History of Credit Scores: The Evolution of Financial Scoring

You are probably well aware of the fact that your credit scores have the ability to influence many different areas in your financial life. Credit scores may be used to determine your ability to qualify for a loan, the interest rates you are charged to borrow funds, and even the cost of your insurance premiums. Credit scores are heavily relied upon as a means to judge the risk of doing business with you and if you are approved, the price you will have to pay.

Like most consumers, you probably accept these facts without question and move along with your life. If you are smart, you use this knowledge as motivation to work toward earning the highest credit scores possible. Yet, the widespread use of credit scores as an evaluation tool is a somewhat new concept, at least in historical terms. Understanding the history of the credit score can be interesting and enlightening.

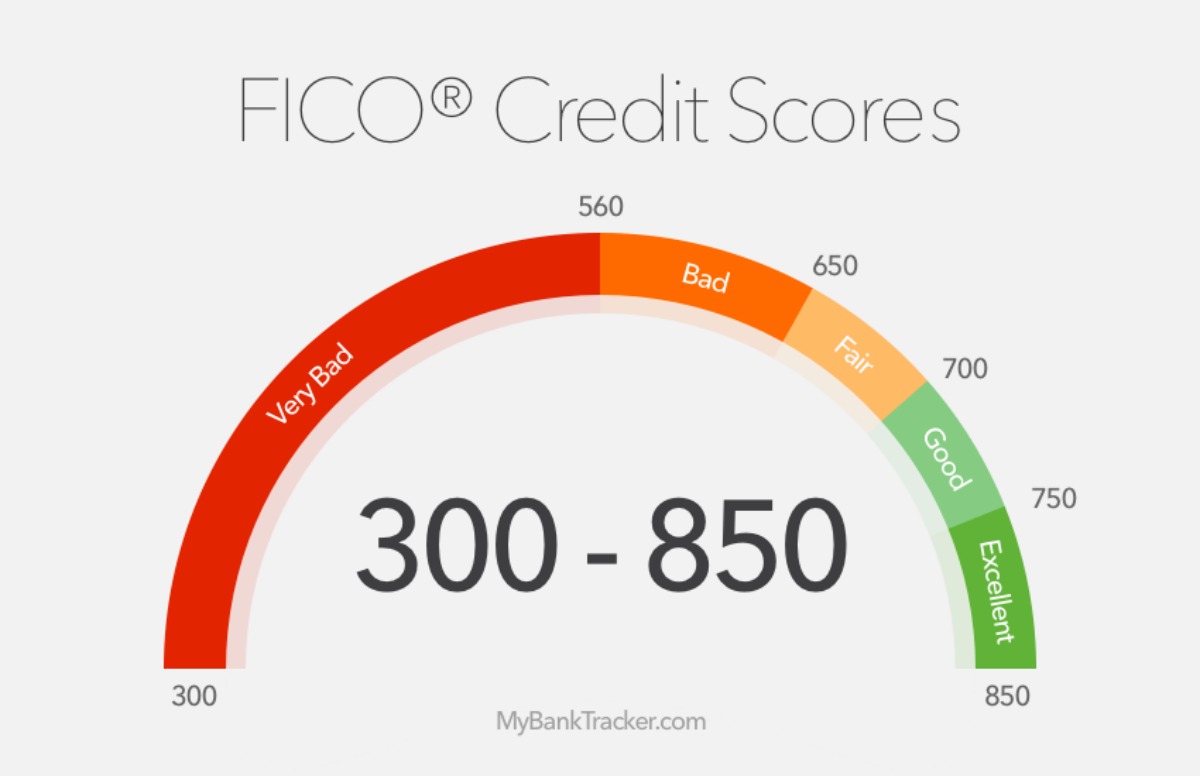

The First Credit Bureau Based Risk Score: FICO

Before the advent of credit scores, loan application review was a subjective and lengthy process, dependent upon the analysis of the information contained in a consumer’s credit reports by a banker or loan officer. The system was inconsistent and prone to error.

Fair Isaac and Company (Yes, that’s FICO’s former name) set out to create a model that would provide a simplified and impartial tool to help lenders more accurately predict consumer credit risk. As early as the 1970s the company began creating consumer credit scores for a variety of lenders and retailers.

However, in 1989 history was made when the FICO Score was introduced at one of the major US credit reporting agencies, Equifax. By 1991 the FICO Score was available at TransUnion and TRW as well (Experian didn’t exist back then).

FICO Scores and Mortgages

In 1993 FICO introduced specialized scores designed to evaluate loan applications in the auto, credit card, mortgage, and small business lending arenas. A few short years later in 1995 Fannie Mae and Freddie Mac endorsed the use of FICO Scores for evaluating residential mortgage applications.

Currently, it is virtually impossible to purchase a home without a lender pulling your FICO Scores from Equifax, TransUnion, and Experian.

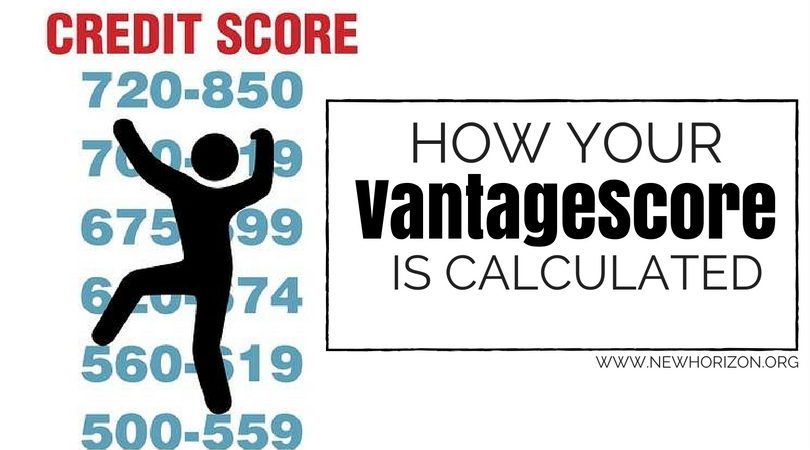

2006: Introducing VantageScore, which was created by the three credit bureaus

A competing product to FICO Scores, the VantageScore, was introduced to the market in March of 2006. Soon after, FICO sued VantageScore and all three of the credit bureaus. Long story short, FICO’s lawsuit didn’t fare well and didn’t do much other than to delay larger scale adoption of the VantageScore. At the same time, FICO lost its control over the 300-850 score range, and now VantageScore uses 300-850 as well.

The new score was jointly created by a team from all three major credit reporting agencies. While VantageScore has not yet overtaken FICO as the most widely used credit score in the lending space, a recent study found that over 8.5 billion VantageScore credit scores were used between July 2016-July 2017. Over 75% of those scores were reportedly used by lenders. So, if you’re interested in credit scores, you have to do your best to learn about both scoring platforms.

Hundreds of Credit Scores

Contrary to popular misconception, there is no single credit score which is your “accurate” score nor does a true “lender” score exist either. In reality, you have hundreds of different credit scores and most of them you’ve never heard of.

The reason why so many credit scores are commercially available is that throughout the years both FICO and VantageScore Solutions have continued to develop new and improved credit scoring systems. Both credit score brands have released multiple versions of their scoring software. In addition to newer versions, there are also numerous “flavors” of FICO Scores as well (e.g., mortgage, auto, bankcard).

With such a wide variety, your credit scores alone are not an excellent means of monitoring your credit health. Instead, your efforts would be best spent tracking the information on your credit reports and your credit management habits. Your reports, after all, contain the information upon which all of your credit scores are based.