Most and Least Financially Literate States in 2024

Financial literacy is more critical today than ever before. It can be the difference between thriving during economic challenges like inflation or struggling to get by. Yet, as we look across the country, it’s clear that too many Americans are still unprepared to manage their finances effectively.

With over $17 trillion in household debt and $1.11 trillion in credit card debt, the consequences of financial illiteracy are becoming increasingly apparent.

Our study at Credit Secrets set out to assess where each state stands in this regard. We examined 9 key metrics, from high school financial literacy grades to average credit scores and access to banking services.

The results show a stark divide: some states are leading the way in financial education, while others are falling dangerously behind.

This report highlights those differences, aiming to spark a conversation about the need for stronger financial education across the nation. By identifying the states that excel and those that need improvement, we hope to inspire actions that will better equip future generations to navigate the complex financial landscape ahead.

Key Findings

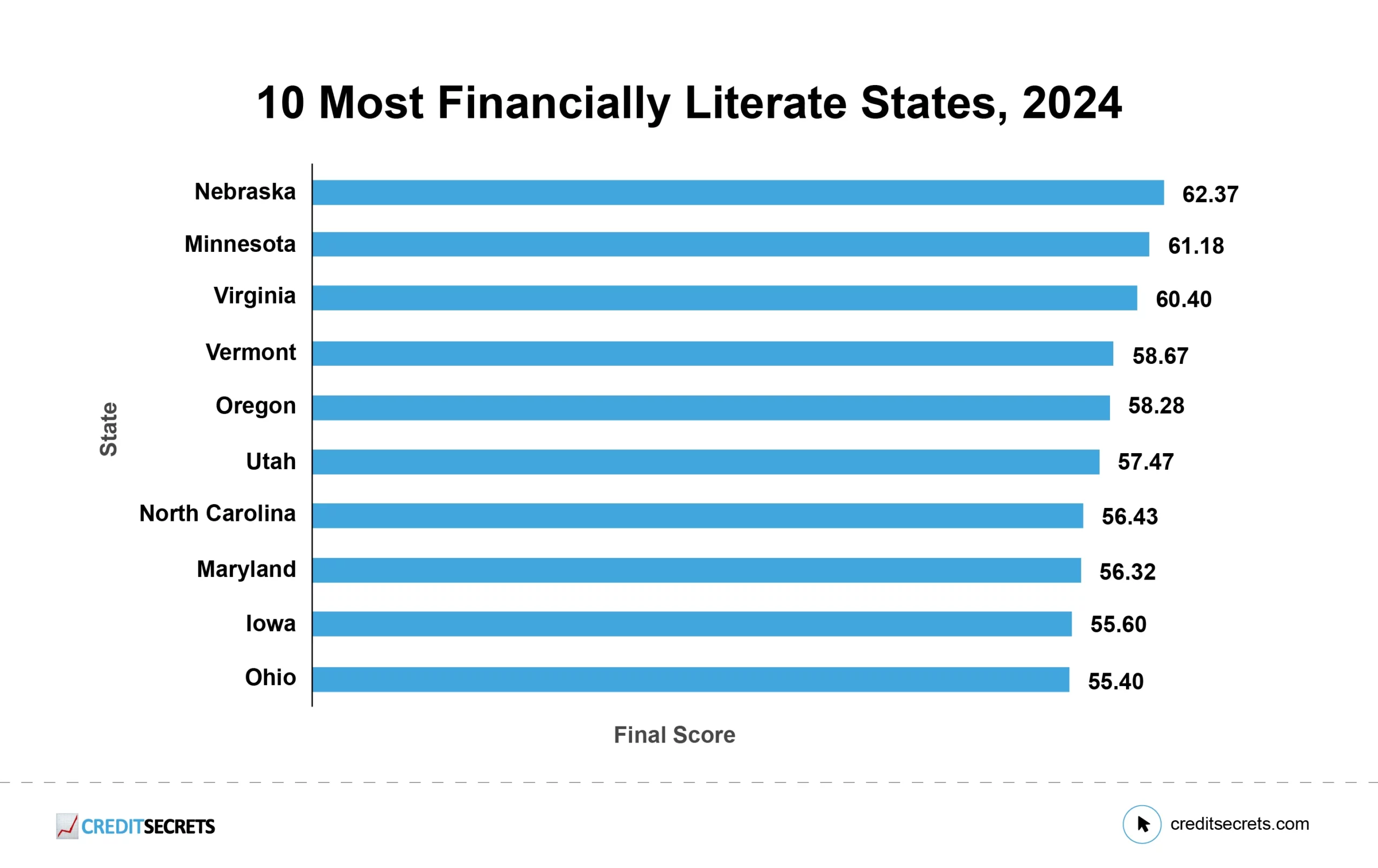

- Financial Literacy: Nebraska is the most financially literate state with a score of 62.37; Alaska ranks the lowest at 36.62.

