Here are 3 Simple Ways to Make Money if the Bitcoin Price Crumbles

I will start with a true story that happened in the Netherlands many years ago.

In 1634, a company started importing tulips from Turkey. The flowers got so popular and their prices skyrocketed.

1637 was the peak of the tulip frenzy. By then, a single flower sold for triple the average annual salary of the Dutch people.

People started borrowing heavily and selling their valuable possessions to buy the tulips.

These people expected the price of the flowers to continue rising. Then, one day many people started to sell their flowers but there were no buyers.

Within a week, tulips became valueless.

You can read more about the tulip mania here.

This story is very relevant today especially in the cryptocurrencies market where bitcoin is the leader. As you possibly know, the price of bitcoins has moved from under $1,000 in January this year to the current price of under $20,000.

It is not alone. Other cryptocurrencies like Ethereum, Litecoin, and Dash have risen by more than 4000% each.

Quick note

You can read this page if you want to learn more about these currencies and the underlying blockchain technology.

The rise of these currencies has resulted to different opinions. The first argues that the currencies are worthless and like tulip, their value will soon fall to zero. The second argues that the currencies are currently expensive but the underlying technology is valuable. The third opinion is that these currencies are so valuable that they are cheap. In fact, some in the latter category have argued that the price could accelerate to more than $1 million.

In a recent article, I argued that the right way to invest in these currencies is to buy one and forget it.

But, if you are pessimistic about the currencies and you believe that they are going to zero, there are ways of making money when the scenario plays out.

Bet against Bitcoin

The first way to make money if a bitcoin crash happens is by shorting selling the bitcoins.

The concept of short selling is very easy. Here is how it works.

Assume your friend – Jake – owns a bitcoin. At today’s price, the bitcoin is worth $15,000. Since Jake is your trusted friend, you approach him and borrow the bitcoin, which he gladly lends you.

You then go to the market and sell the bitcoin. At the current price, you get $15,000 in cash.

Then, after a while, the price of the bitcoin drops to $10,000. You then go to the market and buy one bitcoin at the price of $10,000 and return it to Jake. You remain with the $5,000. This is how short selling works.

Of course, the challenge is on where to find the bitcoins to borrow. This is where bitcoin exchanges come in.

In our country, the two most popular bitcoin exchanges are Coinbase and Kraken . The company allows people to buy and short bitcoins in what is known as margin trading.

Bet against Bitcoin Futures

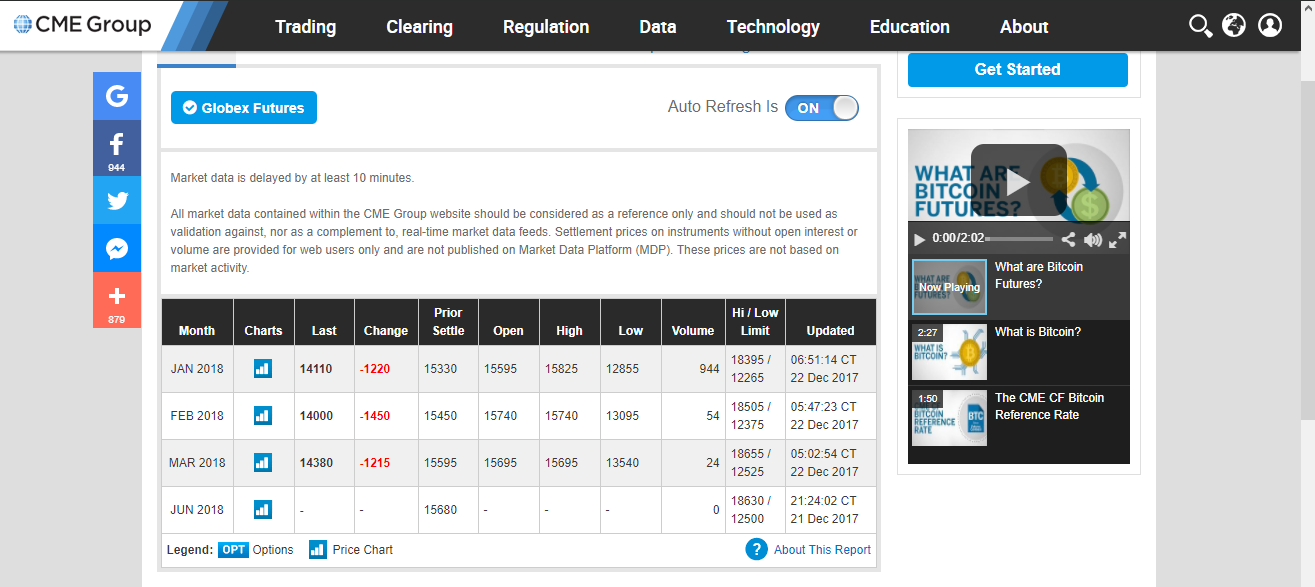

Two weeks ago, American company, CBOE listed bitcoin futures in its exchange. A week later, its competitor CME did the same. This made it possible for ordinary people to buy and sell bitcoin futures.

Futures is that jargon commonly mentioned in financial media. In short, again, assume that you are a corn farmer that supplies a factory. If the price of a corn bushel today is $10.

If you believe the price will be $5 in 6 months, you can make a deal to sell it at $8. If your thesis turns right, you will sell the corn at a better price than the sellers who didn’t have the agreement.

In the same way, if you believe that the price of bitcoin will be lower in the next 5 months, you can enter into such an agreement.

Bet against Bitcoin-Related Companies

If you are afraid of trading bitcoin itself, you can also short companies that are directly related to it. For example, to mine bitcoins, miners require computer with super fast processors.

The biggest suppliers of these products are Micron and NVIDIA, which you can short at your favorite broker.

There are companies that have invested directly in bitcoins. For example, a company called Bitcoin Investment Trust has invested in thousands of bitcoins. Its main source of profit comes from when the price of bitcoin goes up.

If the price of bitcoin collapses, these companies will also suffer because of how related the two are.

Caution

Being a short seller comes with a few challenges.

First, to borrow the bitcoins, the brokers will charge you a commission. These commissions could be as much as 10% of the price of the bitcoin.

Second, the potential for losses are unlimited. In the first example above, the biggest profit you can make, is $15,000. This would happen when the price of bitcoin goes to zero. In this case, you will return the valueless bitcoin to your friend and keep the money.

However, if the trade goes the opposite direction, the potential for a loss are limitless. This is because, if the price reaches to $20,000, you will need to spend more money to buy it so that you can return it to your friend. Here, your loss will be $5000.

If the price reaches $1 million, you will need to buy back the bitcoin at that price to return to your friend.

Therefore, the potential losses as a short seller are unlimited.

In conclusion, it is possible to make money on bitcoin and other cryptocurrencies regardless of the direction their prices. As I mentioned in my previous article, the key is to do it moderately. Whether buying or selling short, I recommend that you don’t exceed one bitcoin.