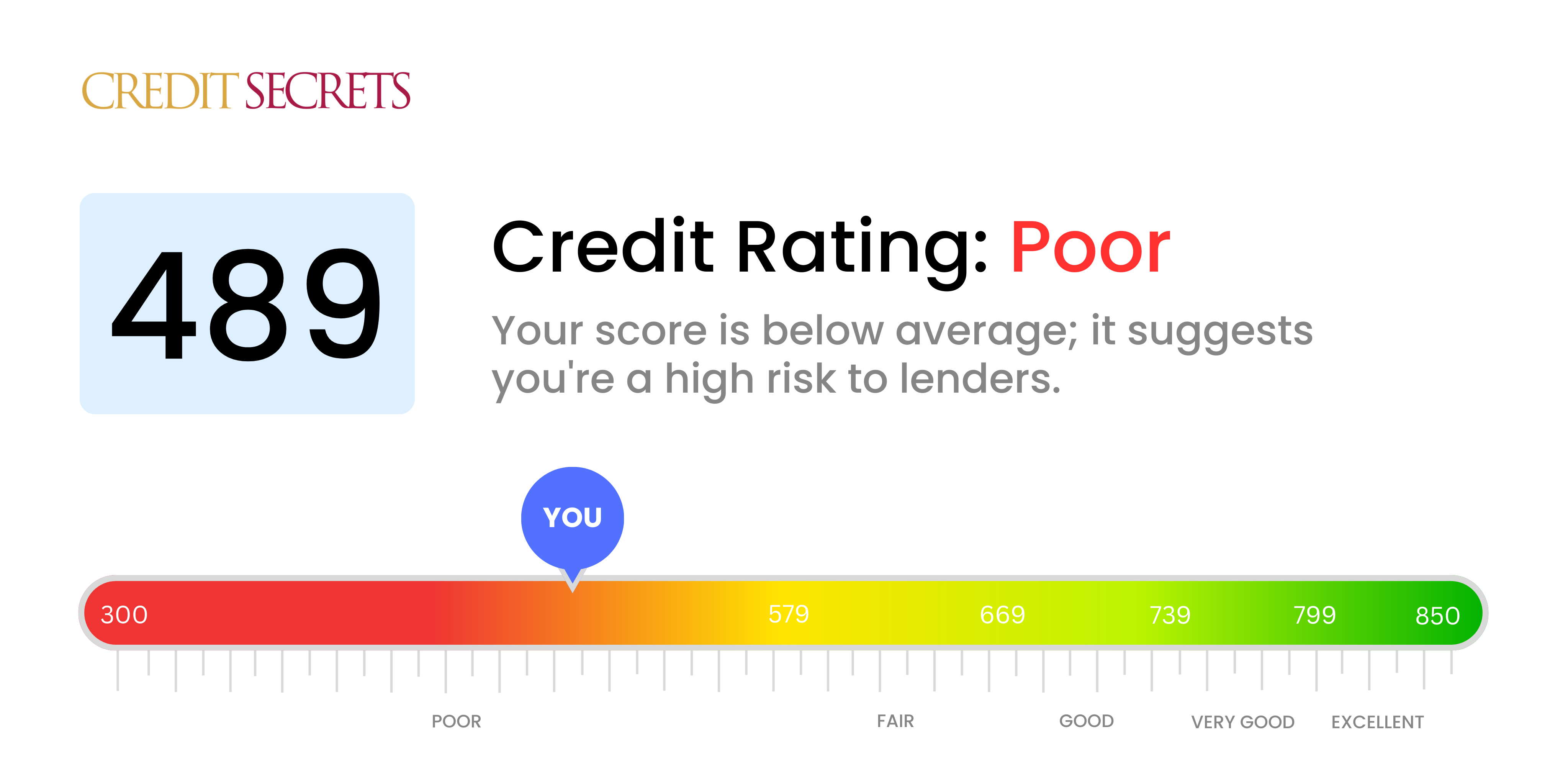

Is 489 a good credit score?

With a credit score of 489, you're unfortunately in the 'poor' credit range. This means you might face significant challenges when trying to get approved for new credit or loans, and you're typically subjected to higher interest rates and less favorable terms.

However, it's important to remember that it's entirely possible to improve your credit score. Steps like paying your bills on time, reducing your overall debt, and regularly checking your credit reports for errors can progressively help raise your score. You have the power to change your financial future.

Can I Get a Mortgage with a 489 Credit Score?

With a credit score of 489, it's important to clarify that securing a mortgage may be quite challenging. This is because this score is significantly lower than what most lenders typically require. A credit score in this range often implies past financial difficulties, such as unpaid bills or late payments.

In light of these circumstances, it might seem like a tough situation, but remember it's not the end of the road. You can start by addressing your outstanding debts and ensuring timely payments henceforth. Gradually, your credit score can improve, but it requires constant and diligent effort. While getting a mortgage may not be possible right away, certain alternatives might work. These can include waiting until your credit score improves, or exploring options like a federal-backed FHA loan, which has more lenient credit requirements. However, interest rates may be higher. Continue to monitor your credit and make responsible decisions that reflect positively on your score.

