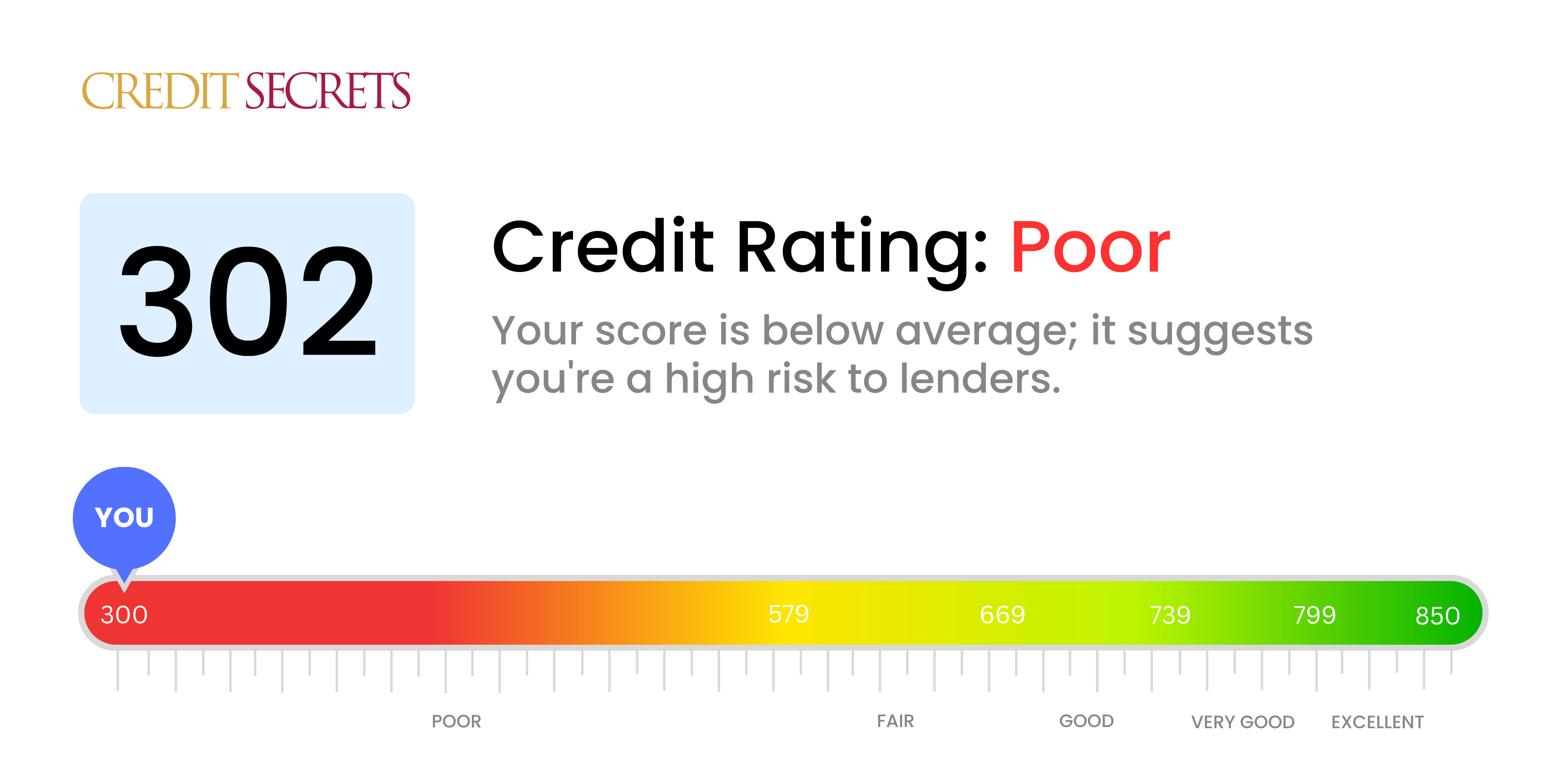

Is 302 a good credit score?

A credit score of 302 is considered a poor credit score. With this score, you may encounter difficulties in obtaining credit, such as loans or credit cards, and you may also face higher interest rates and limited options for financial opportunities.

