Is DisputeBee Legit? A Complete, Uncut Review

Dispute is now one of several hot tools in the repair market. While some of them are built for credit repair companies, some are designed for individuals taking a homespun approach. The DisputeBee platform has an offer for both.

But, is it legit? I’ll tell you everything I know about the platform so that you can decide for yourself. And, I’ll tell you about some alternatives you can explore.

Here’s what’s in store:

- What is DisputeBee?

- How Does DisputeBee Work?

- How Much Does DisputeBee Cost?

- Related Questions

- Conclusion: Is DisputeBee Legit?

Now, let’s dig in!

What is DisputeBee?

DisputeBee is a credit repair software designed to simplify the credit dispute process. It guides users through importing credit reports, automating the generation of dispute letters, and monitoring the progress of disputes with various entities.

The primary goal is to assist users in removing inaccurate negative items from credit reports, potentially leading to an improvement in credit scores. The software provides additional features such as educational materials, dispute letter templates, and tools for organization.

DisputeBee caters to both individual users and businesses handling credit repair for clients, offering different pricing plans to suit varied needs.

You might also like: Credit Repair Cloud Review: Key to Industry Success?

DisputeBee Company Overview

DisputeBee LLC is a Tampa Bay area (St. Petersburg, Florida) company that was, according to Crunchbase, founded in 2018. And, According to the DisputeBee website and the company’s LinkedIn page, the software was created in 2018.

However, whenever I look into a new company, I like to verify claims that might make a brand appear more established than it actually is. Sunbiz, the state of Florida’s Division of Corporations website, has no record of DisputeBee prior to 2020 – this indicates that the company may have been launched later than what they claim, which could be a *small* red flag.

Prior to DisputeBee’s alleged launch in 2018, the company’s founder, Lee Schmidt, worked as a software engineer at Ionic for a few years, and as an application developer for Fi-Med Management for nearly as long. Schmidt clearly has a strong tech background, though his credit repair history is less obvious.

What is clear is that Schmidt used his DisputeBee software to create his own factual dispute letters before the company officially launched. On the DisputeBee About page, Schmidt touts that people were lining up to use the software before it was ready for the public.

Do I believe this? Yeah. It sounds legit, and many great companies start out this way.

While DisputeBee isn’t accredited or rated by the Better Business Bureau (BBB), they do have a 5-star record in the system. Users seem to be satisfied, which is what’s most important.

So, while the company is fairly new (3-5 years old), and may have *officially* launched a little later than what they claim, I don’t see any reason to tell you to run for the hills. And, in the credit repair industry, this is saying something.

How Does DisputeBee Work?

DisputeBee is a practical solution for individuals and professionals who want an efficient credit repair solution – The software offers a pretty user-friendly experience, guiding you through essential steps from importing credit reports to automating dispute letters and tracking progress.

Now, let’s go a bit deeper.

1. Import Credit Reports

Starting the credit repair process with DisputeBee is straightforward. You will receive clear instructions on how to obtain and upload their credit reports, which is meant to ensure that the process is easy for you.

With DisputeBee, you will have to collect your own credit reports, which means you don’t have to give DisputeBee your full social security number – only the last 4 digits.

You can collect a credit report from all three consumer credit bureaus:

- Transunion

- Equifax

- Experian

Moreover, you can do this once per year for free at annualcreditreport.com.

With DisputeBee, you will be asked to click a link to another credit report acquisition site, CreditBeeScore.com. I don’t recommend paying the $20+ monthly fee when you can get your reports for free.

However, it was a probably smart business move on Schmidt’s part to include that link, which has monetary value. I didn’t see an affiliate disclosure, and I couldn’t find any information about CreditBeeScore (other than the fact that the website domain was created in February of 2023). These observations – along with the name similarity – lead me to believe that CreditBeeScore is a subsidiary of DisputeBee, though I couldn’t verify that.

Recommended: DIY Credit Repair Demystified (It’s Not as Hard as You Think)

2. Automate Dispute Letter Generation

DisputeBee simplifies dispute letter creation by automating the process. After importing credit reports and entering your identifying information, you can select items for dispute, such as collections, inquiries, late payments, charge offs, and bankruptcies.

