Save Money While You Sleep With These 5 Powerful Finance Apps

Saving money can sometimes feel impossible, especially when you factor in household expenses, family expenses, and the day-to-day costs of living. The bills continue to roll in, and it seems like you’ll never be free of the never-ending pile. Even when you try to put back a few bucks here and there, you’re constantly reminded of the bills that need to be paid and other necessary expenses that the money could be used for. Your life revolves around money, both spending and saving it, and sometimes it’s just not fair.

But, let’s take a moment to say thank you to the age of technology and all of the new gizmos and gadgets out there that make managing finances just a little bit easier. Whether you need to save up for a new pair of running shoes, or you need to stack up cash for a down payment on a house, there are dozens of tools out there to help you do just that.

When it comes down to it, apps are the simplest and quickest routes to take to get the best results. Many of these apps work silently in the background, saving you money and planning your budget without you constantly having to agonize over the little details. Of all the financing apps available, these five are the best to use to get the most out of your money and remove that savings stress from your life.

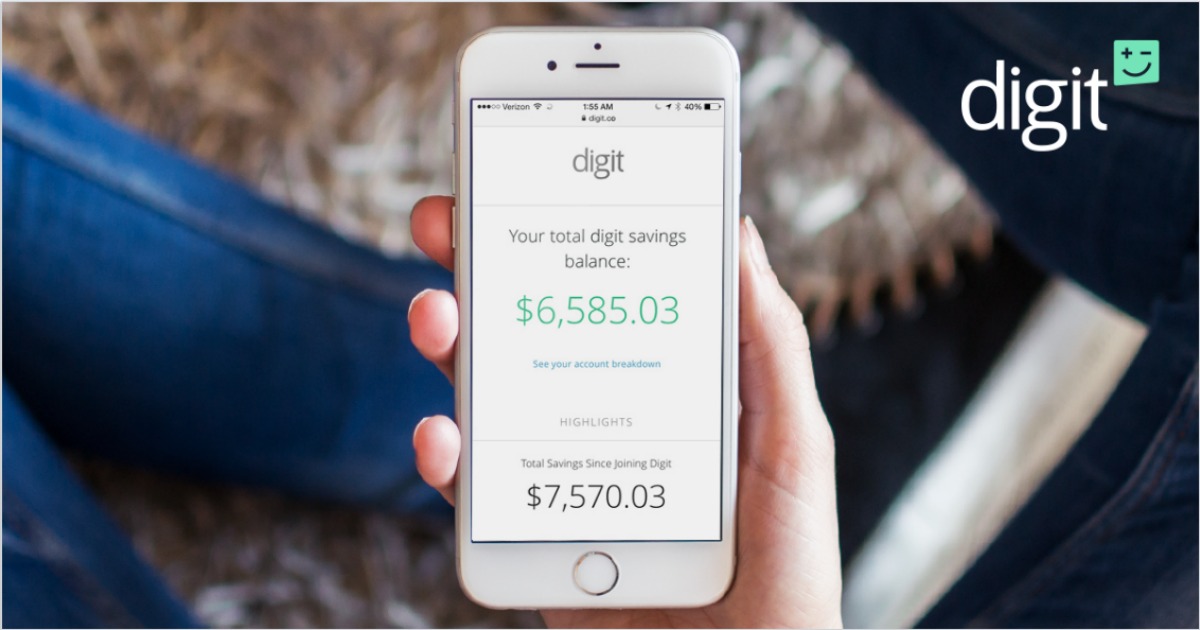

Digit

If you’re new to the money saving game, or maybe you’ve tried to save time and time again and find that you aren’t that good at it, Digit is your best bet. It’s simple, easy, efficient, and provides quality service without over complicating things. Plus, you can access your account both through the app and the website.

Here’s how it works. First, you sign up by connecting your checking account to your Digit account. While this may seem a little terrifying, Digit uses bank-level security and promises to never store your bank account login information, just for added safety measures. Once you’ve connected the two accounts, Digit then analyzes your account information, creating a budget based on your income and spending record, and then determines how much money you can comfortably afford to set aside each month.

Once the app has sorted out what your savings can look like, it quietly sets aside money daily to start working toward building a healthy savings. Don’t worry, Digit won’t take out more money than your budget can allow, and the app has a no-overdraft guarantee. Digit never transfers more than you can afford, and you’ll be surprised just how much you can put back when you’re not overthinking each budgeting detail. You can withdraw from your savings account at any time, without a fee to do so, though it will take up to one business day to transfer the money.

The only catch with the app is that, after your first 100 days of using it, your account will be charged $2.99 per month afterward to keep your profile up and running. But it’s a small price to pay to save money without even having to think about it.

