Here are 10 Surprising Startups that Failed in 2017

In our country, we are taught about the power of entrepreneurship. A lemonade stand is often the most common illustration of how to start and run a business.

As a result, many people try to start their own businesses. Some, like Mark Zuckerberg and Jeff Bezos, make it and become the wealthiest people on earth. However, some fail, and we seldom hear about their failures.

Here are some of the biggest companies that ceased to exist in 2017

Juicero

In 2013, Doug Evans started Juicero to provide a high-end juicer. Doug’s pitch to investors was so good that he managed to raise more than $121 million from the likes of KPCB and Google Ventures with just a prototype and no sales. It was then valued at more than $300 million.

Four years after starting the company, Doug unveiled his product, and it didn’t go well. Bloomberg was the first organization to report about the fundamental issue with the product.

See, Juicero was a high-end Wi-Fi connected juicer that was scheduled to sell for more than $600. The problem was the product was unnecessary because anyone could do what it promised by pressing the sachets using bare hands.

Jawbone

Jawbone was a pioneer in the fitness tracking industry. The company manufactured popular tracking products that helped people track their activities, sleep, and heart.

Its products were so popular that companies like American Express bought thousands of them for their employees.

At its peak, the company raised more than $900 million from the likes of Sequoia, Andreessen Horowitz, Khosla Ventures and Kleiner Perkins Caufield & Byers (KPCB) at a valuation of more than $3 billion.

Many expected the company to go public like its closest competitor, Fitbit.

The company filed for bankruptcy after failing to raise more capital to finance its growth.

Beepi

Beepi was an exciting company that simplified the process of buying a car. The company bought used cars in auctions, repair them, and then listed them on their website. Customers would then place an order, and the company would deliver it to them.

Beepi had raised more than $160 million at a valuation of more than $600 million from investors like Sequoia and Sherpa Capital.

Beepi’s problem was its business model. To succeed, the company had to buy cars, transport them, repair them, market them, and then ship them to their customers. All this left the company with no margins. At times, it lost money when it sold a car.

