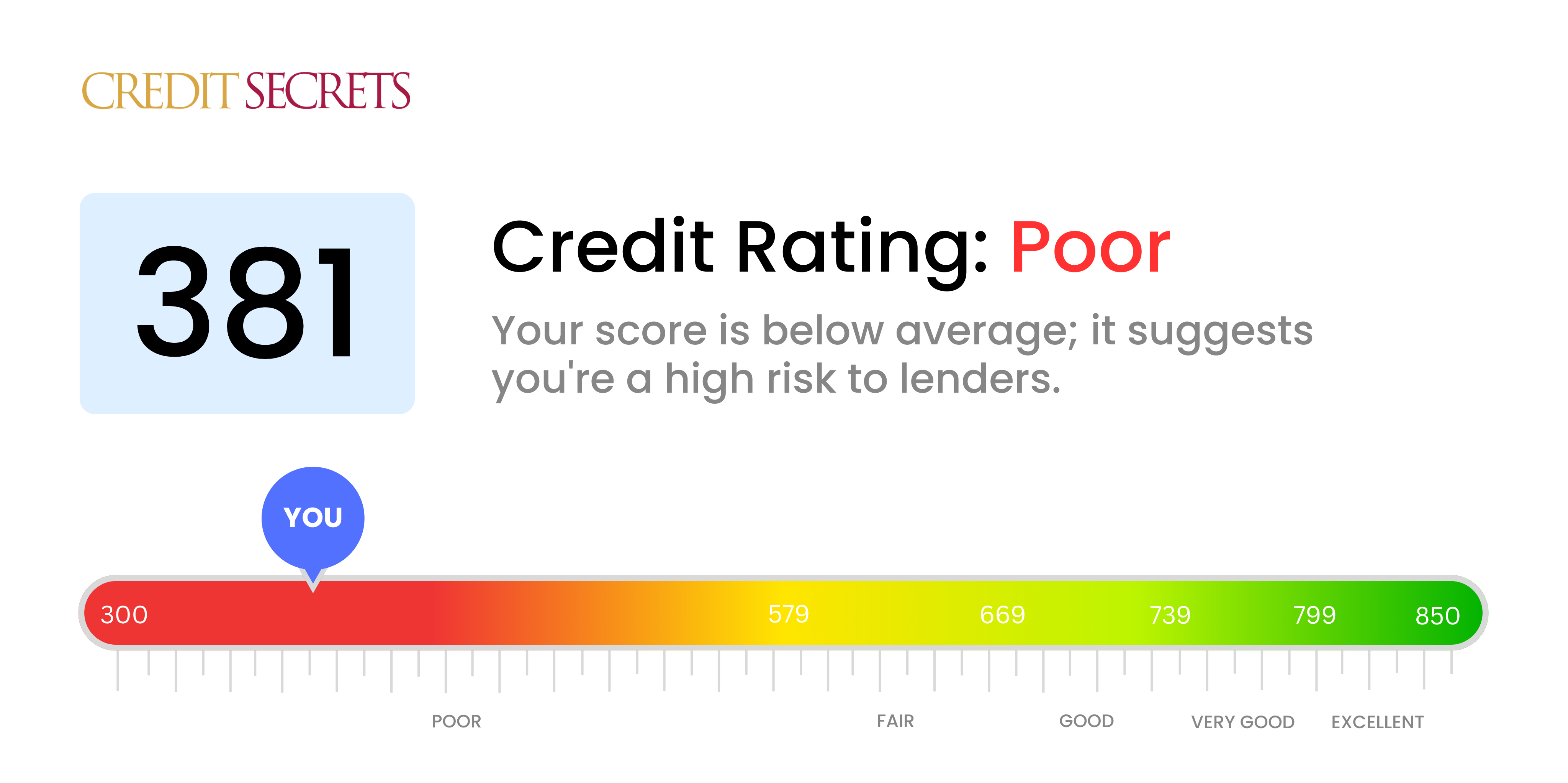

Is 381 a good credit score?

A credit score of 381 falls into the 'poor' category. It's not the best, but don't get disheartened, there is always room for improvement and better financial opportunities down the line.

With this score, getting approved for new credit can be challenging. Expect higher interest rates and less favorable terms on loans and credit cards. However, credit building is a journey and the Credit Secrets program can provide strategies to help improve your credit score.

Can I Get a Mortgage with a 381 Credit Score?

If your credit score is 381, securing approval for a mortgage could prove immensely difficult. This score is significantly below the minimum required by most lenders. A score within this range often signifies past severe financial hurdles, such as delinquencies or defaulted payments. This can make lenders hesitant to approve a mortgage as it suggests potential repayment issues in the future.

Though this news may feel unsettling, it's important to look toward potential alternatives. One option might be to consider private lenders, who might be more flexible with their credit score requirements compared to traditional financial institutions. However, bear in mind that often they offer loans at higher interest rates due to the associated risk. Alternatively, federal housing programs could be an option as they sometimes have more lenient credit requirements. Keep in mind, improving your credit score is a process that takes time and diligence, but with careful planning and solid commitment, enhancing your financial standing is achievable.

