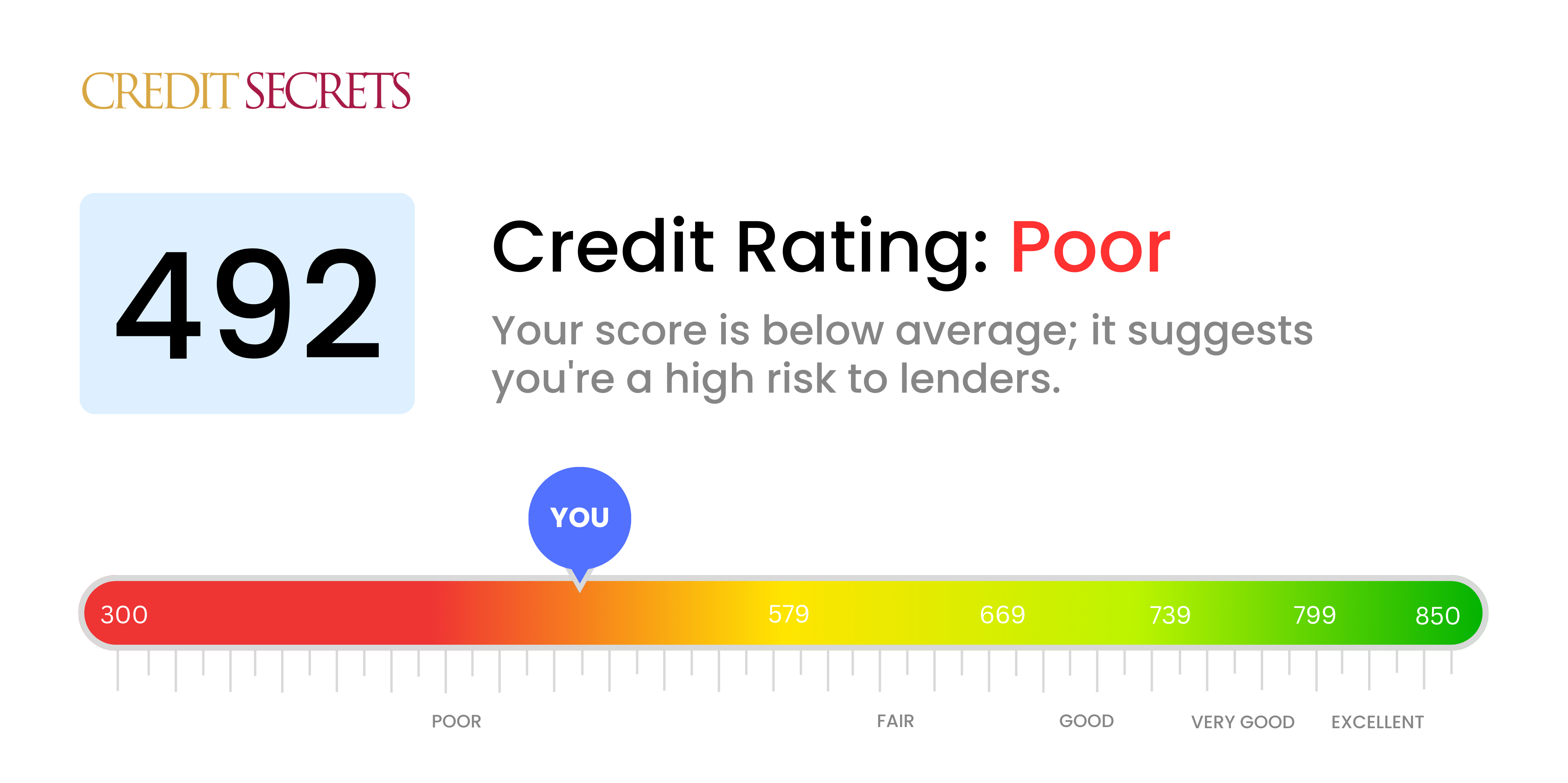

Is 492 a good credit score?

A credit score of 492 falls into the 'Poor' credit range. A score in this range could limit your options for credit cards and loans, might mean higher interest rates and could potentially impact job opportunities.

While this can seem challenging, it's not the end of the line. With diligent effort and the right steps, you can work towards improving your credit score and achieving your financial goals. Remember, your current credit score doesn't define you, but simply represents your financial decisions at this time. You can improve your financial future.

Can I Get a Mortgage with a 492 Credit Score?

With a credit score of 492, it's improbable you'll be offered approval for a mortgage. This score is significantly below what most lenders typically consider acceptable for approval. Such a credit score is indicative of severe financial issues, including defaults, late payments, or substantial debt.

Please know that while it's challenging to deal with a low score, there are practical steps you can take to begin mending your financial health. Start with addressing any overdue debt; these actions can improve your score over time. Establish a regular habit of prompt bill payments and responsible credit utilization. It will require persistence and patience, but each small progress will edge you closer to a better financial future. The journey towards a better credit score won't be overnight, but every small step will lead you towards a stronger financial standing and towards that mortgage approval that you seek.

Can I Get a Credit Card with a 492 Credit Score?