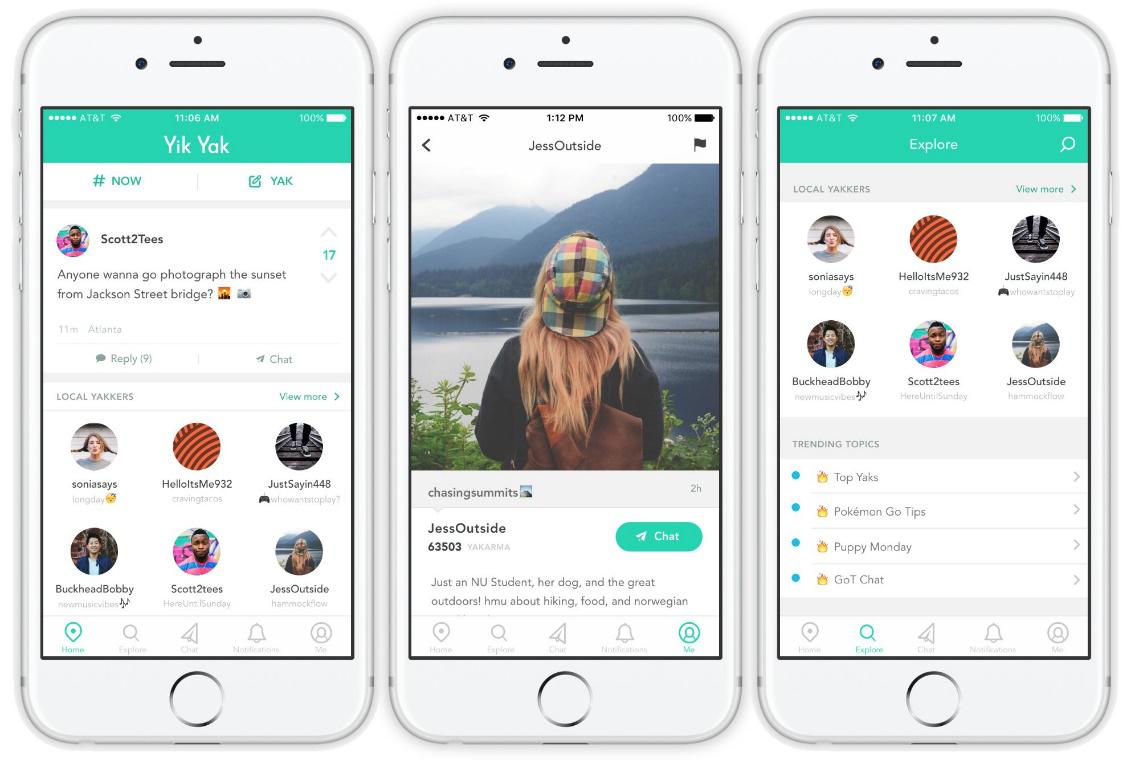

Yik Yak

Yik Yak was once a prized anonymous messaging platform for college students. At its peak, millions of students in the country used the apps. To some, Yik Yak was the next Whatsapp, and it managed to raise more than $75 million at a $400 million valuation.

Yik Yak’s management failed where other anonymous messengers like Telegram and Whisper flourished. They were unable to monetize their product, which led to its death in April.