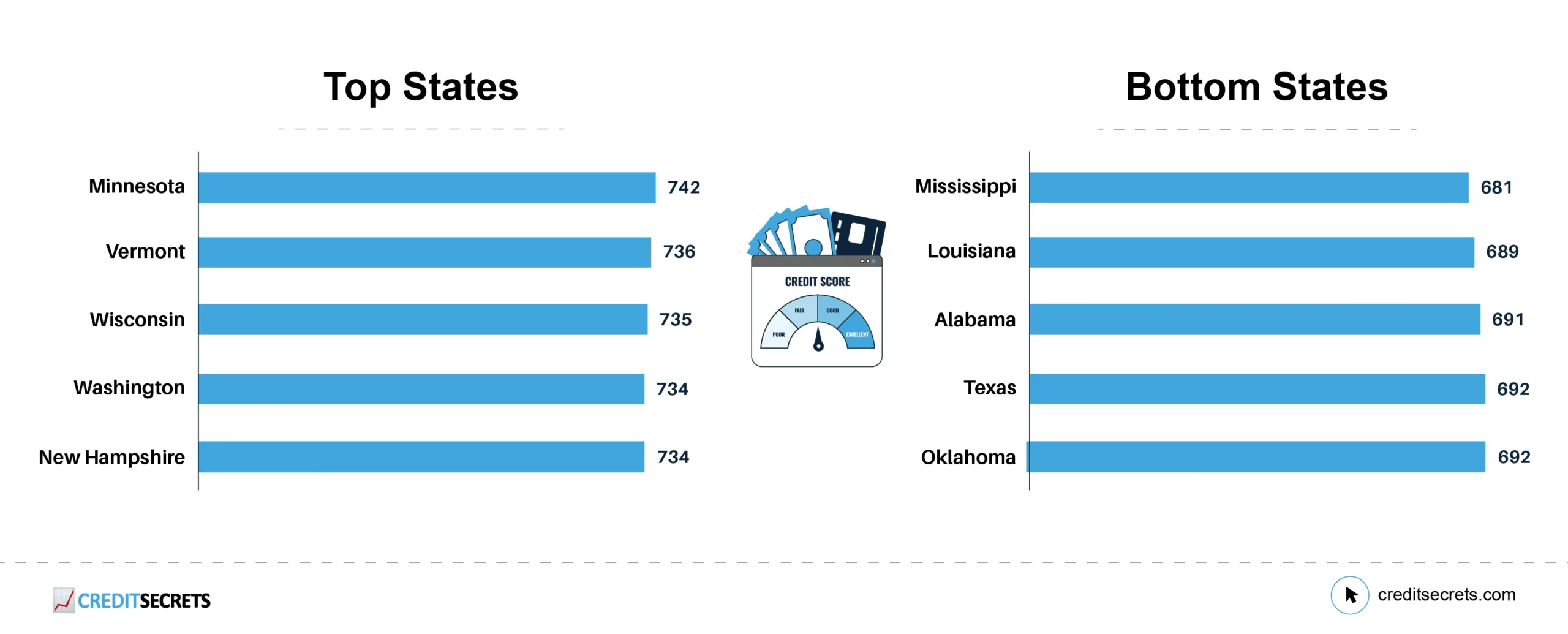

- Credit Scores: Minnesota has the highest average FICO score at 742; Mississippi has the lowest at 681.

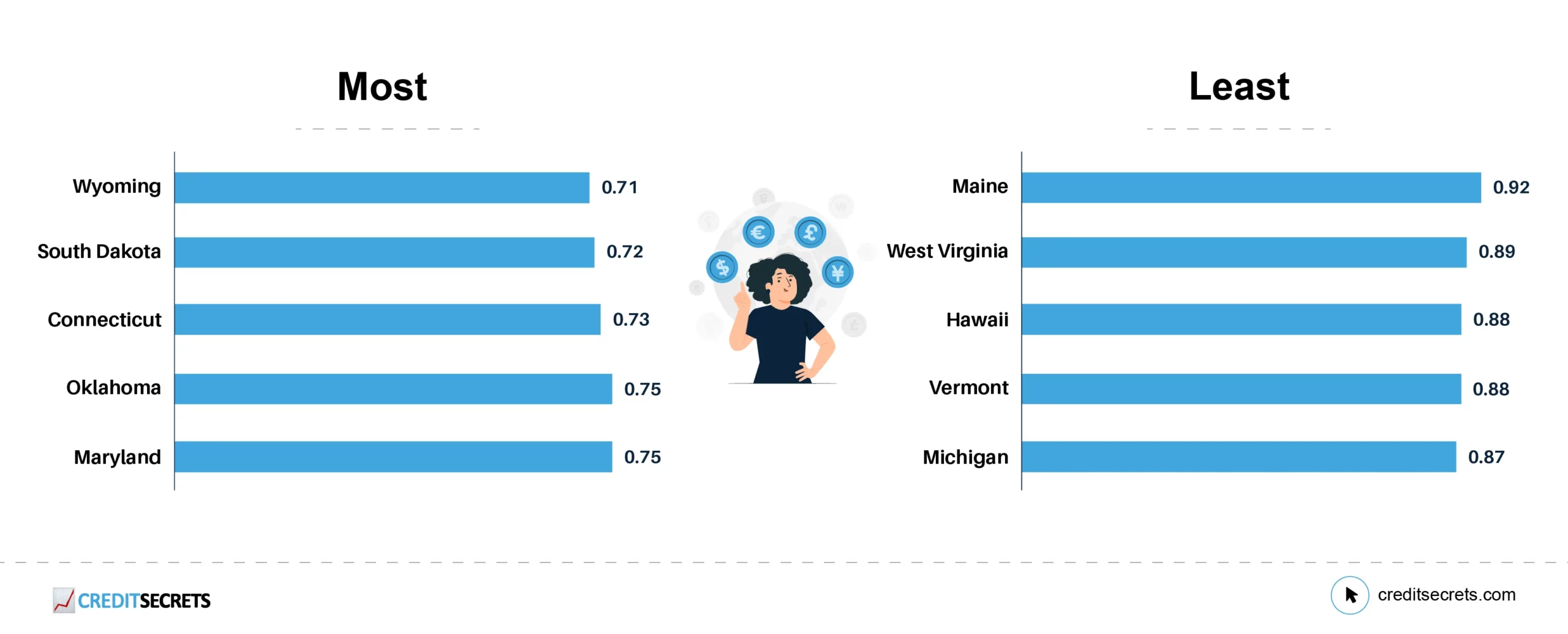

- Spending Habits: Wyoming leads in sustainable spending with a ratio of 0.71; Maine is the least sustainable at 0.92.

