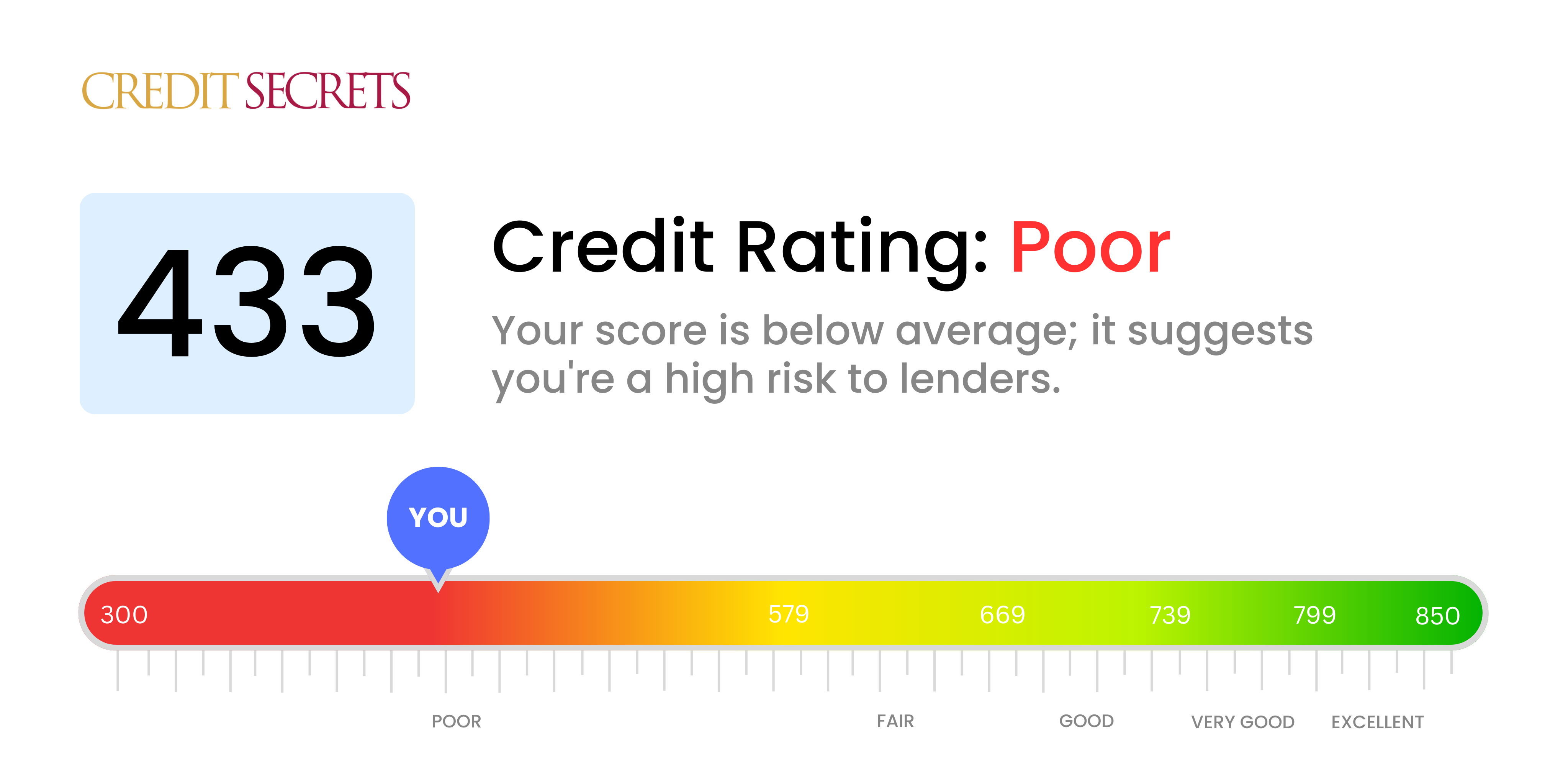

Is 433 a good credit score?

Unfortunately, a credit score of 433 falls into the category of 'poor'. However, don't be discouraged - there are always options and opportunities to help improve your credit standing. With this score, it may be difficult to qualify for new lines of credit, and if approved, you might face higher interest rates. But remember, this is just a snapshot in time, and with a thoughtful plan, you can start to build a better credit future.

Having a poor credit score isn't a life sentence. It's important to understand that it's just a temporary challenge you can overcome. From making timely payments to limiting the amount of debt you carry, there are many simple steps you can take to strengthen your credit score. It won't happen overnight, but consistent efforts and patience can definitely lead to an improved credit score.

Can I Get a Mortgage with a 433 Credit Score?

A credit score of 433 firmly places you in the unfortunate category, making it extremely unlikely for you to qualify for a mortgage. This score signifies severe financial distress, suggesting patterns of missed payments and potential defaults. Lenders would perceive this as a higher risk, and for this reason, approve fewer loans in this range.

However, don't lose hope. This situation, while tough, isn't permanent. Begin by addressing any debts or overdue bills affecting your score badly. Cultivate a habit of timely payments and prudent credit utilization. It won't be an overnight fix; improving credit scores is gradual. While this may put your home buying dreams on hold, it allows you to make better-informed, well-prepared decisions in the future, potentially saving you from high-interest rates and strenuous repayment plans.

