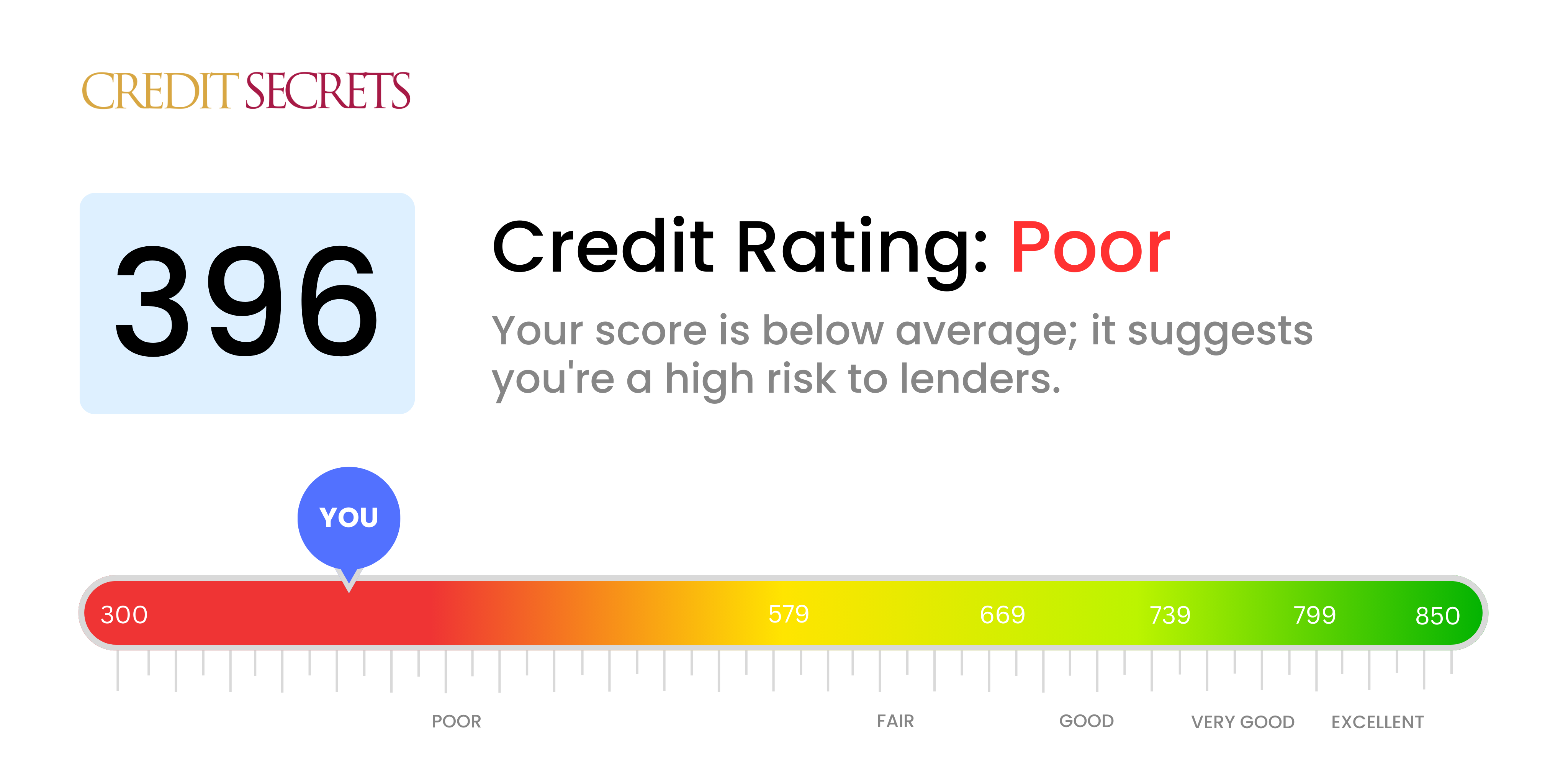

Is 396 a good credit score?

With a credit score of 396, you're currently in the 'Poor' category. There's room for improvement, but don't be disheartened - there are several strategies that can help you build your score.

A score of 396 might lead to challenges in securing lines of credit or loans, and higher interest rates may apply when you are able to secure them. However, this isn't the end of the road - many people have rehabilitated their credit standing. With some discipline, the right tools, and knowledge from Credit Secrets, you have the potential to build a better credit future.

Can I Get a Mortgage with a 396 Credit Score?

A credit score of 396 puts you in a very tricky situation if you're trying to get approval for a mortgage. This score is significantly lower than what most lenders consider acceptable. Having a score this low generally demonstrates a track record of severe financial issues, possibly including defaults or consistently late payments.

