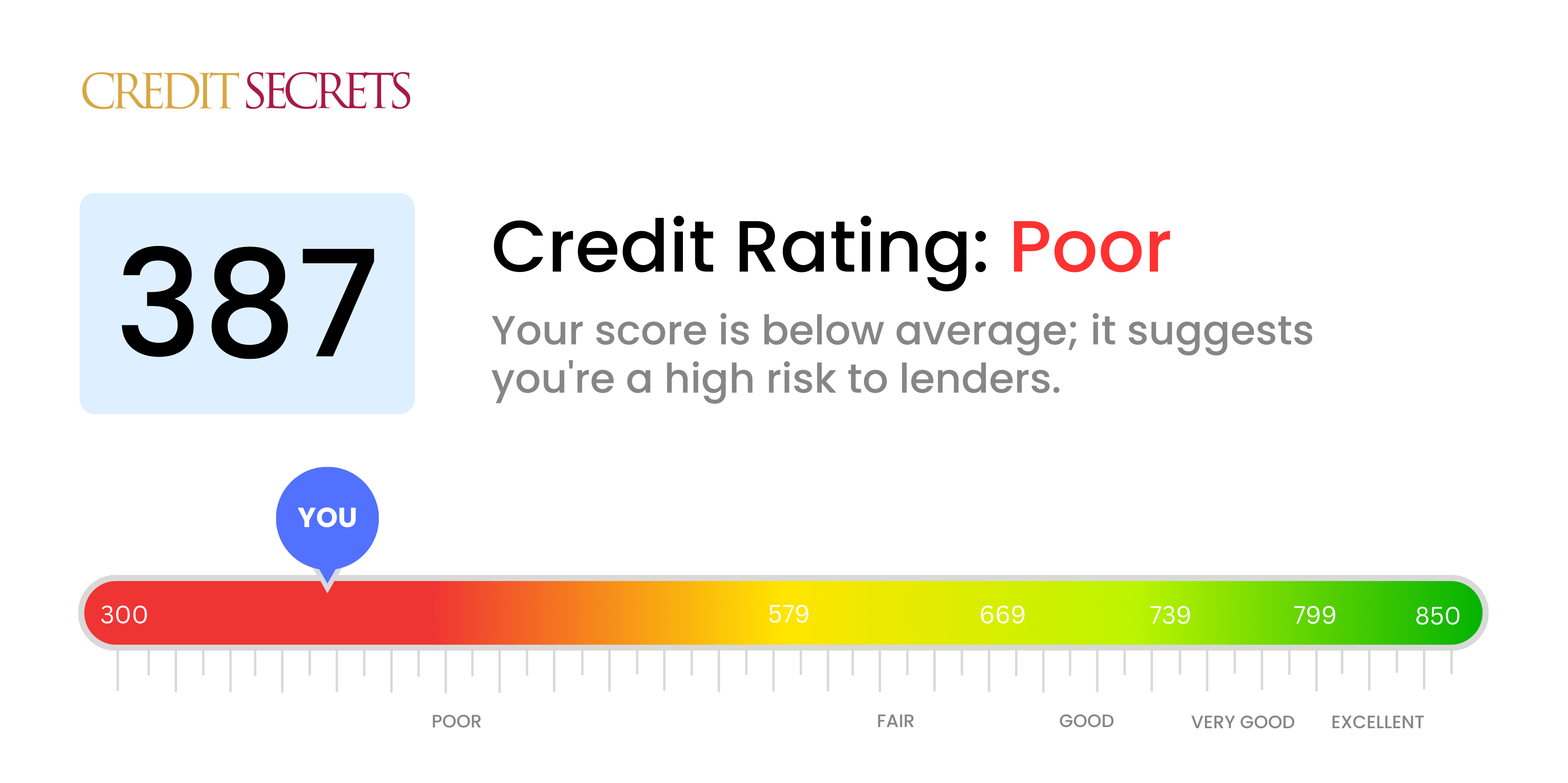

Is 387 a good credit score?

A credit score of 387 is classified as poor according to standard range classifications. Such a score indicates that lenders might regard your profile as a financial risk and therefore, it's probable that you may encounter challenges securing loans or credit with favorable terms. But don't be disheartened, as a poor credit score is not a life sentence – there are strategies out there to boost your score over time.

Remember, improving a credit score takes time and persistence, but it's entirely doable. Your ability to regularly make payments on-time, keep debts to a minimum, and avoid taking on new debt can contribute significantly to rebuilding your credit. It's about undertaking the right habits and sticking to them, and gradually, you can build a stronger credit profile to secure a healthier financial future.

Can I Get a Mortgage with a 387 Credit Score?

With a credit score of 387, securing a mortgage approval will be a significant challenge. This score is far below most lenders' minimum requirement, which usually lies around the mid-600s. Such a low credit score typically reflects serious negative financial events, such as continual missed payments or defaults that have occurred in the past.

