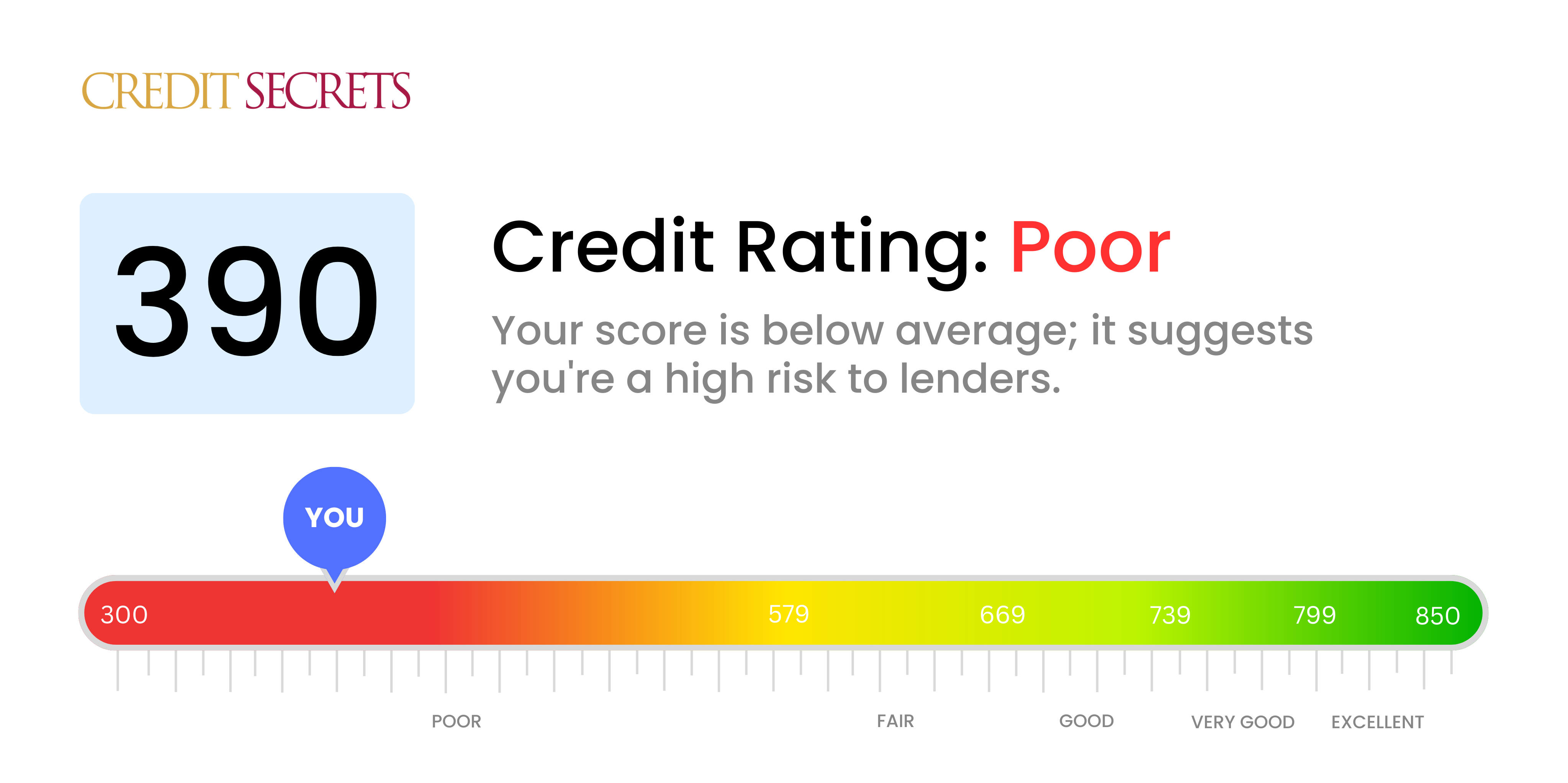

Is 390 a good credit score?

Unfortunately, a credit score of 390 falls within the range of "poor credit". Having a score in this range may make it difficult for you to get approved for new lines of credit, loans, or leases, and if approved, you'll likely face higher interest rates.

Don't let this score deter you, though. Everyone's financial journey has its ups and downs, and the bright side is that there are several ways you can start improving your credit score right away. With the right approach and by adopting good financial habits, such as consistent and timely payments, reducing your debt, and maintaining a low credit utilization, you could gradually witness a healthy rise in your credit score over time.

Can I Get a Mortgage with a 390 Credit Score?

A credit score of 390 indicates a high-risk level for lenders, and as such, it may be difficult for you to get approval for a mortgage. This score, considerably below the minimum required by most lenders, points to a track record of financial mishaps such as missed payments or defaults. Despite this, there's potential to change your circumstances. The key is understanding this situation and acknowledging the need for improvement.

Addressing the issues causing your low score, such as delinquencies or high debt-to-incomes ratio, is essential. Regular payment of your bills, coupled with responsible credit usage, can positively elevate your score. While it may seem challenging, remember that every small step towards responsible financial behaviors can go a long way in enhancing your credit profile. In lieu of a traditional mortgage, there may be alternative financing options available, such as FHA-backed loans, which have lower credit requirements. Be aware, though, these options may carry higher interest rates or require larger down payments. Improving your credit calls for continuous, concerted effort, but it will greatly increase your chances for future financial success.

