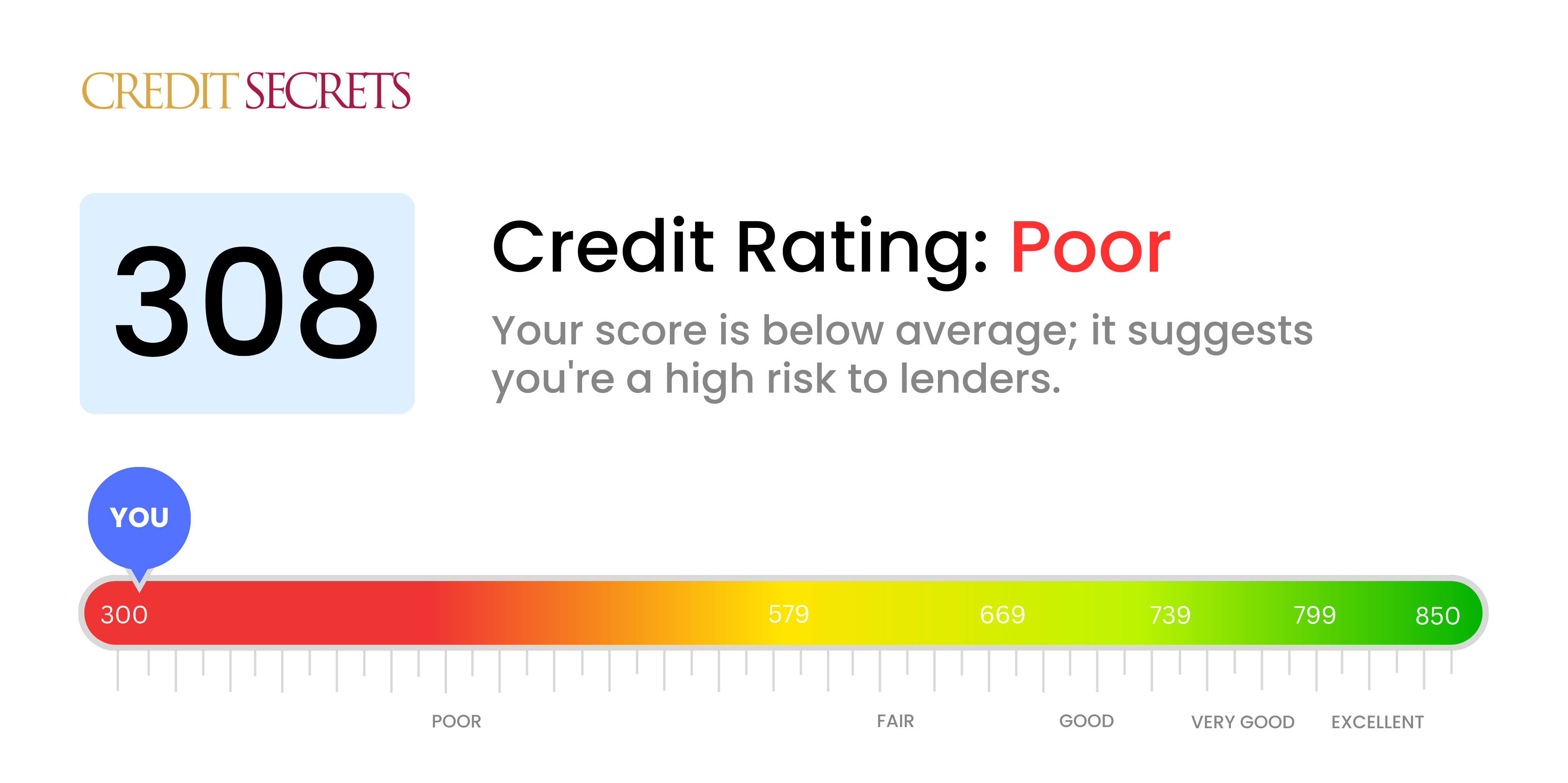

Is 308 a good credit score?

With a credit score of 308, you're unfortunately in the 'poor' category. This means you're likely to face challenges when attempting to secure loans or credit cards, and lenders may view you as a high-risk borrower.

But every cloud has a silver lining, and this is your opportunity for a fresh start. By utilizing our Credit Secrets program, you can take the first steps toward improving your financial health and ultimately enhancing your credit score. Remember, the journey of a thousand miles begins with a single step, and taking that first step matters most.

Can I Get a Mortgage with a 308 Credit Score?

If your credit score is currently 308, receiving approval for a mortgage might pose a considerable challenge. Typically, lenders are looking for scores far higher, as your current score suggests some serious financial hiccups in your past like late payments or defaults. It's important to know that this doesn't mean you're permanently stuck. There are options available to you.

One of the primary factors you should consider at this moment is addressing any outstanding financial issues that may be dragging down your score. Additionally, it would be beneficial to begin establishing a pattern of prompt payments and responsible credit usage. If a traditional mortgage doesn't seem possible right now, there are alternative paths like pursuing a smaller, easier-to-obtain secured loan or a loan from a family member or friend. However, remember that your credit score isn't a permanent report card. It can always be improved with time and effort, and a more hopeful financial future is within your grasp.

Can I Get a Credit Card with a 308 Credit Score?

