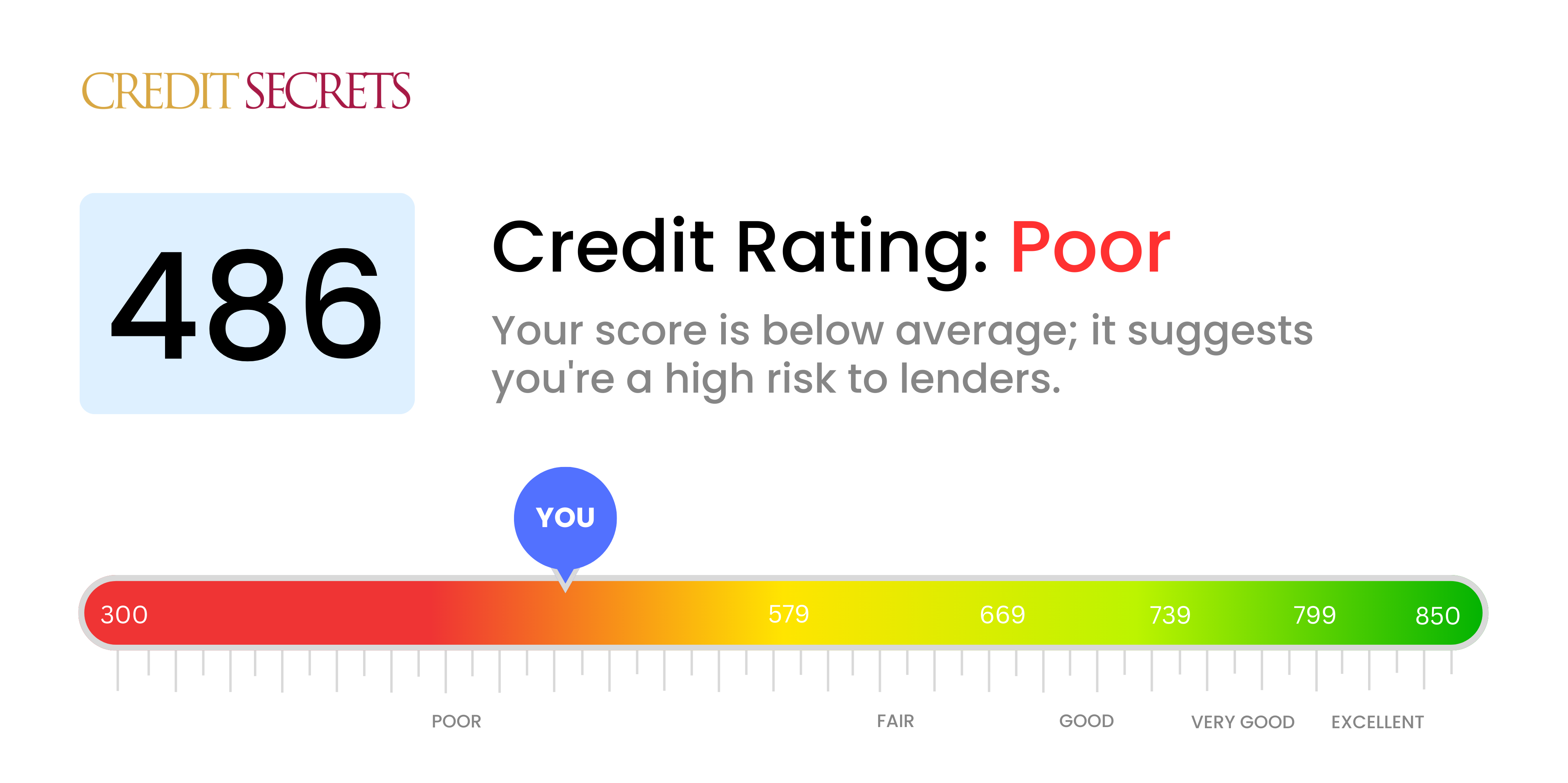

Is 486 a good credit score?

A credit score of 486 falls into the 'poor' category. It's not an ideal situation to be in, but don't lose hope - many have improved their scores from this point.

Getting credit approvals may prove challenging with a score of 486, as lenders consider it a risk to lend to individuals with such scores. You might face higher interest rates or stringent conditions on credit cards and loans. But remember, your financial journey isn't over. You have the power to take action, learn credit improvement strategies, and work towards a stronger financial future.

Can I Get a Mortgage with a 486 Credit Score?

If you possess a credit score of 486, securing approval for a mortgage may present a considerable challenge. This score falls below the range that most financial institutions require, translating to an unfavorable history of financial management such as delinquent payments or previous loan defaults. This can cause potential mortgage lenders to perceive you as a high-risk borrower.

Despite this, don't lose hope. Begin by addressing any existing debts or defaults that are adversely impacting your credit score. Demonstrating a pattern of regular and timely debt repayments can help you slowly but surely improve your credit standing. Although this may take time, each step towards a higher credit score will enhance your chances of acquiring a mortgage in the future. Remember, obtaining a mortgage isn't the only pathway to homeownership. Other potential alternatives like rent-to-own agreements could provide an avenue towards achieving your goals, even with a lower credit score.