Can I Get a Credit Card with a 390 Credit Score?

Carrying a credit score of 390 can feel burdensome. It makes it tough to get clearance for a conventional credit card as lenders commonly perceive this as a high-risk score. It implies a past filled with financial instability or mishandling. Though this can be a bit disheartening, it's essential to address it with pragmatism and positivity. Knowledge about your credit status is a critical step towards a better financial future, even if it means confronting some challenging realities.

Given the hurdles that a low score presents, you might want to consider other options such as secured credit cards. These cards require a deposit that serves as your credit limit. They're typically easier to acquire and they'll help you rebuild your credit over time. You could also think about finding a co-signer or using pre-paid debit cards. Remember, these choices won’t instantaneously rectify your situation, but they can serve as helpful stepping stones on your path to financial health. It's important to note, however, that individuals with such scores are likely to face higher interest rates, showcasing the increased risk perceived by lenders.

Can I Get a Personal Loan with a 390 Credit Score?

Having a credit score of 390 might be hard to swallow. It falls well outside the scope most traditional lenders consider safe for granting a personal loan. A credit score this low signifies that lending money to you involves a high risk. It's tough, but necessary, to understand the constraints a low credit score, like yours, places on your borrowing prospects.

While mainstream loans may seem out of reach, there are some alternative ways you could try. Think about a secured loan, where you offer collateral, or a co-signed loan, where someone with a stronger credit score backs up your application. Peer-to-peer lending could be another option, as their credit requirement is sometimes less stringent. However, these alternate paths mostly come with steeper interest rates and not-so-friendly terms. It's down to the simple fact that the higher risk to the lender, the tougher the loan conditions generally are.

Can I Get a Car Loan with a 390 Credit Score?

With a credit score of 390, you may find it quite hard to get approved for a car loan. Traditional lenders generally look for a score of at least 660 when deciding loan terms. Car loan providers may view your current score as subprime, which unfortunately means they see you as a high-risk borrower.

What does this mean for you? Well, your score of 390 might result in higher interest rates or, in some cases, could lead to a complete denial of your application. This is because a lower score signifies to lenders that there might be a potential risk in successfully repaying the loan based on past behavior.

But don't lose hope! Even with a lower score, there are still options available for purchasing a car. Some lenders specialize in assisting those with lower credit scores. Nevertheless, beware that these loans often come with higher interest rates as lenders try to counterbalance the risk they're taking on. Remember, with careful research and understanding of the terms involved, obtaining a car loan isn't entirely out of your reach.

What Factors Most Impact a 390 Credit Score?

With a credit score of 390, understanding the key influencers for this score can help you steer towards financial health. Every path to better financial standing is unique and holds valuable learning experiences.

Frequent Late Payments

Often, a history of late payments can lead to a low score. They may be impacting your credit score.

How to Check: Inspect your credit report thoroughly for any signs of late payments. Reflect on your payment habits that could have lowered your score.

High Credit Card Balance

High balances on credit cards can be a contributing factor to a low score. Maintaining balances near their limit can have a negative impact.

How to Check: Look at your credit card statements. If the balances are near or at their limit, this might be hurting your score.

Short and Limited Credit History

A short credit history, or few credit accounts, could be influencing your score negatively.

How to Check: Check your credit report to know the length of your credit history, the number of your credit accounts, and the average age of these accounts.

Charge-off Accounts and Collections

Having charge-off or collections accounts can seriously impact your score.

How to Check: Review your credit report for any account marked as charged-off or in collections. Temporary hardship doesn't need to be a permanent issue. Migigate the impact through setting payment plans or resolving delinquencies.

Bankruptcies, Tax Liens or Foreclosures

Public records citations can be the reason your score is lower than expected.

How to Check: Check your credit report for any mention of bankruptcies, tax liens, or foreclosures. If found, address these issues as soon as possible to improve your credit habits going forward.

How Do I Improve my 390 Credit Score?

A credit score of 390 is low, but don’t despair. There are definitive steps you can take to improve it. Let’s dive right into the most feasible and impactful strategies for your current situation:

1. Catch Up on Delinquent Accounts

If any of your accounts are in arrears, make it your highest priority to bring them up to date. The delinquent accounts most severely harm your credit score. Communicate with your creditors and possibly devise a repayment strategy.

2. Lower Your Credit Card Balances

Hefty credit card balances, compared to your credit limit, can lower your score. Strive to keep your credit card balances below 30% of your credit limit, and even aim to eventually cap them at 10%. Begin by paying off the card with the highest utilization rate.

3. Consider a Secured Credit Card

Your current score might make obtaining a regular credit card tough. Look into getting a secured credit card instead, which requires a cash deposit equal to the credit line for the account. Use it responsibly to establish a positive payment trend.

4. Request to be an Authorized User

You can request a good-credit family member or friend if they could add you as an authorized user on their credit card. This adds their good credit behavior to your history, aiding in enhancing your credit score. Be sure that the card issuer notifies the credit bureaus about the authorized user activity.

5. Introduce Diverse Credit Accounts

A variety of credit types can add positively to your credit score. Once a good payment history is established with your secured card, cautiously consider other credit products, like a credit builder loan or a retail credit card.