This can be a daunting situation to face, but it's important to understand that there are options available. First off, direct your efforts towards managing any existing debts or delinquencies that might be dragging your score down. Then, concentrate on consistently making payments on time and using credit responsibly. While you might not be able to rush into homeownership immediately, focusing on improving your credit score, although it can be a slow process, will eventually lead you closer to your dream. With commitment and patience, you'll be better positioned to achieve your financial goals in the future.

Can I Get a Credit Card with a 387 Credit Score?

If you have a credit score of 387, it's likely going to be difficult to be approved for a typical credit card. This score is considered low and shows lenders that there might be some financial mistakes or problems in the past. Having a low score can feel discouraging, but don't lose hope. The first step towards improving your financial situation is to understand where you currently stand and to be honest with yourself about it.

Since gaining approval for a regular credit card may be tough, you may consider alternatives like a secured credit card. These cards require a deposit which usually becomes your credit limit. This can be a simpler method to obtain a card and can help you start rebuilding your credit over time. Another possibility could include getting a co-signer or using pre-paid debit cards. Do remember, these options might not instantly solve the problem, but they are definitely steps in the right direction. However, do note that the interest rates on these options could be high, reflecting the increased risk seen by lenders to individuals with lower credit scores.

Can I Get a Personal Loan with a 387 Credit Score?

With a credit score of 387, it's particularly tough to qualify for a traditional personal loan. Lenders view this score as an indication of high risk, signaling a challenging financial situation. This does not mean the situation is hopeless, but it's crucial to understand what this means for your borrowing prospects.

While mainstream loans might be a hard reach, there are other lending options available to you. Secured loans, where you back the loan with collateral, could be a possible route. Alternately, a co-signed loan, where a person with a better credit score vouches for you, could be another potential solution. You might also consider exploring peer-to-peer lending platforms, which may have more forgiving credit requirements. However, be prepared that these alternatives frequently carry higher interest rates and may not offer the most advantageous terms, due to the increased lender risk.

Can I Get a Car Loan with a 387 Credit Score?

When it comes to a credit score of 387, approval for a car loan may be difficult. Lenders often prefer credit scores well above 600, and sometimes as high as 660, to provide the best loan terms. With a score of 387, this puts you in a tough position. The lower score signifies to lenders a higher risk, suggesting there may be challenges in repaying funds that are lent.

Despite this, don't give up on the hope of owning a car. There are lenders out there who are experienced in working with those who have lower credit scores. However, healthy caution is advised, as the loans they provide can carry hefty interest rates. This is their way of managing the added risk they're taking on. While the journey may not be smooth, with keen attention and understanding of the terms, securing a car loan is not out of your reach.

What Factors Most Impact a 387 Credit Score?

Understanding a Credit Score of 387

Comprehending a score of 387 is essential for managing your financial roadmap. The key to improving this score lies in recognizing and addressing potential causes. Your journey towards financial health is individual, offering lessons and chances for growth.

Payment Record

One of the significant factors impacting your credit score is your payment history. Late payments or defaults could have contributed to this score.

How to check: Scrutinize your credit report to detect any late or missed payments, these may have influenced your score.

Credit Utilization

Overutilization of available credit tends to negatively impact your score. High balances on your credit cards could be a contributing factor.

How to Check: Look through your credit card statements. High balances compared to your limits can lead to lower scores.

Length of Credit History

Your credit score may also be negatively impacted by a shorter credit history.

How to Check: Study your credit report to determine the age of your accounts or if new accounts have been opened recently.

Diversity in Credit

Maintaining a variety of credit types and responsibly managing new credit contributes to a healthy score.

How to Check: Review your mix of credit accounts. Avoid frequent or irresponsible applications for new credit.

Public Records

Public records, namely bankruptcies or tax liens, can significantly impact your score.

How to Check: Check your credit report for any public records that need to be addressed.

How Do I Improve my 387 Credit Score?

Having a credit score of 387 can feel daunting, but with the right steps, you can start to rebuild. At this score level, here are some of the most impactful actions you can take:

1. Settle Unpaid Debts

You may be dealing with unpaid debts or collections. These have a large influence on your current credit score. Tackle these by contacting your creditor to pay off your debt or settle for an amount that’s manageable for you.

2. Lower Your Balances

Lowering your overall outstanding debt is crucial. Aim to decrease your credit card balances to less than 30% of your credit limit. This step includes the goal of keeping the debt ratio below 10% eventually. Begin by focusing on the cards with the highest balances.

3. Use A Secured Credit Card

Getting a regular credit card might be difficult with your current score. Consider obtaining a secured credit card, where you provide a refundable security deposit, making this card accessible. Make sure you use it responsibly, keeping the balance low and paying it off each month.

4. Join as an Authorized User

Joining a close relation or a friend’s credit card account as an authorized user helps. It allows you to benefit from their good credit habits. Be sure that the credit card company will report authorized user activity to the credit bureaus before proceeding.

5. Increase the Variety of Your Credit

Adding variety to your credit portfolio can boost your score. After showing responsible use of a secured card, consider broadening your credit types with a retail card or a credit-building loan, ensuring all obligations are managed diligently.