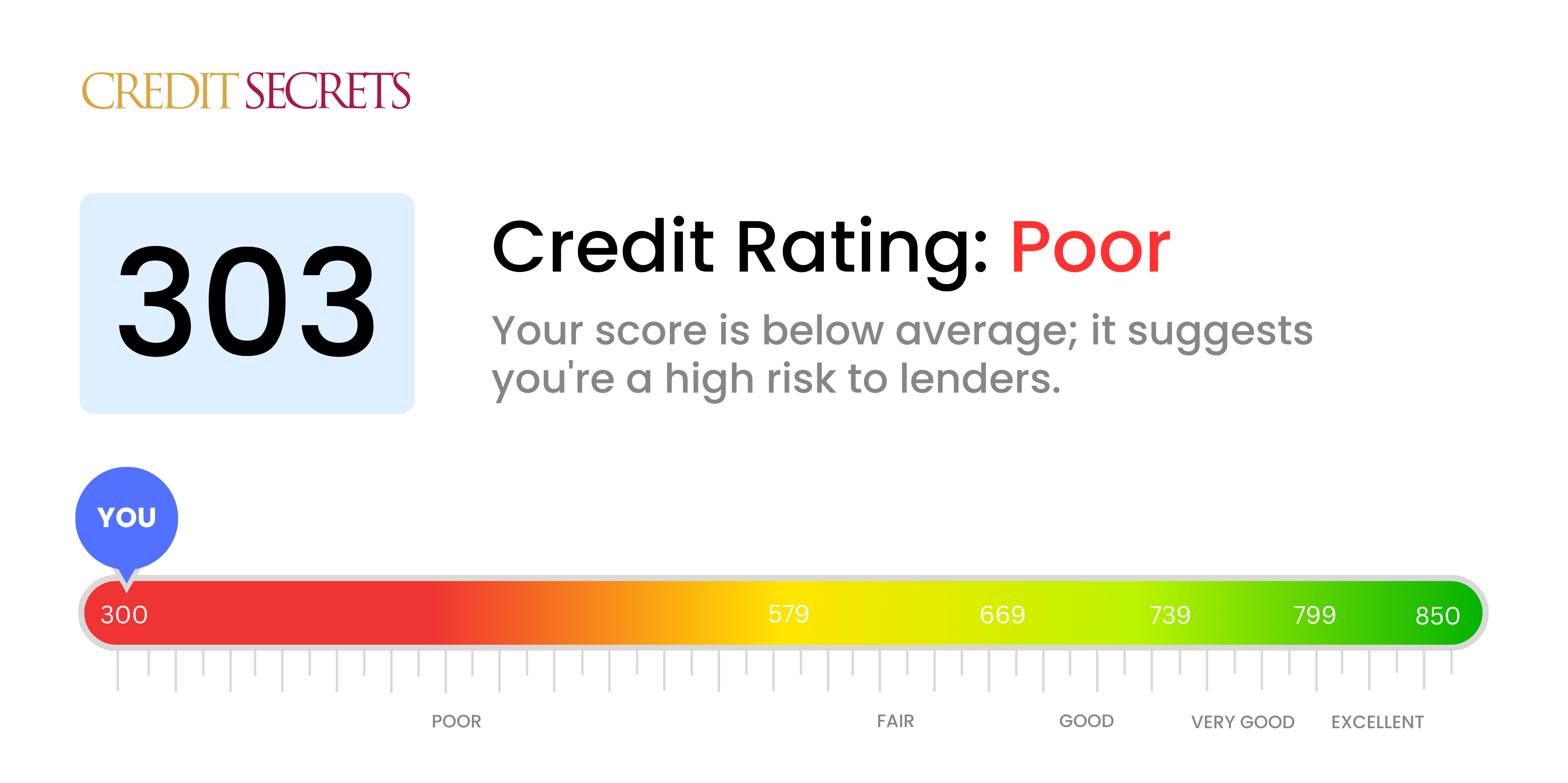

Is 303 a good credit score?

A credit score of 303 falls under the "Poor" category, indicating significant challenges in managing credit. With this score, you may face difficulties in obtaining new credit, securing favorable interest rates, or qualifying for certain financial products.

It's important to understand that a poor credit score can limit your financial options and make it more challenging to achieve your goals. However, this doesn't mean that you're doomed. With the right strategies and commitment to improving your credit, you can gradually work towards raising your score and gaining better access to credit opportunities.

