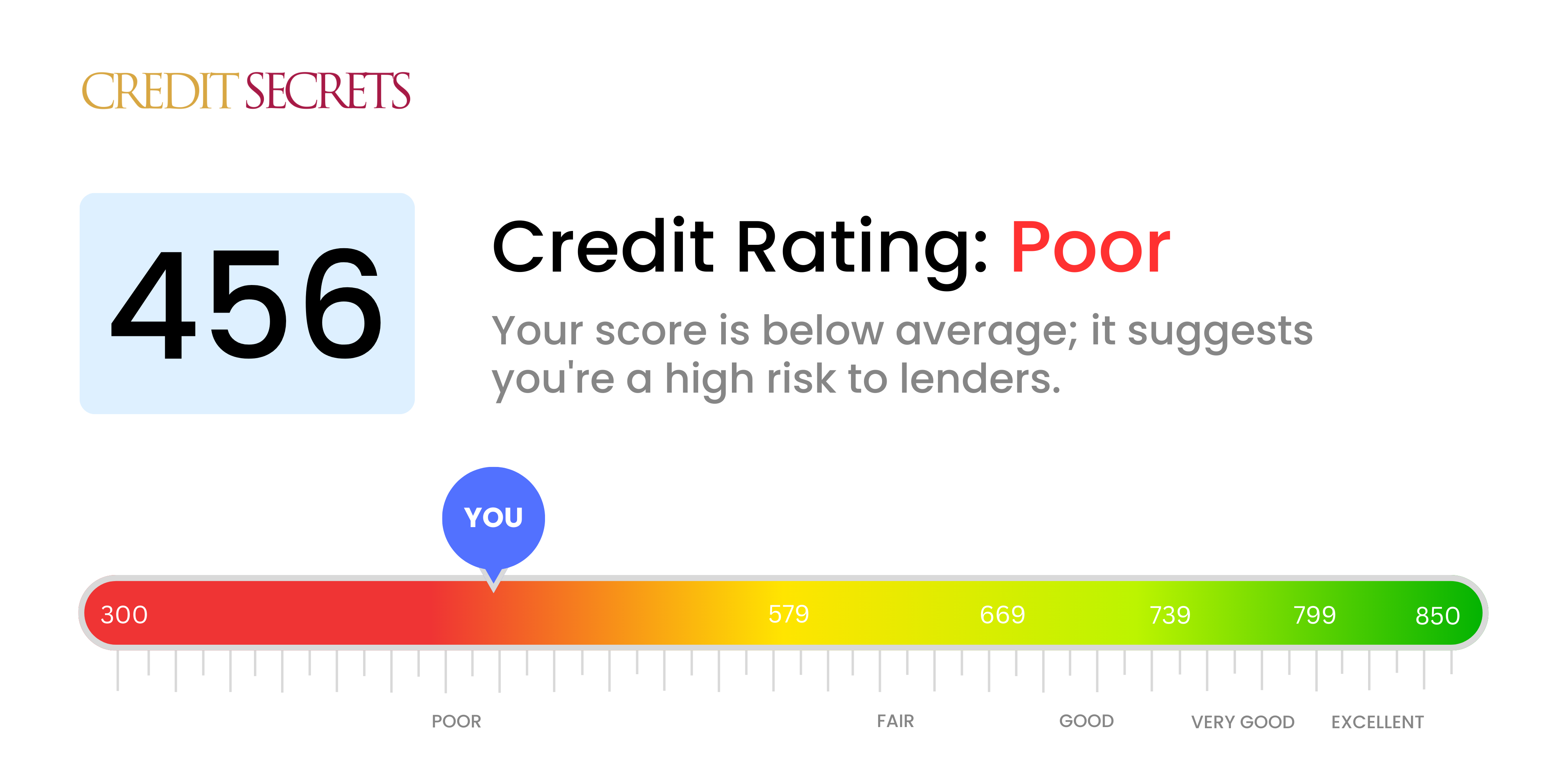

Is 456 a good credit score?

A credit score of 456 falls into the 'Poor' score category. Unfortunately, this is not considered a good credit score, and it may pose some challenges for getting loan approvals and favorable interest rates.

However, don't lose hope. It's essential to remember that a credit score is not set in stone and there are ways to actively work towards improving it. Credit Secrets can assist you in understanding and taking the necessary steps to enhance your credit score. Always remember that the journey toward financial health is one of continuous effort and patience.

Can I Get a Mortgage with a 456 Credit Score?

Having a credit score of 456 unfortunately means that mortgage approval is highly unlikely. The majority of lenders require a credit score that is significantly higher. A score like this usually reflects a history of significant financial hardships, such as multiple missed payments or defaults. It's important to know that this doesn't define your financial future, but it does indicate a need for improved financial management and credit habits.

As an alternative, you may want to consider other housing options such as renting while working towards improving your credit. Remember, boosts in credit scores do not happen overnight. However, diligent effort, such as making all payments on time and consistently lowering your total debt, can gradually increase your score. Although a higher credit score opens up more opportunities for loans and lower interest rates, your score is only one facet of your overall financial health. Keep building towards a more secure financial future, the efforts you make today will benefit you in the long run.

