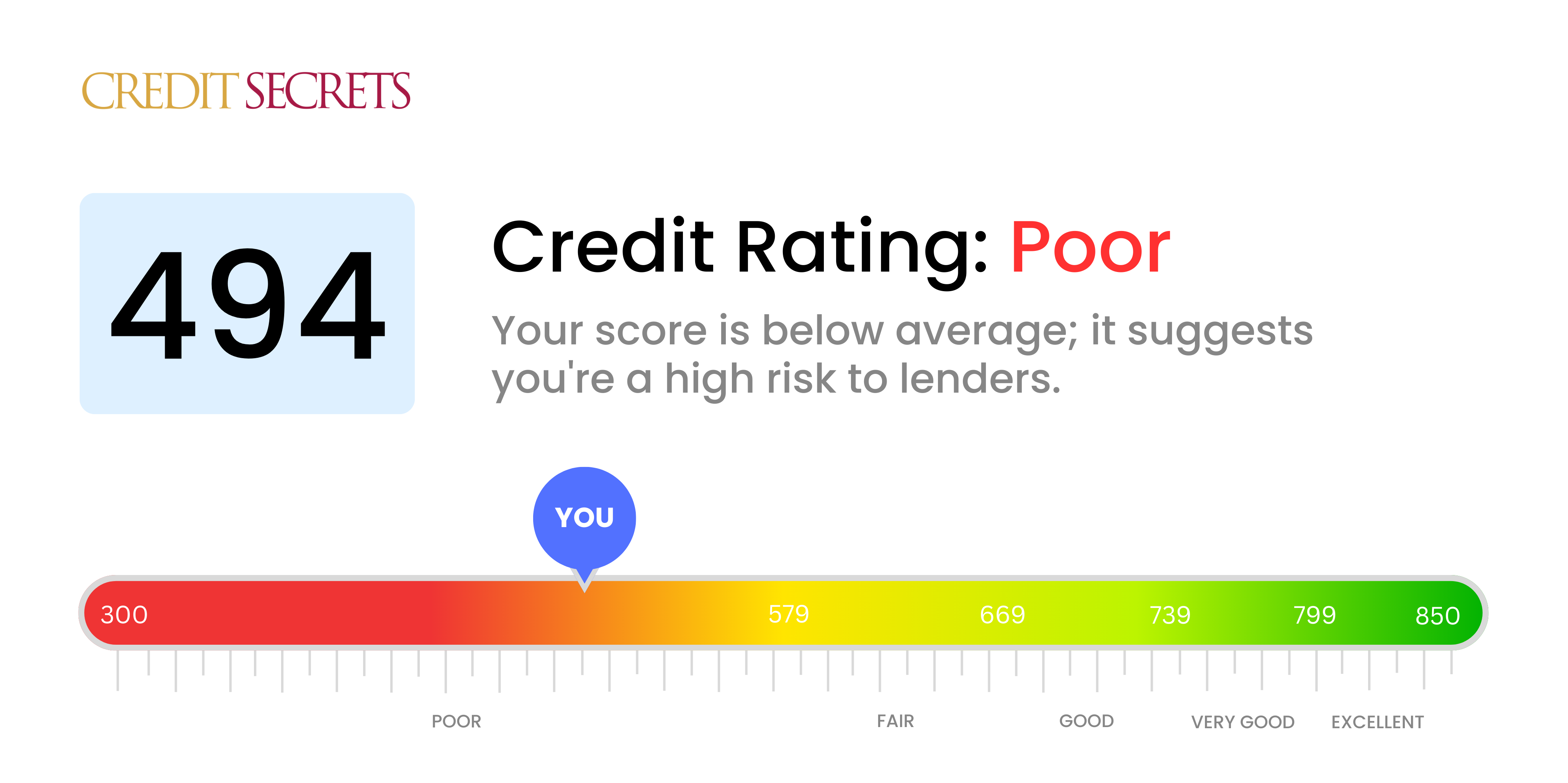

Is 494 a good credit score?

A score of 494 falls under the category of 'poor' on the credit score spectrum. This isn't an ideal situation, but don't lose hope; with time and consistent effort, it's definitely possible to improve this score.

The reality is that a score of 494 might make it challenging to obtain new credit or loans, as lenders may see you as a risky borrower. It may also mean higher interest rates on any loans or credit cards you do qualify for. However, remember that everyone's credit journey is different and this is just one step in yours.

Can I Get a Mortgage with a 494 Credit Score?

Assessing a credit score of 494, it's quite improbable for you to receive mortgage approval. This score is significantly below most mortgage lenders' minimum requirements and indicates a pattern of financial struggle. Your score signifies that there could be a history of missed payments, defaults, or other credit challenges.

Being in this situation is no doubt tough, but it's not the end. Start by addressing any due debts that are impacting your score negatively. Subsequently, you should strive to establish a steady stream of timely payments, coupled with sensible credit usage. This won't typically result in immediate enhancement of your score, however, gradual and consistent efforts can significantly improve your financial stance. Keep in mind that a higher credit score can lead to better interest rates and a wider selection of mortgage options. It might seem a long journey, but every step you take towards better credit health brings you closer to your goal.

