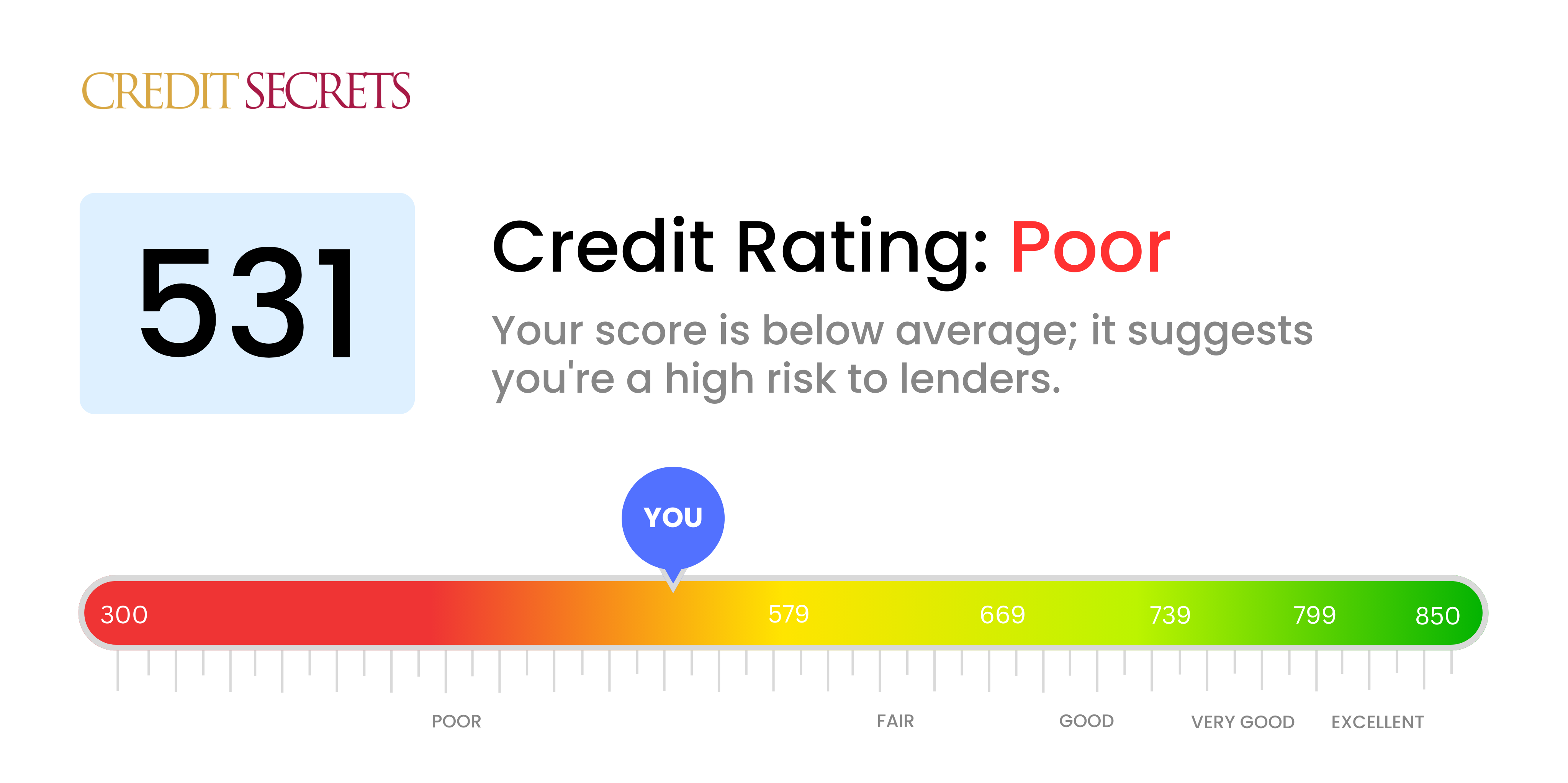

Is 531 a good credit score?

A credit score of 531 falls into the "Poor" category. This score may impact your ability to secure loans or credit, as lenders may perceive you as high risk.

However, there's always room for improvement. By taking responsible financial action, like paying bills on time and keeping low credit card balances, you can start to raise your score. Remember, improving one's credit score is a journey, not a sprint, and you have taken the first step by understanding your current score.

Can I Get a Mortgage with a 531 Credit Score?

With a credit score of 531, the prospect of mortgage approval unfortunately remains quite slim. Typically, lenders seek a minimum score of 620 for traditional mortgages, and even government-backed loans usually require a score of at least 580. Your score suggests that you may have encountered financial issues in the past, such as late payments or defaults.

While this may feel discouraging, it's important to know there are paths forward. The Federal Housing Administration (FHA) loan is an alternate route to homeownership for those with lower credit scores. It's specially designed for individuals who are working on improving their financial circumstances. Alternatively, you may also explore the idea of adding a creditworthy co-signer to your mortgage application. Keep in mind, however, that loans obtained in this way may come with higher interest rates due to the perceived lending risk.

