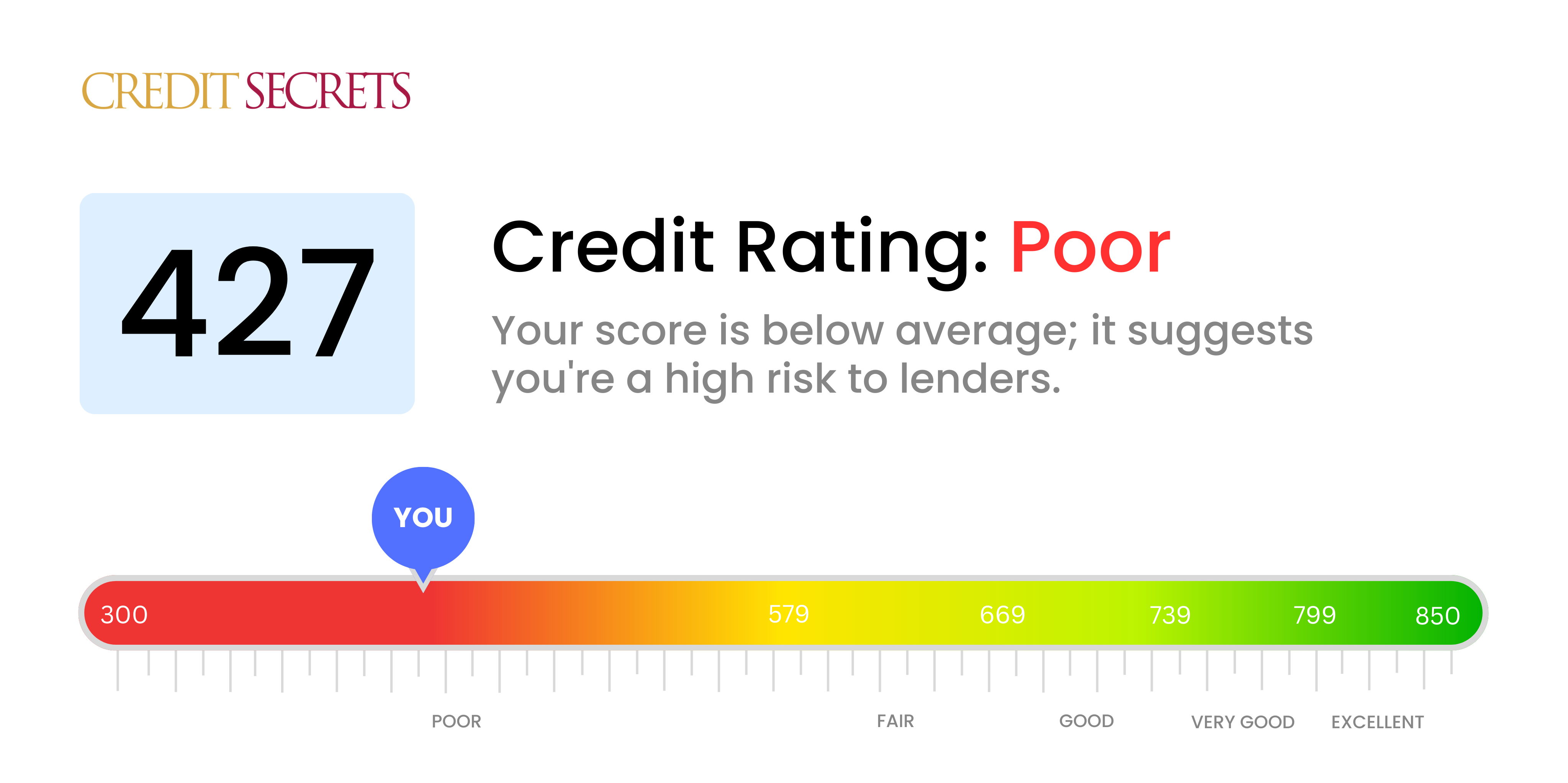

Is 427 a good credit score?

With a score of 427, it unfortunately falls into the 'poor' credit range. This means you may encounter challenges when seeking loans and credit from financial institutions, or could be faced with higher interest rates due to the perceived risk. Nevertheless, this isn't the end of the story and there are certainly ways to improve your score.

It's important to remember that improving your credit score is a journey and not a sprint. Don't be discouraged – with timely payments, reduction of debt, and responsible credit habits, you can strive for a better credit future. Even with a 427 credit score, you have the potential to achieve your financial goals.

Can I Get a Mortgage with a 427 Credit Score?

With a credit score of 427, it's very unlikely you will be approved for a mortgage. This score is significantly lower than what most mortgage lenders require. A score in this range often signifies a history of financial issues, such as missed payments or unpaid debts.

While it's not good news, don't be disheartened. This situation offers an opportunity to confront your financial challenges and create a plan to improve your score. Start by identifying the factors that have caused your score to drop and deal with them accordingly. This might involve paying off outstanding debts, ensuring future bills are always paid on time, and being smart with credit usage. While it might feel daunting, it's important to remember that a credit score isn't immovable. It takes time and consistent effort, but improving your overall score is certainly achievable. In the meantime, consider alternatives like renting or exploring housing assistance programs to fit your current financial situation.