Regrettably, with a credit score of 308, getting approved for a regular credit card could be really tough. This score is generally seen as high-risk by lenders, pointing towards past financial hiccups or difficulties. It's hard news to hear, but it's essential to stare it down with acceptance and a spirit of determination. Knowing the state of your credit is the first crucial step on your journey towards financial improvement.

You should know that it's not all doom and gloom. Certain alternative options like secured credit cards - which require a deposit that serves as your credit limit, might be a consideration. These type of cards can be easier to get and could help in gradually rebuilding your credit score. Options like getting a co-signer or using pre-paid debit cards are also routes you might look into. While these paths don’t provide an immediate fix, they are helpful steps towards financial growth. But remember, any credit product that is open to someone with a low score like yours will likely carry higher interest rates due to the increased risk perceived by lenders.

Can I Get a Personal Loan with a 308 Credit Score?

A score of 308 is considerably lower than what most standard lenders deem acceptable for personal loan approval. This score, unfortunately, portrays a significant risk to the lender, making loan approval under normal terms highly unlikely. Admittedly, this is a tough situation but it's crucial to understand what this credit score signifies about your loan prospects.

When conventional loans seem inaccessible, alternative options could be considered. You could think about secured loans, in which you provide an asset as collateral or co-signed loans, where an individual with a superior credit score guarantees your loan. Also, certain peer-to-peer lending platforms might provide more lenient credit requirements. Nevertheless, it's important to note these alternatives usually come with higher interest rates and less attractive conditions due to the heightened lending risk.

Can I Get a Car Loan with a 308 Credit Score?

A credit score of 308, unfortunately, makes obtaining approval for a car loan quite a task. Most lenders lean towards borrowers with scores above 660, viewing these as a safer bet. A score below 600 places one in a category often seen as less than ideal by lenders, and your score of 308 falls right into this. Lenders may see this as a sign of possible challenge in repaying the loan, leading to higher interest rates or possibly loan denial.

That said, don't let this discourage you. It's tough, yes, but not impossible. Some lenders cater specifically to those with lower credit scores, such as yours. But, remember to tread with caution, these loans usually carry higher interest rates as a form of protection for the lenders against perceived risk. With a careful look at the terms, and by weighing up whether these meet your current financial situation, you could still secure a car loan.

What Factors Most Impact a 308 Credit Score?

Acquiring knowledge about a credit score of 308 is essential to lay the groundwork for financial health and wellbeing. Pinpointing and addressing the factors that contribute to this score are important first steps on the path toward improved finances. Each financial journey is distinct, with plenty of opportunity for growth and development.

Payment Track Record:

Payment history has a considerable influence on your credit score. If your score is 308, late or missed payments may be a significant contributor.

How to Verify: Examine your credit statement for any overdue payments or unfulfilled obligations. Review the payment deadlines and the timing of your payments to ensure timely settlement.

Credit Utilization:

If you're exhausting your credit limits, it likely holds your score down. Aim to maintain a lower balance on your credit limits for a healthier score.

How to Verify: Check your credit card outlines – is there a consistent trend of maxed out limits? Keeping your spending well below your credit ceilings will help your score.

Length of Credit History:

A brief credit history can negatively impact your score. If your score is 308, a minimal credit history may be part of the problem.

How to Verify: Peruse your credit report and assess the duration of your accounts. Consider what recent actions, like opening new accounts, may have decreased the average age of your credit history.

Credit Diversification and New Credit:

Maintaining a good mix of credit types and properly managing new credit are vital for a good score.

How to Verify: Scrutinize your spread of credit accounts. Note whether you've been prudent with new credit applications.

Public Records:

Public records like bankruptcies or tax liens can deeply impact your credit score. This could be a contributing factor to a score of 308.

How to Verify: Inspect your credit report for public records. Handle it right away to resolve outstanding issues.

How Do I Improve my 308 Credit Score?

A credit score of 308 is significantly low, but the road to recovery is possible with dedicated steps tailor-made for this situation. The below strategies can make a remarkable difference:

1. Scrutinize Your Credit Report

Begin by analyzing your credit report for any discrepancies or errors and dispute them promptly. Even small inaccuracies, if unattended, can substantially lower your credit score.

2. Arrange for a Repayment Plan

Communicate with your credit holders and layout a realistic repayment plan. Consistent payments exhibit your commitment towards debt clearance, gradually boosting your credit score.

3. Keep Your Credit Card Balances Low

With a lower credit score, it’s essential to maintain minimal balances on your credit card. Aim to maintain balances lower than 20% of your credit limit. This shows disciplined credit usage and is beneficial to your credit score.

4. Apply for a Secured Credit Card

Getting a regular credit card may be relatively difficult with a lower credit score. Opt for a secured credit card which requires a refundable deposit. Proper handling of your secured card usher in a positive change to your credit score.

5. Explore Diverse Credit Options

A variety of credit types is beneficial for improvement of your credit score. Once regular payments become the norm with your secured card, try different types of credit. Always remember to manage them responsibly.

6. Regular Monitoring

Ensure that all your progress is accurately reflected in your credit reports by keeping a close eye on them. Regular monitoring avoids overlook of potential errors, ensuring your credit recovery journey is smooth.