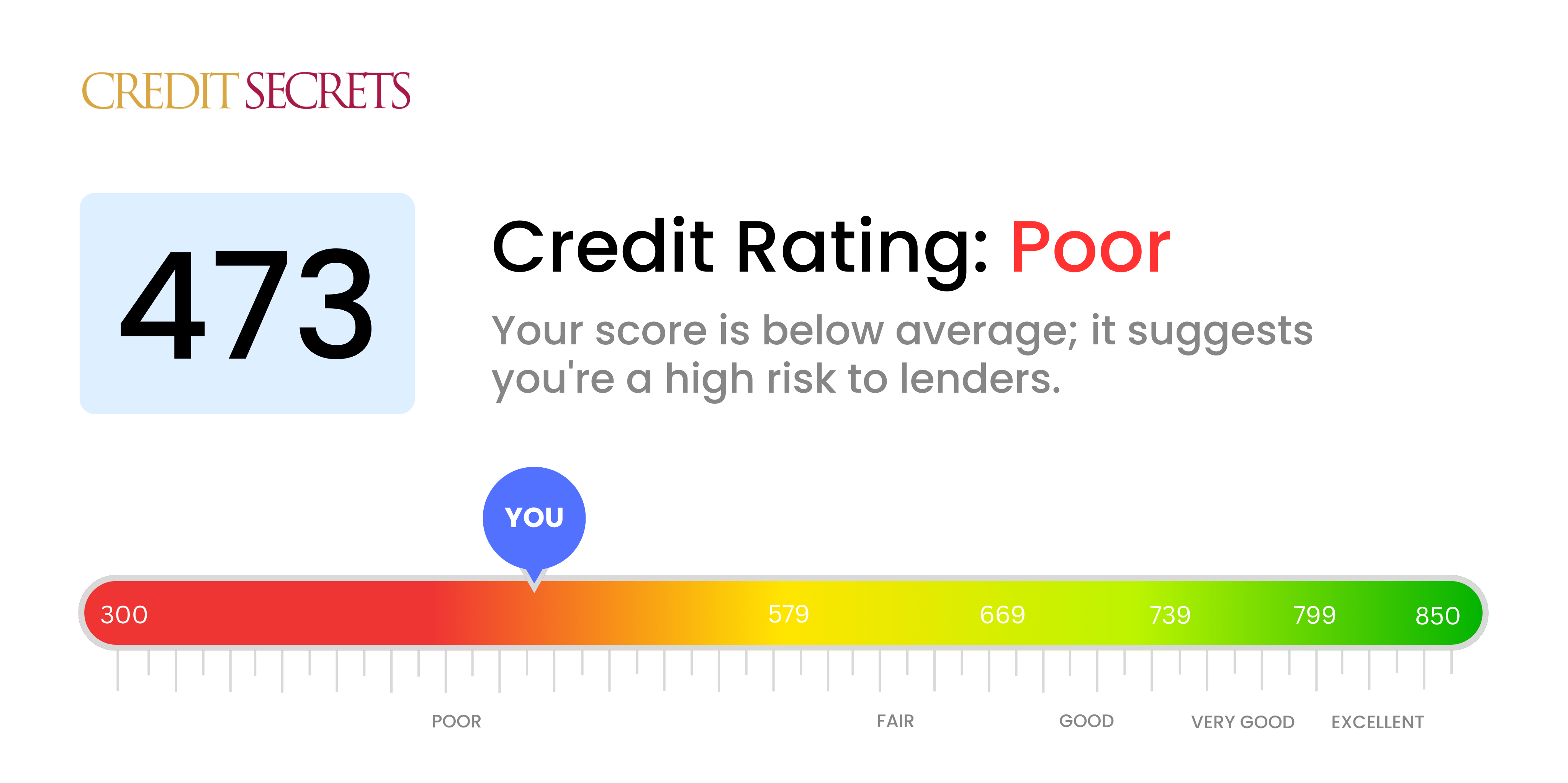

Is 473 a good credit score?

With a credit score of 473, it's clear that there's room for improvement. This places you in the 'Poor' category, and it might make it a bit challenging to get new credit or favorable interest rates. However, don't lose hope; with the right steps, you can start improving your score and head towards your financial goals.

Expect that lenders may be more cautious, and securing loans or credit lines might not be a straightforward task. From applying for a mortgage to getting a new credit card, you'll likely face higher interest rates compared to those with better scores. Yet, remember, you have the power to change this. Credit Secrets is here to guide your journey to financial fitness, without judgements or unrealistic expectations.

Can I Get a Mortgage with a 473 Credit Score?

With a credit score of 473, chances of getting approved for a mortgage are extremely low. Most mortgage lenders require a minimum credit score much higher than this. A score of 473 suggests a history of financial issues, such as missed payments or having too much debt in relation to your income.

This is undoubtedly a difficult situation. However, don't lose hope, as an improvement to your credit score is possible. You may need to look into other housing options for now, such as renting or exploring programs that assist people with lower credit scores in becoming homeowners. It's essential to work on resolving the debt or payment issues that have led to your current score. Being consistent with on-time payments going forward and managing your debt responsibly will gradually contribute to boosting your credit score. Be patient, it's a slow process but one that's doable with commitment and dedication. Remember, every small step you make towards financial recovery makes a huge difference.

