Do Credit Repair Companies Work

Your financial health heavily relies on your credit score. It determines approval of loans, renting homes, and securing mortgages. Not only this, it’s also crucial in landing your dream job.

But what if you have bad credit? Does that mean you won’t get any of these advantages?

The truth is YES. However, here’s the best part: you can rebuild your credit. You can get help from credit repair companies, which assist you in improving your credit score. They will do everything for you, from removing inaccuracies to monitoring your score.

You might be wondering: do credit repair companies work? Is it worth it?

That’s why we’ve made this blog. To help you improve your poor credit score with the assistance of credit repair companies. So, are you ready to learn more about this and give your credit score a boost?

Then, let’s dive in.

What is a Credit Repair Company?

Credit Repair Company is a professional service that assists individuals in improving their creditworthiness. It plays a crucial role in resolving issues on credit reports. It is regulated by laws such as the:

- Telemarketing Sales Rule (TSR)

- Credit Repair Organization Act (CROA)

But what are these laws?

CROA imposes specific requirements on credit repair companies. This law protects consumers’ rights and keeps them safe from deceptive practices. But what’s the significance of the Telemarketing Sales Rule?

It sets standards for telemarketing activities, including those related to credit repair services. It also has guidelines to eliminate misleading and deceptive telemarketing practices. The biggest one is that these companies cannot charge any fees until 6 months AFTER they’ve completed the promised work.

Now comes the biggest question. How do credit repair companies work?

These companies will review your credit report. They check for outdated information, inaccuracies, or inaccurate items that are the reason for your credit score decline. After finding the issue, they’ll immediately engage in the dispute error resolution process on behalf of their clients.

Here’s how this intricate process goes:

Challenging inaccurate or questionable items → Resolve it by telling major credit bureaus & creditors → Seeking corrections or removals → Improve client’s credit standing.

How Do Credit Repair Companies Work?

Credit repair companies operate by assisting customers in improving their credit profiles through a systematic approach to credit repair. Many factors influence the effectiveness of these companies. There are three significant things you should know.

Firstly, they check the initial state of your credit report. Understanding the severity and types of negative items is crucial, as this impacts the complexity and time required for improvements.

You should always check the legitimacy of the credit repair company. Mainly check the credibility of a company. How can you do that?

Analyze their adherence to regulations like the Credit Repair Organization Act (CROA) and Telemarketing Sales Rule (TSR). Legitimate firms follow ethical practices and provide transparent services.

Lastly, the most critical factor in measuring effectiveness is personal financial habits and responsibility because credit repair is a collaborative effort between the company and the individual.

So, what do credit repair companies do?

They do credit report analysis along with a comprehensive dispute process. Your bad or average credit score can eventually improve because of the steps the company takes. However, these companies cannot legally remove accurate and verifiable information from credit reports.

Moreover, they can’t just magically make your credit score from low to amazingly high.

Here are some common misconceptions regarding credit repair companies you must know.

- Thinking companies can erase accurate negative items.

- The belief is that DIY is less effective than professional services.

- Misbelief in rapid, dramatic improvements.

- Assuming higher fees means better results.

- Assuming all companies are scams.

Is Credit Repair Legal?

Yes, credit repair is completely legal. It’s an amazing way to improve your financial health.

However, you must do it using legal practices. Knowing whether a credit repair company is legal or illegal is important. It will help you make the right decision for your future.

Here are some of the features of a legal credit repair agency.

- Adheres to laws like CROA and TSR, ensuring legal practice.

- Transparent about credit monitoring, repairing services, fees, and cancellation terms.

- Charges reasonable fees and adheres to fee-related regulations (TSR).

Here are some of the features that indicate illegal credit repair companies.

- Operates outside legal frameworks, engaging in potentially fraudulent accounts with management errors.

- Lacks transparency, may hide fees, advance payment, cost of credit repair, or provide misleading information.

- Demands excessive payment upfront without delivering results.

How to Choose a Reputable Credit Repair Company?

Now comes the most important part: choosing the right company for your credit repair. You should do proper research before trusting any company with your finances. Here are some things to look for that indicate a reputable and trustworthy company. That way, you can start a new chapter with a clean slate.

Positive Customer Reviews

Reviews matter the most.

While researching, check the reviews of the company. What are clients saying about their services?

Are they happy? Satisfied? Unhappy?