Can I Get a Credit Card with a 456 Credit Score?

If you have a credit score of 456, getting approved for a traditional credit card may be a hurdle. This is a score that credit card companies might see as risky, a signal of past financial hurdles or mishandling of credit. The reality of this isn't easy to swallow, but it's important to stay realistic and aware of your current credit status. Accepting the truth about your credit score is the initial move towards improving your financial health.

When dealing with a low credit score, consider options like secured credit cards. These cards require a security deposit, which also serves as your credit limit. Secured cards are typically easier to qualify for and can be a stepping stone towards repairing your credit. Additionally, think about using a co-signer or maybe even switching to a prepaid debit card. Although these methods won't magically improve your situation overnight, they can be a great help on your path to financial recovery. Remember, any credit option available to you would likely come with higher interest rates, due to the increased risk seen by the lenders.

With a credit score of 456, the prospects of getting approval for a personal loan from usual lenders might seem bleak. It's not an easy predicament to be in, but it's vital to understand that this score reflects a heightened risk from the standpoint of a lender. That being said, while your options might be sparse, they aren't completely out of the picture.

Since traditional personal loans may be a stretch, there are a few alternate avenues to explore. You could consider secured loans, which require you to offer something of value as collateral, or co-signed loans, where another person with a better credit score stands surety for your repayment. Another pathway to investigate could be peer-to-peer lending platforms which are sometimes more flexible with credit requirements. But do bear in mind, these alternatives typically carry higher interest rates and might not have the most favorable terms, owing to the lender's increased risk assumption.

Can I Get a Car Loan with a 456 Credit Score?

A credit score of 456, unfortunately, can make it quite tough to get approval for a car loan. Lenders usually prefer scores above 660, viewing them as less of a risk. Your score of 456 categorizes you as a subprime borrower, often resulting in high interest rates or possibly even rejection of the loan application. This is because a lower credit score signals a potential risk to lenders, reflecting potential issues with repaying money.

That said, don't lose heart! While a credit score of 456 might be a hurdle, it doesn't entirely rule out the possibility of a car loan. Some lenders cater specifically to those with lower credit scores, but remember, these loans usually come with much steeper interest rates. These higher rates account for the increased risk that lenders are assuming. It's a sort of insurance for their investment. Despite the potential challenges, with due diligence and thoughtful examination of the conditions, car loans still remain a possibility. Always remember, every journey starts with a first step, even if that step is a small one.

What Factors Most Impact a 456 Credit Score?

If your credit score is 456, don't worry; implementing positive financial habits can help you improve over time. Your lower score can primarily be affected by a few key factors.

Late or Missed Payments

One of the crucial factors that can significantly lower your score is late or missed payments. If you have any of these on your credit report, they could be the reason for your current score.

How to Verify: Analyze your credit report meticulously for any late payments or missed payments. Reflecting on past payment habits can help identify this problem.

High Credit Card Balances

Another key factor is high balances on credit cards. High utilization usually indicates higher credit risk and hence, can lower your score.

How to Verify: Review your credit card balances. If they are close to the limits, it's a probable contributor to the lower score.

Short Credit History or Newly Opened Accounts

Shorter credit histories and freshly opened accounts can have a negative impact on your credit score.

How to Verify: Survey your credit report to check the age of your credit accounts. If you have opened new accounts recently, it might be affecting your score negatively.

Derogatory Marks

Negative public records like bankruptcies or overdue taxes could severely hurt your credit score.

How to Verify: Scan your credit report for any associative public records. Address these issues promptly for score improvement.

Understanding and addressing these factors can help you make significant strides in your financial journey.

How Do I Improve my 456 Credit Score?

Having a credit score of 456 puts you in the pool of poor credit, but fear not. With concentrated efforts and smart strategies, progress is within your reach. Start by following these steps specifically designed for your current credit situation:

1. Prioritize Outstanding Debts

Addressing any outstanding debts that you have should be your first order of business. These debt accounts, particularly those that are overdue, have a significant negative effect on your credit score. Communicate with your lenders to devise a manageable payment plan.

2. Curtail Your Credit Utilization

High credit card utilization can negatively impact your score. Strive to maintain your credit card balances below 30% of your credit limit, and even better if you can get it below 10%. Focus on the cards with the highest utilization percentages first.

3. Consider a Secured Credit Card

Your current score may present a challenge in obtaining a conventional credit card. A good alternative is a secured credit card that requires a cash deposit equal to your credit line. By responsibly using this card and ensuring full payment each month, you can construct a solid payment record.

4. Seek to Become an Authorized User

Find a trusted person with good credit who would be willing to add you as an authorized user on their credit card. Gathering their positive credit behaviors into your credit report can help boost your credit score. Make sure their credit card company reports authorized user activities to the credit bureaus.

5. Broaden Your Credit Portfolio

A varied combination of credit will uplift your score. Once you’ve developed a good payment performance with the secured card, look at incorporating other credit types such as credit-building loans or store credit cards. Make sure to manage them responsibly.