Acorns

Those who are looking to save money through investments, and those looking to learn just what this whole investment thing is all about, should jump on the Acorns train. With this app, users become investors and discover just how simple, and easy investments can be if you’re doing it the right way. And, just like Digit, you can access your account both through the app or the application’s website.

When you create your Acorn account, you’re going to attach your checking account to it as well. Acorn never saves your login information to any device you check in with, and is a member of the Securities Investor Protection Corporation, so all of your data remains secure. When you’ve established your profile, Acorn takes over and handles the rest for you. Continue on your merry way with spending and Acorn will analyze your income and spending history to determine what investment portfolio would be best for you.

After your investments have been established, Acorn only requires that you make an initial investment of at least $5, and then you can determine how you wish to invest moving forward. You can either continue to manage your investments manually, or you can let Acorn do all the work for you by investing your spare change. For example, if you spend $5.50 on a latte, Acorn will round that to the nearest dollar and invest $0.50.

Like most things in life, Acorn doesn’t come free. Accounts that are under $5,000 pay $1 per month for their account, and those who have more than $5,000 pay 0.25 % of their portfolio per year. But, if you’re a college student with a valid school email, you’ll have full access to Acorn for free, for up to four years. So, while it does come at a cost, it’s so small that you’ll barely even notice, especially with all those savings you’ll be racking up.

Mint

Unlike Digit and Acorn, Mint takes budgeting and personal finances to the next level by providing quality breakdowns of everything spent. Those of you who like things extra organized, or maybe you’re trying to start a new habit to get your spending under control, will love Mint. From the $1.25 you spent on a pack of gum at the grocery store, to the $125 you spent online for a new pair of boots, Mint covers it all and lays it out in a pretty, neat graph.

First things first, you’re going to need to link your checking account to Mint once you’ve established your login. Like most apps of its kind, Mint offers top-notch security so that you never have to worry about your information being stolen or misplaced. After you’ve connected your accounts, Mint gets to it with looking over your account, income, spending history, and financial health to provide a complete breakdown of your finances. This may be a little painful at first, especially when you finally see just how much money goes into unnecessary weekly expenses like coffee runs and pizza delivery, but it’s a must to be well on your way to financial success.

After Mint has finished all the heavy lifting, it will suggest a weekly or monthly budget for you based on your income and spending. It will even break down spending into categories, such as groceries and entertainment, and will send you a notification when you’ve gone over budget in that category. Not only does this help nail down what you do and don’t have to spend, it also allows for you to really hone in on where your money is going, and how your spending can be adjusted to best support a savings routine.

Not only does Mint provide regular budgeting breakdowns and alerts, but you can also keep tabs on your credit score inside the app, for free. In fact, everything about Mint is free, and who doesn’t love that.

