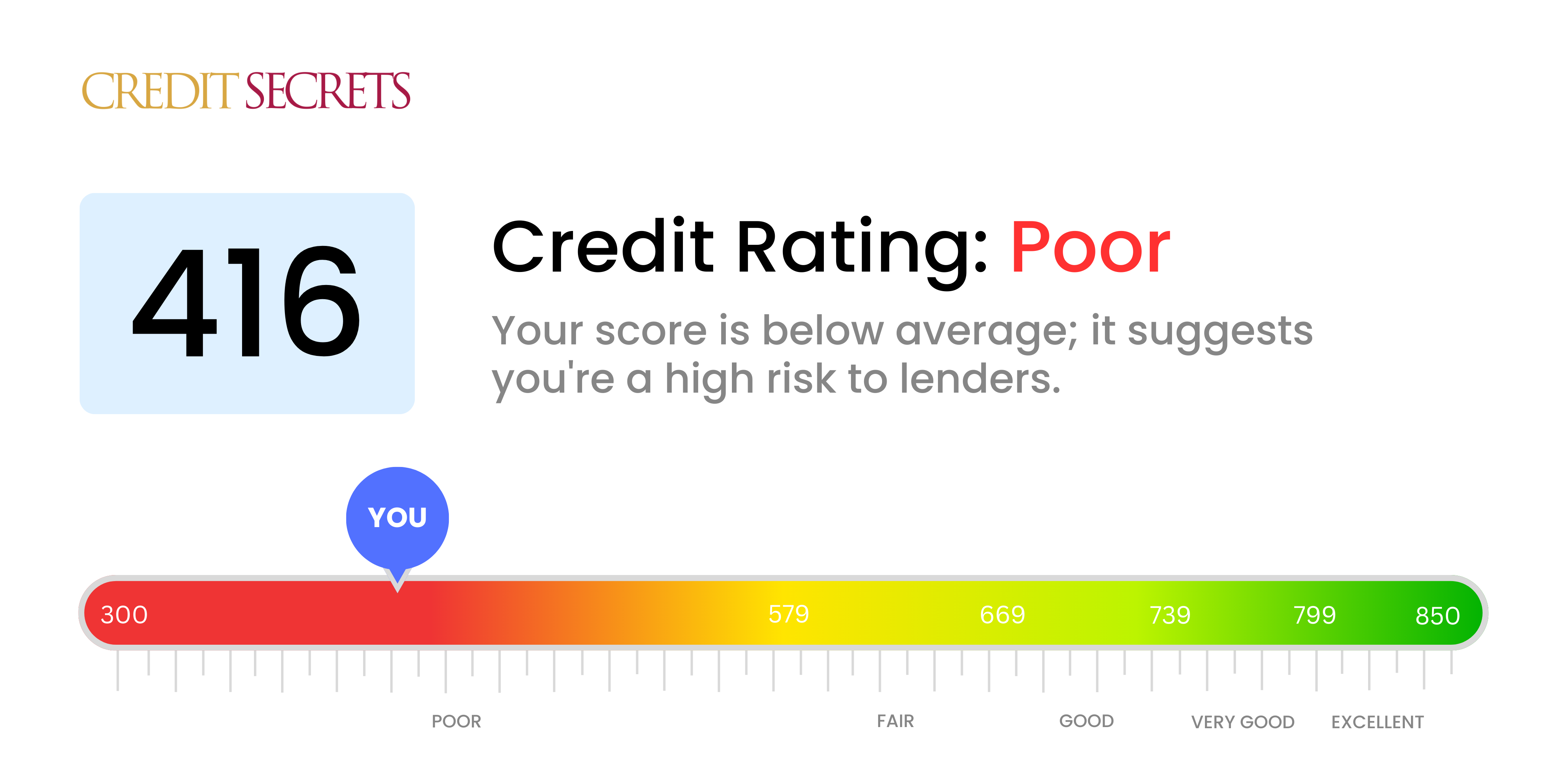

Is 416 a good credit score?

Having a credit score of 416 indicates that your current credit standing is considered poor. This kind of score might represent challenges in securing loans or credit, and you may face higher interest rates due to lenders perceiving a greater risk. However, remember that credit scores are not permanent, and a proactive approach towards understanding and maintaining credit can result in improvements.

Focusing on credit education, debt management, and consistent on-time payments are key steps in enhancing your credit score. Remain hopeful, knowing that many have successfully improved their credit scores and you can too. The journey towards better credit may take time, but every step you take brings you closer to your financial goals.

Can I Get a Mortgage with a 416 Credit Score?

Unfortunately, with a credit score of 416, securing a mortgage approval might be a difficult task. This score falls quite below the minimum benchmark other lenders typically require, indicating prior financial issues such as late payments or defaults. It's not an ideal situation, but it's important to face it with determination and positivity.

Given this scenario, an alternative way could be exploring FHA loans, as they effectually cater to those with bad credit ratings. Nonetheless, the interest rates might be noticeably higher due to the risk associated with poor credit. It’s crucial to manage your existing financial obligations diligently and learn to use credit responsibly. This journey might require patience, but your goal of homeownership should keep you motivated to improve your standing. Remember, today's credit score is not your final state, but merely a snapshot of the present. Investing time in rebuilding your credit can truly alter your financial future.

Can I Get a Credit Card with a 416 Credit Score?

