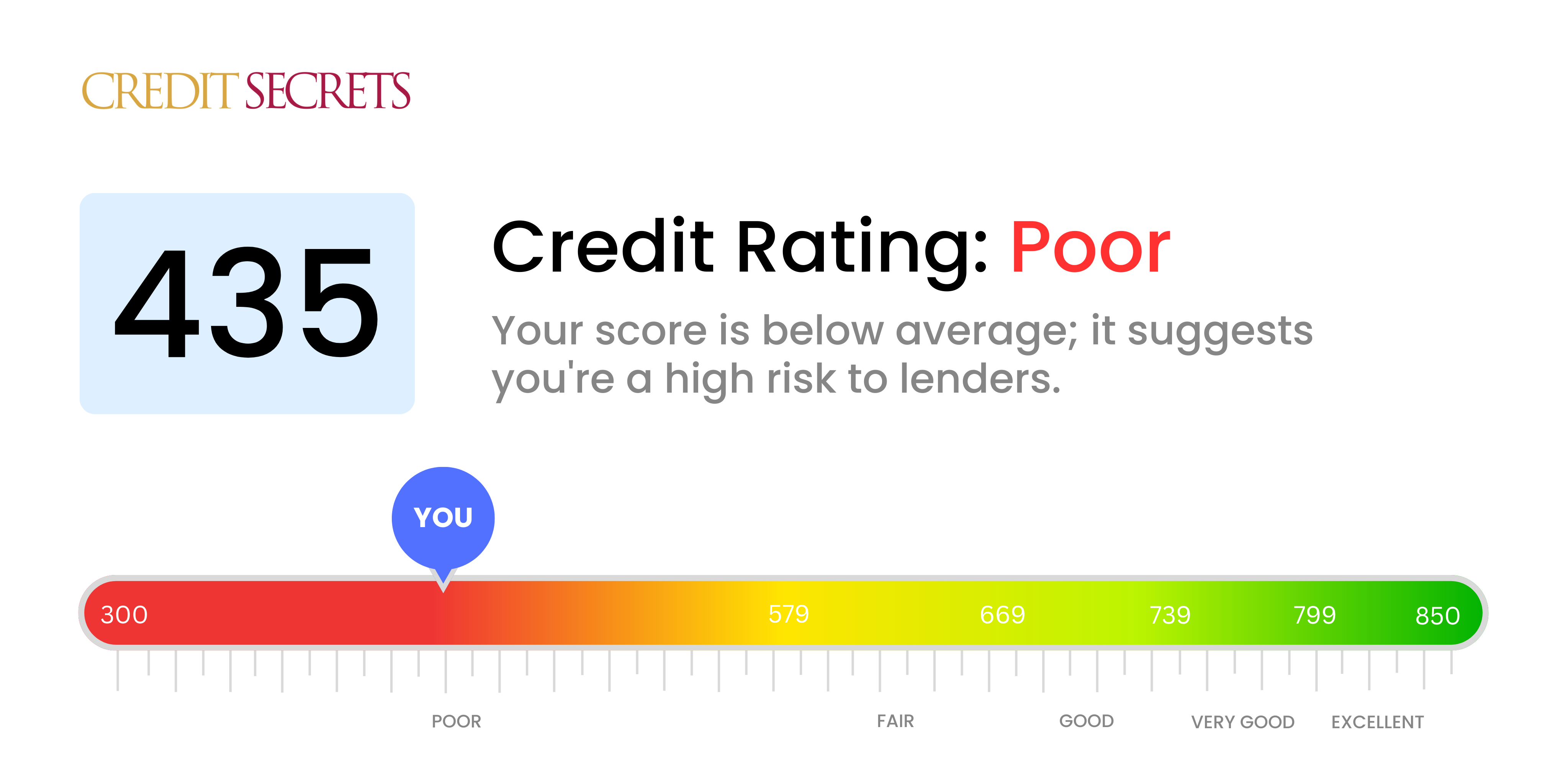

Is 435 a good credit score?

With a credit score of 435, you're currently in the 'poor' credit range. While this is not an ideal place to be, it's important to remember that it's just a starting point, and there are plenty of actions you can take to improve your score. Your score may make it difficult to gain approval for loans or credit cards, and if you are approved, you're likely to face higher interest rates. However, don't despair. With some informed decisions and responsible credit habits, you can start the journey toward bettering your financial health.

In the Credit Secrets program, you'll learn about numerous strategies to help enhance your score. It's not just about paying bills on time, but also about understanding how credit works and knowing your rights in relation to your credit report. You're not alone in this journey, and with patience, consistency and the right knowledge, you can improve your credit score from poor to fair, and even to good or very good. Keep your chin up. Every financial situation can be turned around, and yours is no different.

Can I Get a Mortgage with a 435 Credit Score?

With a credit score of 435, approval for a mortgage might prove a tough hurdle to overcome. Your current score is quite below the minimum threshold typically favored by mortgage lenders, suggesting a past record of financial difficulties, be it missed payments, defaults or other issues.

Nevertheless, don't be disheartened. In this situation, a more viable route might be seeking subprime mortgages which are structured for individuals without immaculate credit. Admittedly, these loans tend to have significantly higher interest rates, reflecting the increased risk taken by the lender. Alternatively, saving up for a larger down payment or securing a co-signer with superior credit are potential approaches that can bolster your chances.