Can I Get a Credit Card with a 486 Credit Score?

Holding a credit score of 486 puts you in a challenging situation when it comes to applying for a traditional credit card. This score is perceived as high-risk by lenders, suggesting a past filled with financial struggles or missteps. It's disappointing to be in this situation, but confronting it honestly is a crucial first step towards reclaiming financial stability. Accepting the reality of your current credit status is tough but necessary.

Your low score makes it tough to secure traditional credit, but you can still explore alternative options. Consider a secured credit card, for which you provide a deposit that acts as your credit limit. These cards can be easier to qualify for and can help rebuild your credit over time. Other potential options might include seeking a co-signer or using a pre-paid debit card. While these alternatives might not be ideal, they can be stepping stones towards improving your credit health. One important thing to keep in mind, though, is that any credit available to you in the meantime will likely come with higher interest rates due to your perceived risk level. Even so, with consistency and diligence, financial stability is within your reach.

With a credit score of 486, the likelihood of being approved for a traditional personal loan is rather slim. This score is quite low, falling below the range most lenders find acceptable. From a lender's standpoint, a score in this range suggests a high risk level and could deter them from approving a loan under standard conditions. While this predicament might seem overwhelming, it's crucial to be aware of what a credit score like this means for your lending possibilities.

You may need to explore alternative funding options. These might include secured loans, which require you to offer an asset as collateral, or co-signed loans, where a friend or family member with excellent credit acts as a guarantor. Another possibility is peer-to-peer lending platforms, which may have more relaxed credit criteria. However, remember that these alternatives often carry higher interest rates and stricter terms as the lenders need to offset their increased risk.

Can I Get a Car Loan with a 486 Credit Score?

It's essential to face the reality – a credit score of 486 will make getting approved for a car loan quite difficult. Lenders generally seek a credit score above 660 to offer favorable loan terms, and scores below 600 may be viewed as subprime. Your score of 486 is in the subprime range which can result in higher interest rates or even a loan denial. The reason behind this is that lenders consider a lower credit score as a sign of higher risk. Your past financial actions hint at potential challenges in repaying the loan amount.

Remember, a lower credit score isn't the end of your car buying pursuit. There are lenders who specialize in assisting individuals with less-than-stellar credit. But proceed with caution, as loans provided to those with lower credit scores come with much higher interest rates. These higher rates are in place because lenders want to protect themselves given the perceived risk. Navigating the process might be a bit confusing, but by taking time to understand the terms and conditions, securing a car loan can still be achievable.

What Factors Most Impact a 486 Credit Score?

Grasping the elements that shape your credit score of 486 is crucial for cultivating your financial wellness. Recognizing the potential influencing factors can help light the path towards improving your credit health. Your financial journey is yours, brimming with opportunities for growth and understanding.

Potential Late Payments

Missed or late payments can greatly impact your credit score. Reflect on your payment habits. Could this be affecting your score?

Next Step: Take a good look at your credit report. Check for any late payments or missed ones. Contemplate recently delayed payments, these could be shaping your score.

High Credit Card Usage

Maxing out your credit cards could negatively affect your score. If your card balances are close to their limits, this could be lowering your score.

Next Step: Assess your credit card statements. Are your cards almost maxed out? Work towards lowering your balance which can lead to improving your score.

Short Credit Duration

A shorter credit history may lower your score.

Next Step: Check your credit report. Review the duration of your oldest and most recent accounts as well as the average age of all your credit accounts. Think about any new credit you may have taken on recently.

Diverse Credit Types Needed

Having and successfully managing a range of credit types contributes positively to your score.

Next Step: Consider the types of credit you have including credit cards, retail and installment loans. Have you applied for any new line of credit recently?

Public Records

Public records such as bankruptcies or tax liens could be detrimental to your score.

Next Step: Check your credit report for any public records. Resolve any issues that may be affecting your score.

How Do I Improve my 486 Credit Score?

With a credit score of 486, you’re facing some challenges. However, there are steps you can take to start boosting that score today. Here’s what you can do:

1. Confirm and Rectify Late Payments

Your credit score might be suffering due to missed or late payments. Make sure to review your payment history on all your accounts and make good on any missed installments as soon as possible. This action will help enhance your payment history, a key factor in your credit score.

2. Maintain Lower Credit Utilization

Your current score indicates a high usage of your available credit. Work towards reducing the extent to which you depend on your credit card limits. Aim for a credit utilization ratio of 30% or less. Start by settling cards with the highest balances.

3. Consider a Secured Credit Card

If obtaining a conventional credit card proves difficult due to your current score, a secured credit card becomes a viable option. It involves a refundable deposit, acting as your credit line. Utilize it judiciously, make meticulous payments every month and watch your score got up.

4. Manage Your Debt

Outstanding debt can negatively affect your credit score. Contact your creditors to set up a reasonable repayment plan. This may prevent any further damage to your credit, and as you pay down your debt, your credit score may improve.

5. Audit Your Credit Report

Mistakes happen. There could be errors on your credit report that are affecting your score. Obtain your free yearly report and look for any inconsistencies. If you find them, file a dispute with the credit bureaus. Fixing these issues can positively impact your score.