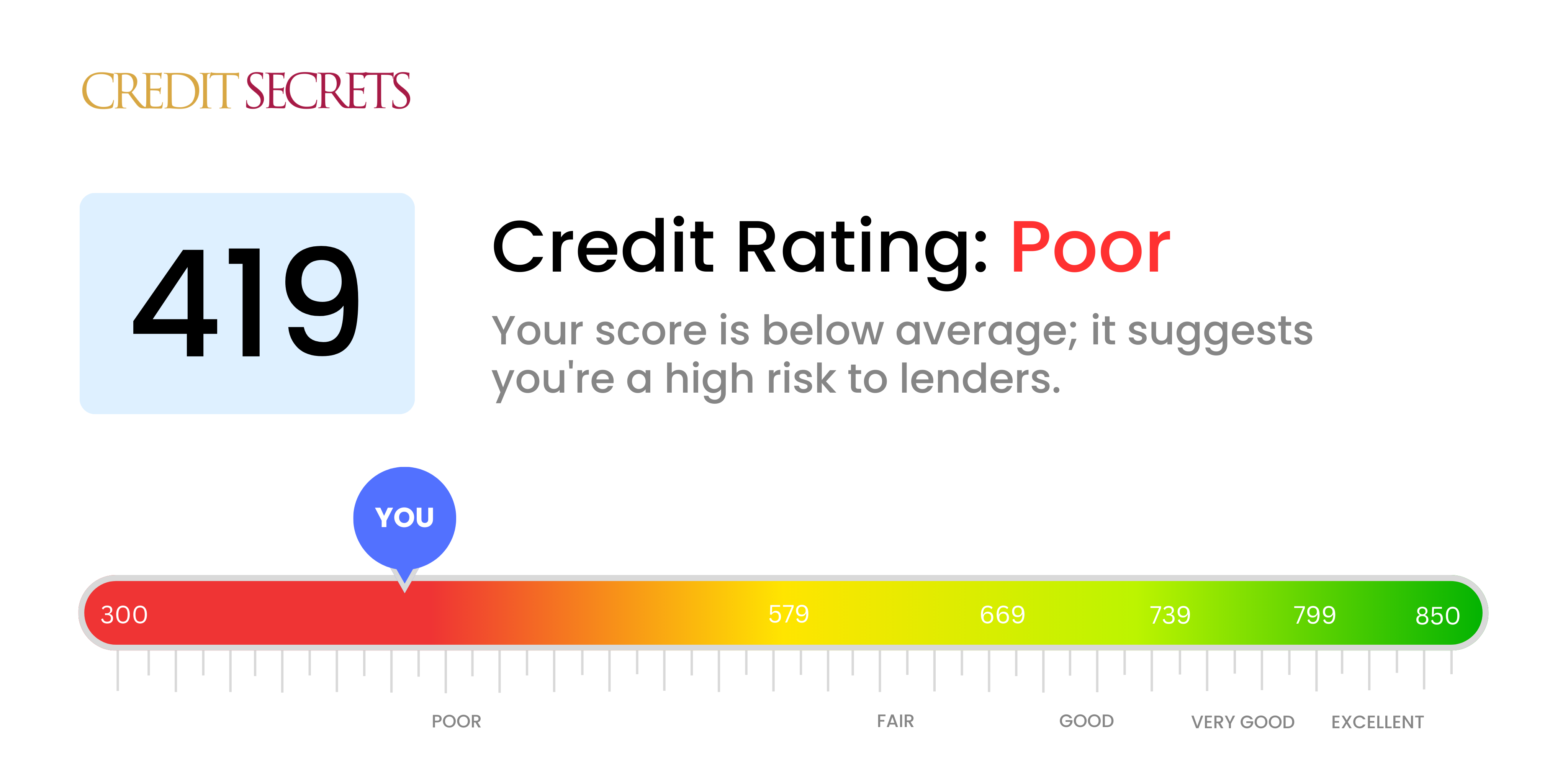

Is 419 a good credit score?

With a 419 credit score, the truth is that you fall into the 'Poor' credit range. This score can present some challenges when it comes to securing loans or receiving favorable terms from lenders. However, remember that your present situation is not your final destination, and there are steps you can take to improve your credit.

At this level, you might find it harder to get approved for credit cards and loans. If you do get approved, you're likely to face higher interest rates because lenders see you as a greater risk. But don't lose hope, with discipline and good financial habits, this can change. Every small positive financial action can help to raise your score over time, empowering you on your journey towards financial freedom.

Can I Get a Mortgage with a 419 Credit Score?

Having a credit score of 419 means mortgage approval will likely be a significant challenge. This number falls far below the standard credit score required to qualify for a mortgage. This low score typically communicates substantial financial troubles, including a history of missed payments or possible defaults.

Despite this tough situation, some alternatives could still bring you closer to home ownership. For instance, government-backed loans such as FHA loans may have more lenient credit requirements. Depending on your circumstances, you might also consider seeking a co-signer with a stronger credit profile. Explore all possible routes before giving up on your dream of owning a home. Moreover, remember to continually work towards bolstering your credit score. Timely payments and other responsible financial behaviors can slowly yet steadily enhance your score, making it easier for you in the long run.