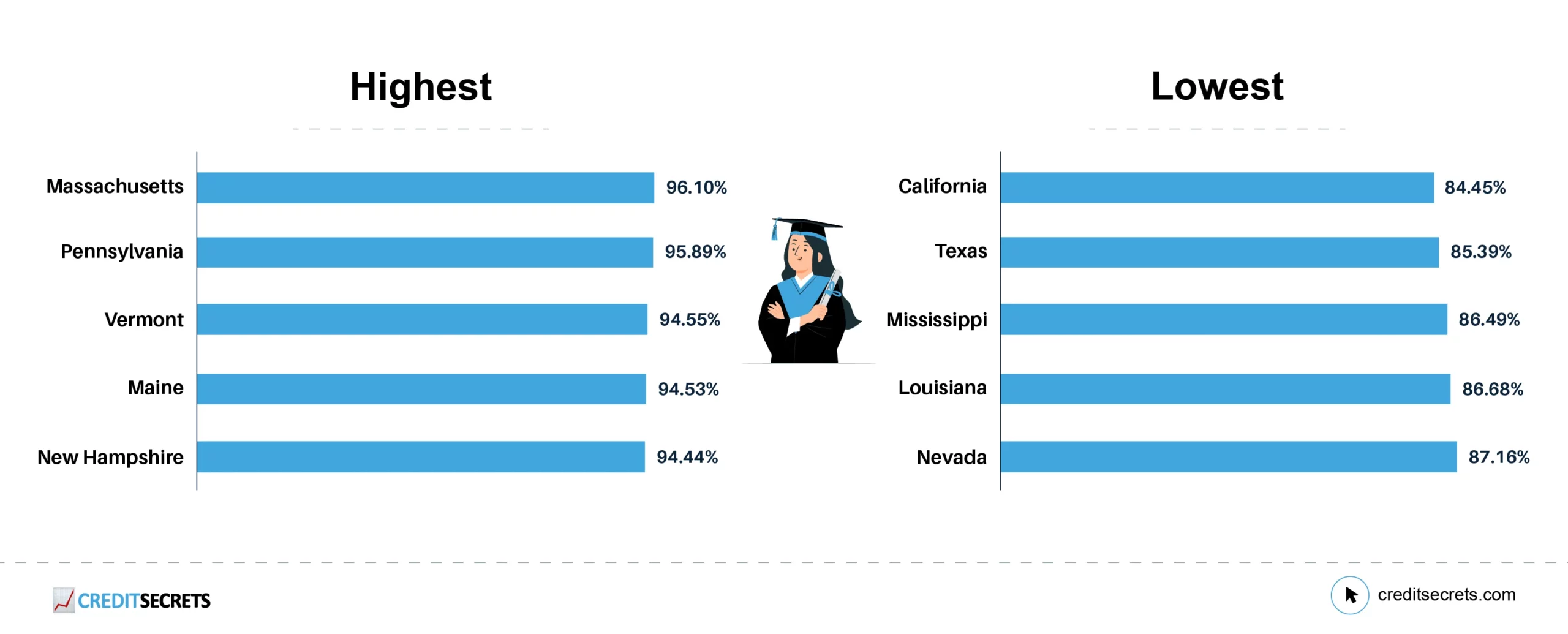

- Graduation Rates: Massachusetts has the highest high school graduation rate at 96.10%; California has the lowest at 84.45%.

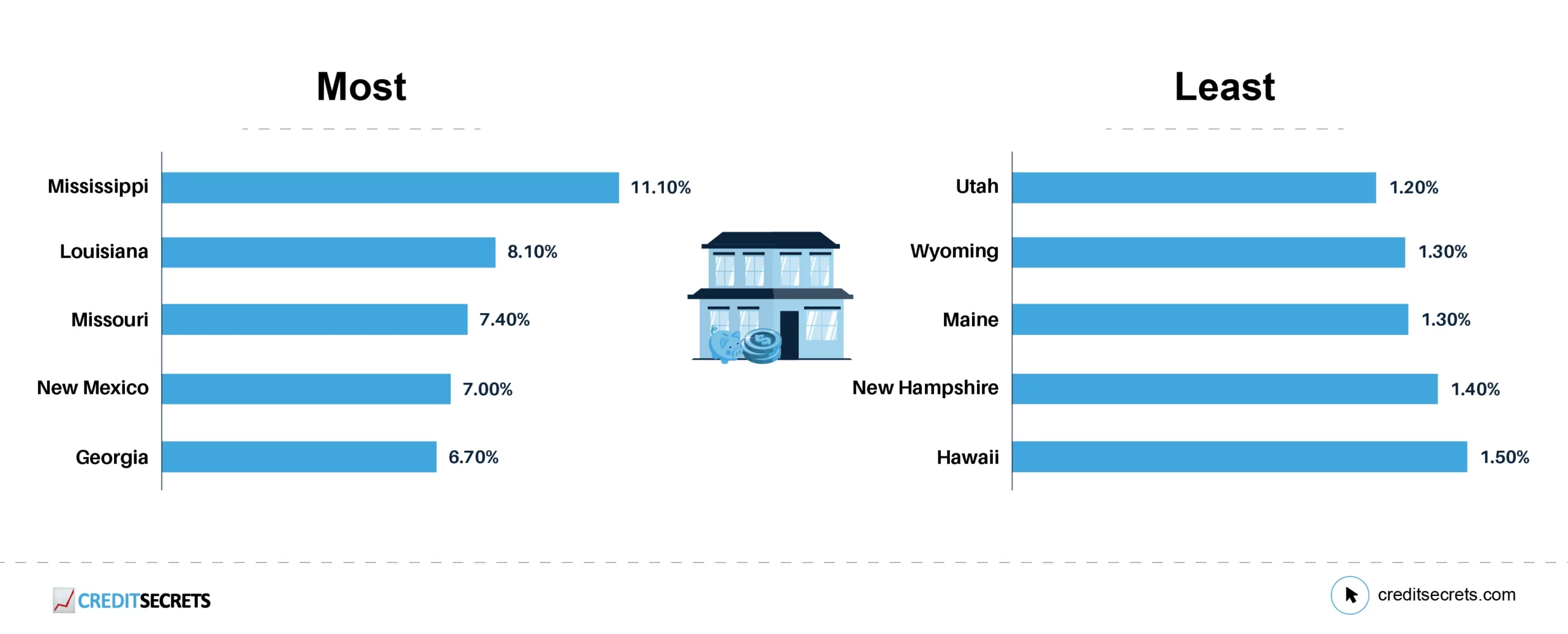

- Unbanked Households: Mississippi has the most unbanked households at 11.10%; Utah has the fewest at 1.20%.

