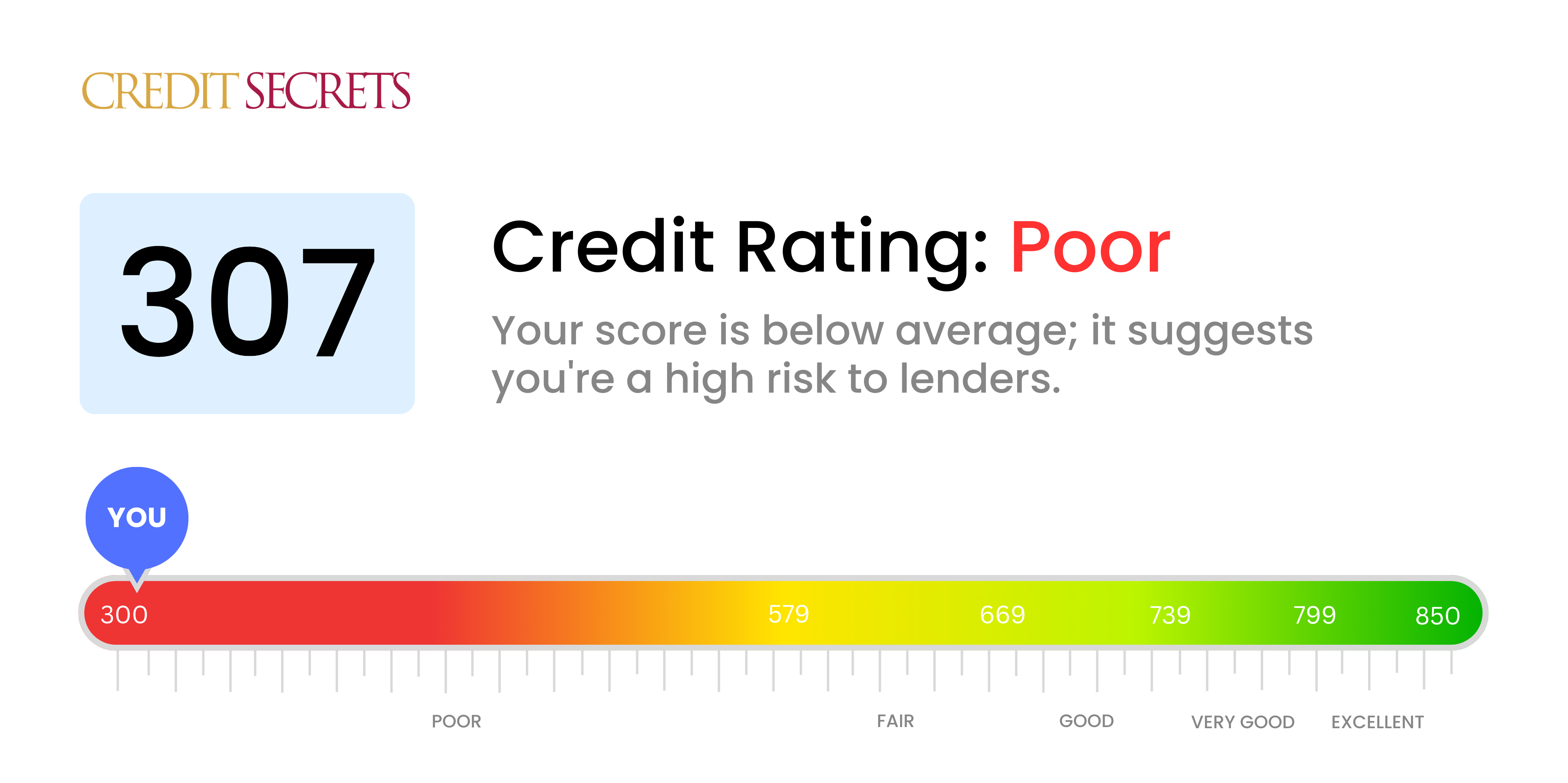

Is 307 a good credit score?

With a score of 307, it's evident that your credit health is currently categorized as poor. Though this might feel daunting, it's important to understand that it's just a temporary situation and steps can be taken to turn things around.

A credit score of 307 will likely limit your options when it comes to certain financial opportunities. For instance, you may encounter higher interest rates, restricted credit limits, and you may find it tough to qualify for personal loans, credit cards, or mortgages. The silver lining here is that this situation isn't permanent; with dedicated effort, your credit score and financial outlook can transform for the better.

Can I Get a Mortgage with a 307 Credit Score?

With a credit score of 307, attaining a mortgage approval is unfortunately improbable. This score is quite below the necessary threshold for most lenders. A credit score within this range often signals a history of financial setbacks, possibly pledged with missed or defaulted payments.

This may seem like a tough spot to be in, but don't lose hope. The key to overcoming this hurdle is through improving your credit score. Embarking on this journey means dealing with any existing debts or delinquencies that may be weighing your score down. Subsequently, it is essential to establish a strong record of timely payments and prudent credit utilization. Importantly, improving your credit score won't happen overnight, it takes dedication and time. However, with consistent effort, the prospect of future financial freedom becomes a truly possible outcome.