Can I Get a Credit Card with a 419 Credit Score?

Having a credit score of 419 is generally seen as a bit difficult by lenders when attempting to apply for a traditional credit card. This kind of score signifies a challenging financial past, which lending companies may view as a risk. It's a tough situation, but acknowledging it paves the way for positive changes. The initial step towards healing your credit is accepting the reality of your situation, even if it's not as ideal as you'd hope.

Given the struggles tied to a low credit score like this, you might want to consider other options. Secured credit cards, for example, might be an excellent choice. These cards need a deposit that'll serve as your credit limit, making them somewhat easier to acquire. They can also be a helpful tool in incrementally improving your credit. Also, you could ponder getting a co-signer or using prepaid debit cards as an alternative. Remember, these options don't solve the issue immediately, but they do set you on the path towards financial improvement. Lastly, be mindful that any credit you do acquire will typically have a higher interest rate due to your lower credit score, as this is perceived as a greater risk by lenders.

Can I Get a Personal Loan with a 419 Credit Score?

With a credit score of 419, gaining approval for a personal loan through traditional avenues might be prohibitively difficult. This particular score is considerably lower than the typical minimum required by most lenders. In the eyes of these entities, a score in this range suggests a great deal of risk, which may dissuade them from considering your application. Despite the strictness of this situation, it's important to be straightforward about what a score of 419 can mean for your loan prospects.

While traditional personal loans may decline your request, there are alternative options you could consider. Secured loans, which require collateral, are one such option, as are loans signed alongside a co-signer with excellent credit. Peer-to-peer lenders sometimes have more relaxed credit prerequisites than traditional financial institutions. However, remember that these alternatives could come with higher interest rates and less accommodating terms. This is due to how lenders view a lower credit score as an increased risk, which they offset with these stricter conditions.

Can I Get a Car Loan with a 419 Credit Score?

It's important to be honest, yet supportive. With a credit score of 419, your chance of being approved for a car loan is quite small. Lenders often require scores of at least 660 to consider you for favorable loan terms. Falling below that, particularly under 600, puts you in the subprime category, meaning higher interest rates or even loan rejection might be on the horizon. This all comes down to lenders viewing low scores as a higher risk when it comes to loan repayment.

Despite the uncertainty, there's still hope. Some lenders focus on helping individuals with lower scores. Remember, though, that these loans often carry much higher interest rates as lenders seek to protect their investment. Tread carefully, and make sure to thoroughly explore the terms. While it may be an uphill battle, securing a car loan with a score of 419 isn't impossible.

What Factors Most Impact a 419 Credit Score?

A credit score of 419 may be a concern, but understanding the factors that influence it will equip you with the knowledge to work towards improving your financial situation. Remember, everyone's financial journey is their own, and each step towards improvement is a victory.

Credit History

With a score of 419, it's likely that your credit history has significantly influenced this figure. Erratic payment histories, defaults, or bankruptcies can harm your score.

How to Check: Analyze your credit report to find any signs of late or defaulted payments. Any recent bankruptcies or public records will also be important to note.

Credit Utilization

If your credit card balances are nearing their limits, this high credit utilization could be the reason for your score.

How to Check: Go through your credit card statements and assess whether you have high balances compared to your credit limits.

Length of Credit History

If you have a relatively short credit history, this can negatively impact your score.

How to Check: Check your credit report to assess the age of your oldest and newest accounts. Any recent opening of new accounts might have contributed to your score.

Credit Variety

Having a balanced variety of different types of credit such as credit cards, retail accounts, mortgages, etc can also influence your score.

How to Check: Check your credit report for a healthy mix of credit. If you only have one type of credit account, consider diversifying.

Public Records

Bankruptcies, tax liens, lawsuits, or judgements can greatly impact your credit score.

How to Check: Review your credit report for any public records. Resolve any possible issues that may be present.

How Do I Improve my 419 Credit Score?

Carrying a credit score of 419 is no doubt challenging, but not impossible to improve. Here, we propose immediate and attainable steps relative to your current credit standing:

1. Straighten Out Collection Accounts

An essential move at this stage is handling any accounts in collections. This could involve settling them or arranging a payment plan. Bear in mind that paying off a collection account likely won’t remove it from your credit report immediately, but it shows future lenders that you’re taking responsibility. Make sure all communications and agreements with the collection agency are documented.

2. Steer Clear of New Negative Records

Avoid incurring new late payments, charge-offs or other harmful records, as these can further damage your credit score. Strive to make all your current payments on schedule, even if it requires adjusting your budget or establishing automatic payments.

3. Obtain a Secured Credit Card

Your present score may make getting a standard credit card difficult. Look into getting a secured credit card instead—this requires a security deposit which serves as the card’s limit. Reliable usage and on-time monthly payments can gradually strengthen your credit history.

4. Join as an Authorized User

Request to be an authorized user on a trusted person’s credit card. This can boost your credit score, as their well-managed payment history will reflect on your credit report. Ensure the credit card company reports authorized user activity to the credit bureaus.

5. Grow a Healthy Credit Portfolio

Once you’ve established a good payment history with your secured card, consider expanding your credit type mix. A combination of installment loans and credit cards can give your credit profile a positive bump, provided they are all managed responsibly.