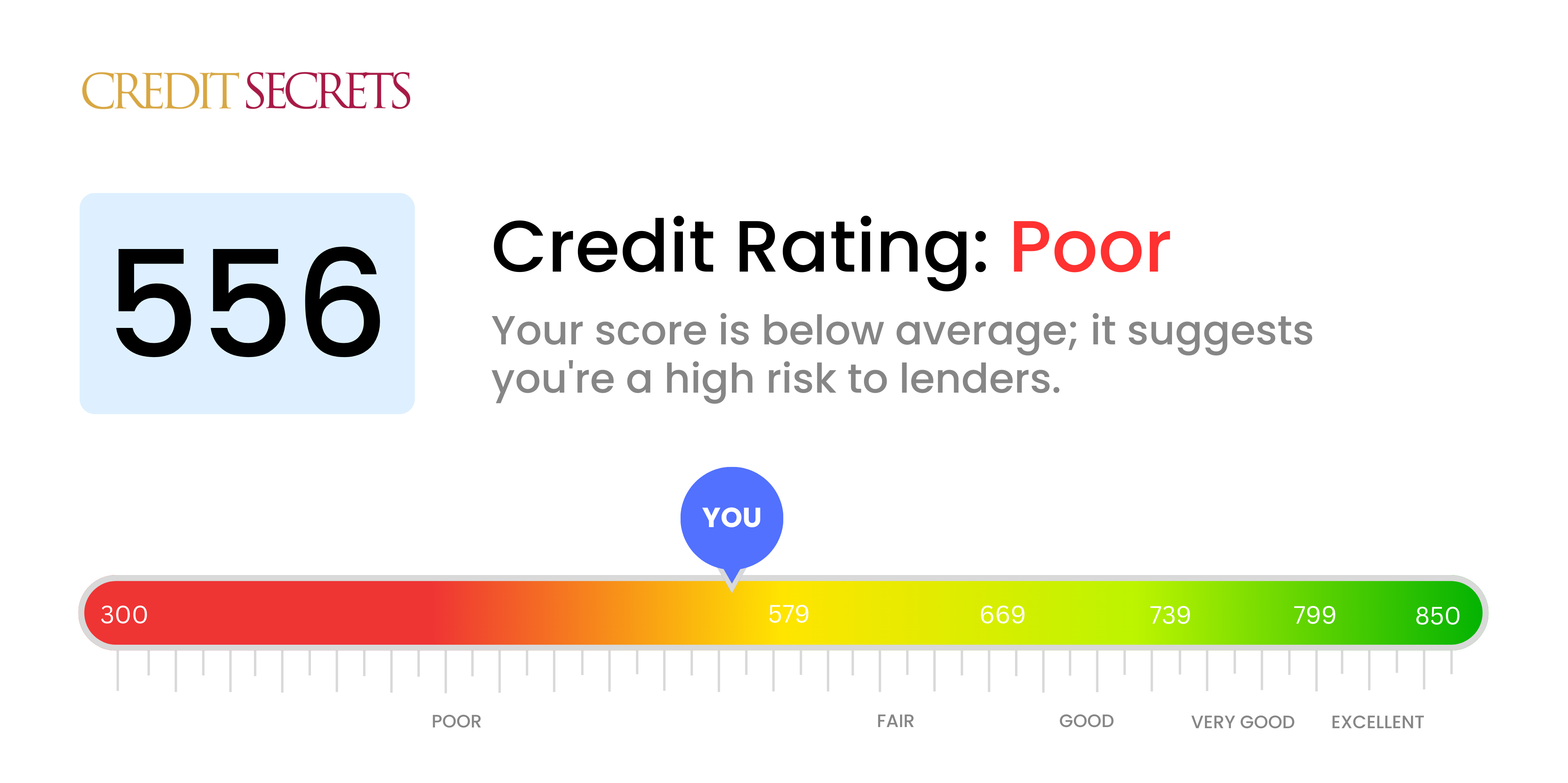

With a score of 556, you're currently situated in the 'Poor' credit range. It's an uphill situation, but don't dishearten. Improvement is truly within reach, and it's essential to remember that you're not alone in this journey.

Given your present financial performance, you could find it a bit challenging to get approval for loans or credit, and if you do, they might come with higher interest rates. Yet, with consistent effort and proper financial habits, such as timely payment of bills and reducing the amount of debt, your credit score has the potential to rise steadily. A higher score will gradually unlock better opportunities for you in the future.

Can I Get a Mortgage with a 556 Credit Score?