Additionally, even if a loan approval is possible with a credit score of 307, it's not recommended because you'll likely be subjected to higher interest rates and harsher loan conditions. These terms could potentially cause more financial strain down the line, adding to your debt instead of helping you manage it.

Can I Get a Credit Card with a 307 Credit Score?

If your credit score is 307, getting approved for a traditional credit card could be a tough hurdle. A score this low might suggest to lenders a history of financial mishaps and they might see you as a risky borrower. Coming to terms with this situation can sting a bit, but realizing the reality of your financial status is the first step towards cardiographic rehabilitation.

As you face barriers with a low score, alternatives such as secured credit cards might be helpful. These cards ask for a deposit that mirrors your credit limit, making them easier to obtain and a useful tool to uplift your score over time. Another alternative could be finding a co-signer or switching to pre-paid debit cards. Bear in mind, these are not instant solutions, but they do act as stepping stones towards financial stability. Also, be aware that interest rates can be significantly higher for any credit accessible to you due to the higher perceived risk for the lenders.

Can I Get a Personal Loan with a 307 Credit Score?

Unfortunately, a credit score of 307 is considerably lower than the typical credit range required for traditional personal loan approval. Lenders see this score as indicative of a high-risk situation, making it improbable for a loan sanction. Acknowledging this reality is tough but necessary in understanding your borrowing alternatives.

In situations where conventional loans aren't possible, there are other options you could explore. You might consider a secured loan, which involves providing collateral. Alternatively, you could opt for a co-signed loan, where another individual with a stronger credit score acts as your guarantor. Peer-to-peer lending platforms could also be an option as they often have more flexible credit requirements. While these platforms might offer higher chances of approval, it's important to note that they often come with higher interest rates and less borrower-friendly terms due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 307 Credit Score?

With a credit score of 307, it's likely you'll face some challenges when applying for a car loan. Auto lenders usually prefer to see a credit score above 660. Anything less than 600 is often viewed as subprime which could lead to potentially higher interest rates or even denial of your loan application. Your score of 307 is in this subprime category. Lower scores suggest a higher risk to lenders and may indicate potential issues with repayments in the future.

But don't lose hope. Even with a lower score, options for car financing do exist. Certain lenders focus on helping those with lower credit scores. However, be prepared as these loans typically come with higher interest rates. This is because lenders are taking on a greater risk and want to protect their investment. It may be a difficult path, but with proper understanding and evaluation of your options, securing a car loan isn't entirely out of reach.

What Factors Most Impact a 307 Credit Score?

Deciphering a score of 307 is a significant step in your journey towards financially securing your future. Focusing on key factors that might have contributed to this score is crucial in setting your financial course right.

Negatively Affected Payment History

Your record of late payments or defaults could have significantly influenced your credit score, as payment history plays a pivotal role in credit scoring.

How to Check: Inspect your credit report for any evidence of late payments or defaults. Look back on past payment practices to pinpoint any delays in payment that might have negatively impacted your score.

High Credit Utilization

High credit card balances can also be detrimental to your credit score. If your credit cards are nearing their limits, this could be a reason behind your score.

How to Check: Scrutinize your credit card statements. Are your balances close to the limits? Strive to maintain low balances relative to your credit limit to enhance your score.

Short Credit History

Your credit score can also be negatively impacted by a brief credit history.

How to Check: Look over your credit report to assess the length of your oldest and newest accounts and the average period of all your accounts. Reflect on whether you have opened any new accounts recently.

Credit Variety and Recent Credit

Ensuring a mix of diverse credit types and cautiously opening and handling new credit are vital for improving your score.

How to Check: Evaluate your range of credit accounts. If you've been applying for new credit too often, it may have negatively impacted your credit score.

Derogatory Marks

Public records or collections, such as bankruptcies and tax liens, can notably decrease your score.

How to Check: Inspect your credit reports for any derogatory marks and address any that need resolution.

How Do I Improve my 307 Credit Score?

With a credit score of 307, there’s substantial room for improvement. But don’t worry, better financial health is within reach with some strategic moves. Here’s the most impactful path forward for you:

1. Prioritize Outstanding Balances

Addressing your unpaid debts is key. Get a handle on which debts are overdue and start by aiming to rectify those. Communicate with your creditors and see if it’s possible to formulate a repayment scheme that suits your current finances.

2. Establish a lower credit utilization ratio

High balances on your credit cards in relation to your credit limit can drastically affect your score. Aim for your balances to remain below 30% of your total limit. Strive to pay off your cards with the highest utilization first to lower your overall usage ratio.

3. Apply for a secured credit card

Your score currently may pose challenges for standard credit card approval. A viable route to consider is obtaining a secured credit card. This type of card requires a refundable deposit and helps you to establish better spending habits while slowly building your credit score.

4. Request to be an Authorized User

Approach someone with a good credit score–a friend or family member–and ask them to add you as an authorized user on their card. This allows their positive credit behavior to reflect on your report, thus boosting your score.

5. Cultivate a Variety of Credit

An array of well-managed credit accounts can help leverage your score. Start with consistent, responsible usage of a secured card. Once this is established, consider other forms of credit such as retail credit cards or credit builder loans, managed responsibly.