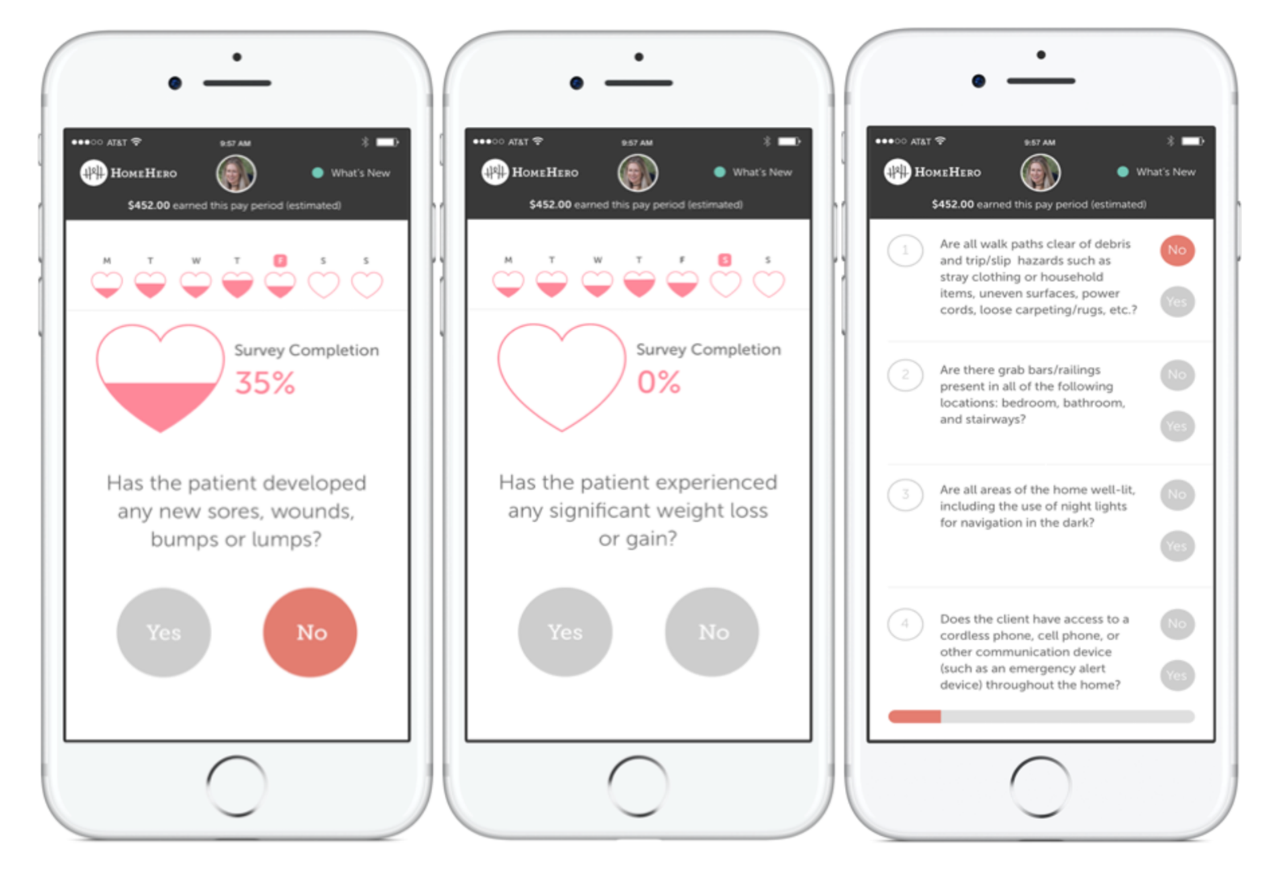

HomeHero

HomeHero was once a prized company in the $30 billion non-medical home care industry. The company offered a platform where people would find quality home care professionals.

The company managed to raise more than $23 million from top venture firms like Social Capital and Graham Holdings.

Unfortunately, the company died three years after it was founded. In a lengthy medium post, the founder blamed the federal government that mandated such companies to treat its workforce as employees instead of contractors.

Hello

Like Jawbone, Hello was in the sleep tracking industry. The company manufactured Fitbit-like sleep tracking products that helped people monitor their sleep.

It was started in 2014 and went on to raise more than $2 million in a kick-starter campaign and an additional $40 million from venture capitalists. It had a valuation of more than $236 million.

The company’s problems came from online reviews and critics. They gave the products very negative reviews, which affected the sales.

Luxe

Like in all cities, finding a parking spot is challenging. Luxe, a company founded in 2013, aimed to solve this.

The company’s model was simple. Once you arrive in a city, use its app to find a pre-screened valet who will find parking for you. When you need it back, you will use the app to summon the valet who would bring it back.

The company, which operated in New York, San Francisco, and Chicago, raised more than $75 million from venture firms and car hire company, Hertz. Its valuation at peak was more than $250 million.

The company faced two major challenges. First, it experienced significant competition from similar companies. Second, it failed to find a suitable business model to monetize and scale the business.

Imzy

Imzy was a social media platform started in 2016 to provide a forum for people to discuss issues of interest. It was created to be an alternative to popular social media platforms like Reddit.

To differentiate itself and attract users, the company’s platform would be ad-free. It would instead make money through a planned system where users would tip one another. All this failed to work out.

The company had raised more than $11 million at a $26 million valuation.

Sprig

Sprig was an on-demand meal kit company that specialized in cooking and delivering organic food.

The company had opened kitchens in several cities including San Francisco, Chicago, and New York. It had raised more than $56 million at a valuation of $169 million.

The company’s challenge was the high cost of operations which made it burn through its capital. It also faced a lot of competition from the hundreds of meal kit companies that have emerged.

By exiting the business, the company joined other companies like SpoonRocket, Maple, and Ola that exited the market.

Qliance Medical Management

Qliance Medical Management was a ten-year company that pioneered a monthly membership model to primary care. The company operated mostly in the Seattle area where it had about six clinics.

It had raised more than $37 million from the likes of Jeff Bezos, Michael Dell, and venture capitalist Nick Hanauer.

The company closed and shut down its business after one of its lenders made an unauthorized withdrawal of $200,000 from their account.

Notable mentions

Other companies that failed in 2017 include Pearl, Quixey, and Teforia, which had raised $50 million, $134 million, and $17 million respectively.

If you are interested in starting a company, you should learn from the companies that failed. Doing this will help you avoid repeating mistakes that the entrepreneurs and managers did.

What's Trending