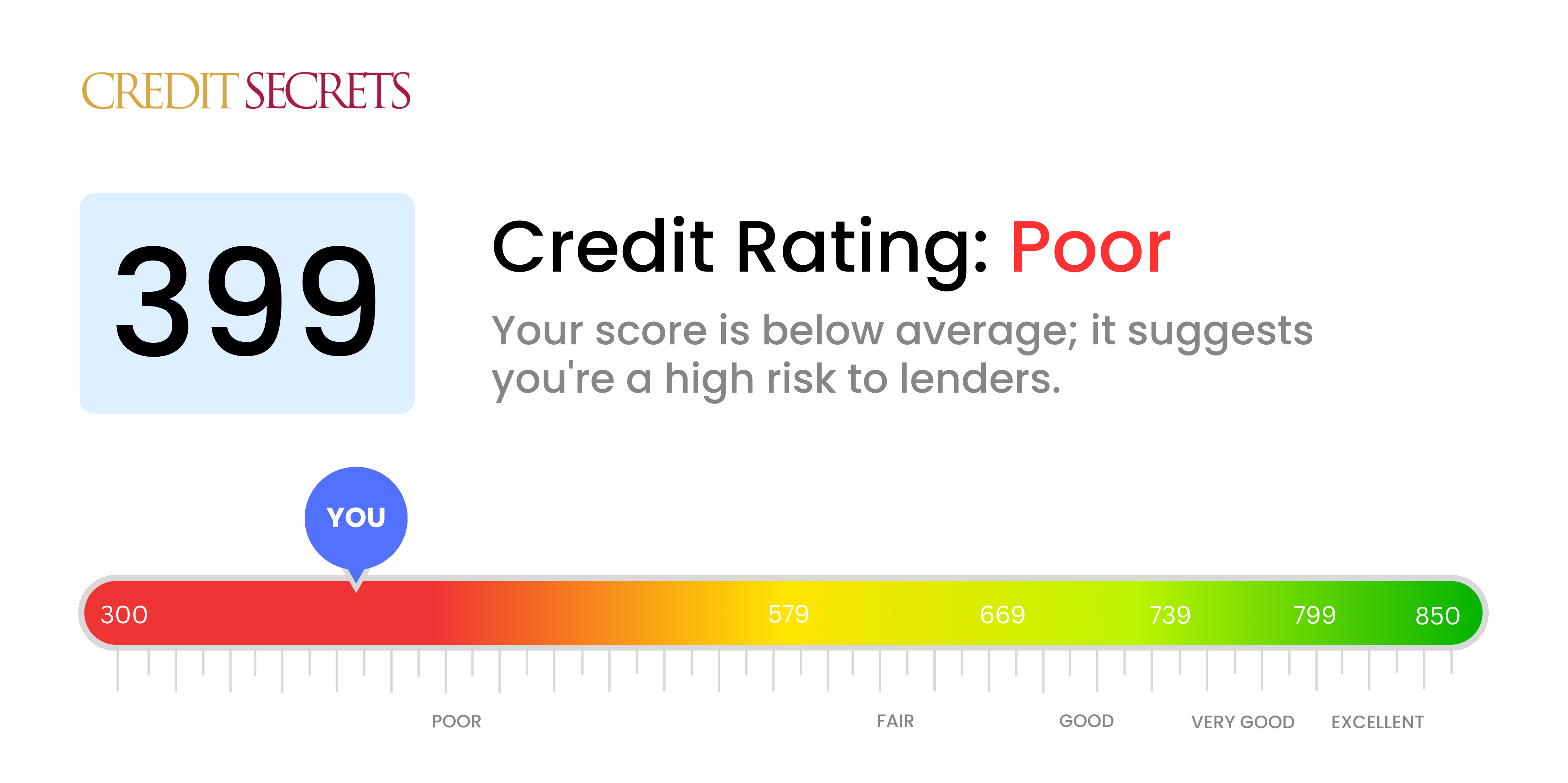

Is 399 a good credit score?

With a credit score of 399, unfortunately, you fall within the 'poor' category according to standard credit score ranges. This isn't an ideal position to be in, as it could make it more challenging to secure loans or credit cards and you might encounter higher interest rates than someone with a better score. However, this isn't the end of the road, there are strategies and steps you can take to enhance your credit score over time.

Remember, it's important to understand that a low score isn't a character judgement, it just means that there are areas where you could improve your credit behavior. While it may seem daunting now, you are not alone; many people have begun with low scores and have worked their way up to much better ones. There's no quick fix for improving your score, but with consistent effort and prudent financial habits, you can gradually improve it and work toward your financial goals.

Can I Get a Mortgage with a 399 Credit Score?

Regrettably, attaining a mortgage could prove highly challenging with a credit score of 399. Factors resulting in this score often include missed payments or defaults, possibly triggering lenders to view your application as risky. It is important to grasp that the likelihood of obtaining a mortgage under these conditions is extremely low, as most lending institutions typically mandate a minimum credit score substantially higher than 399.

