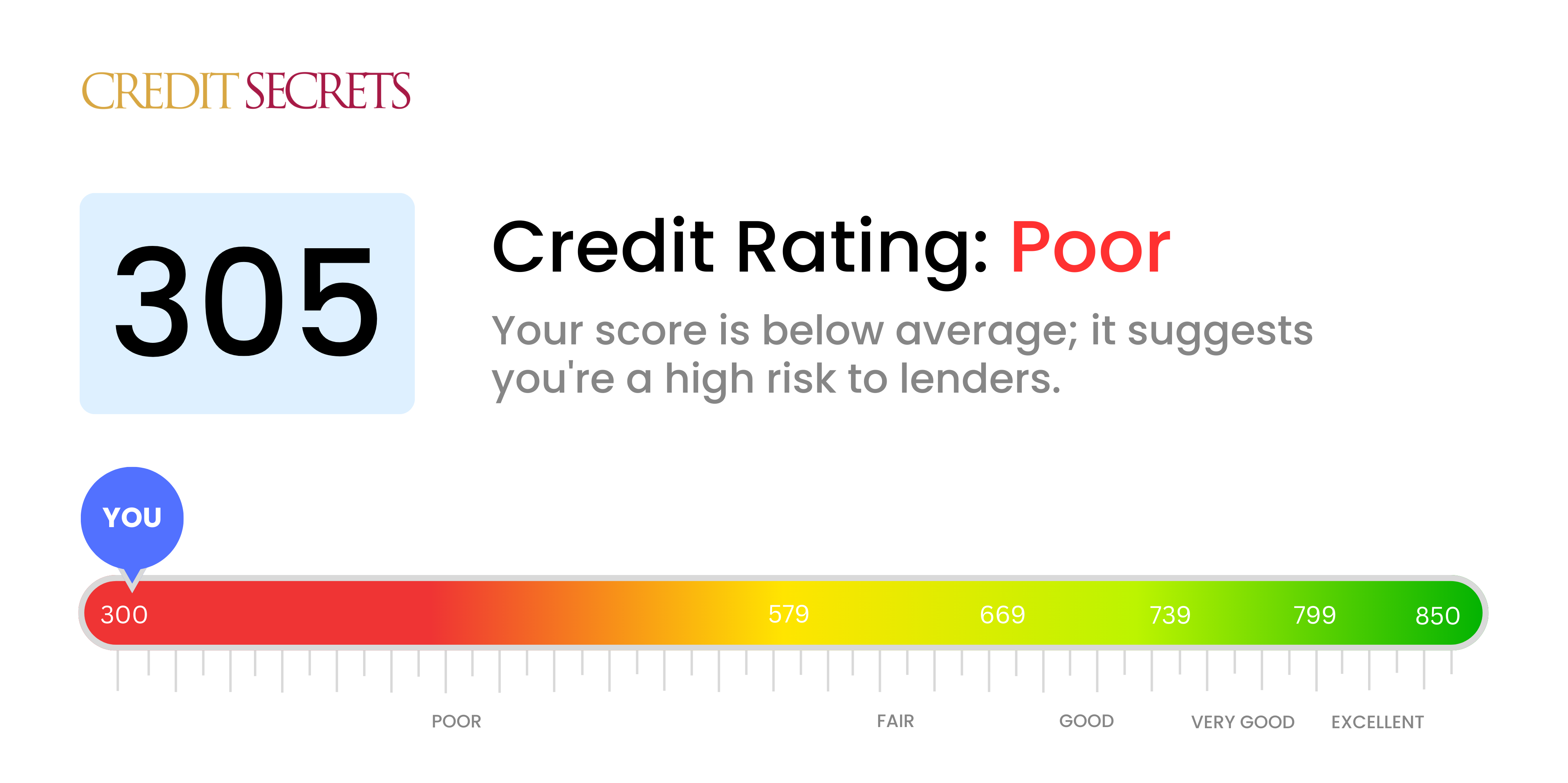

Is 305 a good credit score?

A credit score of 305 is categorized as poor, indicating significant room for improvement. Despite being a less than ideal score, you should remember that it's not permanent and can be improved upon with focused effort and financial discipline.

With this score, you might find it challenging to get approved for loans, credit cards, and other credit-based services. If you do get approved, it's likely you may face higher interest rates and less favorable terms due to higher perceived risk on the part of lenders. However, with time, responsible credit behavior, and positive financial habits, you can gradually increase your credit score.

Can I Get a Mortgage with a 305 Credit Score?

Having a credit score of 305 indicates that acquiring a mortgage will be exceptionally difficult, given that most lenders typically seek a minimum score much higher than this. A score in this range suggests a track record of severe financial struggles, which might involve skipped payments or defaulted loans.

Recognizing that you may feel frustrated, it's important to know there are alternative solutions to consider. One possibility is a Federal Housing Administration (FHA) loan, typically more forgiving with credit scores, while some other non-profit organizations sometimes provide housing assistance to individuals with low credit scores. However, expect higher interest rates due to the increased risk lenders associate with lower credit scores. As you face this challenge, maintain hope and determination. While there are no quick fixes, steadily paying off debts and maintaining financial responsibility will gradually bolster your credit score. Remember, even a small step toward improving your credit is a step in the right direction.

