Take Back Control Of Your Money With These 7 Personal Finance Apps

Making money is hard, right? Well, managing money is even harder. How many times have you made money only to lose it within a short period? If you are like me, those times were many. Fortunately, technology has made it easier for you to make, save, and even grow your money.

In this article, I look at several apps that will help you improve your personal finance.

Acorns

When you go shopping, what do you do with the loose change you get? Some people leave it to the cashier as a tip while others might give it to a charity jar. But, did you know that you can save and invest that money within seconds? This is where Acorns comes in.

Acorns is a mobile and web application that helps people invest as little as $5 in a diversified portfolio and watch it grow. In the past, to invest in stocks or funds, you needed a substantial amount of money and knowledge on investing. With Acorns, you don’t need to have any of these.

All you need to do is to create an account, add the card you use for shopping, and the app will do the rest for you. For all transactions that you do with the card, the app will round off the shopping to the nearest dollar and then invest the rest. How cool is that?

The app is currently used by more than 1.1 million people who have given it a rating of 4.3 and 4.8 in Google PlayStore and iOS app stores respectively.

You can also try other robot-investment apps like Betterment, Wealthfront, Stash, and Ellevest.

Mint

How many times have you sat down and wondered where your money went? Also, how many times have you delayed making a crucial payment? Has your bank account ever been hacked and you failed to realize it?

If you answered yes to any of the above questions, Mint could help you.

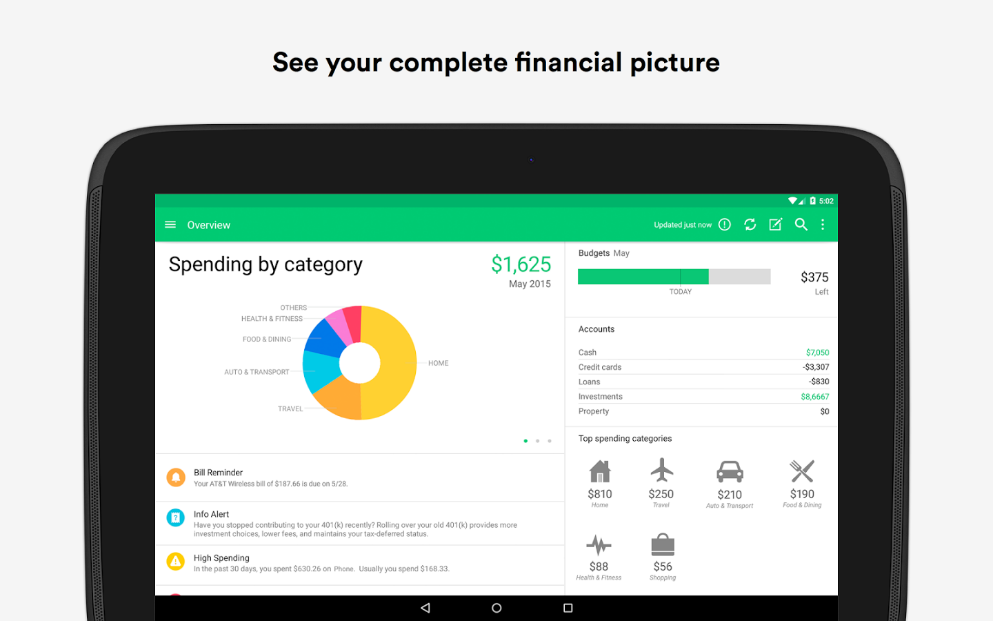

Mint is an app developed by Intuit, one of the biggest cloud accounting companies in the world. Mint offers a free web and mobile application that connects your bank accounts, investments, bills, and credit cards in one place.

After connecting all these, the application will send you alerts when a transaction is made from your any of your accounts. It also has a dashboard that shows you where you spent your money so that you can get insights about your spending habits. In addition, the app helps you track your credit score.

