How to Organize Your Finances: 10 Steps to Financial Peace

How much time do you spend thinking about money? Things like, how to make more, save more, invest more, and even give more.

Often, I assume you spend your time regretting about your past money mistakes. The time you bought a flashy car, you couldn’t afford, when you took an unplanned trip, and when you failed to pay for your car’s insurance.

Thinking about money is a normal thing to do. In fact, a survey showed that most people think about money more than they think about other things.

Here are ten simple steps you need to take this week to organize your finances.

Plan a Meeting

We can learn a lot from companies. Regularly, the management and the operations team hold meetings to assess their financial position. During these meetings, they evaluate whether everything is going on as planned. They then come up with actionable steps to solve the problems they might have.

As an individual, or family, the starting point to organize your finances is to hold a meeting. In this meeting, you should analyze your current situation, and come up with plans on how to achieve your financial goals.

Consult a Financial Advisor

We all hate the concept of going to a financial advisor. The idea of opening up to a stranger about finances is not always easy.

However, financial experts believe that consulting an experienced and certified expert can help you plan and organize your finances. A recent study showed that people and families who consult advisors are often more successful in planning their money.

In the meeting, you should be candid enough to share everything about your finances to the advisor and write down everything they say.

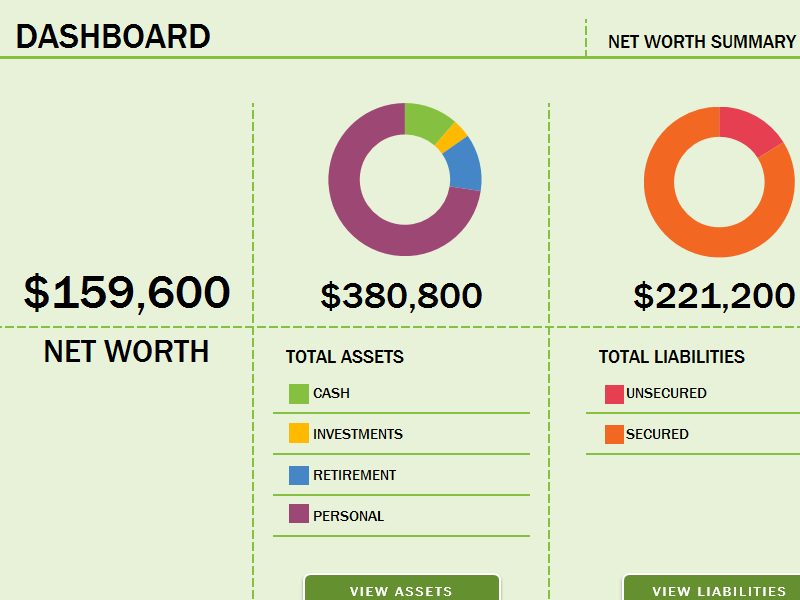

Estimate Your Net Worth

The concept of net worth does not apply to millionaires and billionaires alone. It applies to everyone, including you.

Knowing how much you are worth will help you become more organized. For example, it will help you know more about your debts and income, which will help you live in your lane.

To do this, you need to subtract your debt from your assets. Assets include items like your house, car, and your bank savings.

Do a Monthly Budget

After seeing your worth and analyzing your cash flow, you should now create your monthly budget. You should create this budget using the advice you received from the financial advisor.

Most advisors recommend that you use a 20-30-50 ratio. In this, 20% of your income should go to short-term and long-term savings. 30% should go towards your housing needs while the remaining should go to other necessities. You can create a personal ratio based on your financial needs and goals.

Here are a few tips about budgeting:

Use a mobile app to track your spending.

Always compare prices when buying.

Have an accountability partner.

Always review the spending on a weekly basis.

Use an online budget calculator.

Recover Your Debts

If you have lent money to a friend, colleague, or family member, now is the best time to recover it if they have overstayed. Of course, you want to be as civil and friendly as you can when recovering this debt.

However, if this does not work, and if it involves a substantial amount of money, you can consider court action.

Legal experts recommend that you go to a disputes tribunal if the amount is less than $7,500, district court if the amount is up to $200,000, and the high court if the amount is more than $200K.

Debt Consolidation

If you have debt from multiple sources, you should consider consolidating it into one payment. To do this, you should find a low-cost money lender, take a loan from them, and clear your other debts. Then, every month, you will make payments to the new lender.

Experts believe that debt consolidation can help you save thousands of dollars in debt payments. It will also simplify your process of paying off debt.

Sell Unnecessary Items

Your house is probably cluttered with many things you don’t use or need. You also probably pay money to a storage company.

Now is the best time to dispose of these things. That old TV you don’t watch or that old bed no one uses.

To do this, you can use ordinary websites like eBay, Offerup, and Craigslist to find local buyers. You will be surprised by the amount of money you will make.

Automate Your Bill Payments

We all hate paying bills, but they are part of life. To be well-organized, you should start by automating your bill payments. Different banks give you the option of paying your monthly bills automatically from your account.

If it does not, you can use apps like Mint, Venmo, and Prism Bills to handle your bills. Doing this will give you peace of mind knowing that everything is well taken care of.

Cancel Unwanted Subscriptions

Every month, you likely spend hundreds of dollars without even knowing it. This is because you probably start new trials, add your cards, and then forget to unsubscribe.

This is the best time for you to cancel the subscriptions you don’t need and downgrade those you rarely use. To avoid forgetting to unsubscribe, you can write down all your subscriptions on a piece of paper and assess them regularly.

It’s is also an excellent time to think about how to save money on the subscriptions you have. For example, if you are in a family of three, you can each subscribe to a movie streaming service, Netflix, Hulu, and Prime Video. Then share the accounts instead of subscribing to the three of them.

Review Your Credit Card Provider

Finally, since a credit card is very important, you should review your current provider and compare the services and interest rates with other providers.

To start, you should use popular online platforms like NerdWallet to compare these prices. After this, you should narrow your search to local financial companies like credit unions.

By comparing the prices, you can save a substantial amount of money.

Bottom line

It is impossible to live a happier life without organizing your finances. Doing these steps I outlined can help you simplify your life, identify loopholes, and save money.