With a credit score of 416, it would be quite difficult to secure approval for a traditional credit card. This score is often viewed by lenders as high-risk, indicating a past filled with financial challenges or missteps. Yes, it may feel disheartening, but acceptance and acknowledging this fact can bring about a significant positive change. Recognizing your credit position is the first substantial move towards financial recovery.

Given the constraints with a score this low, exploring other options such as secured credit cards might be beneficial. These cards require a deposit which becomes your credit limit. They are often more accessible, even with a low credit score, and can play a crucial role in your journey towards rebuilding good credit. Other possibilities might include seeking a trusted co-signer or considering pre-paid debit cards. Bear in mind, these solutions won't resolve your situation overnight, but they are handy tools to help you achieve long-term financial stability. Regrettably, any credit options accessible to individuals with a score this low will likely have markedly higher interest rates, mirroring the increased risk perceived by the lenders.

Can I Get a Personal Loan with a 416 Credit Score?

Having a credit score of 416 is a tough spot to be in. This score is considerably below what is usually required for approval from most traditional lenders when taking out a personal loan. In the financial world, a score of 416 indicates a high level of risk. This means that obtaining approval for a loan can be difficult. We understand that this can be a challenging situation, but it's crucial to be aware of the implications of this credit score for your borrowing options.

Traditional loans may be difficult to secure, but there are alternatives you could explore. These include secured loans, which would require you to provide collateral, or co-signed loans. In the case of co-signed loans, someone with a better credit record could vouch for you, thus increasing your chances of approval. Another available alternative is peer-to-peer lending sites, which may not be as strict with credit score requirements. However, be prepared for these alternatives to potentially come with higher interest rates, as lenders generally view lower credit scores as higher risks, and adjust the terms of their loans accordingly.

Can I Get a Car Loan with a 416 Credit Score?

With a credit score of 416, receiving approval for a car loan may prove quite tough. Lenders usually seek out scores above 660 for encouraging loan conditions. Unfortunately, a score less than 600 is often categorized as subprime, and your score of 416 falls into this group. The upshot of this is that higher interest rates or even outright loan denial could be a reality. The rationale behind this is that a lower score signifies greater risk for lenders, suggesting potential obstacles in paying back borrowed funds.

Hope certainly exists, though, even with a lower credit score—it doesn't necessarily eliminate your chances of purchasing a car. Certain lenders concentrate on serving individuals with lower credit scores. However, be careful, as these loans frequently carry considerably higher interest rates. This additional cost is caused by the heightened risk the lenders perceive and is their way to secure their investment. Thus, with ample thoughtfulness and a comprehensive scrutiny of the terms, accomplishing your goal of securing a car loan despite a low credit score remains achievable.

What Factors Most Impact a 416 Credit Score?

With a credit score of 416, understanding key factors playing a role is fundamental to improving your financial health. There are several reasons your current score is at this level, and addressing these can advance your financial future. Keep in mind that your financial journey is unique and there is always room for growth and improvement.

Consistent Payments

Your payment history heavily influences your credit score. With a score of 416, it's likely that missed payments or defaults are affecting your credit.

How to Check: Scrutinize your credit report for missed payments or defaults. Think back on any payments you may have missed as these could be damaging your score.

Credit Usage

Your credit utilization rate could be negatively impacting your score. If your credit balances are maxed out, this is likely a key reason for your current low score.

How to Check: Analyze your credit card statements. Are your cards maxed out? Aim to maintain balances that are low compared to your credit limit to improve your score.

History of Credit

A limited credit history could be lowering your score.

How to Check: Look at your credit report and calculate the average age of all your accounts. An older average age of credit can positively affect your score.

Range of Credit and New Credit

Having a broad mix of credit accounts and handling new credit responsibly also impact your credit score.

How to Check: Look at the diversity of your credit accounts including credit cards, personal loans and mortgages. Avoid applying for multiple new credit accounts at once.

Public Records

Public records like bankruptcy filings or tax liens can drastically lower your score.

How to Check: Check your credit report for any public records. Any existing items should be promptly addressed and resolved.

How Do I Improve my 416 Credit Score?

With a credit score of 416, it may seem like a steep journey towards financial stability, but remember, it’s absolutely achievable. Here are your most crucial and feasible steps:

1. Straighten Out Delinquent Accounts

Accounts that have fallen behind are central to addressing your credit score. Tackle delinquent accounts head-on, prioritizing those most overdue. Open dialogues with your creditors could help design a feasible repayment plan.

2. Lower Your Credit Card Usage

High credit card balances can negatively impact your credit score. Aim for your balances to be below 30% of your credit limit, eventually working towards making it less than 10%. Be sure to target the cards with the largest utilization first.

3. Consider a Secured Credit Card

Your current score might not allow for regular credit card qualification. A secured credit card could be a viable option, as it requires a cash deposit that becomes the credit line for that account. Execute small transactions and clear the balance each month to build a positive payment structure.

4. Seek Permission to Become an Authorized User

If possible, find a relative or trusted friend with solid credit and ask to become an authorized user on their credit card. Being able to tap into their healthy payment history can uplift your credit score. Just ensure the card issuer reports authorized user transactions.

5. Diversify Your Credit Portfolio

Having a variety of credit accounts is beneficial to your score. Once you’ve matured a healthy payment record with a secured card, consider opening up different types of credit like a credit-building loan or retail credit card while maintaining responsible management.