Mint has won several awards and has appeared on many lists from the likes of Time Magazine, Kiplinger’s, and Wired among others.

Users have given it 4.3 stars in Apple’s Appstore and 4.3 stars in Google Play store.

In the unlikely event, you find Mint being overrated; you can give a try to these similar apps: Spending Tracker, Credit Karma (for your credit scores), and Wally.

LearnVest

Financial planning or budgeting can be tough. In fact, very few of us follow our monthly budgets to the letter.

Probably, you have tried consulting experts to help you create efficient budgets. If you did, the chances are that you used a lot of money.

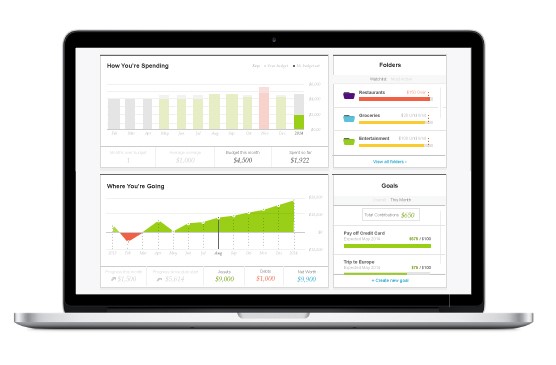

This is where LearnVest comes in. LearnVest is a mobile and web application that connects you to a certified financial planner who will guide you through this process.

The app offers operates using a freemium model where you get several basic services for free or opt for a paying option.

If you opt for the payment option, the app charges you about $300. Expensive? Not really, if you consider that the average price of a financial planner is about $1,900.

After paying the fee, you will have access to a qualified and certified planner and access to a mobile or web-based application that will help track your progress.

You can download the Learnvest iOS application here.

Other budgeting apps you can try are PocketGuard, HomeBudget with Sync (costs $5.99), DollarBird, YNAB, and Fudget among others.

Robinhood

The stock market has always held a lot of appeal to people. Who doesn’t want to be like Warren Buffet one day? Traditionally, your options for buying stocks was through brokers like Charles Schwab’s, Fidelity, Ally Invest and E-Trade among others.

The stock market has always held a lot of appeal to people. Who doesn’t want to be like Warren Buffet one day? Traditionally, your options for buying stocks was through brokers like Charles Schwab’s, Fidelity, Ally Invest and E-Trade among others.

While these companies are good, the fact is that they are expensive. They charge as high as $20 per trade.

This is where Robinhood comes in.

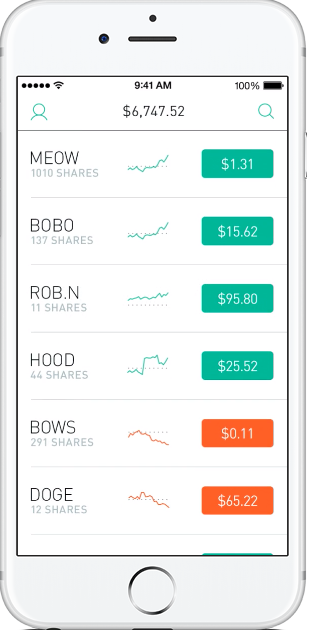

Robinhood is a mobile app that helps anyone analyze companies and place their orders within minutes for free. Traders and investors of all sizes are not charged a penny to buy or sell stocks.

After buying the stocks, you can watch your investment grow and exit when your money grows or when you are making a loss.

The app is currently used by millions of people who have given it a 4.6-star rating in Android and 4.5 in iOS.

While there are no major alternatives to Robinhood, you can try its only alternative called Stash. However, Stash charges you just $5 per trade regardless of the size.