Can I Get a Credit Card with a 489 Credit Score?

With a credit score of 489, it may be quite challenging to secure approval for a traditional credit card. Lenders often perceive this as a high-risk score, indicative of past financial difficulties or lack of proper management, and this can indeed be disheartening. However, recognizing the state of your credit score brings you a step closer to financial recovery, even if it means acknowledging some unpleasant realities.

Considering such a low score, you might want to look into options like secured credit cards. These cards require a deposit which serves as your credit limit and can be comparatively easier to obtain. They also help in progressively rebuilding your credit. Other options could include getting someone to co-sign for you or exploring the concept of pre-paid debit cards. Please bear in mind that none of these alternatives offer overnight solutions, but they can serve as valuable aids in your journey towards financial stability. Lastly, be prepared for potentially higher interest rates, as this is often reflective of the heightened risk perceived by lenders.

Having a credit score of 489 means that it may be challenging for you to get approval for a traditional personal loan. Lenders view this score as a symbol of high risk, and it's important to understand that your borrowing prospects could be limited. Please know that even though this situation may seem tough, there are options out there for you.

While traditional personal loans might not be available, you could consider other alternatives. Options such as secured loans, which require collateral, or co-signed loans, where someone with a higher credit score co-signs, might be more viable. Another possibility is peer-to-peer lending platforms. These platforms can sometimes offer loans with more flexible credit requirements. However, remember that these alternatives usually come with higher interest rates and terms that might not be as favorable, due to the lender's increased risk. Stay optimistic, though, as these are potential paths to consider on your financial journey.

Can I Get a Car Loan with a 489 Credit Score?

Having a credit score of 489 understandably causes some worry when considering applying for a car loan. Approval for such loans typically requires a score above 660, and anything below 600 falls into a riskier subprime bracket. Your score of 489 is within this subprime realm, and this can affect the loan terms. Lenders might see it as a sign of potential difficulty in repaying the loan, leading to possible denial or much higher interest rates.

The reassuring news, though, is that this isn't necessarily a roadblock for your car buying aspirations. There are lenders out there who can accommodate people with lower credit scores. Just remember to be extra careful and comprehensive while going through the loan terms. Keep in mind that these types of loans typically have higher interest rates to compensate for the perceived risk. However, with thoughtful consideration, getting a car loan remains a viable option – it's just a matter of navigating the financial journey carefully.

What Factors Most Impact a 489 Credit Score?

Realizing the significance of a 489 credit score is important for your financial betterment. By understanding and addressing the factors affecting your score, you can start on the pathway to a healthier financial future. Bear in mind, every financial journey is unique with opportunities for growth and learning.

Late or Missed Payments

Missed or late payments greatly influence your credit score. This could be one of the main factors affecting your current score.

How to Check: Check your credit report for any defaults or late payments. Reflect on any instances where payments were delayed as these could be the culprits.

Credit Utilization Ratio

High credit balances compared to your limits can negatively impact your score. If your credit cards are almost maxed out, this might be a chief contributor.

How to Check: Review your credit card balances. Are they close to the credit limits? Strive to keep balances low to help improve your score.

Short Credit History

Having a shorter credit history can adversely affect your score.

How to Check: Examine your credit report to see how long your accounts have been active. If you have opened new accounts recently, this could be influencing your score negatively.

Types of Credit and New Credit Applications

Maintaining a good mix of credit types and applying for new credit sparingly is crucial for a better score.

How to Check: Look at your mix of credit accounts like credit cards, retail accounts, installment loans, and mortgage loans. Consider your recent credit applications – too many could lower your score.

Public Records

Public records such as bankruptcies and tax liens can severely hurt your score.

How to Check: Scrutinize your credit report for any public records. Handle any items that require resolution to help boost your score.

How Do I Improve my 489 Credit Score?

With a credit score of 489, you’re in a challenging spot, but it’s not impossible to move upward. Follow these targeted and effective strategies to enhance your credit score:

1. Back-Pedal on Late Payments

Focus on settling any outstanding payments. Late or missed payments can deeply harm your credit score. Contact your creditors and discuss a repayment plan that works for you.

2. Keep Credit Card Balances Low

Scoring models often look at the amount you owe compared to your available credit limit. Aim to keep your balances below 30% of your available credit. This signals that you can manage credit responsibly.

3. Apply for a Secured Credit Card

Your score might pose a challenge in getting a traditional credit card. A secured credit card, secured by a cash deposit, could be a good alternative. Using this card wisely helps demonstrate responsible credit behavior.

4. Join as an Authorized User

Find a trusted friend or family member willing to add you as an authorized user to their credit card. This could improve your score by adding their positive credit habits to your report. Make sure the card issuer reports to the credit bureaus.

5. Work on Credit Variety

Diversifying your credit types can improve your score. After proving responsible credit use with a secured card, consider carefully adding other forms such as a retail card or credit builder loan.