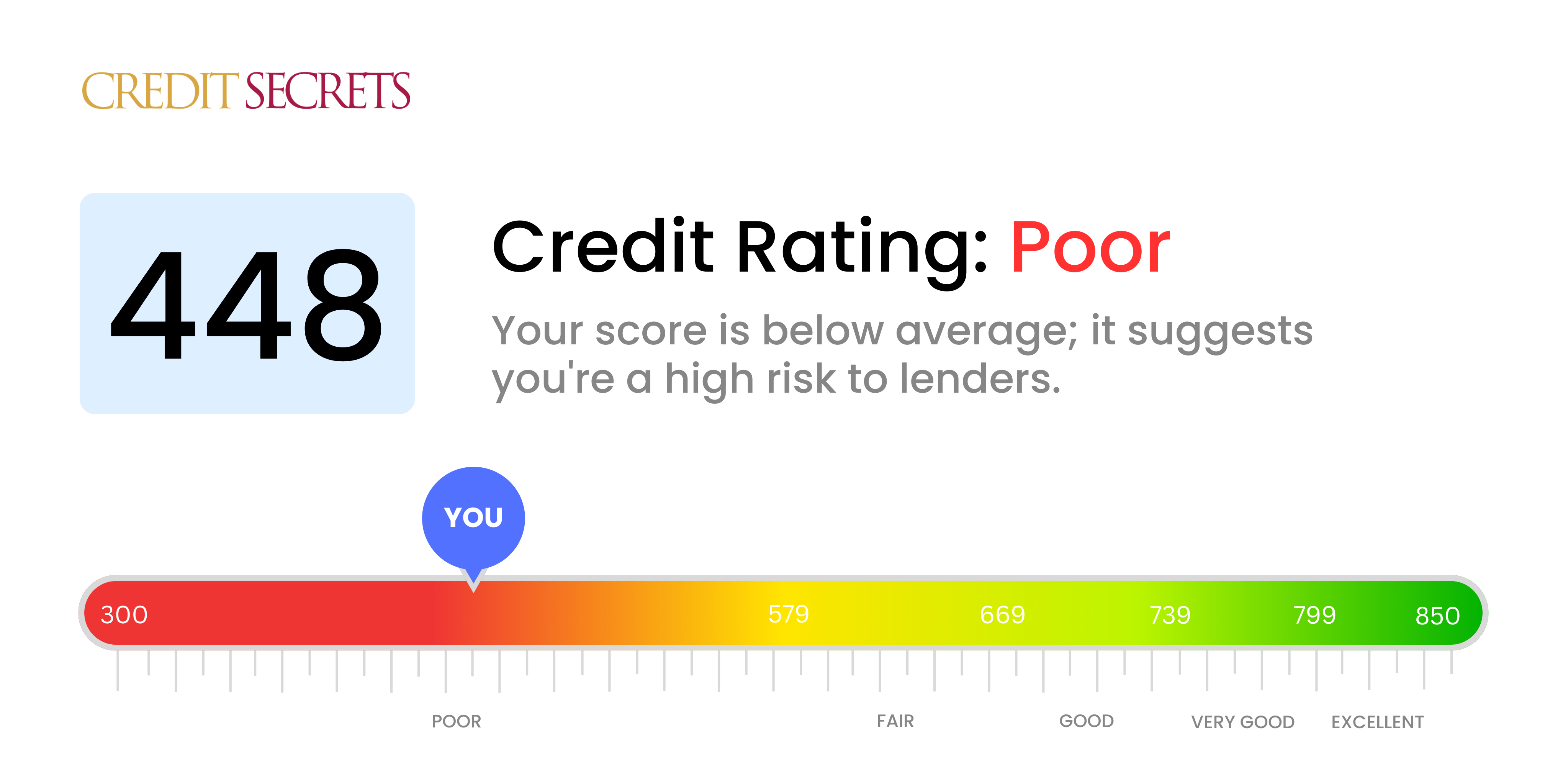

Is 448 a good credit score?

Unfortunately, a credit score of 448 isn't considered a good credit score; it falls into the 'Poor' category. With this score, you may encounter difficulties in securing loans or credit cards, and if you are approved, it's likely you'll face higher interest rates and less favorable terms.

However, it's important to remember that your current situation is not a life sentence. You have the power to change your financial situation. By making timely payments, reducing your debt, and employing effective financial management strategies, you can gradually improve your credit score over time. The road may be tough, but every small step you take towards a healthier credit score is a step towards a stronger financial future.

Can I Get a Mortgage with a 448 Credit Score?

A credit score of 448, unfortunately, falls far below the threshold preferred by lenders for mortgage approval. This indicates that you may have a history of financial hardships, such as late payments or falling behind on bills. Generally, acquiring a mortgage with a score in this territory might be quite challenging.

However, this isn't the end of your home-owning journey. Rather, consider this as the beginning of a new phase where you aim to steadily improve your credit standing. It's essential to start rectifying the factors causing the slump in your score. This could involve paying off outstanding debts, ensuring future bills are paid on time, and maintaining a good credit utilization. While this may seem daunting, remember that this process takes time and patience. As you commence this credit improvement journey, you'll find yourself gradually progressing towards a stronger financial future.

When your score is on the lower side, it can result in higher interest rates when you do get approved, which means you'll end up paying more over the life of your loan. Therefore, working towards a better credit score is not only essential for approval, it can also save you a significant amount down the line.

