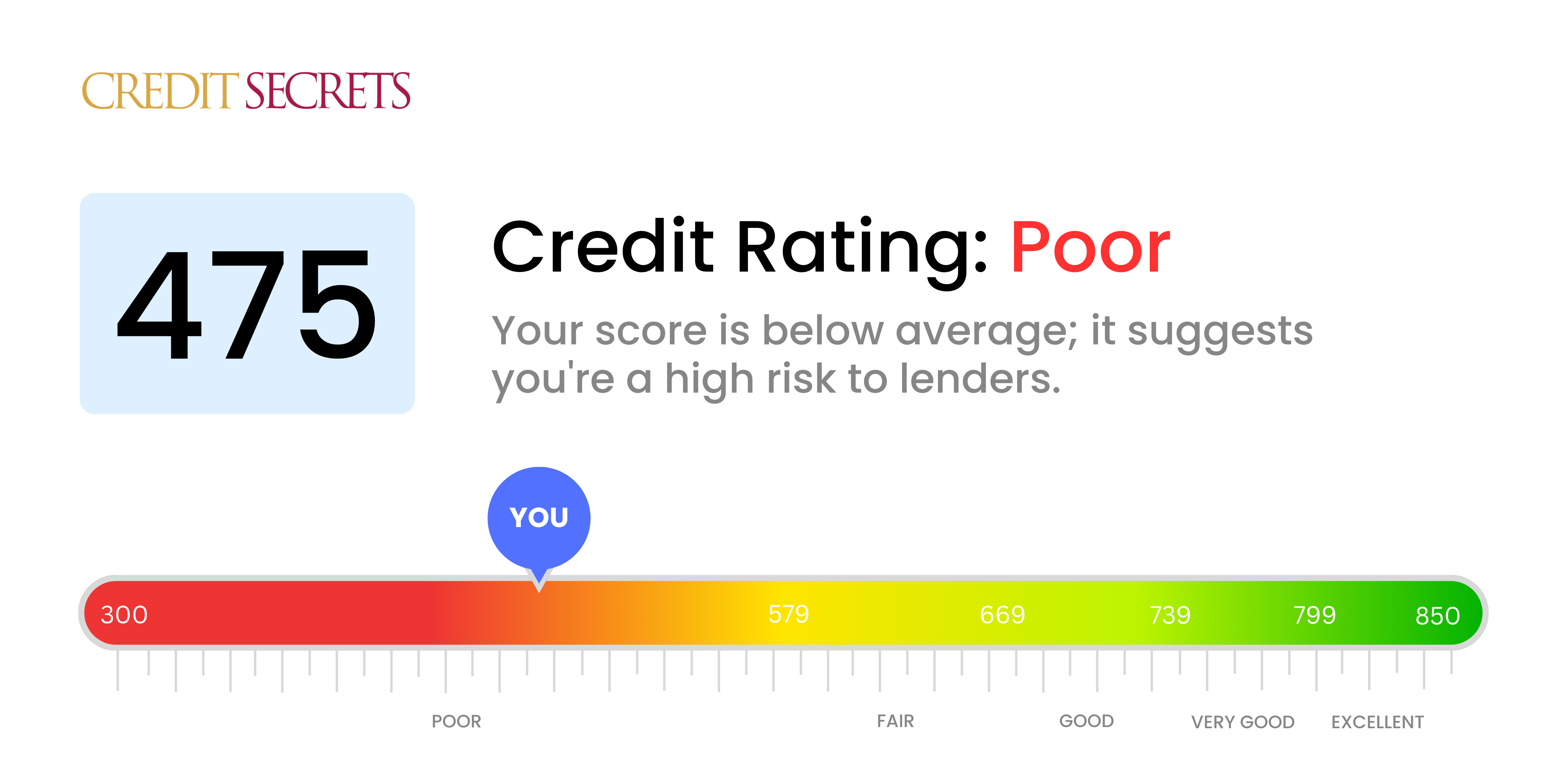

Is 475 a good credit score?

A credit score of 475 is categorized as poor according to current standards. Having a score within this range means you might find it difficult to get approved for new credit, and if you do, you will likely face higher interest rates and less favorable terms because lenders may view you as a higher risk.

However, don't be discouraged. Slow and steady efforts can bring about improvements to your credit score. By implementing better financial habits such as paying bills on time, reducing debt, and keeping credit card balances low, you can begin to see positive changes that will enhance your financial outlook. Remember, your credit score is something you have the power to change.

Can I Get a Mortgage with a 475 Credit Score?

Coming to terms with a credit score of 475 can be tough - it's a low score and unfortunately, it will likely pose significant challenges to your chances of securing a mortgage. Most lenders regard this score as a reflection of financial risk, with it telling them that there have been some credit management issues, including problems like late payments or defaults in your past.

You may feel stuck, but it's crucial to know that there are alternative paths to homeownership. While traditional mortgages may be out of reach now, there are other programs specifically designed for people with low credit scores. Some Federal Housing Administration (FHA) loans, for example, cater to those with scores as low as 500. Be aware though, lower scores generally result in higher interest rates, and you'll also need a significant down payment (usually 10%). A lower credit score doesn't mean owning a home is impossible - it just means the route may be a bit different and potentially more expensive.