Can I Get a Credit Card with a 556 Credit Score?

With a credit score of 556, it can be challenging to be approved for a traditional credit card. Lenders often view this score as a sign of some previous financial difficulties or mismanagement. While this news may not be what you were hoping for, it's important to approach it with understanding and realism. Recognizing your current credit status is the first step towards rebuilding your financial health.

Given the difficulties associated with your score, it may be worth considering alternatives like secured credit cards. These cards require a deposit that acts as your credit limit, making them easier to obtain and aiding in the process of rebuilding credit over time. Another option to explore could be applying for a starter credit card designed for people looking to establish credit. These cards tend to have lower credit limits and higher interest rates, but they can be a stepping stone towards better opportunities in the future.

It's important to keep in mind that the interest rates on any credit card available to individuals with a score of 556 might be higher, reflecting the higher perceived risk to lenders. While the road to improving your credit may seem challenging, taking small steps and being diligent can bring positive changes to your financial future. Remember, you have the power to rebuild and improve your credit score over time.

A credit score of 556 is considered below average and falls into the subprime category. While it may be possible to get approved for a personal loan with this score, it will likely be challenging. Lenders view lower credit scores as a higher risk, which can lead to stricter borrowing terms and higher interest rates.

If you're seeking a personal loan, it's important to explore alternatives such as secured loans, where you offer collateral, or co-signed loans, where someone with stronger credit vouches for you. Additionally, there are online lending platforms that cater to individuals with less-than-perfect credit, but keep in mind that these options often come with higher interest rates.

Remember, improving your credit score over time will enhance your chances of being approved for better loans with more favorable terms. By using Credit Secrets, you'll gain valuable insights to bolster your credit profile, increasing your financial opportunities in the long run.

Can I Get a Car Loan with a 556 Credit Score?

What Factors Most Impact a 556 Credit Score?

Understanding a score of 556 is crucial for mapping out your journey toward financial improvement. Identifying and addressing the factors contributing to this score can pave the way for a healthier financial future. Remember, every financial journey is unique, filled with growth and learning opportunities.

Payment History

Payment history has a substantial impact on your credit score. If there are late payments or defaults, this could be a key contributing factor.

How to Check: Review your credit report for any late payments or defaults. Reflect on any instances of delayed payments, as these could have affected your score.

Credit Utilization

High credit utilization can negatively affect your score. If your credit cards are near their limits, this might be a contributing factor.

How to Check: Examine your credit card statements. Are the balances close to the limits? Aiming to keep balances low compared to the limit is beneficial.

Length of Credit History

A shorter credit history can influence your score negatively.

How to Check: Review your credit report to assess the age of your oldest and newest accounts and the average age of all your accounts. Consider whether you have recently opened new accounts.

Credit Mix and New Credit

Having a variety of credit types and managing new credit responsibly are essential for a good score.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Consider whether you have been applying for new credit sparingly.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score.

How to Check: Examine your credit report for any public records. Address any items listed that may need resolution.

How Do I Improve my 556 Credit Score?

A credit score of 556 is considered poor, but don’t worry, there are targeted steps you can take to improve it. Here are the most impactful and accessible strategies for your current score:

1. Address Past-Due Accounts

If you have any accounts that are past due, it’s essential to bring them current. Start by prioritizing the accounts that are the most overdue, as they have the biggest negative impact on your credit score. Reach out to your creditors and try to negotiate a payment plan if needed.

2. Reduce Credit Card Balances

High credit card balances compared to your credit limit can greatly impact your credit score. Aim to lower your credit card balances to below 30% of your credit limit, with a long-term goal of keeping them below 10%. Begin by paying down the cards with the highest utilization rates first.

3. Secured Credit Card

Given your current score, qualifying for a regular credit card might be challenging. Consider applying for a secured credit card, which requires a cash collateral deposit that acts as your credit line. Use it responsibly by making small purchases and paying off the balance in full each month to build a positive payment history.

4. Become an Authorized User

You can ask a family member or friend with good credit if they will add you as an authorized user on their credit card. This can improve your credit score by incorporating their positive payment history into your credit report. Just make sure the card issuer reports authorized user activity to the credit bureaus.

5. Diversify Your Credit Mix

Having a diverse mix of credit accounts can contribute to improving your credit score. Once you’ve established a good payment history with a secured card, consider exploring other types of credit, such as a credit builder loan or a retail credit card, and manage them responsibly.

Remember, improving your credit score takes time and consistency. Stay committed to these strategies, and you’ll be on your way to achieving your financial goals.