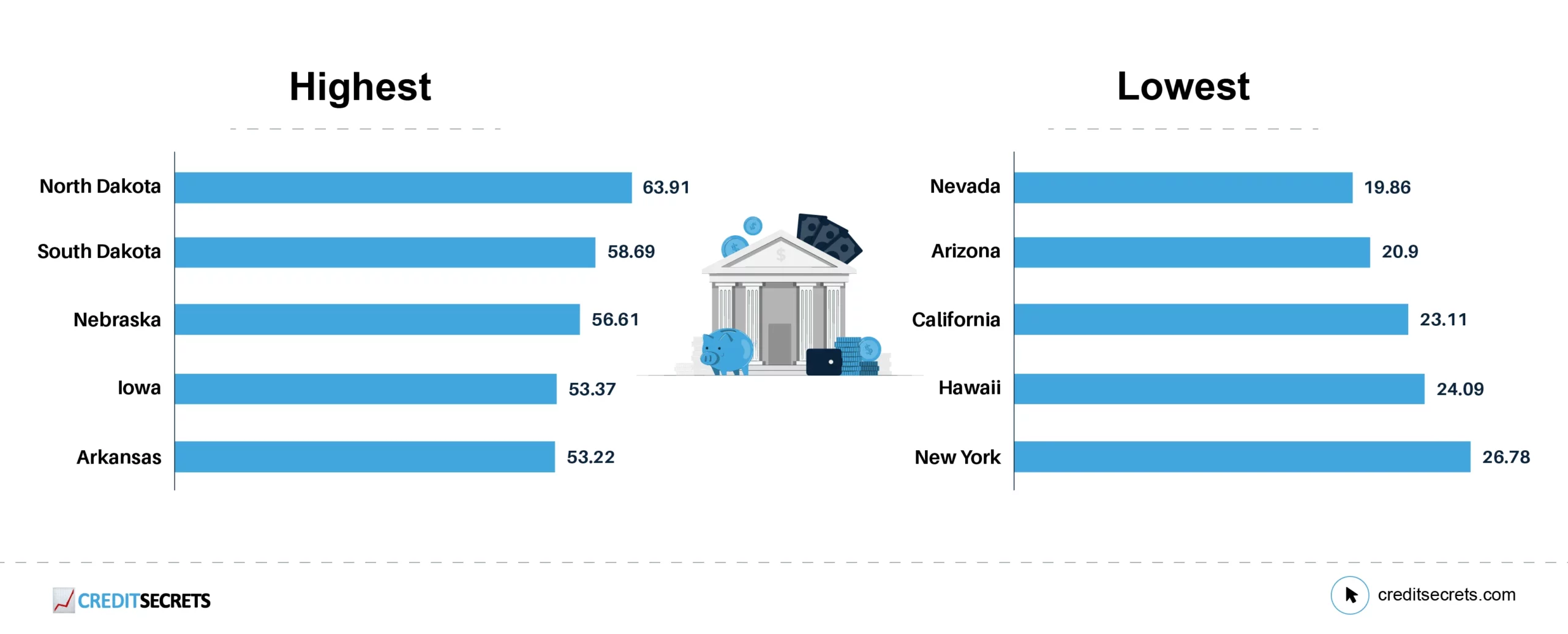

- Financial Institutions: North Dakota offers the most financial institutions per 100K residents at 63.91; Nevada has the fewest at 19.86.

Most and Least Financially Literate States

Ranking the Most Financially Literate States

Top and Bottom States with Average Credit Score (FICO)

Understanding the average credit score (FICO) of a state is important. It shows us how well residents manage their credit and debts. The national average credit score is 716, which falls within the “Good” range. A higher score means better financial habits. A lower score can point to financial struggles.

Top State: Minnesota

Minnesota has the highest average credit score of 742, placing it in the “Very Good” range. This shows that people in Minnesota manage their finances better than most, well above the national average.

Bottom State: Mississippi

Mississippi has the lowest average score of 681, which is in the “Good” range but below the national average. This suggests that residents might face more financial challenges and have room for improvement in their credit management.

Most and Least Sustainable Spending Habits

The ratio of personal consumption expenditure to income is a key indicator of sustainable spending habits. A lower ratio suggests more sustainable spending, while a higher ratio indicates that people may be spending beyond their means.

Most Sustainable: Wyoming

Wyoming has the lowest ratio at 0.71, indicating that residents spend conservatively compared to their income. This suggests strong financial discipline in the state.

Least Sustainable: Maine

Maine has the highest ratio at 0.92, indicating that residents spend a significant portion of their income. This suggests that people in Maine might be more financially stretched, leading to less sustainable spending habits.

Highest and Lowest Public High School Graduation Rate

The public high school graduation rate is an important factor in financial literacy. Completing high school provides students with a basic education, which is foundational for understanding personal finance.

Highest High School Graduation Rate: Massachusetts

Massachusetts has the highest public high school graduation rate at 96.10%. This strong educational foundation contributes to higher levels of financial literacy among residents.

Lowest High School Graduation Rate: California

California has the lowest graduation rate at 84.45%. This lower completion rate may impact the financial literacy of its residents, as fewer students are likely to receive essential financial education.

States with the Most and Least Unbanked Households

The percentage of unbanked households is a crucial indicator of financial inclusion. Being unbanked limits access to essential financial services, which can hinder financial literacy and planning.

Most Unbanked: Mississippi

Mississippi has the highest percentage of unbanked households at 11.10%. This indicates significant barriers to financial access, which may negatively impact financial literacy in the state.

Least Unbanked: Utah

Utah has the lowest percentage of unbanked households at 1.20%. This suggests that most residents have access to banking services, which supports better financial literacy and planning.

States with the Highest and Lowest Number of Financial Institutions

The number of financial institutions per 100,000 residents is a key factor in financial literacy. Greater access to banks and credit unions can lead to better financial education and planning opportunities for residents.

Highest Number of Financial Institutions: North Dakota

North Dakota has the highest number of financial institutions per capita, with 63.91 institutions per 100,000 residents. This high availability of financial services supports strong financial literacy and access to resources.