Can I Get a Credit Card with a 475 Credit Score?

With a credit score of 475, the likelihood of securing approval for a traditional credit card is less favorable. Lenders interpret such a score as indicative of possible financial missteps or hardships in the past. It could feel overwhelming, but acknowledging your financial status forms the initial step towards fiscal recovery, which sometimes entails confronting harsh realities.

However, this situation is not hopeless. Exploring alternative options like secured credit cards, that need a deposit equal to your credit limit, can be a beneficial approach. These cards might be easier to get and can help gradually restore your credit standing. Alternatively, seeking a co-signer or exploring pre-paid debit cards could be other potential options. These strategies won't provide an immediate improvement but are necessary stepping stones in your journey towards financial stability. Remember, the interest rates on credit options available for such scores will likely be noticeably higher, as lenders perceive scenarios like this as higher risk.

A credit score of 475 doesn't fall within the standard range typically accepted by traditional lenders for approving personal loans. It's difficult to hear, but a score this low indicates high risk to lenders, making it highly unlikely to secure a personal loan through conventional means. It's a tough situation to be in, but understanding the realities of such a credit score is essential in your financial journey.

If the traditional loan route is unviable, there are alternatives you could consider. Secured loans involve providing collateral and co-signed loans require someone possessing a better credit score to vouch for you. Additionally, exploring peer-to-peer lending platforms could also yield possibilities, as they generally have more accommodating credit requirements. Be aware, these options usually come with higher interest rates and less favorable conditions due to the high risk involved for lenders. It's crucial to fully understand these implications before proceeding.

Can I Get a Car Loan with a 475 Credit Score?

Having a credit score of 475 can present some obstacles when looking to secure a car loan. Lenders commonly favor scores above 660 and consider anything below 600 as subprime, which is where your score of 475 falls. This score signifies to lenders a heightened risk and suggests there may be trouble in repaying borrowed funds, potentially leading to higher interest rates or even loan denial.

Don't lose hope, though. A lower credit score like yours doesn't mean owning a car is out of the question. There are lenders out there who cater to those with lower credit scores, although you should approach with care as these loans often come saddled with significantly higher interest rates. This is a means for lenders to protect their investment given the perceived risk involved. The path may be a little tough, but with the right planning and understanding of the terms, a car loan remains a feasible option.

What Factors Most Impact a 475 Credit Score?

Deciphering the factors influencing your score of 475 is your first step toward credit recovery. Addressing these factors can help bolster your score and steer your financial journey in a positive direction. Remember, your financial journey is unique and offers numerous opportunities for growth and empowerment.

Neglected Credit Accounts

Unattended credit accounts can have a negative impact on your score. If you've been inactive on any of your opened credit accounts, this could be a key reason for your score.

What to Do: Analyze your credit report for any dormant accounts. Keeping your accounts active can contribute to a healthier score.

Charge-offs or Collections

Having accounts in collections or charged-off can significantly lower your credit score. If you have such accounts, this might be a significant factor.

What to Do: Review your credit report for any collections or charge-offs. Attending to these could considerably increase your score.

Inquiries

Too many hard inquiries on your credit report can adversely affect your credit score.

What to Do: Check your credit report to see if there have been numerous hard inquiries. Applying for credit sparingly can help boost your score.

Credit History

Short credit history may be negatively impacting your score. Having only recent accounts could be a reason for your current score.

What to Do: Evaluate your credit report to assess the age of your accounts. A longer credit history could lead to a better score.

Legal Judgments

Legal judgments like court-ordered debts can seriously affect your score.

What to Do: Look through your credit report for any legal judgments. Resolving these can lead to an improved credit score.

How Do I Improve my 475 Credit Score?

A credit score of 475 is undeniably low, and it signifies a troubled financial history. Nonetheless, there’s always room for improvement with the right actionable strategies personalized to your situation:

1. Rectify Credit Report Errors

Your credit report might have errors that are dragging your score down. These could be as simple as a falsely reported late payment. Start by ordering a free annual credit report, review it meticulously for any errors, and dispute them with the credit bureau if needed. This can lead to an instant increase in your score.

2. Prioritize Defaulted Accounts

Focusing on defaulted accounts or accounts in collections should be top on your agenda. Negotiate with your creditors for ‘pay for delete’ agreements where the negative items are removed from your credit report in exchange for payment. Remember – clearing these debts will halt further damage to your score.

3. Smart Use of Secured Credit Card

A secured credit card could be your pathway to credit score recovery. These cards are easier to qualify for, even with a low score like 475. Deposit a certain amount as collateral, and make small purchases each month, ensuring you pay the balance in full and on time.

4. Authorized User Advantage

You may want to ask someone trustworthy with good credit to add you onto their credit card as an authorized user. It’s a straightforward way for their positive payment history to reflect in your credit report. However, make sure the credit card company reports authorized user activities to the credit bureaus.

5. Don’t Ignore Small Debts

Every little bit counts. Clearing off small, manageable debts can incrementally boost your score over time and create a better credit profile. Also, it consistently shows your commitment to paying your debts.