Can I Get a Credit Card with a 305 Credit Score?

With a credit score of 305, securing a traditional credit card approval might be a tall order. This is considered a significantly low score, an indicator that financial institutions might view you as a high-risk client, which suggests a possibility of previous financial mishaps. Approaching this situation with understanding and a dose of reality is crucial. Acknowledging your credit status is a primary step towards financial recovery.

The alternatives for someone with this score could be exploring secured credit cards, requiring a deposit that serves as your credit limit. This can potentially help rebuild your credit over time. You might also consider requesting a reliable person to co-sign for you or use pre-paid debit cards. Always remember, these alternatives do not offer an immediate fix, but they do provide a starting point towards regaining financial stability. Keep in mind, though, that any credit availability for someone at this score range usually comes with considerably high-interest rates, due to the perceived risk from lenders. Patience is key here, and using these tools wisely can gradually lead to improved financial standings.

Can I Get a Personal Loan with a 305 Credit Score?

Having a credit score of 453 presents a tricky situation for obtaining a personal loan from traditional lenders. This credit score is significantly lower than what most lenders find acceptable and therefore, can be seen as an indicator of high risk. Due to this, your chances of loan approval in typical conditions might be quite slim. It's a tough pill to swallow, but it's vital to comprehend the implications of this credit score on your borrowing abilities.

So, where do you go from here? Though conventional loans might be hard to acquire, there are different directions to explore. Consider secured loans, where you offer some form of collateral, or co-signed loans, having someone with better credit back you up. Peer-to-peer lending could also be an avenue, as they sometimes don't have stringent credit score demands. It's important to bear in mind, though, that these alternative solutions likely carry higher interest rates and less desirable terms, as they're seen as quite risky from the lender's perspective.

Can I Get a Car Loan with a 305 Credit Score?

With a credit score of 305, navigating your way to a car loan approval might prove to be quite a hurdle. This score is significantly lower than what most lenders look for, which usually exceeds a score of 660. Essentially, a score below 600 is viewed as subprime, indicating a higher risk for lenders because it suggests potential challenges in paying back the borrowed funds. Your score of 305 regrettably falls well within this category, and as a result, may lead to higher interest rates or even outright denial of your loan request.

Despite this, it's important to remember that a low credit score doesn't automatically take away your chance of becoming a car owner. There are lenders who specialize in working with individuals carrying lower credit scores. Yet, prudence is key as these loans likely carry substantially higher interest rates. This is caused by the increased risk lenders perceive and their need to ensure that their investment is protected. Although it might be a tougher path, if you're cautious and pay close attention to the terms, there's potential for you to secure a car loan.

What Factors Most Impact a 305 Credit Score?

Improving a score of 305 can seem challenging, but understanding the factors that impact this score will help your journey to a healthier financial score. Your credit score is your financial health indicator; it's important to keep it in good shape.

Payment History

Your payment history significantly affects your credit score. Having a record of missed or late payments is likely a factor in your current score.

How to Check: Scrutinise your credit report for missed or late payments. Think about any payments you might have made after the due date, as these are likely impacting your score unfavorably.

Credit Card Balances

If you're maxing out your credit cards, it can negatively impact your score. High credit card balances could be a significant factor in your current score.

How to Check: Review your credit card statements. If your balances are close to or at the limit, this could be detrimental to your score.

Debt to Income Ratio

If your overall debt is high compared to your income, it could negatively affect your score.

How to Check: Take note of how much of your income goes towards paying off debt every month. A high debt-to-income ratio could be dragging your score down.

Credit Enquiries

Too many credit applications, especially in a short time, can lower your score.

How to Check: On your credit report, look at the section detailing credit enquiries. If there have been multiple enquiries recently, this can be damaging to your score.

Derogatory Marks

Bankruptcies, tax liens, or civil judgments can lower your score drastically.

How to Check: Check your credit report for any derogatory marks. These could be a significant reason behind your current score.

How Do I Improve my 305 Credit Score?

A credit score of 305 is classified as very poor. Yet, don’t lose heart because rebuilding your credit can be an achievable goal. Here are the most feasible and impactful steps for your current situation:

1. Confronting Collection Accounts

Collection accounts have a negative impact on your credit score. Immediately tackling them should be your priority. Approach your collection agencies to discuss possible payment strategies. Remember, each settled account is a positive step towards improving your score.

2. Strategically Pay Off Debts

Having debts not only presents a financial burden but also hinders your credit score growth. Formulate a systematic plan to pay off your debts, prioritizing those with the highest interest rates. Consistently reducing your debt will gradually enhance your credit score.

3. Adopt a Secured Credit Card

Your current credit score might make it difficult to obtain a traditional credit card. A secured credit card could be a practical alternative. These cards, which require a refundable deposit, can help you establish a solid payment history if properly managed.

4. Leverage as an Authorized User

Consider asking a reliable family member or friend with sound credit to add you as an authorized user on one of their credit cards. This could boost your credit score by integrating their strong payment record into your credit history.

5. Utilize a Credit-Builder Loan

A credit-builder loan might be an effective tool for improving your credit score. These loans, typically offered by credit unions and community banks, are designed specifically to help individuals rebuild their credit.