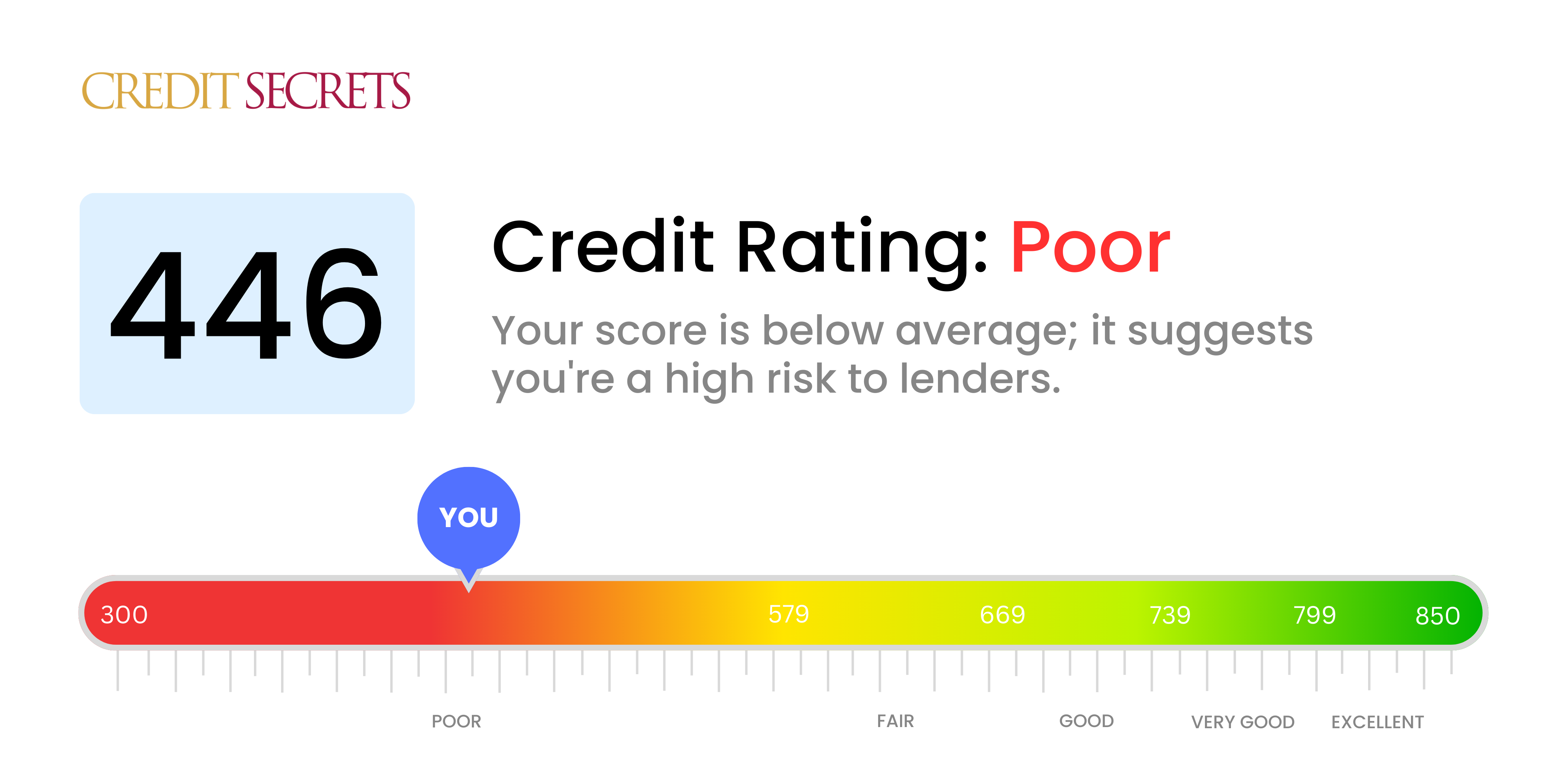

Is 446 a good credit score?

With a score of 446, your credit falls into the 'Poor' category according to the widely-used credit score ranges. This isn't the position anyone would want to be in, but remember that your past does not define your future and there's always room for improvement.

Having a credit score of 446 likely means you may face struggles when trying to secure credit or get approved for loans. You may receive higher interest rates or need to provide a deposit or collateral. However, this represents an opportunity to start repairing your credit. Planning, budgeting, and regular repayment of debts are some steps that can gradually increase your score.

Can I Get a Mortgage with a 446 Credit Score?

With a credit score of 446, your chances of being approved for a mortgage are unfortunately quite low. This score is substantially below the threshold most mortgage lenders look for, indicating that there may have been some significant financial missteps in your past such as late payments or loan defaults.

Although this is a tough situation to be in, it's not irreversible. The first step toward improvement is to address any pending financial obligations or overdue amounts that are dragging your score down. Following that, concentrate on cultivating a positive record of timely payments and sensible credit utilization. Remember, it's a slow and steady journey to boost your credit score, but with determination and discipline, it's entirely achievable.

While you work on enhancing your credit health, looking into alternatives like seeking a co-signer with a high credit score or saving for a larger down payment might increase your chances of securing a mortgage. Keep in mind that while these alternatives may help you secure a loan, your interest rate may still be high due to your lower credit score.