Can I Get a Credit Card with a 473 Credit Score?

With a credit score of 473, getting approved for a traditional credit card will likely be tough. This score is often seen by lenders as high-risk, indicating past financial difficulties or problems with managing finances. It might be a bitter pill to swallow, but acknowledging your financial standing is the first move towards financial wellness.

For such low scores, other routes apart from traditional credit cards can be explored. For instance, a secured credit card, that needs a deposit that then becomes your credit limit, might be a more feasible option. These cards are generally easier to get and can work towards rebuilding your credit over time. Considering having a co-signer, or using pre-paid debit cards, could be other alternatives worth looking into. While these options won't resolve the situation instantly, they can serve as effective tools on your path towards improved financial health. The interest rates for these options are typically higher for individuals with low scores, as it's a way for lenders to balance the higher risk involved.

Understanding your credit score can be tough, but it's important to know where you stand. With a credit score of 453, traditional lenders may see you as a high risk and hesitate to approve a personal loan. This score is unfortunately below the range most lenders consider acceptable, making getting a personal loan challenging. However, the good news is that there are options out there for you.

Have you considered alternatives like secured loans or co-signed loans? Secured loans require collateral, such as your car or house. Co-signed loans involve someone with a higher credit score vouching for you. You could also explore peer-to-peer lending platforms, which often have more lenient credit requirements. Keep in mind, though, these alternative loans often come with higher interest rates and less flexible terms. This because lenders see lending money to you as a higher risk. It's important to carefully research and consider these options before coming to a decision.

Can I Get a Car Loan with a 473 Credit Score?

A credit score of 473 could pose some difficulties if you're hoping to secure a car loan. Lenders generally see credit scores of 660 and above as preferable, and anything below 600 is often perceived as subprime. Your current score of 473 is in this lower bracket, which could lead to increased interest rates or even the denial of your loan application. This is because a lower score can signify a greater risk to lenders, suggesting that there may be troubles in paying back the borrowed funds.

But keep in mind, a low credit score does not absolutely prevent you from obtaining a car loan. There are certain lenders who are willing to work with lower credit scores, although it's crucial to be aware that these loans often carry higher interest rates. This is a measure taken by the lender to account for the increased risk. The journey may not be smooth, but with thoughtful consideration and thorough examination of loan terms, getting a car loan remains a possibility. Stay optimistic and maintain diligence in reviewing available options.

What Factors Most Impact a 473 Credit Score?

Understanding your credit score of 473 is the first step towards a brighter financial future. By determining the factors affecting your current score, you can lay the foundation for a successful credit improvement path. Each financial journey is a unique chance to grow toward better financial stability.

Timeliness of Payments

Missed or late payments can significantly lower your credit score.

How to Check: Look for any overdue payments or defaults in your credit report. Evaluate your past habits and acknowledge any delayed payments which could have brought down your score.

Borrowing Limit Usage

High usage of your credit could negatively affect your score. If your cards are frequently maxed out, this could be impacting you.

How to Check: Scour your credit card statements. High or maxed out balances consistently? Keeping balances low relative to your borrowing limit helps score.

Duration of Credit History

Having a short credit history could be playing a role in your low score.

How to Check: Look at your credit report to evaluate the length of your credit history, including the age of the youngest, oldest and the average age of all your financial accounts. Recent, multiple new accounts could hurt your score.

Type of Credit and Credit Inquiries

Having a diverse credit portfolio and cautious about applying for new credit plays a part in a good score.

How to Check: Scrutinize your different types of credit accounts, such as credit cards, car loans, mortgages, etc. Make sure you're not frequently applying for new credit.

Official Financial Records

Court records like bankruptcies or tax liens can weigh your score down substantially.

How to Check: Monitor your credit report for any official records mentioning financial issues that need to be proactively resolved.

How Do I Improve my 473 Credit Score?

With a credit score of 473, you fall in the ‘poor’ category. But worry not, there are immediate and practical actions that can help raise your score.

1. Repay Overdue Bills:

Overdue accounts can drag down your credit score. Prioritize clearing them. If you’re struggling to pay, contact your creditors and work out a repayment plan that you can afford.

2. Keep Credit Card Balances Low:

A high card balance could harm your score. Aim to keep your balance below 30% of your credit limit or better yet, below 10%. Start by paying off cards that are most maxed out.

3. Opt for a Secured Credit Card:

With your current score, getting an unsecured credit card could be challenging. A secured credit card can be a good alternative. Make sure you responsibly manage this card, making small purchases and paying off the full balance every month.

4. Seek to Be an Authorized User:

Ask a trusted individual with good credit if you can be an authorized user on their account. This could raise your score by adding their positive payment history to your account. Make sure the credit card company reports this history to the credit bureaus.

5. Diversify Your Credit types:

Variety in your credit can have a positive impact on your score. Once you’ve built a strong history with a secured card, consider exploring other credit types such as a credit builder loan or retail credit card. Be sure to handle these responsibly.