Reading experiences from other clients provides insights into the company’s effectiveness and customer satisfaction. So make sure to check company reviews and complaints about the credit repair company.

Accreditation And Certifications

Check for accreditation and certifications from recognized authorities.

Remember that most reputable companies have certifications from relevant organizations, such as the Better Business Bureau and the National Association of Credit Services Organizations.

It shows a commitment to ethical practices.

Transparent Pricing

Prefer companies that openly communicate their prices.

Reputable companies clearly outline fees, including initial setup costs and ongoing charges. Avoid those with unclear or hidden fees. But is it important?

Yes. A transparent pricing model ensures you understand the cost implications from the start.

Remember, no fees until the work is complete, per the Telemarketing Sales Rule.

Potential Pitfalls and Scams

According to statistics, 26% of people who use credit repair see their credit scores go up by 100 to 149 points. But there are some warning signs you should look for because not every company is legit.

If you notice incomplete, costly contracts, high promises, false statements, and poor practices, it might be a sign that the company is a scam. The communications by credit repair company are not professional. Moreover, they only make false honey-glazed claims.

You should be aware of consumer protection laws. Know your legal rights and ensure the company strictly adheres to these laws.

DIY Credit Repair vs Credit Repair Companies

Many individuals prefer to DIY their credit repair. They make a strategic plan and implement it to increase their credit score. It saves a lot of money and teaches them financial awareness. You can start by getting accurate credit reports for free via the Annual Credit Report. Check for credit report errors and do your credit score analysis.

DIY allows you to handle sensitive information without involving external parties.

However, is it really good?

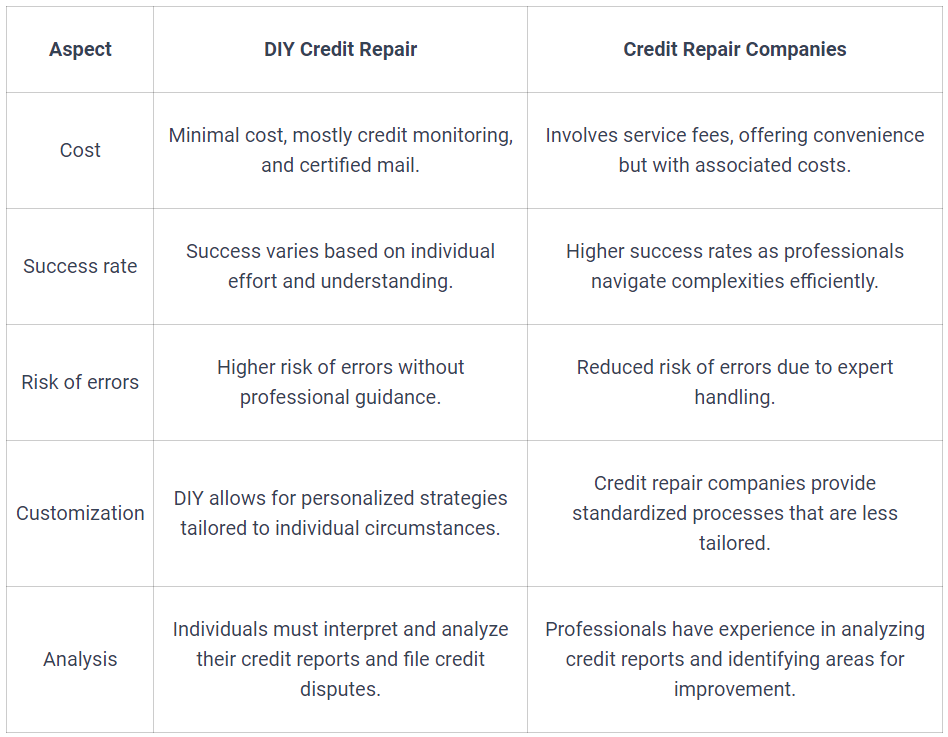

The simple process can be time-consuming and effort-intensive. Understanding credit laws and procedures is also essential, which may be challenging for some. Here’s a table comparing DIY efforts and professional assistance.

Credit Secrets To Try Before Going To A Credit Repair Company

Every person has a different financial situation, and that’s why results vary for each person based on their unique circumstances. You should properly research and stay alert. Look for any signs pointing out that the company is a scam.

You should learn more about finances. We have the most suitable educational materials for your financial security. Learn now from here what steps you can take before getting help from a credit repair company.

Jenn Cartwright

What's Trending