Acknowledging present circumstances, it's important to stress the value of revamping your credit score. Commencing with resolving any current debts or collections impacting your score, pursuing a steady flow of timely payments and smart credit usage will definitely pave the way. Remember, the journey to better credit, while gradual, is totally achievable with sustained effort.

Can I Get a Credit Card with a 435 Credit Score?

With a credit score of 435, it's likely you'll face certain challenges when applying for a typical credit card. This score is usually seen as high-risk by lenders, suggesting past financial struggles or mishandling. This can be a hard pill to swallow, but recognizing the current state of your credit score is a crucial first step towards financial recovery, even if it means acknowledging some uncomfortable realities.

When it comes to a low score like 435, considering alternative paths could be beneficial. One option can be applying for a secured credit card, which asks for a deposit that becomes your credit limit. These cards could be an easier way to start rebuilding your credit over time. Further, contemplating the assistance of a co-signer or the use of pre-paid debit cards can also be effective routes. Keeping in mind, while such paths don't offer an immediate fix, they can be instrumental tools in building up to financial resilience. And, let's not forget, interest rates tend to be much higher with the level of credit available to low-score holders, serving as another indicator of the heightened risk seen by lenders.

With a credit score of 453, obtaining a traditional personal loan will pose a significant challenge. This score is considerably below the range that most lenders feel comfortable with, marking you as a high risk borrower. It's a tough reality, but it's crucial to recognize what this score means for your loan possibilities.

Although conventional loans may be out of reach, there are other alternatives worth considering. Secured loans, which require you to provide collateral, or co-signed loans, requiring someone with a higher credit score to endorse you, could be potential solutions. Peer-to-peer lending platforms might provide another avenue for funding. However, you should be aware that these alternatives generally have higher interest rates and less favorable terms due to the heightened risk for the lender. Keep in mind that your credit score is not permanent and it's never too late to work towards improving it.

Can I Get a Car Loan with a 435 Credit Score?

If your credit score sits at 435, it's important to know that this might pose some hurdles when applying for a car loan. Most lenders tend to prefer credit scores that are 660 or higher to offer attractive loan terms. A score below 600 is usually viewed as subprime, and sadly, your score of 435 is well within this range. Therefore, it's very possible that you could encounter higher interest rates or even find your loan application turned down. The main reason for this is that lenders see a lower credit score as an indication of high risk, suggesting that there may have been difficulties repaying loans in the past.

Don't lose heart though. Even with a credit score of 435, there's still a chance you can secure a car loan. There are lenders out there who specialize in helping individuals with lower credit scores. However, keep in mind that the interest rates on these loans are typically higher due to the increased risk the lender assumes. With careful planning and a detailed understanding of the loan's terms, your goal of owning a car could still be achievable, despite the low credit score.

What Factors Most Impact a 435 Credit Score?

A credit score of 435 requires serious attention and a well-outlined plan to improve. It is crucial to understand the contributing factors to this score and work towards improving them. Each and everything on your credit report impacts your credit score, so it is essential to realize there's always a chance for improvement.

Payment History

One major contribution to such a low score could be a history of late or missed payments. This is considered a major red flag by lenders and tends to have a significant impact on your score.

How to Check: Scrutinize your credit report for any late payments which could have adversely affected your score.

Credit Utilization Ratio

If your revolving credit sources are maxed out, this could have a detrimental effect on your score. It's important to maintain a low ratio of credit utilization.

How to Check: Check your credit card statements to see if your balances are close to your credit limits. Aim to keep the balances as low as possible.

Recent Applications for Credit

If you've recently applied for numerous credit lines, lenders may perceive this as a sign of risk, negatively impacting your score.

How to Check: Your credit report will contain a list of recent credit inquiries. Avoid making too many new applications within a short period.

Negative Public Records

Public records such as bankruptcies, tax liens, or judgements can significantly lower your score.

How to Check: Review your credit report for any negative public records, and strive to resolve these issues promptly.

Keeping these potential pitfalls in mind will help steer you towards a healthier financial future. As you work on these factors, aim for consistency and patience as credit improvement takes time.

How Do I Improve my 435 Credit Score?

Navigating a credit score of 435 can be tricky but with tailored steps, you can make substantial growth. The actions you need to take first for your credit score are:

1. Clear Collections

Outstanding collections significantly impact your score. Settling these debts not only lightens your financial burden but also starts the process of credit repair. Initiate contact with your creditors and negotiate for easier payment options if you can’t pay in full.

2. Aim for Lower Credit Utilization

High credit utilization is a red flag. Aim to keep your credit card balances below 30% of your total available credit limit. Prioritize cards with the highest balance as they affect your score the most. It’s a challenging but necessary endeavor.

3. Consider a Secured Credit Card

Your current score may limit your access to traditional credit cards. A secured credit card, backed by a cash deposit, is a good alternative. Consistent, responsible use of this card helps improve your score.

4. Seek to Be an Authorized User

Request someone you trust with good credit to add you as an authorized user to their account. This helps you gain from their positive credit habits. Make sure the credit card company reports authorized users to credit bureaus.

5. Gradual Credit Diversification

Having a varied credit portfolio can boost your credit score. After building a steady payment history with the secured card, consider exploring other credit types such as retail credit cards and credit builder loans, and handle them responsibly.