Can I Get a Credit Card with a 531 Credit Score?

With a credit score of 531, qualifying for a standard credit card can be quite difficult. Lenders often see this score as a signal of high risk, indicating a past filled with various financial challenges. This may seem disheartening, but acknowledging and understanding your credit status is an integral part of gaining control over your financial life. Making peace with these realities, although perhaps uncomfortable, is the first stride towards a more stable financial future.

Given the hurdles that a low score brings, you may want to consider other options such as secured credit cards. These cards require a deposit that becomes your credit limit, making them more accessible for those striving to build credit. Other potential alternatives could include finding a co-signer or opting for prepaid debit cards. While these alternatives may not provide an instant credit improvement, they can serve as beneficial stepping stones on your journey towards financial stability. Please keep in mind, though, any forms of credit that are offered to individuals with this score range typically come with considerably higher interest rates, telling of the increased risk seen by lenders.

Having a credit score of 531 commonly indicates a higher risk to potential lenders. Unfortunately, with a score in this range, it's less likely that a traditional lender would approve your application for a personal loan. This score signifies an unfortunate history with credit, and it suggests the possibility of future difficulties in paying back a loan. It's tough, but it's essential to recognize what this credit score means for your financial options.

However, that doesn't mean all doors are shut. There are alternatives to consider such as secured loans, where you offer an asset as collateral, or co-signed loans, where someone with a higher credit score can act as your guarantor. Platforms for peer-to-peer lending may also be an option, as they can have more relaxed credit score criteria. Do bear in mind though, these types of loans often involve higher interest rates and terms that may not be as flexible, as they need to take into account the increased uncertainty for the lender.

Can I Get a Car Loan with a 531 Credit Score?

A credit score of 531 might place a few obstacles on your path towards getting a car loan approval. Fraud prevention agencies generally prefer credit scores above 660 when considering approving loans. With 531, the credit score falls into the subprime category which is typically below 600. This score could suggest to lenders that you may face challenges making consistent loan repayments, thus increasing their risk.

Yet, your credit score doesn’t entirely lock the doors of possibility for you. There are certain lenders who are willing to work with individuals with lower scores, but these loans often come with much higher interest rates. Higher interest rates are the lender's way of balancing the perceived risk, and ensuring they protect their investment. It may be a tougher journey, but with thoughtful planning, good understanding of the terms, and patience, the goal of securing a car loan is achievable.

What Factors Most Impact a 531 Credit Score?

Grasping the intricacies of a 531 credit score is an important first step on your financial health journey. Understanding what's significantly impacting your score will help you to chart a path towards improvement. Your financial journey is individual and presents countless possibilities for growth.

Late Payment Record

One of the major influences on your credit score is your payment history. Late repayments or any evidence of non-payment might be the key source of your current score.

How to Inspect: Carefully go through your credit report and check for any delayed or missed payments. Think of the times you may have postponed payment, as they might have impacted your score.

Amount Owed

If your credit utilization is high, it's likely to negatively impact your score. High balances on your credit cards relative to their limits could be a factor in your score.

How to Inspect: Check your recent credit card statements. Are you nearing your limit? Striving to maintain lower balances can be beneficial.

Credit History

A relatively short credit history may have negative implications for your score.

How to Inspect: Go through your records and calculate the extended length of your credit history, considering both the oldest and newest accounts.

Credit Types

Having diversity in your credit records and managing it efficiently contributes to a healthy score.

How to Inspect: Assess the different types of credit you're handling – like credit cards, installment loans, and mortgage loans. Keep track of the new credit you apply for.

Public Records

Public records such as bankruptcies or tax liens could drastically affect your score.

How to Inspect: Evaluate your public records in your credit report and address any issues that require remediation ASAP.

How Do I Improve my 531 Credit Score?

With a credit score of 531, you’re on the cusp of credit improvement – everything you do now will be instrumental in raising your number. Let’s delve into the optimal maneuvers at this stage:

1. Settle Collection Accounts

Collection accounts have a substantial effect on your credit score. If you have any, resolving them promptly is essential. You might choose to negotiate a ‘pay for delete’ with the collection agency, where they remove the negative mark in exchange for payment.

2. Minimize Credit Utilization

Ensure your credit card balances stay below 30% of your credit limit. This shows lenders you can handle credit responsibly, and it brings a positive impact to your score. Work to repay those with the highest utilization rates first.

3. Consider a Secured Credit Card

Given your present score, getting approved for an unsecured card can be tough. A secured credit card can be a fit here – it needs a cash collateral deposit that becomes your credit line. Utilize it carefully, paying off the balance each month, and it’ll aid your score.

4. Inquiry for Authorized User Status

Approach a close person with good credit to add you as an authorized user on their card. This shares their positive credit activity with your report. Confirm first that the card provider reports authorized user actions to the credit bureaus.

5. Diversify Your Credit

Once your score starts to augment, broaden your credit profile with various types of accounts. Managing different types of credit responsibly – such as credit builder loans or store credit cards – can assist in lifting your credit score.