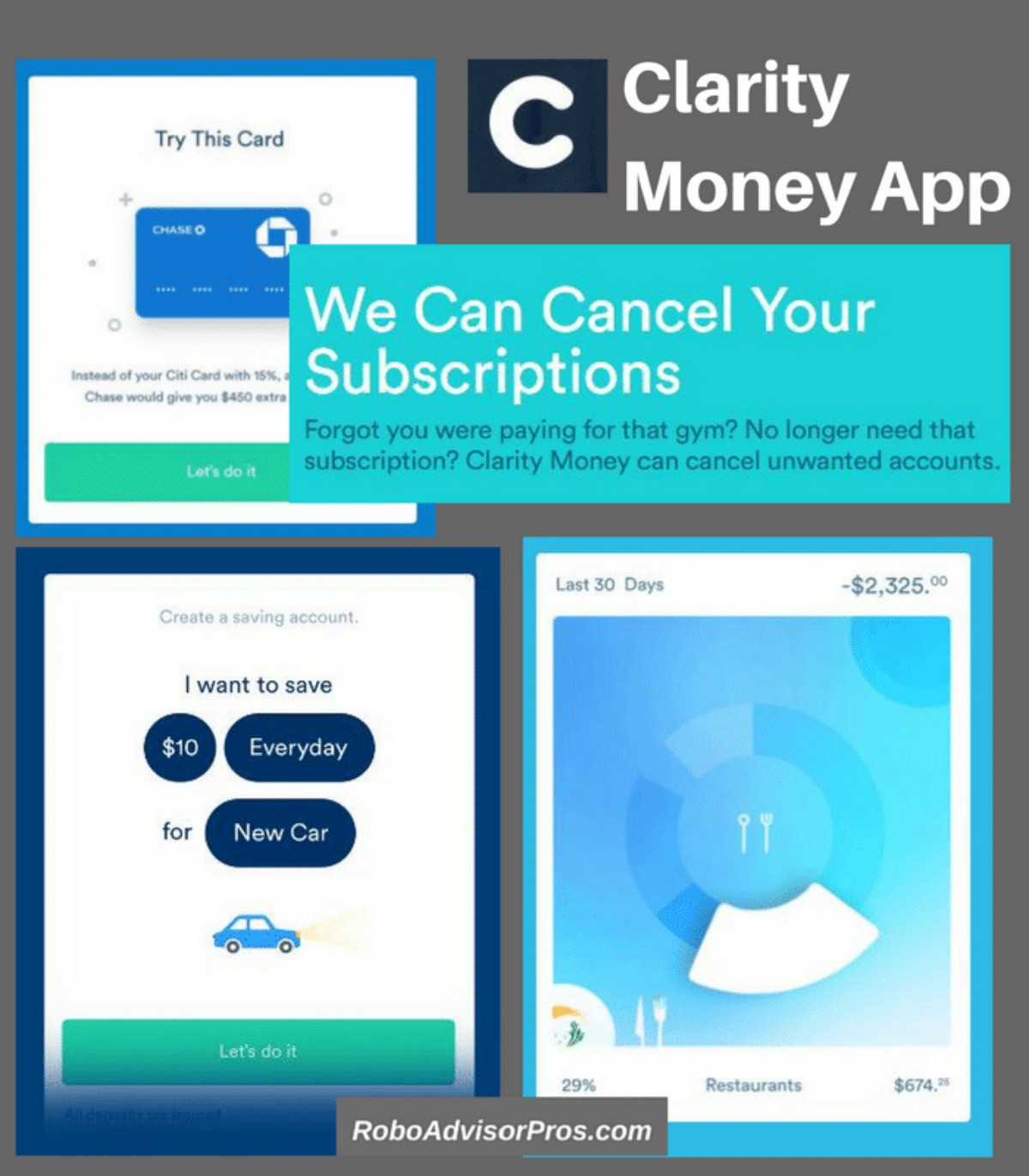

Clarity

Clarity, or Clarity Money, takes budgeting and financial analyzing to the next level by offering financial advisors to help monitor your finances. If you’re new to saving, or have difficulty managing your finances, Clarity provides everything you need to know about spending, saving, and budgeting and it’s all tailored to your personal financial state. Say goodbye to theorized saving techniques and hello to personalized budgeting.

Getting started is quite simple. You just link your checking account, and any other spending accounts, to your Clarity login and let the app take the lead from there. Don’t worry, Clarity has taken the necessary steps to insure your security, so you’re at no risk through the app of having your finances hacked since Clarity doesn’t store any login information. After your accounts have been linked, Clarity provides feasible, realistic recommendations to improve your financial well being, such as canceling monthly subscriptions that you didn’t realize you were still paying for or offering suggestions to lowing your monthly bills.

Within the app, Clarity provides countless other financial tools to help make budgeting and maintaining good financial health that much easier. If Clarity feels that you could have access to a better credit card, it will suggest one for you. And you don’t even have to leave the app to get the card. Everything can be done right there due to Clarity’s partnerships with several financial institutions. You can also check your credit score from inside the app and set up savings accounts that are tailored to you. It’s an all-around win with this app.

And, as an added bonus, all basic services within the app are 100% free to the customer. So, sign up and start saving.

Walla.by

Similarly to Mint, Walla.by is another app that not only establishes and encourages smart spending and saving; it also provides all the necessary tools you might need to be well on your way to financial freedom and stability. It’s perfect for those who use multiple accounts, such as a debit card and credit card, or even for those who are new to the investing and saving lifestyle.

Keeping with the finance app theme, when you download and sign up for Walla.by, you’ll need to connect all of your accounts to your Walla.by account. From there, you don’t need to do much else as Walla.by gets right to it with tracking your various debit and credit accounts. If you overspend, or even if there’s activity on your account that’s a little suspicious, Walla.by sends you a notice to alert you.

One of the unique and best features of the app is that, if you’re a multiple card and account user, Walla.by will notify you as to which card is best suited for which purchase. So, if you’re going on an IKEA shopping spree, Walla.by will be the first to tell you whether you should be swiping a MasterCard or Visa, and why. And for those who are a little wary of linking up multiple accounts with the app, you aren’t required to do so to get use out of the app. While you won’t be notified for over spending and suspicious activity, as long as you identify the types of cards you have, Walla.by will still fill you in on which is the best to use and when, so you can always get the best bang for your buck.

This app is entirely free, but the only downside is there is not an online website to accompany it. However, with all of that wonderful finance information at your fingertips free of charge, you won’t even notice.