Can I Get a Credit Card with a 448 Credit Score?

With a credit score of 448, the chances of being approved for a conventional credit card tend to be slim. This score, in the eyes of lenders, indicates a high level of risk, possibly due to past financial hardships or mishaps. This may come as a hard pill to swallow but recognizing the reality of the situation is a crucial step on the path to financial recovery.

Not to be disheartened, there are other avenues to consider. Secured credit cards, for instance, may be a good fit. These cards require a refundable deposit, which typically determines your credit limit. They're often easier to acquire and can assist in the process of rebuilding your credit. Alternatively, exploring options like finding a co-signer or opting for pre-paid debit cards might be worth considering. Keep in mind though, these options won't magically fix your credit overnight but can be helpful tools on your road to financial resilience. Be vigilant as well, as interest rates offered to individuals with such credit scores are usually quite high, given the increased risk lenders associate with them.

Having a credit score of 448 presents a significant challenge when applying for a personal loan from traditional lenders. This score is considerably lower than what most lenders find acceptable. A low score like this often signifies a high risk to lenders, hence it's unlikely that you'd be approved for a traditional loan. Your situation might seem daunting, but clearly understanding the implications of this credit score on your borrowing options can help you strategize accordingly.

However, not all hope is lost. There are alternative routes for gaining a loan. You might explore the possibility of secured loans, where you leverage your own assets as collateral. Alternatively, a co-signed loan allows another individual with a stronger credit score to endorse your responsibility. Peer-to-peer lending is also an avenue worth considering as they can have more accommodating credit stipulations. Keep in mind, these options usually carry higher interest rates and stringent conditions due to the greater risk for the lender.

Can I Get a Car Loan with a 448 Credit Score?

Having a credit score of 448 likely makes securing approval for a car loan quite tough. The reason is that lenders are usually looking for credit scores that are above 660, as it signals a lower risk for them. However, a credit score such as yours, which is below 600, often falls into the subprime category. This could result in the possibility of increased interest rates or even a rejection of the loan application by lenders.

This isn't because they want to make your life difficult, but because a lower credit score indicates a higher risk for lenders, essentially suggesting that there might be issues in paying the borrowed money back. But, don't lose hope. Despite the hurdles, car ownership is not an entirely closed avenue. There are lenders out there who specialize in helping individuals with lower credit scores. Be aware though, these type of loans usually carry considerably higher interest rates. This is a measure lenders take to counter the risk they perceive in the loan.

So, while the journey might seem a bit hard right now, with the right balance of patience, exploration and an understanding of the terms and conditions, it is still possible for you to secure a car loan. Keep in mind, though, that it's essential to make an informed and practical decision about this to avoid further financial complications.

What Factors Most Impact a 448 Credit Score?

A credit score of 448 calls for immediate attention and strategic planning to revive your financial situation. Let's identify and take steps to address the significant factors that have influenced your score.

Delayed Payments

Payment history is critical to your credit score. Late payments or defaults could substantially lower your rating.

What to Do: Scrutinize your credit report for any overdue payments or defaults. Any instance of postponed payments would have affected your score.

Heavy Credit Use

High credit utilization, or using most of your available credit, could be negatively affecting your score. If you're frequently maxing out your credit cards, it's time for a rethink.

What to Do: Analyze your credit card statements. Are you making full use of your credit limit? Strive to keep your balances low to improve your score.

Short Credit History

Having a new, or short, credit history could lower your score considerably.

What to Do: Refer to your credit report to evaluate the age of your oldest and newest accounts. Take into consideration if you have opened many new accounts recently.

Diverse Credit Portfolio

Maintaining various types of credit responsibly proves to lenders that you can handle credit well. This can help improve your score.

What to Do: Assess your mix of credit accounts to see if you have a good balance between credit cards, retail accounts, installment loans, and mortgage loans.

Public Records

Public records can impact your score heavily. These might include bankruptcy filings or tax liens.

What to Do: Review your credit report for any public records. If there are, you need to address them as soon as possible.

How Do I Improve my 448 Credit Score?

A credit score of 448 falls significantly below the average score, widely considered to be poor. However, worry not! Here are some pertinent steps you could follow particular to your present situation to improve your credit score:

1. Prioritize Payment of Delinquent Accounts

If there are any delinquent debts on your credit reports, consider paying them first. Overdue payments take considerable toll on your credit scores. Prioritize the most overdue items. If necessary, engage in a conversation with your creditors, discussing a feasible payment plan.

2. Lower Your Credit Utilization Ratio

Keep in mind that high credit card balances can adversely affect your credit score. Your goal should be to keep your balances under 30% of your credit limit, better still under 10%. Prioritize reducing debt on the cards with the highest utilization first.

3. Opt for a Secured Credit Card

At this current score, getting a conventional credit card might be difficult. Apply for a secured one, which requires a refundable security deposit – essentially a credit line for your account. Use it sparingly and ensure to clear your balances every month to develop a healthy payment history.

4. Consider Credit Piggybacking

Enquire from a loved one or a friend with an excellent credit record whether you can be an authorized user on their card. This can enhance your credit scores by integrating their commendable payment history onto your report. Verify if the card issuer communicates authorized user activity to the credit bureaus.

5. Diversify Your Credit Portfolio

Utilizing diverse credit accounts judiciously can push your credit score upwards. As soon as your payment history with a secured card brings about improvement, consider exploring other credit types like a credit builder loan or a store credit card. Pay these responsibly for best results.