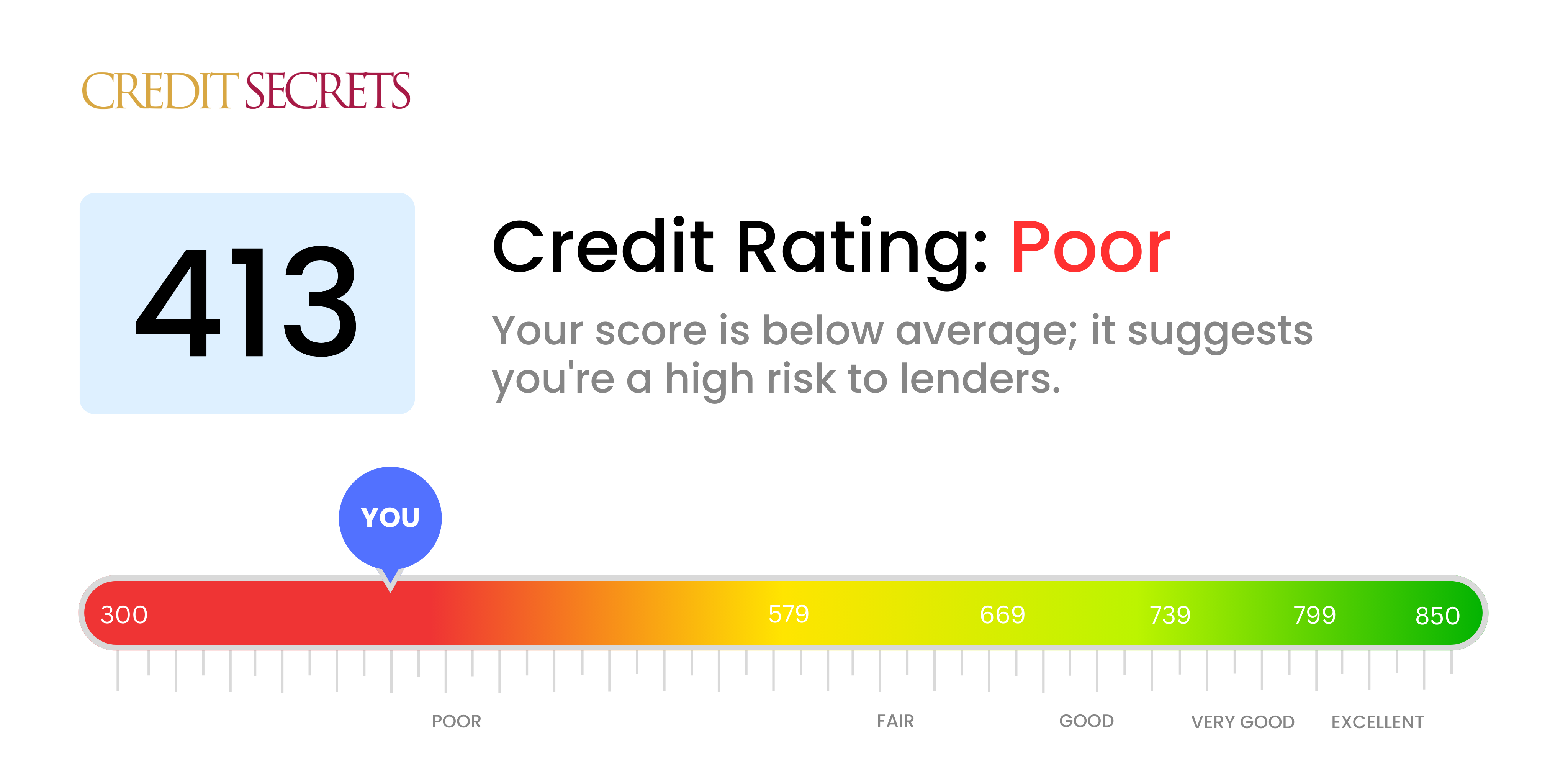

Is 413 a good credit score?

With a credit score of 413, you're currently classified as having 'Poor' credit standing. This isn't the news you might want to hear, but it's essential to understand it's a starting point, not an end one.

Holding a score in this range might create some hurdles when applying for new credit or loans; you could face higher interest rates or stricter lending terms. But remember, this is not a lasting verdict. Your credit score is dynamic, means it can change over time. There are strategies you can employ to improve it, and resources like Credit Secrets are here to help guide you on that journey.

Can I Get a Mortgage with a 413 Credit Score?

With a credit score of 413, it's typically unlikely that you'll be approved for a mortgage. This score falls substantially below the typical minimum requirement and suggests that there may be financial challenges to address, including late payments or charge-offs. It's important to approach this honestly, as overcoming these difficulties is key to reaching your financial goals.

While a traditional mortgage might currently be out of reach, there are other paths to homeownership available. Certain government-backed loans, like an FHA loan, have more flexible credit requirements and might be an option worth exploring. Additionally, you might consider a rent-to-own agreement which could offer a path to owning a home over time. Of course, while investigating these options, it is also critical to focus on improving your credit score. A higher score will undoubtedly open up further opportunities and could result in more favorable interest rates in the future.

