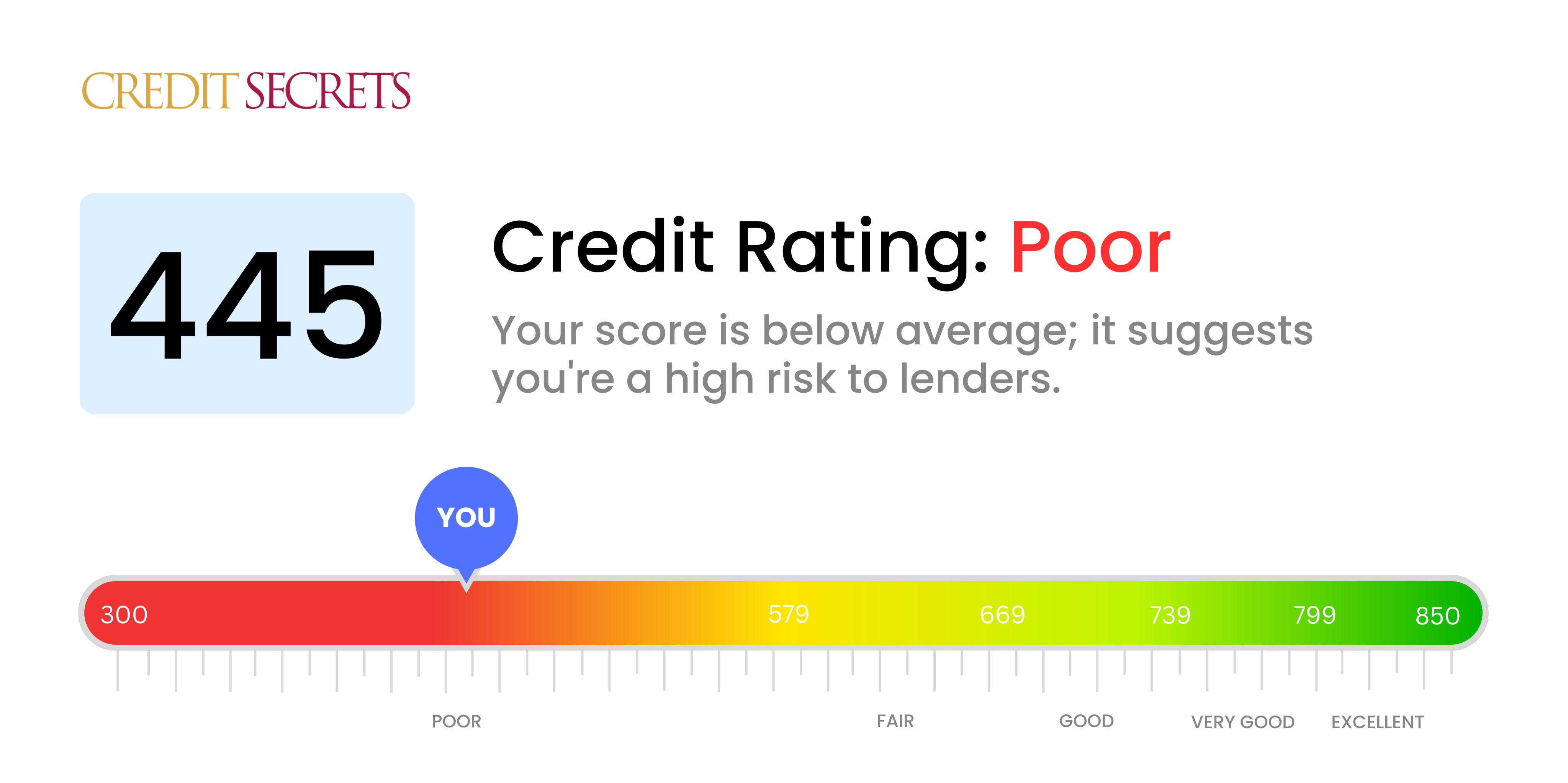

Is 445 a good credit score?

With a score of 445, you are currently categorized in the 'Poor' credit score range. You may be struggling with high interest rates, rejection from credit issuers, and difficulty getting approved for a personal loan or mortgage. However, there's room for growth and tools available to help boost your credit score.

While managing a 445 credit score can feel overwhelming, remember that you have the power to improve it. There are several credit improvement programs, like Credit Secrets, that can guide you in transitioning your credit status from bad to better. With diligence and the right resources, it's possible to move towards a brighter financial future with a healthier credit score.

Can I Get a Mortgage with a 445 Credit Score?

At a score of 445, unfortunately your chance of being approved for a mortgage is low. This score is significantly beneath what most mortgage lenders will typically look for, and it usually indicates previous financial hardships, including missed or late payments on debt.

Being in this position can be tough, but there are actions you can take. Prioritize clearing any outstanding debts that could be bringing down your credit score. This will not only improve your score but also your overall financial stability. Also spend time building a strong, reliable payment history moving forward. Although it may take time and consistency, a better score, and improved financial opportunities can be the result. High-interest rate loans may be an option, but it's important to consider the long-term costs involved with these types of loans. It is always advisable to continue to work on improving your credit score for a better financial future.