Lowest Number of Financial Institutions: Nevada

Nevada has the lowest number of financial institutions per capita, with 19.86 institutions per 100,000 residents. Limited access to financial services may hinder residents’ ability to manage their finances effectively and contribute to lower financial literacy.

Most Financially Literate States

1. Nebraska

Nebraska is ranked as the most financially literate state in 2024, with a final score of 62.37. The state has earned an ‘A’ grade in financial literacy, which means Nebraska ensures financial literacy instruction in every grade from K-12. This includes a mandatory stand-alone personal finance course for high school graduation.

In Nebraska, 92.16% of the population has at least a high school diploma. The average credit score in the state is 731, indicating good financial management among residents. The Spending vs Income Ratio per Capita is 0.77, showing that most residents manage their spending well.

Only 3.00% of households in Nebraska are unbanked, and 1.30% have nonbank personal loans. The state has a strong presence of financial institutions, with 56.61 per 100,000 residents, providing good access to banking services. However, Nebraska does have 3.20 predatory lenders per 100,000 residents.

Nebraska’s strong financial education system, responsible financial behavior, and access to financial services make it the top state for financial literacy in 2024.

2. Minnesota

Minnesota secures the second spot with a final score of 61.18. The state boasts an ‘A’ grade in Financial Literacy, ensuring comprehensive financial education for students across all K-12 levels, including a mandatory personal finance course for high school graduation.

A notable 94.13% of Minnesotans have at least a high school diploma, highlighting the state’s strong educational foundation. The average FICO score of 742 further underscores the residents’ solid credit habits.

Financially, Minnesotans maintain a balanced approach, with a Spending vs Income Ratio of 0.77. The state has a relatively low percentage of unbanked households at 2.40%, and only 2.30% of households depend on nonbank personal loans. With 34.77 financial institutions per 100,000 residents, access to banking services is ample, and predatory lending is minimal, at just 1.54 per 100,000 residents.

3. Virginia

Virginia ranks third in the list of most financially literate states with a final score of 60.40. The state has earned an ‘A’ in Financial Literacy, ensuring that students receive financial education throughout their K-12 years, including a required personal finance course for high school graduates.

With 91.38% of its population holding at least a high school diploma, Virginia’s educational achievements are commendable. The state’s residents have an average FICO score of 721, reflecting solid credit practices.

In terms of financial behavior, Virginians show restraint, with a Spending vs Income Ratio of 0.75, indicating responsible spending relative to income. The unbanked household percentage is low at 1.80%, and reliance on nonbank personal loans is also modest, affecting just 3.00% of households.

Virginia has 34.18 financial institutions per 100,000 residents, offering decent access to banking services. However, the state faces a slightly higher presence of predatory lenders at 2.96 per 100,000 residents, which is a concern to consider.

4. Vermont

Vermont claims the fourth position in financial literacy with a final score of 58.67. The state is awarded a ‘B’ grade in Financial Literacy, indicating above-average financial education, with either embedded personal finance concepts or specific financial literacy standards in place for students.

Vermont has an impressive educational achievement, with 94.55% of its population holding a high school diploma or higher. The average FICO score in the state is 736, which shows that residents generally manage their credit well.

However, the Spending vs Income Ratio per Capita in Vermont is 0.88, slightly higher than some other top states, suggesting that residents might spend a bit more relative to their income. The unbanked household percentage is 2.50%, which remains relatively low, and 2.30% of households have nonbank personal loans, indicating a stable financial environment.

Vermont has 42.19 financial institutions per 100,000 residents, providing strong access to financial services. Interestingly, the state has no predatory lenders per 100,000 residents, which is a significant positive.

5. Oregon

Oregon ranks fifth with a final score of 58.28. The state holds an ‘A’ grade in Financial Literacy, ensuring that financial education is thoroughly covered throughout K-12, including a mandatory personal finance course for high school graduation.

Oregon’s educational attainment is strong, with 91.87% of its population having a high school diploma or higher. The state’s residents maintain an average FICO score of 731, reflecting their responsible credit management.

Oregonians have a Spending vs Income Ratio per Capita of 0.84, suggesting that residents generally manage their spending well in relation to their income. The unbanked household percentage is quite low at 1.60%, and only 1.60% of households rely on nonbank personal loans, indicating a stable and financially secure environment.

Access to financial services in Oregon is supported by 31.15 financial institutions per 100,000 residents. However, the presence of predatory lenders is slightly higher at 3.79 per 100,000 residents, which could be a point of concern.

6. Utah

Utah ranks sixth with a final score of 57.47. The state has earned an ‘A’ grade in Financial Literacy, ensuring financial education is consistently provided across all K-12 grades, including a mandatory personal finance course for high school graduation.

In Utah, 93.17% of the population has completed high school or higher, which reflects a strong educational foundation. The average FICO score in Utah is 727, indicating responsible credit management by its residents.

The state has a Spending vs Income Ratio per Capita of 0.81, showing that residents generally manage their spending well relative to their income. Utah also has a very low unbanked household percentage at 1.20%, and 4.20% of households rely on nonbank personal loans, which indicates a stable financial environment but with some reliance on alternative lending sources.

Utah has 30.17 financial institutions per 100,000 residents, providing adequate access to financial services. However, the state does have a higher presence of predatory lenders, with 3.79 per 100,000 residents, which could be a concern for financial stability.

7. North Carolina

North Carolina ranks seventh with a final score of 56.43. The state has earned an ‘A’ in Financial Literacy, meaning that financial education is prioritized across all K-12 grades, including a required personal finance course for high school graduation.

In North Carolina, 89.70% of the population has completed high school or higher. The average FICO score for residents is 707, reflecting a decent level of credit management.

The state’s Spending vs Income Ratio per Capita is 0.82, indicating that residents are generally mindful of their spending in relation to their income. The unbanked household percentage stands at 3.30%, which is a bit higher than some other top states. Additionally, 3.70% of households rely on nonbank personal loans, suggesting some financial vulnerability.

