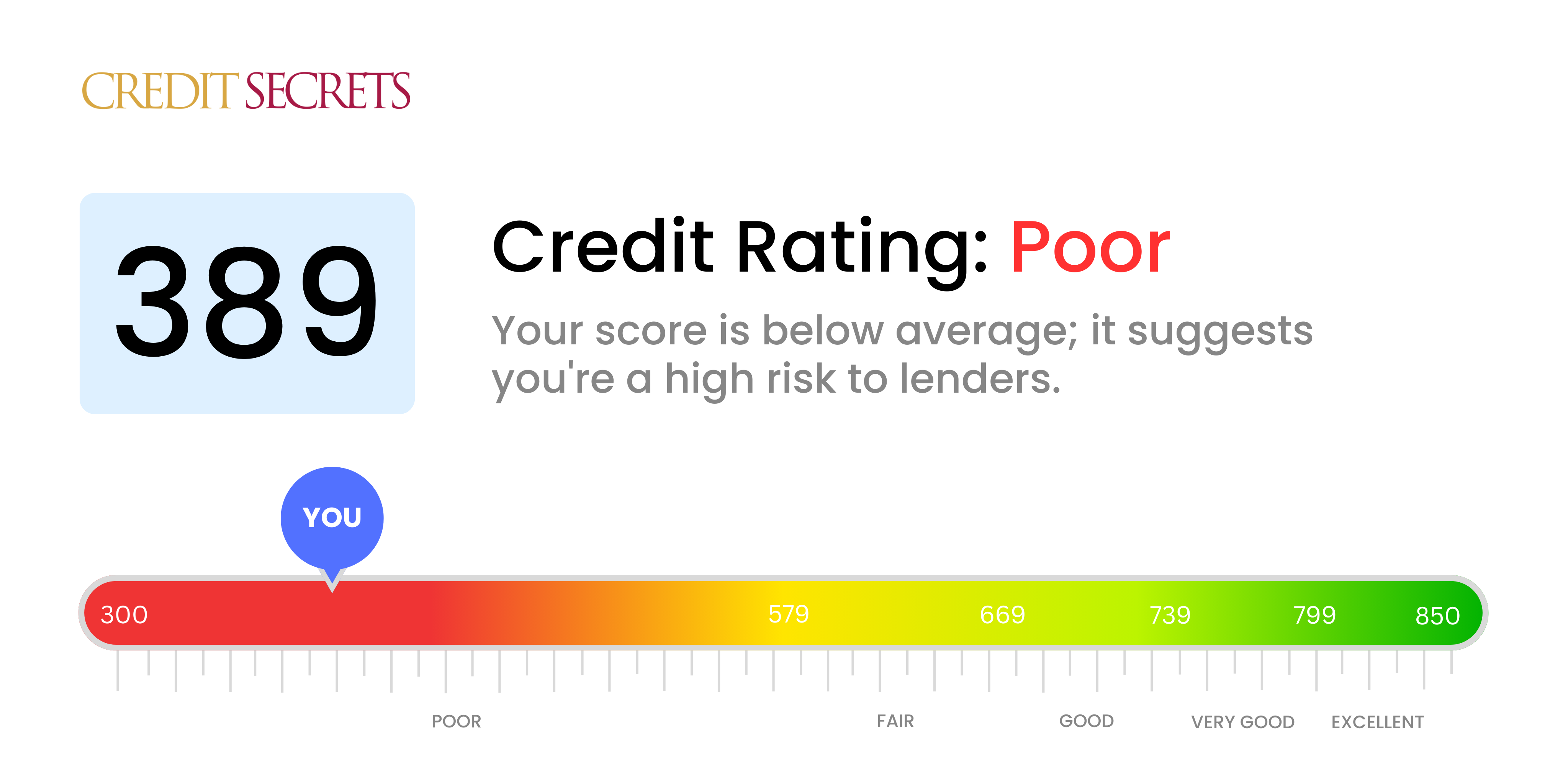

Is 389 a good credit score?

A credit score of 389 falls within the 'poor' range according to typical credit score classifications. This isn't the score you likely hoped for, but remember, it's a starting point and can be improved over time.

With a score in this range, generally, you may find it challenging to get approved for many common types of credit, such as credit cards or loans. If you do get approved, expect higher interest rates and more stringent terms due to the perceived risk lenders associate with a low credit score. However, don't feel disheartened. There are steps you can take to change your credit situation.

The Credit Secrets program can aid you in understanding the factors contributing to your current score and help you make a strategic plan to boost your credit. It's vital to keep in mind that improving your credit score takes time - and perseverance, but there are already many who've followed this path and succeeded in their credit recovery journey. Your financial future can still be bright.

Can I Get a Mortgage with a 389 Credit Score?

With a credit score as low as 389, it's very unlikely you'll secure a mortgage approval. This score is significantly under the minimum threshold typically set by lenders, indicating a track record of substantial financial issues like frequent missed payments or defaulting on debts.

While it can feel discouraging to face such obstacles, it's key to understand the importance of enhancing your credit score. Start by resolving any outstanding debts that might be hurting your score negatively. Begin establishing a pattern of making timely payments and practicing judicious use of credit. This endeavor might feel challenging, but remember that improving a credit score isn't an overnight task. It requires ongoing patience and commitment. Over time, steady effort can substantially bolster your credit standing, paving the way towards secure future financial prospects including, eventually, a successful mortgage application.