Turbo Tax

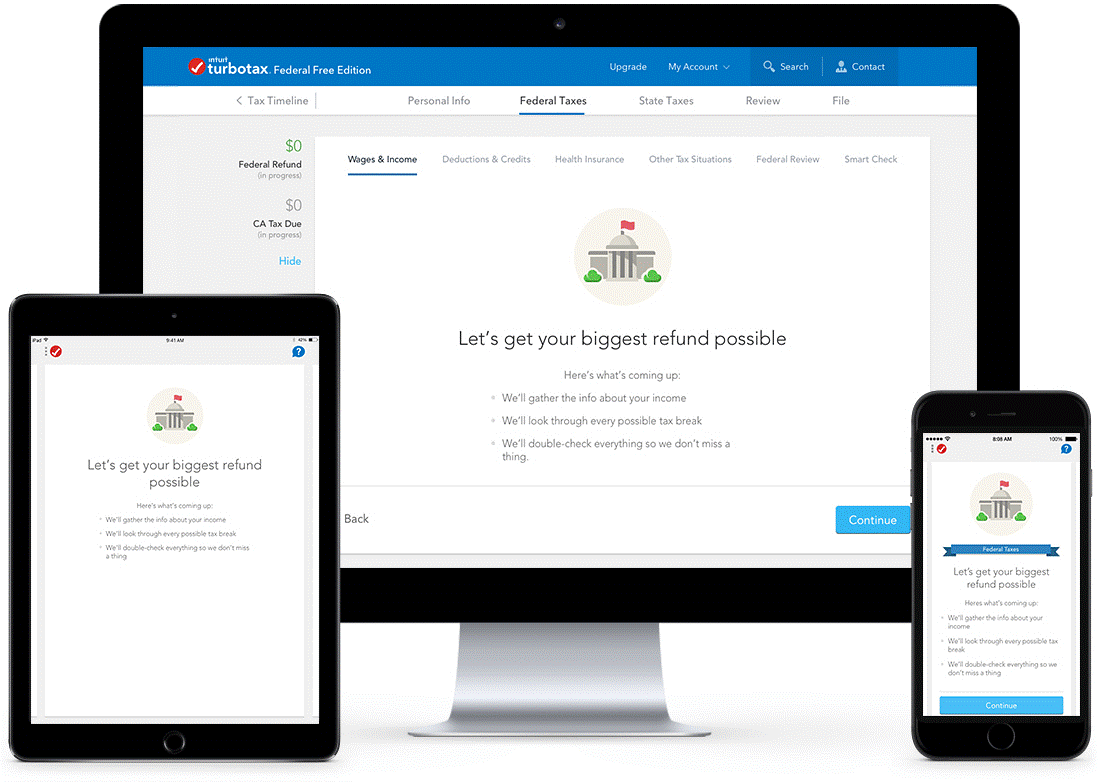

Filing taxes is hectic. Turbo Tax, developed by Intuit, can help you simplify the tax problem. Using Turbo Tax, all you need to do is to take a picture of your W-2, answer a few questions, and then file the taxes automatically from your computer or mobile applications.

Filing taxes is hectic. Turbo Tax, developed by Intuit, can help you simplify the tax problem. Using Turbo Tax, all you need to do is to take a picture of your W-2, answer a few questions, and then file the taxes automatically from your computer or mobile applications.

The app offers several benefits over other similar applications. For example, it shows you more than 350 tax deductions and credits that help you maximize your refunds. It also offers a live on-screen video help which connects you to a tax expert. It also gives you a step-by-step guide on tax filing.

Above all this, Turbo Tax is a free application that charges you only when you file your tax return.

If TurboTax app is not for you, you can use MyBlock from H&R Block and TaxAct from TaxAct.

PriceBlink

These days, we are all shopping online. In fact, many brick and mortar retailers are struggling while some of them have already gone bankrupt.

These days, we are all shopping online. In fact, many brick and mortar retailers are struggling while some of them have already gone bankrupt.

When you are shopping online, you want to save money.

PriceBlink helps you achieve this by automatically comparing prices from thousands of stores and presenting you with the cheapest alternatives. It also provides you a list of coupons which you can use to shop.