Access to financial services in North Carolina includes 30.08 financial institutions per 100,000 residents. The state has a relatively low presence of predatory lenders, with 1.10 per 100,000 residents, which is a positive sign for financial stability.

8. Maryland

Maryland ranks eighth in financial literacy with a final score of 56.32. The state receives a ‘B’ grade in Financial Literacy, indicating above-average financial education with either embedded financial concepts in existing courses or specific financial literacy standards for students.

In Maryland, 91.09% of the population has at least a high school diploma. The average FICO score is 716, which suggests good credit management by residents.

The state shows responsible financial behavior with a Spending vs Income Ratio per Capita of 0.75, reflecting cautious spending relative to income. However, Maryland has a higher percentage of unbanked households at 5.00%, which is notable among the top states. Additionally, 2.40% of households rely on nonbank personal loans.

Maryland has 28.76 financial institutions per 100,000 residents, which provides reasonable access to financial services. The state also has a moderate presence of predatory lenders, with 2.08 per 100,000 residents.

9. Iowa

Iowa takes the ninth spot with a final score of 55.60. The state is awarded a ‘B’ grade in Financial Literacy, indicating that it provides above-average financial education, with either embedded financial concepts or specific literacy standards for students.

In Iowa, 93.32% of the population has at least a high school diploma, showing strong educational attainment. The average FICO score in Iowa is 729, reflecting good credit management among residents.

The Spending vs Income Ratio per Capita in Iowa is 0.75, suggesting that residents are generally prudent with their spending. The unbanked household percentage is 3.00%, which is relatively low, and only 1.60% of households rely on nonbank personal loans, indicating a stable financial environment.

Access to financial services is strong, with 53.37 financial institutions per 100,000 residents, one of the highest among the top states. However, Iowa does have a higher presence of predatory lenders, with 4.09 per 100,000 residents, which could pose risks for some consumers.

10. Ohio

Ohio rounds out the top ten with a final score of 55.40. The state has earned an ‘A’ grade in Financial Literacy, ensuring comprehensive financial education across all K-12 grades, including a mandatory personal finance course for high school graduation.

In Ohio, 91.74% of the population has completed high school or higher. The average FICO score is 715, indicating that residents generally manage their credit responsibly.

The Spending vs Income Ratio per Capita in Ohio is 0.83, showing that residents tend to keep their spending in line with their income. The state has a slightly higher unbanked household percentage at 3.50%, and 3.70% of households rely on nonbank personal loans, pointing to a bit more financial vulnerability.

Ohio has 33.70 financial institutions per 100,000 residents, providing decent access to banking services. However, the state faces a relatively high presence of predatory lenders, with 3.12 per 100,000 residents, which is an area of concern.

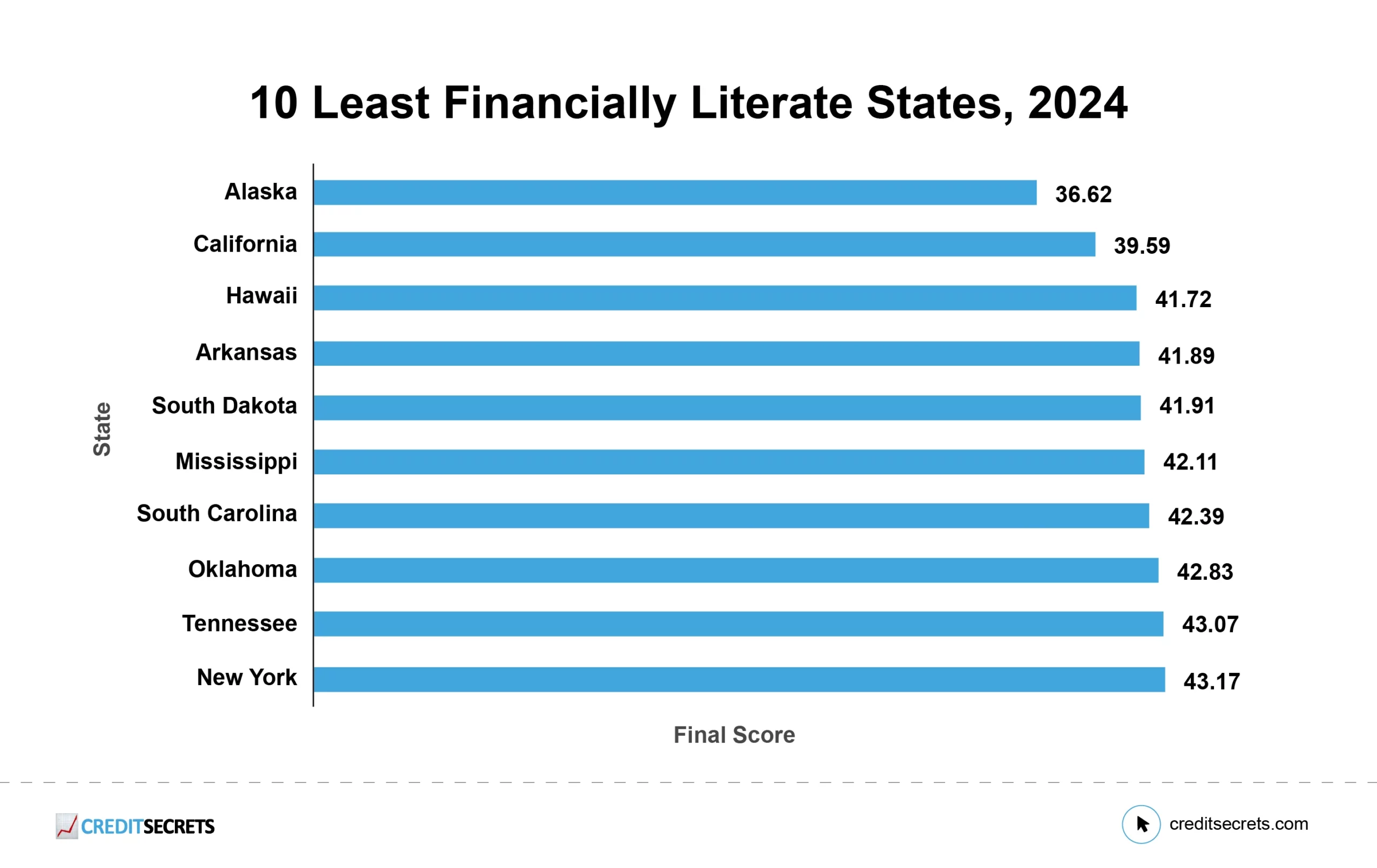

Least Financially Literate States

50. Alaska

Alaska ranks at the bottom of the list with a final score of 36.62, making it the least financially literate state in 2024. The state has earned an ‘F’ grade in Financial Literacy, meaning it does not require or guarantee any financial literacy instruction from grades K-12.