Can I Get a Credit Card with a 389 Credit Score?

With a credit score of 389, it seems hard to secure approval for a conventional credit card. A score of this magnitude is generally seen by lenders as high-risk, suggesting previous financial trouble. It's indeed a tough situation, but it's crucial to accept it with the seriousness it deserves because knowing where you stand is a stepping stone to financial improvement.

There are a few options for those with lower scores like yours. A secured credit card, which needs a deposit that doubles as your credit limit, might be an option. These cards often have more lenient approval criteria and can assist in rebuilding your score gradually. A co-signer or a prepaid debit card can serve as potential alternatives. These approaches may not resolve the issue immediately, but can be effective tools on the path to financial recovery. Interest rates for any sort of credit available to individuals with such scores are usually much higher due to the increased risk for lenders. Remember, taking little steps can lead to significant strides in improving your financial stability.

Can I Get a Personal Loan with a 389 Credit Score?

With a score of 389, your credit level falls significantly under the range that most traditional lenders find acceptable for personal loan approval. It's a challenging situation for sure, but it's essential to approach it realistically. This credit score, from a lender's perspective, indicates a high risk, which reduces your chances of securing a loan through conventional means.

Though traditional loans may be challenging to obtain, alternative options exist. Secured loans, which require collateral, and co-signed loans, backed by someone with a healthier credit score, are potential avenues. Another option is peer-to-peer lending, as they often have more flexible credit conditions. However, it's important to note that these alternatives typically come with higher interest rates and less favorable terms, due to the increased risk for the lender. These options may not be ideal, but they can help you navigate around your lower credit score.

Can I Get a Car Loan with a 389 Credit Score?

With a credit score of 389, it may be significantly difficult to get approved for a car loan. Most lenders prefer credit scores above 660 and consider any score beneath 600 as subprime. Your credit score falls into this lower range, which can result in unfavorable terms such as higher interest rates or even a complete denial of loan application. The reasoning behind this takes into account your lower score as a greater risk to the lender, suggesting potential issues with repaying the loan.

However, don't be disheartened. Despite a low credit score, you can still explore options for obtaining a car loan. Some loan providers focus specifically on helping people who have lower credit scores. Be mindful though, these particular loans often come with a heavier expense due to higher interest rates. This increase in rates is a preventive measure taken by the lenders to protect their investment against any perceived risk. Therefore, it is imperative to evaluate the terms carefully and with reasonable foresight. The journey might be a tad challenging, but obtaining a car loan is not entirely unachievable.

What Factors Most Impact a 389 Credit Score?

Navigating the financial realm with a credit score of 389 need not be daunting. Unraveling the factors that have caused this score is your first step towards a healthier financial future. Your journey is unique, and holds the potential for positive change and growth.

Payment Consistency

Your credit score heavily relies on your payment history and consistency. Late payments or missed ones altogether can cause significant harm to your score.

Checking Tip: Survey your credit report and identify any inconsistencies or late payments that might have occurred. Reflection upon past financial behaviors can be key to understanding your score.

Credit Utilization Ratio

High credit utilization can also harm your score. If your credit cards are teetering on their limits, this could be negatively impacting your score.

Checking Tip: Take a closer look at your credit card statements. If your balances are close to the limits, consider strategies for decreasing this ratio.

Credit Duration

Having a shorter credit history can potentially influence your score negatively. Your credit age comprises the age of your oldest account, the age of your newest account and an average age of all your accounts.

Checking Tip: Survey your credit report to evaluate your credit history. Consider the possibility that the age of your credit accounts may be affecting your score.

Assortment of Credit and New Credit Enquiries

Maintaining a variety of credit types and managing new credit responsibly form essential pillars for a good score.

Checking Tip:: Review your credit accounts and ascertain whether you have been handling new credit sparingly and responsibly.

Public Records

Public records like bankruptcies or tax liens can heavily impact your score. Make sure to address any such items to pledge a recovery in your credit score.

Checking Tip: Peruse your credit report for any public records. Any trace of bankruptcy or tax lien warrants immediate attention and resolution.

How Do I Improve my 389 Credit Score?

With a credit score of 389, it’s time to take decisive steps to improve your financial position. These are the most impactful actions suited to your current credit standing:

1. Review Your Credit Report

Obtain a copy of your credit report – it’s free every year from each of the three credit bureaus: Equifax, Experian, and TransUnion. Scrutinise it for mistakes. Disputing and correcting errors can have a positive effect on your credit score.

2. Tackle Delinquent Accounts

An account falls into delinquency once you miss a payment. Multiple delinquent accounts adversely affect your score. Start your recovery by becoming current on these payments. Negotiate with your creditors to set up payment plans if required.

3. Limit Credit Inquiries

Too many credit inquiries can drag down your score. Make a conscious effort to avoid new credit applications until your score improves noticeably.

4. Opt for a Secured Credit Card

Secured credit cards are more accessible at your current score, as they require a cash deposit that acts as the credit limit. Use it judiciously by making small purchases and paying off the balance monthly to establish a positive payment history.

5. Request for Goodwill Adjustments

Approach your creditors to remove any late payment entries from your report. This goodwill adjustment request can result in a better credit reputation, improving your score over time.

Stay patient and consistent. Your credit score didn’t plummet overnight, and it won’t improve in a blink too. Rest assured, suitable action and discipline will guide the positive transformation of your score.