However, this doesn't mean your chances are permanently dashed. Even though this stage feels daunting, there are potential alternatives. One strategy includes trying to address existing delinquencies or debts that are negatively affecting your score. Simultaneously, attempt to establish a pattern of on-time payments and prudent utilization of credit. It's worth noting that improving your credit score is a journey, not a sprint, requiring patience and consistent effort. Let's remember, every step taken towards boosting your credit score places you closer to your future financial goals.

Can I Get a Credit Card with a 399 Credit Score?

If you have a credit score of 399, securing approval for a traditional credit card can be a tough proposition. A score in this range often signals to lenders that you've had past financial troubles or difficulty managing credit, thus presenting them with a high-risk proposition. This may be hard to accept, but speaking frankly about it is a vital first step on the journey to better financial health.

Due to the challenges a low score presents, you might want to consider other options. One such alternative is a secured credit card, which entails making a deposit that then acts as your credit limit. This type of card can be easier to get and can also help rebuild your credit over time. Co-signing a credit card or using prepaid debit cards are additional options that might work for you. It's important to remember that while these alternatives don't offer an immediate fix, they offer a path towards improving your financial situation. Bear in mind that the interest rates on any credit option available to you will likely be higher, reflecting the increased risk for lenders.

Can I Get a Personal Loan with a 399 Credit Score?

With a credit score of 399, it's highly unlikely that a traditional lender would approve your application for a personal loan. This score is considerably lower than what is typically deemed acceptable, signaling to lenders a high risk scenario. It might be hard to hear, but it is crucial to understand what this score indicates about your borrowing capacity.

Although regular personal loans might not be accessible for you, there are alternative borrowing options to explore. Secured loans, which necessitate collateral, or co-signed loans, where another person with a better credit score cosigns your loan, could be potential avenues. Peer-to-peer lending platforms may have more accommodating credit requirements, but it's important to remember, this often comes with higher interest rates and less favorable terms due to the increased risks to lenders.

Can I Get a Car Loan with a 399 Credit Score?

With a credit score of 399, securing a car loan may pose a challenge. Financial institutions often seek credit scores above 660 to grant favorable lending conditions. Regrettably, a score below 600 usually lands in the subprime range, and your score of 399 sits within this bracket. The assumption is, lower scores embody heightened risk to loan providers, reflecting a potential inability to repay borrowed funds.

However, having a low credit score doesn't mean you should abandon your hopes of owning a car. There are lenders who cater specifically to individuals with less-than-stellar credit scores. But keep in mind, the interest rates on these loans tend to be markedly higher. This uptick in rates is a lender's protective measure against their increased risk. Nonetheless, with judicious appraisal of the loan conditions and terms, getting a car loan remains an achievable aspiration, despite the hurdles you may face.

What Factors Most Impact a 399 Credit Score?

When it comes to a credit score of 399, understanding the influential factors is imperative for your path towards financial stability. The key to a brighter financial future lies in pinpointing and rectifying these elements. Remember, every financial journey is individualized - a space filled with opportunities for growth and learning.

Negative Items on Credit Report

With a lower score like this, negative items such as collections, charge-offs, or bankruptcies could be a crucial contributing factor.

How to Check: Thoroughly inspect your credit report, paying close attention to these negative items, if any. Address these, where possible.

High Credit Utilization

Utilizing a significant portion of your available credit may be negatively affecting your score. High balances reflect negatively.

How to Check: Look over your credit card accounts. Are the balances high compared to your limits? Aim to keep your balances considerably low.

Length of Credit History

Short credit histories can negatively impact your score.

How to Check: Review your credit report to ascertain the age of your accounts. Recent account openings can cause your score to dip.

Lack of Diversified Credit

Having a diverse portfolio of credit - including credit cards, installment loans, and more - is crucial for a healthier score. Lack of diversity may be holding your score down.

How to Check: Verify the variety in your credit accounts. Showcasing financial adaptability across multiple credit types impacts your score positively.

Public Records

Public records such as repossessions or foreclosures can significantly affect your score.

How to Check: Check your credit report for any public records. Address these urgently to work on improving your score.

How Do I Improve my 399 Credit Score?

A credit score of 399 is far from ideal, but there’s always room for improvement. Let’s focus on the most feasible and impactful actions you can take for your current situation.

1. Prioritize Existing Debts

At this score level, it’s likely you have outstanding debts. Tackling them head-on is crucial. Where possible, arrange payment schedules with your creditors. Start to steadily pay off what’s due, focusing first on the debts incurring highest interest.

2. Monitor Your Credit Report

Errors on your credit reports can unfairly lower your scores. Lawfully, you’re entitled to a free yearly report from all three credit bureaus. Examine them carefully and report inaccuracies immediately.

3. Timely Bill Payments

Punctual bill payments are influential in credit scores. Make all future payments on time, even if they are small. Automating payments, where feasible, can be a helpful strategy ensuring you don’t miss due dates.

4. Explore Secured Credit Card Option

In your current situation, a secured credit card could be a feasible choice. These cards require a refundable deposit, which then becomes your credit limit. Use it responsibly to foster a positive repayment history.

5. Gradually Add New Credit

Once some improvement is seen, cautiously add new forms of credit such as credit builder loans. Having a mix of credit types can positively impact your score. However, manage them responsibly to avoid falling into a debt trap.

Remember, rebuilding credit takes time and patience. Stay consistent in your efforts and your score will start to reflect the progress.