Can I Get a Credit Card with a 446 Credit Score?

With a credit score of 446, it might be tricky to get approved for a standard credit card. This score usually suggests to lenders that there's a risk involved because it hints at past financial trouble or mishandling. It might feel quite disheartening, but it's always better to be aware and realistic about your credit situation. Understanding the current state of your credit is the initial move towards taking control of your financial health, even if the reality isn't pretty.

Because of the hurdles posed by a low score like 446, other options such as secured credit cards, which require a deposit that doubles up as your credit limit, might be worth considering. These cards are relatively easier to get, and can slowly but surely help improve your credit. Alternatively, finding a reliable co-signer or exploring pre-paid debit cards might help. These options don’t offer a quick fix, but can serve as effective stepping stones towards financial recovery. Please note, any credit you are able to obtain might come with high interest rates, as lenders will likely view your situation as higher risk.

Your 446 credit score is quite low and it significantly reduces the likelihood of you getting approved for a personal loan with traditional lenders. This is because a score in this range is viewed as a high-risk indicator, and lenders might hesitate to grant a loan under such circumstances. It's a tough situation, but it's crucial to be aware of the financial implications your credit score brings.

Despite these obstacles, you do have other alternatives. Secured loans, where you provide collateral, can be a viable option as can co-signed loans, where a person with a better credit score guarantees your loan. You might also consider peer-to-peer lending platforms that often have more flexible credit requirements. However, remember that these options typically come with higher interest rates and less favorable terms because of the increased risk perceived by lenders.

Can I Get a Car Loan with a 446 Credit Score?

Having a credit score of 446 can make obtaining approval for a car loan quite a challenge. Generally, lenders prefer a credit score exceeding 660, and anything under 600 is usually considered subprime. Your score of 446 belongs to this subprime category, which could mean higher interest rates or potential denial of your loan application. It's because, from a lender's perspective, a lower credit score means higher risk, as it might suggest possible hurdles with repayment.

However, don't lose hope. Despite a lower score, a car loan remains a real possibility. There are lenders who are willing to work with applicants who have lower credit scores. That said, you have to be mindful because the interest rates are usually higher in such cases. This is a measure taken by the lenders to offset the perceived risk. Despite the journey being somewhat rocky, a careful study of the loan terms and being fully aware of what you sign up for can still put that car within your reach.

What Factors Most Impact a 446 Credit Score?

With a credit score of 446, it's vital to comprehend the significant factors that have led to this score. This understanding provides a foundation for crafting your financial comeback.

Poor Payment History

Generally, a credit score of 446 might indicate a poor payment history. Late or missed payments can considerably lower your credit score.

How to Check: Examine your credit report thoroughly and verify for any late or missed payments. Recollect if there were periods when you fell behind on your bills.

High Credit Utilization Ratio

Excessive usage of your credit limit, known as a high credit utilization ratio, could contribute to your current score.

How to Check: Review your credit card statements. Are your balances too close to your credit limit? Remember, it's recommended to maintain a balance lower than 30% of your total limit.

Short Credit History

Possessing a short credit history, or a lack of diversified credit could adversely influence your score.

How to Check: Analyze your credit report for the age of your oldest, newest, and the average age of all your accounts. Reflect if you've newly opened multiple accounts.

Negative Public Records

Negative entries like bankruptcies or tax liens can leave a substantial impact on your credit score.

How to Check: Look into your credit report for any adverse public records. Working towards the resolution of these items can help you uplift your score.

Frequent Credit Applications

Incessantly applying for new credit can result in hard inquiries, reducing your score potentially.

How to Check: Check your credit report for hard inquiries. Try to limit new credit applications and continue with credit accounts you already have in good standing.

How Do I Improve my 446 Credit Score?

With a score of 446, your credit status is quite low, but not impossible to mend. Put into action the following specific and achievable steps to improve your situation:

1. Prioritize Outstanding Debts

Start by paying off overdue obligations, beginning with those that have been overdue the longest. These have the most significant negative impact on your credit score. Create a payment plan or approach your creditors to discuss viable alternative arrangements if you’re unable to clear the debts outrightly.

2. Optimize Credit Utilization

Curbing the volume of available credit used can be a huge boost for your score. Strive to maintain your credit card balances below 30% of your credit limit and work towards a long-term aim of keeping them below 10%. Prioritize settling balances on cards with the highest utilization rates.

3. Contemplate a Secured Credit Card

At your present score, getting a regular credit card might prove difficult. Consider taking out a secured credit card – here, you deposit cash as collateral which acts as your credit limit. Furnish a good payment history by responsibly buying small items and fully paying off the balance monthly.

4. Seek Authorization

Find a relative or friend with excellent credit who agrees to add you as an authorized user on their credit card. This can enhance your credit score by merging their strong payment history into your credit report. Ensure the card provider will notify the credit bureaus of the authorized user activity.

5. Explore Diverse Credit Account Types

Building a good payment relationship with a secured card is an ideal foundation for opening other kinds of credit like retail credit cards or credit builder loans. Diversifying your credit mix and responsibly maintaining them can enhance your credit score.