Despite having a high school graduation rate of 93.31%, Alaska struggles with financial literacy. The average FICO score in the state is 717, which is decent, but the Spending vs Income Ratio per Capita is 0.86, indicating that residents may be stretching their income.

The unbanked household percentage in Alaska is relatively high at 4.80%, and 2.00% of households rely on nonbank personal loans. Access to financial services is somewhat limited, with only 30.13 financial institutions per 100,000 residents. The state has a low presence of predatory lenders, with 1.09 per 100,000 residents, which is one of the few positives in its financial landscape.

Overall, Alaska’s poor financial literacy ranking is driven by its lack of financial education and challenges in accessing traditional financial services.

49. California

California ranks 49th with a final score of 39.59, placing it among the least financially literate states in 2024. The state has received a ‘D’ grade in Financial Literacy, meaning it offers limited financial literacy instruction, primarily at the high school level, but lacks comprehensive coverage across all grades.

California has a high school graduation rate of 84.45%, which is among the lowest in the country. The average FICO score in the state is 721, indicating moderate credit management by residents. The Spending vs Income Ratio per Capita is 0.78, suggesting that residents generally live within their means.

The state faces significant challenges with financial access, as 5.00% of households are unbanked, and 2.60% rely on nonbank personal loans. California has only 23.11 financial institutions per 100,000 residents, making access to traditional banking services limited. Additionally, the state has a high presence of predatory lenders, with 4.45 per 100,000 residents, which further complicates financial stability.

48. Hawaii

Hawaii ranks 48th in financial literacy with a final score of 41.72. The state has earned a ‘D’ grade in Financial Literacy, indicating limited financial education, with some focus on high school but lacking comprehensive coverage throughout K-12.

Hawaii’s high school graduation rate is relatively high at 92.93%, yet the state struggles with financial literacy. The average FICO score of 732 suggests decent credit management by residents. However, the Spending vs Income Ratio per Capita is 0.88, which is on the higher side, indicating that residents may be spending more relative to their income.

The percentage of unbanked households in Hawaii is low at 1.50%, but 2.60% of households rely on nonbank personal loans, showing some dependence on alternative financial services. The state has 24.09 financial institutions per 100,000 residents, which is relatively limited access to banking services. Additionally, Hawaii has 1.94 predatory lenders per 100,000 residents, which is relatively lower than others.

47. Arkansas

Arkansas ranks 47th with a final score of 41.89, placing it among the least financially literate states in 2024. The state has received a ‘D’ grade in Financial Literacy, meaning financial literacy instruction is limited, focusing mainly on high schools without comprehensive K-12 coverage.

Arkansas has a high school graduation rate of 88.67%. The average FICO score in the state is 694, which is lower than many other states, indicating challenges in credit management. The Spending vs Income Ratio per Capita is 0.80, suggesting that residents are somewhat mindful of their spending relative to their income.

The state has a relatively high percentage of unbanked households at 3.40%, and 3.90% of households rely on nonbank personal loans, highlighting a significant reliance on alternative financial services. However, Arkansas has one of the highest access to traditional financial institutions, with 53.22 financial institutions per 100,000 residents. The state also has a low presence of predatory lenders, with only 0.82 per 100,000 residents.

46. South Dakota

South Dakota ranks 46th in financial literacy with a final score of 41.91. The state has received an ‘F’ grade in Financial Literacy, meaning it does not require or guarantee any financial literacy instruction throughout grades K-12.

Despite a high school graduation rate of 93.05%, South Dakota struggles with financial literacy. The average FICO score is 733, which indicates relatively good credit management among residents. However, the Spending vs Income Ratio per Capita is 0.72, suggesting that residents are cautious with their spending.

The percentage of unbanked households in South Dakota is 3.70%, and 4.20% of households rely on nonbank personal loans, which points to a reliance on alternative financial services. On the positive side, South Dakota has one of the highest numbers of financial institutions, with 58.69 per 100,000 residents. The state also has a low presence of predatory lenders, with 1.21 per 100,000 residents.

45. Mississippi

Mississippi ranks 45th in financial literacy with a final score of 42.11. The state has earned a ‘B’ grade in Financial Literacy, indicating that it provides above-average financial education, though it still faces significant financial challenges.

The high school graduation rate in Mississippi is 86.49%. The average FICO score is 681, which is quite low, indicating struggles with credit management among residents. The Spending vs Income Ratio per Capita is 0.85, showing that residents may be spending close to their income, which could lead to financial strain.

Mississippi has a notably high unbanked household percentage at 11.10%, the highest among the bottom states, suggesting significant barriers to traditional banking services. Additionally, 5.70% of households rely on nonbank personal loans, indicating a reliance on alternative financial services. The state has 45.71 financial institutions per 100,000 residents, which provides decent access to banking services. However, the presence of predatory lenders is alarmingly high, with 13.74 per 100,000 residents, posing serious risks for financial stability.

44. South Carolina

South Carolina ranks 44th in financial literacy with a final score of 42.39. The state has been assigned a ‘C’ grade in Financial Literacy, indicating that while some financial education is provided, it is not comprehensive or consistent across all grades.

South Carolina has a high school graduation rate of 89.61%, reflecting a moderate level of educational attainment. The average FICO score in the state is 693, which suggests that many residents face challenges in managing their credit. The Spending vs Income Ratio per Capita is 0.86, indicating that residents may be pushing the limits of their income.