Can I Get a Credit Card with a 494 Credit Score?

Regrettably, with a credit score of 494, it's unlikely you'll be approved for a standard credit card. Lenders may perceive this score as high-risk, suggesting past financial mishaps or struggles. This situation might be hard to accept, but transparency and realism are critical steps toward rebuilding. Recognizing your credit score is a pivotal part in your path to financial recovery.

To answer this challenge, you could consider options like secured credit cards. These cards call for a deposit which serves as your credit limit and are typically more accessible to those with lower scores. Additionally, you might contemplate involving a co-signer or opting for prepaid debit cards. It's important to remember that while these paths don’t quickly resolve the issue, they can be practical stepping stones on your way to financial sturdiness. Be mindful that any credit available to those with lower scores generally carries higher interest rates due to the increased risk to lenders. Nevertheless, each of these options could be worth exploring. Remember, difficulty today doesn't mean defeat tomorrow.

Having a credit score of 494 does present a challenge when you're applying for a personal loan. Unfortunately, this score falls well below what many lenders typically require for loan approval. A low score like this signals high risk and may make it unlikely to be approved for conventional personal loans. Remember, it's not a judgment of you but a measure of risk for the lender based on past financial data.

While the situation is tough, all is not lost. Alternatives do exist such as secured loans where you can use assets as collateral or co-signed loans with the help of an individual with stronger credit. Peer-to- peer lending platforms could also be an option as these often have more relaxed credit score requirements. Despite these opportunities, bear in mind that they carry higher interest rates and more stringent conditions due to the increased risk presented to the lender.

Can I Get a Car Loan with a 494 Credit Score?

Having a credit score of 494 may pose a few obstacles on the path to getting approved for a car loan. Ideally, lenders prefer scores that are over 660, and anything below 600 often falls into what they categorize as a subprime credit score. Regrettably, your credit score of 494 sits within this less favorable range. This could result in higher interest rates or even outright loan denial owing to the increased risk your score presents to lenders. This simply means that your past financial behavior suggests a potential difficulty in repaying the borrowed money.

Despite the challenges, it's important to keep in mind that a low credit score doesn't mean you can't obtain a car loan. There are lenders who focus on working with borrowers with less-than-stellar credit histories. However, loans from these types of lenders usually come with substantially higher interest rates as a strategy to balance out the risk. Always be sure to scrutinize all the terms and conditions before making a final decision. While it may be a bumpy ride, securing a car loan is definitely not off the table.

What Factors Most Impact a 494 Credit Score?

Grasping a credit score of 494 is a critical first step in achieving your financial goals. Your score is affected by certain key elements that we're poised to explore in order to help improve your credit health. This journey to financial improvement is unique to you, filled with opportunities to learn and grow.

Payment History

One of the largest influences on your score is your payment history, especially if it includes late or missed payments. These could significantly contribute to your current score.

How to Check: Analyze your credit report for any outstanding or overdue payments. Past instances of unpunctual payments could have played a role in your existing score.

Credit Utilization Rate

Your credit score may be impacted if you're utilizing a high proportion of your available credit. If your balances are close to your limits, this could be a significant factor.

How to Check: Look at your credit card statements. If your balances are nearing your credit limits, it’s important to work towards reducing them.

Length of Credit History

A credit history that’s brief can lower your score.

How to Check: Use your credit report to check the age of your credit accounts, the recent additions, and the average age overall. Recent, multiple credit applications could be impacting your score negatively.

Diversity of Credit

A balanced mix of credit types is beneficial for your score. Opening several new credit types in a short while can adversely impact it.

How to Check: Look at your types of credit such as credit cards and loans. Evaluate whether you have been applying for new credit regularly.

Derogatory Marks

Significant events like bankruptcies, foreclosures, or tax liens can drastically lower your score.

How to Check: Search your credit report for any of these events. Addressing these derogatory marks can help improve your score.

How Do I Improve my 494 Credit Score?

Having a credit score of 494 certainly presents challenges, but don’t worry, it’s not a life sentence. You can improve your score by following some simple steps tailored to your circumstances:

1. Settle Late Payments

Catching up on outstanding debt is crucial to improving your credit history and therefore your credit score. Contact your creditors and establish a feasible repayment plan to tackle your debts as soon as possible.

2. Minimize Credit Utilization

Your credit utilization, or the percentage of your available credit you’re using, has a significant impact on your credit score. Strive to maintain your utilization below 30% of your overall credit limit and even lower if possible.

3. Apply for a Secured Credit Card

With a credit score of 494, obtaining a traditional credit card may be challenging. Opt for a secured credit card, a type of card that requires a refundable deposit which sets your credit limit. Manage it prudently by making small purchases and repaying the balance in full each month.

4. Request to Become an Authorized User

Maybe a reliable friend or family member could add you as an authorized user on one of their credit cards. This method allows you to piggyback off their credit history, thus improving your credit score. But ensure that the credit card issuer will report authorized user activity to the credit bureaus.

5. Expand Your Credit Portfolio

Once you’re making steady progress, consider diversifying your credit profile with different types of credit. Responsibly managing various credit accounts including a credit builder loan or a department store card can demonstrate your financial stability and raise your credit score.