Can I Get a Mortgage with a 303 Credit Score?

Can I Get a Credit Card with a 303 Credit Score?

With a credit score of 303, it is highly unlikely that you will be approved for a traditional credit card. This score is considered very low and indicates a history of financial difficulties or mismanagement. While this news may be disappointing, it is important to face it with a realistic understanding of your current credit situation. Acknowledging your credit status is the first step towards rebuilding your financial health, even if it means confronting some challenges.

Given the difficulties associated with such a low score, exploring alternative options like secured credit cards could be beneficial. These cards require a deposit that acts as your credit limit and can be easier to obtain. They also offer the opportunity to rebuild your credit over time. Additionally, considering a co-signer or looking into pre-paid debit cards might also be viable alternatives for now. It is crucial to remember that these alternatives don't instantly fix the situation, but they can serve as useful tools on your journey towards financial stability. Lastly, it's important to note that interest rates on any form of credit available to individuals with such scores tend to be significantly higher, reflecting the higher perceived risk to lenders.

Can I Get a Personal Loan with a 303 Credit Score?

Can I Get a Car Loan with a 303 Credit Score?

What Factors Most Impact a 303 Credit Score?

Understanding a score of 303 is crucial for mapping out your journey toward financial improvement. Identifying and addressing the factors contributing to this score can pave the way for a healthier financial future. Remember, every financial journey is unique, filled with growth and learning opportunities.

Payment History

Payment history has a significant impact on your credit score. Late payments, defaults, or missed payments can be key contributing factors to your current score.

How to Check: Review your credit report for any late payments, defaults, or missed payments. Reflect on any instances where you may have struggled to make payments on time, as these could have affected your score.

Credit Utilization

High credit utilization can negatively affect your score. If your credit cards are maxed out or close to their limits, this might be a contributing factor impacting your score.

How to Check: Examine your credit card statements. Are the balances close to or exceeding the credit limits? Aim to keep balances low compared to the limit to help improve your score.

Length of Credit History

A shorter credit history can influence your score negatively. If you have recently established credit or do not have a long credit history, this could be a contributing factor to your current score.

How to Check: Review your credit report to assess the age of your oldest and newest accounts, as well as the average age of all your accounts. Consider whether you have recently opened new accounts, as this can impact your credit score.

Credit Mix and New Credit

Having a variety of credit types and managing new credit responsibly are important for improving your score. If you lack diverse credit accounts or have been applying for new credit frequently, this may be impacting your score.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Consider whether you have been applying for new credit sparingly, as multiple inquiries can be detrimental to your score.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score. If you have any unresolved public records listed on your credit report, they may be contributing to your current score.

How to Check: Examine your credit report for any public records. If there are any items listed that require resolution, address them promptly to minimize their impact on your credit score.

How Do I Improve my 303 Credit Score?

A credit score of 303 is considered extremely low, but don’t lose hope just yet. There are practical steps you can take to start improving your credit score from where it is right now.

1. Address Outstanding Debts

If you have any lingering debts, it’s crucial to address them as soon as possible. Start by contacting your creditors to negotiate a payment plan or explore options for debt settlement. Paying off these debts will show financial responsibility and have a positive impact on your credit score.

2. Establish a Payment Schedule

Create a realistic payment schedule to ensure you make timely payments. Missing or late payments have a significant negative impact on your credit score. Set reminders, automate payments, or use budgeting tools to help you stay on track and avoid further damage.

3. Seek Secured Credit Products

Considering your current score, it may be difficult to qualify for traditional credit cards. However, you can explore secured credit cards or secured loans. These require a cash deposit or collateral to establish the credit line. Use them responsibly, making small purchases and paying off the balance in full each month to gradually rebuild your credit.

4. Dispute Errors on Your Credit Report

Review your credit report for any inaccuracies or errors that could be negatively impacting your score. If you find any discrepancies, file a dispute with the credit bureaus to have them corrected or removed. Even small errors can make a difference in improving your credit standing.

5. Seek Credit Education and Resources

Take advantage of educational resources and programs, like Credit Secrets, that can provide valuable insights and strategies for improving your credit. Educating yourself about credit management can help you make informed decisions and take the necessary steps to boost your score.

Remember, rebuilding your credit takes time and patience, but with the right actions, you can start making a positive impact on your credit score. Stay committed and focused on your financial goals, and you’ll be on your way to achieving a healthier credit profile.