Can I Get a Credit Card with a 445 Credit Score?

With a credit score of 445, obtaining approval for a standard credit card might be quite challenging. This score is usually considered high-risk by lenders, indicating a history of financial instability. While this situation might seem frustrating, it's crucial to meet it with a realist and composed frame of mind. Acknowledging and understanding your credit situation is the initial stage towards financial improvement.

When faced with a low score like 445, you could consider alternatives such as secured credit cards. These type of cards necessitate a deposit that becomes your credit limit, making them typically more accessible. They also serve as a beneficial tool for gradually rebuilding your credit. Other options could include seeking a co-signer or utilising prepaid debit cards. Be aware, these options don't offer an instant resolve, but act as incremental steps towards financial wellness. Keep in mind, any form of credit available to you will most likely carry higher interest rates due to the increased perceived risk to lenders.

Unfortunately, with a credit score of 445, obtaining a traditional personal loan could be challenging. Many lenders typically seek borrowers with higher scores, viewing lower scores as a greater risk. Although it's a tough situation to be in, it's crucial to understand the realities of this credit score and your borrowing possibility.

There may be alternatives to consider, such as a secured loan where you supply collateral, or a co-signed loan with the assistance of someone with a stronger credit score. Peer-to-peer lending platforms can also be an alternative, as these platforms sometimes have more flexible credit score requirements. Keep in mind, though, these options can often come with higher interest rates and less favorable terms due to the increased risk to the lender.

Can I Get a Car Loan with a 445 Credit Score?

Having a credit score of 445 makes it tough to secure approval for a car loan. It's a hard truth, but it’s important to know that lenders generally favor credit scores above 660. A score under 600 typically lands in the subprime category, so unfortunately, your score of 445 falls within this range. This might lead to more challenging loan terms, higher interest rates, or even outright denial. This is because lenders view lower credit scores as high-risk, suggesting a likelihood of difficulties in repaying the loan.

But don't lose heart, a low credit score doesn’t mean an end to your car buying ambitions. There are lenders who specialize in working with individuals with lower credit scores. However, be aware that these types of loans often come with much higher interest rates. This is the lender's way of protecting their investment against the perceived risk. It may seem like a challenging route, but with careful deliberation and a thorough examination of the terms, achieving a car loan is still possible.

What Factors Most Impact a 445 Credit Score?

Solving the mystery of a 445 credit score can help pave the way to better financial health. Grasping the elements contributing to this score will equip you with the knowledge needed to boost your financial stability. Crimes remember, no two financial journeys are identical and each one offers myriad chances for development and learning.

Payment Record

The substantial role of your payment record in determining your credit score shouldn't be overlooked. Late or missed payments could significantly tank your score.

How to Inspect: Scrutinize your credit report for any late payments or defaults. Consider any past instances of payment delays and how they could have affected your score.

Credit Usage

A high credit usage could be a driving force behind the reduction in your credit score. If your credit card balances are always maxed out, that could be a principal reason behind your score.

How to Inspect: Analyze your credit card statements. Are the balances almost at the limit? Keeping your balances low compared to your credit limit will work to your advantage.

History Length of Credit

Short credit histories can negatively impact a credit score.

How to Inspect: Review your credit report and look at how long you’ve had your oldest and newest accounts, and the average length of all your accounts. Think about if you've opened new accounts recently.

Assortment of Credit and Fresh Credit

Maintaining a good mix of credit, like credit cards, retail accounts, installment loans, and handling fresh credit responsibly is crucial for improving credit scores.

How to Inspect: Take a look at the variety in your credit accounts and how often you have been applying for new credit.

Public Records

Your score can be significantly affected by public records, such as bankruptcy filings or tax liens.

How to Inspect: Check your credit report for any public records. Take action to resolve any items you come across.

How Do I Improve my 445 Credit Score?

Being at a credit score of 445 means you are in the poor credit range, but don’t lose hope. You can still make positive changes. Here are some customized strategies you could employ:

1. Get Current on Your Bills

First, make sure you’re up to date with all your bill payments. Late or missed payments can significantly damage your credit, so making them regularly and on-time can help improve your score.

2. Look into Debt Consolidation

Debt consolidation loans or balance transfer cards could help simplify your repayments and potentially lower your interest rates. Just remember to keep up with the payments on this new line of credit.

3. Utilize a Credit-Builder Loan

For your score range, a credit-builder loan might be a good option. This type of loan can help you boost your credit score by allowing you to demonstrate consistent and responsible repayment behavior.

4. Harness the Power of Rent Reporting

If you’re renting your home, consider a rent reporting service. With these services, your on-time rent payments get reported to the credit bureaus, boosting your credit score.

5. Keep Old Credit Accounts Open

Older credit accounts contribute to your credit history length, a key component of your credit score. Even if you don’t actively use an old credit card, keep it open – just be sure to pay off any balances.