It works in the form of an iOS app as well as a Chrome and Mozilla extension.

By using the app, you can make big savings from credible companies like Amazon, Walmart, and eBay among others.

You can also try other applications like Shop Savvy, BuyVia, and ScanLife among others.

Affirm

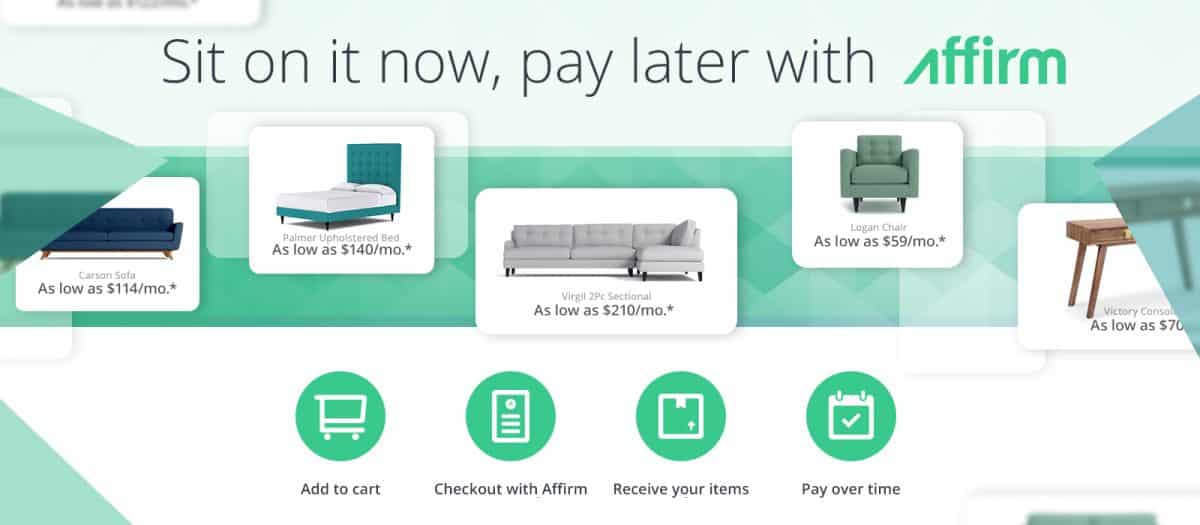

Have you spotted something that you like but don’t have the money to pay for it? If the answer is yes, then Affirm is your perfect answer.

Have you spotted something that you like but don’t have the money to pay for it? If the answer is yes, then Affirm is your perfect answer.

Affirm is a mobile and web application that allows you to shop the top companies online and then split the payment into flexible monthly installments.

Affirm has partnered with more than 1000 partners who include companies like Walmart, Amazon, and Wayfair among others.

Affirm operates like an ordinary credit card with the differences being its transparency and the fact that you set your own payment terms. When you checkout with Affirm, you will see the total amount of money you will pay at the end.

To date, the app which launched in 2012 has offered more than 1 million loans through its apps which you can download from Android and the Apple AppStore.

Notable Mentions

This list is not conclusive. There are thousands of finance apps are created every day. Here are other notable apps you can consider:

- Bloomberg, Reuters, Webull, Yahoo Finance, and Investing.com. These apps give you access to financial news that move markets and affects your financial world.

- StockTwits and Estimize. These apps help you crowdsource financial data from thousands of like-minded professionals.

- XE Currency converter. This app gives you the exchange rate of virtually any currency.

- Venmo, Paypal, Google Wallet, Apple Pay, and Square Cash. These apps help you transfer money to your friend or colleague within seconds.

- Coinbase. It helps you buy and sell bitcoins with ease.

Whichever financial app you choose to use, always be smart with your personal details. Good luck with learning to manage your finances! And don’t forget to learn all the tools and tricks that are in CreditSecrets!