Can I Get a Credit Card with a 427 Credit Score?

A credit score of 427 unfortunately makes it particularly difficult to be approved for most credit cards. This score is generally viewed as high-risk by lenders, indicating past financial mishaps. It's surely not pleasing news, but facing reality is a key move. Recognizing where the credit status stands is the initial step towards setting it right, even if it means swallowing some uneasy truths.

Given the complexities tied with this low score, there might be an interest in alternatives such as secured credit cards. These cards need a deposit which serves as your spending limit, and can often be obtained more readily. This way, credit can gradually be rebuilt. Also, thinking about using a co-signer or even pre-paid debit cards could be worthwhile options too. Understand, these paths don't work magic instantly but are aidful in the long-run. Remember, any credit options accessible to someone with a score on the lower side will likely come with steeper interest rates, given the high risk perceived by lenders.

Where a credit score of 427 sits on the scale is significantly lower than what most traditional lenders might consider good for a personal loan. To most lenders, this score may signify a higher risk, meaning that your chance of obtaining a loan on standard terms might be fairly low. This is certainly a hard situation but understanding the implications of this credit score in respect to your borrowing options is important.

With traditional loans potentially out of reach, you may need to look into other options such as secured loans, where you provide a form of collateral, or co-signed loans, where someone with a better credit score supports your application. Peer-to-peer loans could be another choice to consider, as they're sometimes more lenient when it comes to credit standards. However, it's important to note that these alternatives could come with higher interest rates and terms that might not be in your favor, reflecting the lender's perceived risk.

Can I Get a Car Loan with a 427 Credit Score?

With a credit score of 427, the path towards obtaining a car loan may seem rocky, yet not impossible. Understandably, most lenders prefer a credit score of 660 or higher to offer favorable loan terms. Anything below 600 typically falls into the subprime category. Regrettably, your score of 427 is a part of this category, signaling an increased risk to potential lenders based on repayment history.

Despite the low credit score, it doesn't mean you can't purchase a car. Some lenders purposely cater to those with lesser credit scores. However, remember that these loans are likely to come with heftier interest rates, reflecting the lenders' apprehension about the risk associated with these loans. While securing a car loan is not an easy task, it remains a possibility. It is crucial, though, to scrutinize the terms and make sure it's a decision you're comfortable with. A sound understanding of the rates and conditions can pave the way towards acquiring that car loan.

What Factors Most Impact a 427 Credit Score?

Getting a grip on a 427 credit score is crucial to set sail on your journey towards financial enhancement. Recognizing and addressing the principal factors influencing this score can serve as a stepping stone towards financial stability. Remember, every financial voyage is distinct, replete with opportunities to grow and learn.

Payment Performance

Payment performance largely influences your credit score. If you have a history of missed or delayed payments, this could play a major role in your current score.

How to Check: Go through your credit report to look for any missed payments or defaults. Be mindful of any times you have been late with payments as these influence your score.

Credit Usage

Overusing your available credit can harm your score. If you have maxed out your credit cards, this might be impacting your score.

How to Check: Take a look at your credit card statements. Are your balances nearing the credit limits? Striving to maintain lower balances in proportion to your limit can aid your score.

Credit Age

A brief credit history can weigh down your score.

How to Check: Examine your credit report to determine the ages of your oldest and newest accounts and the average duration of all your accounts.

Type of Credit and New Credit

Owning a range of credit types and efficiently managing new credit could increase your score.

How to Check: Look at the variety of your credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Ponder on whether you have been conservative in applying for new credit.

Public Records

Public records like bankruptcies or tax liens can drastically decrease your score.

How to Check: Inspect your credit report for any public records. Attend to any listed items that may require resolution.

How Do I Improve my 427 Credit Score?

With a credit score of 427, improvement may seem daunting but with specific steps, the road to a better score is manageable. Here are the most accessible and effective steps to elevate your score from this level:

1. Make a Plan for Delinquent Accounts

Any delinquent accounts on your credit report drastically damage your score. Tackle these as your top priority. If repayment in full feels overwhelming, reach out to your creditors to negotiate manageable payment arrangements.

2. Low Credit Utilization

Your credit score suffers if your credit card balances are high compared to your limits. Make it a goal to get balances below 30% of your credit limit. This can be a significant step towards increasing your score.

3. Consider a Secured Credit Card

Given your current credit score, a regular credit card may be out of reach. However, a secured credit card could be an alternative. This card requires a cash deposit which becomes your credit limit. Use this card to make small, manageable purchases and pay your balance in full every month to build a healthier credit history.

4. Look into Authorized User Status

If someone with high credit is willing, you could become an authorized user on their credit card. Their good credit habits can influence your score positively. But do ensure beforehand that the credit card company reports authorized user activity to the bureaus.

5. Expand Type of Credit Usage

Once a good payment pattern with a secured card is established, consider diversifying your credit usage by responsibly managing different types of credit like retail credit cards or credit builder loans.