Can I Get a Credit Card with a 381 Credit Score?

Having a credit score of 381 suggests that credit approval for a traditional credit card might be quite difficult. This score is considered low by lenders, and often indicates a past of financial struggles or mishandling. Even though this is far from ideal, it's crucial to face these realities with sincerity and understanding. Recognizing your financial situation is the initial stride in the marathon towards economic recovery, which sometimes means confronting uncomfortable truths.

With a credit score of 381, exploring alternative credit options could be beneficial. Secured credit cards, for instance, need a deposit that doubles as your credit limit and could be less challenging to obtain. These cards can slowly assist in rebuilding your credit. A co-signer or pre-paid debit card might also be practical options. These alternatives don't promise immediate resolve, but they can be instrumental in steering towards a healthier financial future. Remember that any credit that does become available is likely to come with a higher interest rate, as this reflects the elevated risk perceived by the lender.

Can I Get a Personal Loan with a 381 Credit Score?

With a credit score of 381, it's clear that obtaining a traditional personal loan may pose a considerable challenge. Most mainstream financial institutions view a score in this range as a prominent risk, leading to a reduced likelihood of loan approval. While the situation may seem daunting, it's crucial to recognize the real implications of your credit score on your borrowing potential.

Faced with a lower credit score, exploring alternatives to traditional loans might be your best bet. You could look into secured loans, which require some form of collateral, or co-signed loans, where someone with a higher credit score stands as your guarantor. Platforms offering peer-to-peer lending could also prove beneficial, as they often have more flexible credit score requirements. However, it's critical to keep in mind that these choices typically entail higher interest rates and less favorable terms, a reflection of your perceived risk to the lender.

Can I Get a Car Loan with a 381 Credit Score?

Having a credit score of 381 presents significant challenges when seeking approval for a car loan. An ideal credit score is usually above 660, and anything below 600 is typically seen as subprime. In this case, your 381 score is definitely in the subprime range. This may result in higher interest rates or even denial due to the risk it presents to lenders. It indicates the potential issues you might face in paying back borrowed funds.

Still, it's important to remember that a low credit score doesn't entirely slam the door shut on opportunities to purchase a car. There are certain lenders that focus on helping those with lower credit scores, though it's worth noting that these loans typically carry higher interest rates. This is because lenders are taking on a perceived risk and they want to protect their investment. Although it may seem like a tough path ahead, with careful scrutiny and thorough understanding of the terms, getting a car loan is not entirely out of scope.

What Factors Most Impact a 381 Credit Score?

Decoding a credit score of 381 is a vital step towards improving your financial health. Understanding and addressing the components behind this score can be your starting point towards a better financial future. Remember, the journey to financial success is always unique and filled with insightful learnings.

Defaults or Delinquent payments

Your credit score may be significantly impacted by any late payments or defaults. This could be one of the significant reasons your score is at 381.

What to Do: Analyze your credit report for any late payments or missed payments. Identify if any such incidents have potentially resulted in lowering your score.

High Credit Utilization

Excessive usage of your credit limit can have a negative effect on your score. Take a look at how much of your available credit you are currently using.

What to Do: Monitor your credit card statements. If the balances are anywhere near the limits, that could be a potential issue. Aim to maintain a lower balance relative to your overall credit limit.

Short Credit History

A brief credit history may also impact your score negatively.

What to Do: Check your credit history on your credit report to gauge the average age of all your accounts. Take into consideration if you have opened new accounts recently.

Credit Mix and New Credit Applications

A diverse mix of credit types and cautious handling of new credit are important for maintaining a good score.

What to Do: Consider the variety of your credit accounts, like credit cards, retail accounts, installment loans. Assess whether you have been applying for new credit cautiously.

Public Records

Public records such as bankruptcies or tax liens can significantly lower your credit score.

What to Do: Inspect your credit report for any public records. Address any significant issues listed that may require resolution.

How Do I Improve my 381 Credit Score?

A credit score of 381 is on the lower end of the scale, but fret not, with systematic efforts you can improve it. Let’s look at the most feasible steps that you can take starting from your present score.

1. Evaluate Your Credit Report

A good starting point would be to obtain your credit report and review it thoroughly. Identify any inaccuracies or fraudulent entries and dispute them through the concerned credit bureau immediately. This can drastically change your credit score.

2. Regularize Unpaid Debts

If there are unpaid debts, focus on paying them down. Clearing off past-due debts, specially those which have gone to collections can make a huge difference to your credit score.

3. Apply For a Secured Credit Card

With your current score, obtaining a secured credit card could be more feasible. A secured card requires a collateral deposit which becomes your credit limit. Use it wisely by only spending what you can pay back in full every month. This will help build a solid payment history.

4. Request to Be an Authorized User

An effective way to improve your score is by becoming an authorized user on a credit card of a trusted person with a good credit history. Always ensure the card company reports this to the credit bureaus for maximum benefit.

5. Create A Diversified Credit Portfolio

When ready, slowly add to your credit portfolio. Try other credit types such as a credit-builder loan or a store credit card. Maintaining these responsibly will go a long way in building up your credit score.