Remember, every little step towards improving your credit health can put you on a path to a brighter financial future. It's not about how hard you fall, but how you pick yourself up and learn from your mistakes. It's an uphill climb, but one worth taking.

Can I Get a Credit Card with a 433 Credit Score?

With a credit score of 433, it's very tough to get a traditional credit card. Credit card companies see this score as risky, indicating past financial struggles or mishandling of credit. It's a hard pill to swallow, but acknowledging the reality of your credit score is the start towards financial recovery.

Given the challenges that this low score presents, it might be wise to consider other options. Secured credit cards, for instance, require an upfront deposit which then becomes your credit limit. These cards are often more accessible and can help rebuild credit over time. Another pathway might be to get a co-signer or use pre-paid debit cards. Bear in mind that these options aren't immediate solutions, but they will help you on your path to financial health. Also note, with your current score, interest rates on any type of credit can be high due to the increased risk lenders perceive.

If your credit score is 433, it's important to know that this is significantly below the range many traditional lenders consider for personal loan approval. Your score is seen as indicative of high risk, and this can make securing a standard loan quite challenging. It's not an easy situation, but understanding what your score means for your borrowing potential is the crucial first step.

In light of your score, alternative loan options may become more relevant. These can include secured loans, where tangible property serves as collateral, or co-signed loans, in which another individual with a better credit score stands as a guarantor. Peer-to-peer lending might be another path to consider since these platforms occasionally have more forgiving credit requirements. But bear in mind, these alternatives often translate to higher interest rates and less advantageous conditions, due to the increased lender risk involved.

Can I Get a Car Loan with a 433 Credit Score?

With a credit score of 433, it's quite a challenge to get approved for a car loan. This score is considerably low as most lenders tend to seek out scores over 660 to offer good conditions. Unfortunately, any figure below 600 is usually seen as subprime - and your 433 falls firmly in this less favorable zone. Lenders view a low credit score as an indication of amplified risk, because it suggests past issues in repaying bills.

However, a credit constraint doesn't mean you can't buy a car. Some lenders are suited to cater to clients with credit scores like yours. But do be careful and prepare yourself for higher interest rates that such lenders might charge. They do this because they perceive lending to someone with a lower credit score as riskier - it's a way for them to protect their investment. Even though the journey may appear tough, with an understanding of the terms and cautious decision-making, it's still possible to secure a car loan.

What Factors Most Impact a 433 Credit Score?

Unpacking a credit score of 433 is significant for plotting your path to better financial health. Recognizing and dealing with the factors causing this score can be your first step towards a more prosperous future. Let's dive into the specifics that are immensely affecting your score.

Payment History

Your credit score heavily relies on your payment history. Frequent late payments or total non-payments might be contributing to your score.

How to Check: Look through your credit report for any late or missed payments. Think back to any instances where you delayed payments as they might be the culprit.

Credit Utilization Ratio

A high credit utilization ratio can take a toll on your credit score. If you're constantly maxing out your credit cards, it's likely affecting your score.

How to Check: Look at your credit card reports. Are your card limits constantly maxed out? Strive to keep your balances low to build a healthier credit profile.

Credit History

A shorter credit history can hindrance your credit score. Having only new credit accounts is a common factor at this score range.

How to Check: Check your credit report to assess the average age of all your accounts. Take note whether you recently opened multiple new accounts.

Type and Quantity of Credit

A balanced mix of credit types and limiting new credit frequency can help improve your score.

How to Check: Evaluate the variety of credit accounts you have such as credit cards or loans and whether you've been applying for new credit often.

Public Record Entries

Public records like insolvencies or tax liens can have a substantial impact on your score.

How to Check: Review your credit report for any public records. Tackling any listed items for resolution can improve your score.

How Do I Improve my 433 Credit Score?

A credit score of 433 falls into the low credit range, yet with diligent actions and targeted strategies, it is possible to revive it back to a healthier score. To improve this score, eminently achievable and impactful measures could be taken, tailored to your current situation.

1. Prioritize Defaulted Accounts

If you have defaulted on any of your credit accounts, it’s pivotal to prioritize settling them. Defaulted accounts have one of the most severe consequences on your credit score. Reach out to your lenders to device a feasible repayment plan right away.

2. Maintain Low Credit Utilization

Keeping your credit utilization low is extremely important for your credit score. Strive to limit your credit card balances to just below 30% of your available credit limit, and progressively strive to keep it under 10%. Prioritize paying off the cards with the highest balances first.

3. Apply for a Secured Credit Card

With a credit score of 433, obtaining an unsecured credit card might be challenging. Consider acquiring a secured credit card which requires a cash deposit as collateral. Regular payments of small purchases and paying the balance in full each month can help jump-start your positive payment history.

4. Use Credit as an Authorized User

Becoming an authorized user on a trusted family member or friend’s card could help your credit score. This strategy can integrate a positive payment history into your credit report, given that the card issuer reports to the credit bureaus.

5. Explore Diversified Credit options

Once you’ve built a reputable history with your secured card, consider incorporating other credit types into your credit profile, such as installment loans or retail credit cards. Diversifying your credit mix, when managed responsibly, can help to further enhance your credit score.