Having a 492 credit score may make getting a traditional credit card quite challenging. Typically, this score might be seen as high-risk by lenders, indicating a possible history of financial strain or missteps. Although this can be disheartening, acknowledging your credit situation is a crucial step towards achieving financial wellness, even if it means addressing some uncomfortable facts.

Considering the hurdles linked to such a low credit score, you might want to consider options like secured credit cards, which require a deposit that serves as your credit limit. Secured cards could be easier to get and can contribute to improving your credit over time. Other alternatives could include finding a co-signer or resorting to pre-paid debit cards. Keep in mind, while these alternatives don't provide an immediate solution, they can be effective in the long journey towards financial stability. Be aware, however, that interest rates on any type of credit for individuals with such scores are often quite high, echoing the high-risk perceived by lenders.

Having a credit score of 492 is indeed well below the preferred threshold for many traditional lenders. It may be difficult, but with this score, the probability of being granted a personal loan through conventional means is quite low. Your credit score depicts a high-risk scenario in the lender's view, which can make obtaining a loan a bit of a challenge. However, even amidst this hurdle, it is crucial to not lose hope and understand the full extent of what your credit score can mean for your borrowing capabilities.

When conventional personal loans seem out of reach, options such as secured loans, where you offer collateral, or co-signed loans, where another individual with a higher credit score guarantees your loan, might serve as viable alternatives. A less traditional route could be peer-to-peer lending platforms. Remember, however, these options may present a different set of challenges, such as higher interest rates and less accommodating terms, due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 492 Credit Score?

Securing a car loan with a credit score of 492 could be a difficult task. Generally, lenders prefer scores above 660 to provide positive loan terms and a score under 600 usually falls into the category considered less prime. With a credit score of 492, you are indeed in this less prime group. This could mean you face higher interest rates or possibly being declined outright. This is because lower credit scores are seen as a greater risk to lenders, as they suggest probably difficulties in repaying loans in the past.

But don't lose heart! A less-than-ideal credit score doesn't completely rule out the chance of getting a car loan. There are some lenders out there who specialize in loans for individuals with lower credit scores. However, tread cautiously, as these loans often come with higher interest rates as a way for lenders to protect their investment amidst the perceived risk. Despite the challenges, with careful planning and thoughtful research into loan terms, obtaining a car loan isn't an unreachable goal.

What Factors Most Impact a 492 Credit Score?

Navigating your path toward financial stability begins with comprehending a score of 492. By focusing on the factors that have influenced your score, you can generate a robust plan to elevate it. Your financial journey is personal and offers room for growth and learning.

Outstanding Debts

Outstanding debts can strongly influence your credit score. Consolidating or managing these could be a decisive move toward improving your score.

How to Check: Scrutinize your credit report for any outstanding debts. Acknowledge your circumstances and begin formulating a plan to pay off these debts systematically.

Credit Applications

Frequent credit applications can negatively impact your score. Avoid applying for new credit excessively.

How to Check: Review your recent credit inquiries. If you've applied for credit multiple times recently, this could explain your score.

Derogatory Marks

Derogatory marks, including bankruptcies, charge-offs, or tax liens might be a significant element pulling down your score.

How to Check: Look at your credit report for any derogatory marks. If there are any, make an effort to resolve these issues.

Payment Delays

Delays in making payments, particularly for credit cards, can be quite damaging to your credit score.

How to Check: Assess your payment history on your credit report. If there are late payments, try setting reminders or automatic payments for future bills.

Credit Use

Using large amounts of your available credit can harm your score. Try to keep your balance less than 30% of your credit limit.

How to Check: Check your credit card statements. If your balances are high in relation to their limit, it's advantageous to pay down your balances.

How Do I Improve my 492 Credit Score?

A credit score of 492 is doubtlessly low. However, don’t fret: You have the power to change this! With careful planning and precise actions, a better score is within your reach. Here are the most crucial steps for your specific situation:

1. Clear Outstanding Debts

Highly impacting your credit score is the presence of any outstanding debts. Swiftly addressing these should be at the top of your list. Prioritize resolving debts that have been due for the longest period. If the direct payment isn’t yet feasible, reach out to your lenders to set up achievable payment plans.

2. Curb Credit Utilization

Your credit utilization ratio – the percentage of your available credit you’re using – significantly influences your credit score. Aim to keep this ratio below 30%. To do this, focus on reducing the balance on cards where you’ve used up the maximum limit.

3. Get a Secured Credit Card

With your current score, a secured credit card could be a feasible option. This type of card requires a cash security deposit which typically doubles as your credit limit. Use this card wisely, paying off the balance completely every month to establish a history of prompt payments.

4. Seek Authorized User Status

Consider asking someone you trust with a healthy credit history to add you as an authorized user on their credit card. This is a way to incorporate their positive credit history into your own report, though ensure the card issuer reports authorized user activity to the credit bureaus.

5. Expand Your Credit Portfolio

Having a variety of different credit types can enhance your score over time, once you’ve obtained a good track record with a secured card. Experiment with responsible use of diverse credit options such as a retail card or a credit-builder loan.