Can I Get a Credit Card with a 413 Credit Score?

Having a credit score of 413 is typically viewed by lenders as high risk, and getting approved for a standard credit card may be a tough hurdle. This situation might seem discouraging, but acknowledging your current credit predicament is essential for making progress towards achieving your financial goals. Though this part is tough, it signifies the first step towards regaining financial control and establishing a more promising credit future.

A potential alternative to consider might be secured credit cards. These cards require an up-front deposit that becomes your credit limit. Even though the initial deposit for a secured card might be a bit of a stretch, these cards tend to be easier to get and can gradually help rebuild your credit. Another possible solution could be getting a co-signer, or using prepaid debit cards. It's crucial to note that interest rates for individuals with lower scores like 413 can be high, reflecting the risky nature perceived by the lenders. While these alternatives do not provide an instant magic fix, they can serve as instrumental tools in rebuilding your credit effectively and sensibly.

Can I Get a Personal Loan with a 413 Credit Score?

With a credit score of 413, obtaining a personal loan from a traditional lender would be challenging. A score at this level typically signals considerable risk to lenders, making the likelihood of loan approval quite low. This may feel like a disadvantage, but knowing and understanding your credit score can help you make informed decisions about your financial future.

Although traditional loans may not be easily accessible for you, exploring alternatives might be an option. Secured loans, which require collateral, could be a consideration. Alternatively, you could look into co-signed loans, where someone with a higher credit score acts as a guarantor. Another avenue could be peer-to-peer lending platforms, as they are sometimes more flexible with credit requirements. It's essential to remember, though, these alternatives often come with higher interest rates and less favorable conditions, given the increased risk perceived by the lender.

Can I Get a Car Loan with a 413 Credit Score?

Having a credit score of 413, unfortunately, makes it hard to secure approval for a car loan. In the world of lending, a score over 660 is usually seen as desirable, while anything less than 600 is viewed as below average, or subprime. Sadly, your score of 413 falls into the subprime category, which often results in higher interest rates or even outright rejection for a loan. This is due to the fact that lower credit scores indicate a greater risk for lenders; these scores suggest a higher likelihood of difficulties in repaying loans on time.

That said, it's important to remember that a lower credit score doesn't entirely eliminate your chances of purchasing a car. There are lenders who specialize in assisting those with lower credit scores. However, be prepared, as these loans often have much higher interest rates, due to the risk lenders perceive in such transactions. Though the path to getting a car loan might seem rocky at this point, with patience and thoughtful decision-making, it's definitely not impossible. With comprehensive understanding of the terms and careful planning, you can still find a path to car ownership.

What Factors Most Impact a 413 Credit Score?

Understanding your credit score of 413 is a vital first step towards better financial health. By focusing on key factors that have likely influenced your score, you can spearhead your journey to improvement.

Payment History

One of the predominant determinants of your credit score is your payment history. Lateness or skipped payments could be a significant part of your low score.

How to Check: Scrutinize your credit report for any late or missed payments. Think about any times you've been late in making payments, which could be impacting your credit score.

Credit Utilization Rate

Being heavily reliant on your available credit can negatively impact your score. If you have maxed out credit cards, it's a probable reason for your score.

How to Check: Inspect your credit card statements to see if balances are nearing their limits. Keep in mind the importance of maintaining balances well below their limits.

Length of Credit History

Shorter credit history could be bringing your score down.

How to Check: Check your credit report for the age of your earliest and latest accounts, and average age of all accounts. Have you opened new lines of credit recently?

Type and Amount of Debt

Varying your types of credit along with managing your debt is pivotal for a better score.

How to Check: Review the variety of your credit - do you have credit cards, retail accounts, installment loans, mortgage loans? Are you moderate when applying for new credit?

Damaging Financial Events

Damaging financial events like bankruptcies or tax liens are likely having a significant effect on your score.

How to Check: Look over your report for any damaging financial events. Take necessary actions to resolve these issues.

How Do I Improve my 413 Credit Score?

A credit score of 413 isn’t easy to manage, but don’t despair—there are several practical steps you can take to start improving it today:

1. Audit Your Credit Report

At this score, errors on your credit report could be contributing to your low score. You’re entitled to a free annual credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Review your reports for errors and dispute inaccuracies promptly.

2. Tackle Outstanding Debt

Overdue bills and unpaid debts can significantly drag down your score. Work towards settling those, starting with the most delinquent accounts. Make regular, timely payments to prove your creditworthiness to future lenders.

3. Secure a Credit Card

Securing a credit card designed for low credit scores—like a secured card—can help rebuild your credit. Remember to use it responsibly, keeping your utilization rate below 30% and paying the full balance each month to gradually increase your score.

4. Request Credit Limit Increases

If you’re in good standing with your card issuers, ask for a credit limit increase. This can lower your credit utilization ratio, a key factor in your credit score.

5. Consider a Credit-Builder Loan

Credit-builder loans could be an option. These loans are specifically designed to help individuals with bad or no credit by allowing them to make small monthly deposits into a savings account, which the lender reports as on-time payments to the credit bureaus.

Remember, improving credit doesn’t occur overnight, but consistent effort can make a world of difference. Stay positive and committed to the plan!