Even though this isn't what you wanted to hear, it's far from the end of the line. You must concentrate on bolstering your credit score. Begin by resolving any outstanding debts or collections on your account that are dragging your score down. Strive to make all future payments on time and manage your existing credit responsibly. Remember, transforming your credit score won't happen overnight. It will require patience and perseverance. However, consistent effort can turn your financial standing around. So keep your chin up! There are indeed better financial days ahead.

Can I Get a Credit Card with a 396 Credit Score?

A credit score of 396 represents a significant obstacle when seeking approval for traditional credit cards. This score is viewed as high-risk by lenders, indicating a prior history of financial struggles or mishandling of money. It's disappointing to face such a situation, but the reality can't be ignored. Acknowledging the current state of your credit is a crucial first step towards regaining financial health.

With a score this low, other avenues like secured credit cards may be worth exploring. These cards require a deposit matching your credit limit and can be a valuable tool for rebuilding credit. You may also consider options like finding a co-signer or looking into pre-paid debit cards. These replace instant fixes but are resourceful methods to start rebuilding financial strength. Remember, the interest rates on any form of credit available to individuals with such scores are often considerably higher, due to the perceived risk by lenders.

Can I Get a Personal Loan with a 396 Credit Score?

Having a credit score of 396 can make getting approved for a traditional personal loan quite challenging. This score suggests a high level of risk for the lender, which can unfortunately limit your options. It's a tough spot to find oneself in, but recognizing the implications of this credit score is a crucial step towards finding a suitable solution.

An alternative pathway could involve looking into secured loans where collateral is provided, or co-signed loans where someone else with good credit vouches for you. Another option could be exploring peer-to-peer lending platforms, which sometimes have less strict credit requirements. It's essential, however, to grasp that these alternative options often come with steeper interest rates and less advantageous terms to make up for the higher risk to the lender.

Can I Get a Car Loan with a 396 Credit Score?

Having a credit score of 396 can make it quite difficult when trying to obtain approval for a car loan. Normally, lenders would prefer to approve loans to those with a credit score above 660. A score under 600 is typically viewed as subprime, and your score of 396 definitely falls within this bracket. This may indicate to lenders that there's a higher risk associated, given the probability of past struggles to pay back borrowed funds.

But a credit score of 396 does not mean buying a car is an impossibility. There are lenders who are experienced in working with individuals who have lower credit scores. But remember, these car loans could possibly come with much higher interest rates. This is lenders' way to offset the risk they're undertaking. The journey might not be smooth, yet with circumspect planning and understanding of the loan terms, getting a car loan can still be attainable.

What Factors Most Impact a 396 Credit Score?

A credit score of 396 indicates a need for improvement. Here are the crucial factors likely influencing this score:

Past Due Payments

Delinquent payments might be the most damaging factor. Late or missed payments could significantly lower your score.

How to Check: Analyze your credit report to spot any recent or old overdue payments. Any missed or late payments could have led to a decrease in your score.

Excessive Credit Card Utilization

Your credit utilization rate, or the percentage of your credit limit you’re using, could be high. This may be contributing to your low score.

How to Check: Look at your credit card balances. If they are nearing their limits, this could be affecting your score negatively.

Short Credit History

A brief credit history may be working against you. Lenders prefer to see a track record of responsible credit use.

How to Check: Consider the age of your credit accounts. If they are relatively new, this could be impacting your score negatively.

Insufficient Credit Mix

Having a mix of different types of credit accounts, such as credit cards, auto loans, or mortgages, can improve your score. Lack of variety might be a factor in your present score.

How to Check: Review your current credit accounts. If they are all of one type, this may be adversely affecting your score.

Derogatory Marks in Public Records

Any public records like bankruptcy or tax liens significantly reduce your credit score.

How to Check: Inspect your credit report for any public records. Addressing these issues can improve the credit score.

How Do I Improve my 396 Credit Score?

With a credit score of 396, it’s clear you’ve encountered financial difficulties. Imperative action is needed to turn your situation around. Here’s the right track:

1. Rectify Delinquent Accounts

Priority number one should be setting right any unpaid accounts – this single step will have an immediate and significant bearing on your credit score. Even if you can’t pay in full, most creditors are open to creating a workable payment plan.

2. Lower Credit Utilization

Keeping your credit card balances below 30% of the provided limit improves your score. If your balances are high, try prioritizing the repayment of credit cards with the most outstanding balance.

3. Consider a Secured Credit Card

Owing to your current score, a standard credit card could be out of reach. However, a cash-backed secured credit card could serve as the stepping stone to demonstrate a positive payment history.

4. Seek Authorized User Status

Look to become an authorized user on a trusted friend or family member’s card – their solid credit behavior could positively reflect on your rating. Remember, the card provider must report authorized user activity to credit bureaus for this to work.

5. Broaden Your Credit Types

Once a secured credit card is well-managed, contemplate other credit options like retail credit cards or credit builder loans. Employ these responsibly to further enhance your score.