However, it's important to remember that credit scores are not permanent and can be improved with the right strategies. By implementing responsible financial habits, such as making timely payments, keeping credit utilization low, and managing your debts wisely, you can start rebuilding your credit and working towards a better financial future.

Can I Get a Mortgage with a 302 Credit Score?

Can I Get a Credit Card with a 302 Credit Score?

Can I Get a Personal Loan with a 302 Credit Score?

Can I Get a Car Loan with a 302 Credit Score?

With a credit score of 302, obtaining approval for a car loan can be quite challenging. Lenders typically prefer borrowers with credit scores above 660 for more favorable terms, and a score below 600 is often considered subprime. Unfortunately, your score falls into this subprime category, which may lead to higher interest rates or even loan denial. It's important to understand that a lower credit score implies a higher risk to lenders, as it suggests potential difficulties in repaying borrowed money.

However, don't lose hope just yet. Some lenders specialize in working with individuals who have lower credit scores. Though you need to exercise caution, as these loans often come with significantly higher interest rates. These increased rates are a way for lenders to protect their investment and compensate for the perceived risk. While the path to securing a car loan may not be smooth, with careful consideration and a thorough exploration of the terms, it is still possible to achieve your car purchasing goals.

Remember, each lender has their own criteria, so it's essential to shop around and compare offers. And keep taking steps to improve your credit score over time, as this will open up more options for you in the future.

What Factors Most Impact a 302 Credit Score?

Understanding a score of 302 is crucial for mapping out your journey toward financial improvement. Identifying and addressing the factors contributing to this score can pave the way for a healthier financial future. Remember, every financial journey is unique, filled with growth and learning opportunities.

Payment History

Your payment history has a significant impact on your credit score. Late payments or defaults could be key contributing factors to your score.

How to Check: Review your credit report for any instances of late payments or defaults. Reflect on any delayed payments that may have affected your score.

Credit Utilization

High credit utilization can negatively affect your score. If your credit cards are close to their limits, this might be a contributing factor.

How to Check: Examine your credit card statements. Are your balances near the limits? Aim to keep your balances low compared to the limit, as it is beneficial for your score.

Length of Credit History

A shorter credit history can have a negative influence on your score.

How to Check: Review your credit report to assess the ages of your oldest and newest accounts, as well as the average age of all your accounts. Consider whether you have recently opened new accounts.

Credit Mix and New Credit

Having a variety of credit types and managing new credit responsibly are essential for a good score.

How to Check: Evaluate the mix of your credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Also, consider whether you have been applying for new credit sparingly.

Public Records

Public records such as bankruptcies or tax liens can have a significant impact on your score.

How to Check: Examine your credit report for any listed public records. If there are any items that need resolution, make sure to address them promptly.

How Do I Improve my 302 Credit Score?

A credit score of 302 is considered very poor, but don’t worry, there are steps you can take to start improving it. Here are the most impactful and accessible strategies for your current credit score:

1. Address Past-Due Accounts

If you have any accounts that are past due, it’s crucial to bring them current as soon as possible. Focus on paying off the most overdue accounts first, as they have the most negative impact on your credit score. If needed, reach out to your creditors to negotiate a payment plan.

2. Settle Outstanding Debts

Work on settling any outstanding debts that you may have. Contact your creditors or collection agencies to discuss repayment options. Negotiating a lower settlement amount can help you clear the debt faster, but be sure to get any agreements in writing before making payments.

3. Use Secured Credit Cards

Given your current score, qualifying for a regular credit card might be challenging. Consider applying for a secured credit card, which requires a cash collateral deposit that serves as the credit line for the account. Use it responsibly by making small purchases and paying off the balance in full each month. This will help you build a positive payment history over time.

4. Check for Errors

Review your credit reports from all three major credit bureaus for any errors or inaccuracies. Dispute any incorrect information you find, as these errors can impact your credit score. Rectifying these errors can potentially boost your score.

5. Budget and Pay on Time

Create a realistic monthly budget to ensure you make timely payments to all your creditors. Paying your bills on time is essential for improving your credit score. Consider setting up automatic payments or reminders to help you stay on track.

Remember, improving your credit score takes time and consistency. By following these steps and staying committed, you can make progress toward achieving a better credit standing.