The state has a relatively high unbanked household percentage at 5.50%, and 3.30% of households rely on nonbank personal loans, pointing to a reliance on alternative financial services. South Carolina has 31.61 financial institutions per 100,000 residents, which provides some access to traditional banking services. However, the presence of predatory lenders is concerning, with 6.97 per 100,000 residents, posing risks to vulnerable consumers.

43. Oklahoma

Oklahoma ranks 43rd in financial literacy with a final score of 42.83. The state has received a ‘C’ grade in Financial Literacy, indicating that while financial education is present, it is not fully integrated across all grade levels.

Oklahoma’s high school graduation rate stands at 88.71%, which is relatively low compared to other states. The average FICO score in the state is 692, pointing to struggles in credit management. The Spending vs Income Ratio per Capita is 0.75, suggesting that residents are somewhat cautious with their spending relative to their income.

The state has a high unbanked household percentage of 5.40%, and 4.30% of households rely on nonbank personal loans, indicating a significant reliance on alternative financial services. Oklahoma has 36.42 financial institutions per 100,000 residents, which offers reasonable access to banking services. However, the state faces a concerningly high presence of predatory lenders, with 6.57 per 100,000 residents.

42. Tennessee

Tennessee ranks 42nd in financial literacy with a final score of 43.07. The state has been assigned a ‘C’ grade in Financial Literacy, indicating that financial education is provided, but it is not uniformly applied across all grade levels.

Tennessee has a high school graduation rate of 89.74%, reflecting moderate educational attainment. The average FICO score in the state is 701, which suggests that residents have some challenges in managing their credit. The Spending vs Income Ratio per Capita is 0.79, showing that residents are somewhat careful with their spending relative to their income.

The unbanked household percentage in Tennessee is 5.00%, and 3.30% of households rely on nonbank personal loans, pointing to a reliance on alternative financial services. The state has 37.30 financial institutions per 100,000 residents, offering decent access to traditional banking services. However, the presence of predatory lenders is quite high, with 9.74 per 100,000 residents, which is a significant concern for financial stability.

41. New York

New York ranks 41st in financial literacy with a final score of 43.17. The state has received a ‘D’ grade in Financial Literacy, indicating that financial education is minimal and primarily concentrated at the high school level, with little to no comprehensive K-12 coverage.

In New York, 88.03% of the population has completed high school, which is lower than many other states. The average FICO score is 722, showing moderate credit management among residents. The Spending vs Income Ratio per Capita is 0.78, indicating that residents generally manage to keep their spending in line with their income.

The state has a 5.90% unbanked household percentage, which is relatively high, but only 0.90% of households rely on nonbank personal loans, reflecting a lower dependency on alternative and potentially more expensive forms of credit. New York has 26.78 financial institutions per 100,000 residents, which provides limited access to traditional banking services. The presence of predatory lenders is moderate, with 3.12 per 100,000 residents.

Least Financially Literate States

This study aims to identify and rank the most and least financially literate states in the United States for 2024 by evaluating key dimensions of financial literacy across the 50 states.

The study assesses financial literacy by analyzing two primary dimensions: Financial Knowledge & Education and Financial Planning & Habits. These dimensions are evaluated using nine relevant metrics, each weighted according to its importance in determining financial literacy.

The metrics are as follows:

Financial Knowledge & Education (50% Total Weight)

- High School Financial Literacy Score (20%): Based on The American Public Education Foundation’s “The Nation’s Report Card,” this metric evaluates the effectiveness of high school financial literacy programs.

- High School Graduation or Higher (15%): This measures the percentage of the population over 25 with at least a high school diploma, reflecting general educational attainment.

- Bachelor’s Degree or Higher (15%): This metric measures the percentage of the population over 25 with at least a bachelor’s degree, which often correlates with higher financial literacy.

Financial Planning & Habits (50% Total Weight)

- Average FICO Score (20%): A key indicator of financial habits, this metric reflects credit management and overall financial health.

- Per Capita Personal Consumption Expenditure vs. Income Ratio (-10%): This negative-weighted metric penalizes states where personal consumption exceeds income, indicating poor financial habits.

- Unbanked Household Percentage (-2.5%): A higher percentage of unbanked households indicates financial exclusion, leading to a negative impact on the score.

- Households with Nonbank Personal Loans (-2.5%): Reliance on nonbank loans, often indicative of financial instability, negatively impacts the state’s score.

- Financial Institutions per Capita (10%): Access to banks and credit unions is critical for financial planning, making this a positive indicator.

- Predatory Lenders per Capita (-5%): A higher number of predatory lenders per capita is detrimental, leading to a reduction in the overall score.

Scoring Methodology:

Each state is evaluated across these nine metrics, with each metric scored on a 100-point scale. A score of 100 represents the highest level of financial literacy. The state’s overall score is calculated by determining the weighted average of all metrics, which then allows for a ranking of the states from most to least financially literate.

Data Sources:

The data for this study are sourced from reliable and widely recognized institutions:

- High-School Financial Literacy Grade: The American Public Education Foundation’s “The Nation’s Report Card.“

- FICO Score: Data on average credit scores by state sourced from Investopedia (2021).

- Per Capita Personal Consumption Expenditure vs Income Ratio: Sourced from the Bureau of Economic Analysis (2022).

- Unbanked Household Percentage: FDIC data based on the 2021 Census.

- Households with Nonbank Personal Loans: FDIC data based on the 2021 Census.

- Financial Institutions per Capita: Data from Forbes, originally sourced from the U.S. Census Bureau’s 2021 County Business Patterns database.

- Predatory Lenders per Capita: Data from Forbes, originally sourced from the U.S. Census Bureau’s 2021 County Business Patterns database.

- Educational Attainment: Data on the population over 25 with a high school diploma or higher, and with a bachelor’s degree or higher, sourced from Wikipedia.

Weight Distribution:

The weights assigned to each metric reflect their significance in assessing financial literacy. Metrics that indicate stronger financial literacy or access to financial resources are given positive weights, while those indicating financial challenges or instability are assigned negative weights. This balanced approach ensures an accurate and comprehensive evaluation of financial literacy across states.