The software then generates customized dispute letters you can submit to the right entities like credit bureaus and debt collection agencies.

👀 Did you know that Credit Secrets members get exclusive access to Automator™ software, which generates professional dispute letters and SENDS THEM via Certified Mail?

3. Track Your Progress

DisputeBee provides progress tracking through the dashboard, though you have to upload or enter most of your communications manually. By doing so, you can monitor the status of your disputes.

DisputeBee can help you organize credit documents throughout the credit repair journey. The software caters to both novices and experienced users objectively. It serves as a comprehensive toolkit designed to make credit repair accessible to a diverse user base.

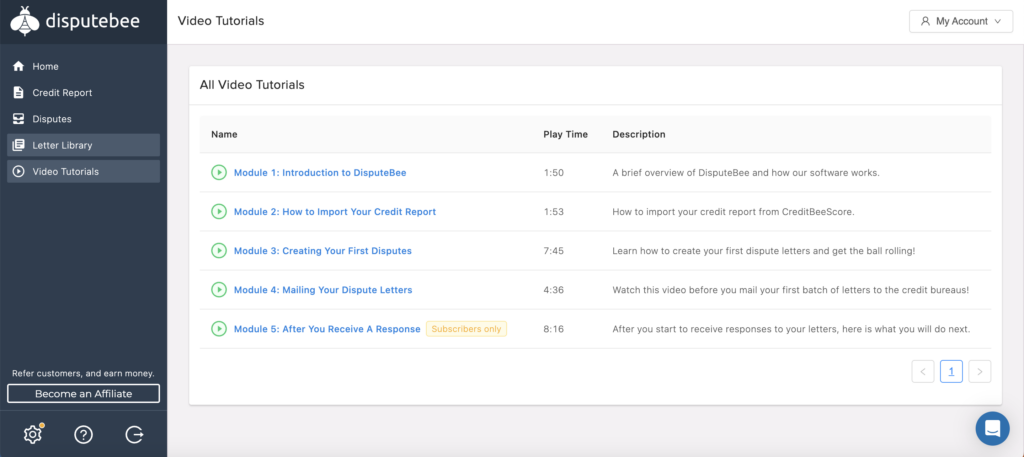

4. Credit Repair Resources

In addition to dispute functionalities, DisputeBee offers educational resources. With these, you can gain insights into the platform and other credit mechanisms. DisputeBee provides guidance on maintaining a healthy credit profile.

This educational support underscores DisputeBee’s commitment to empowering users with knowledge for sustained credit health.

Recommended: Top 8 Best Credit Repair Books of All Time +Free Resources

How Much Does DisputeBee Cost?

DisputeBee offers two pricing plans tailored to different user needs.

For individual users looking to improve their own credit, the Individual plan is priced at $49 per month. This plan includes features such as:

- Importing credit reports

- Support for all three credit bureaus

- Personal disputes to bureaus and collectors

- Pre-written letter templates

- Dispute process tracking

- The ability to dispute various items like collections, credit inquiries, late payments, and bankruptcies

Additionally, an Intelligent Letter Suggester feature is listed as “coming soon.”

For companies that manage credit repair for clients, the Business plan is available for $129 per month. This plan encompasses all features included in the Individual plan, with the added advantage of accommodating unlimited team members and clients.

The business plan also offers:

- Advanced dispute strategies

- Bulk letter generation and printing

- The ability to send mail via API

- Custom letter templates and sequences

- Electronic contract integration

- Client portal

- Zapier integration

- Client billing integration

Both plans operate on a cancel-anytime basis, providing flexibility for users to adjust their subscription based on their evolving needs.

Related Questions

Yes, credit repair is a process designed to identify and correct inaccuracies on your credit report. By disputing and removing erroneous negative items, credit repair can contribute to an improvement in your credit score over time.

Credit repair apps — like DisputeBee and Credit Secrets’ Automator — can be effective tools to streamline the credit repair process. They speed up tasks such as generating dispute letters, tracking progress, and credit repair education. The effectiveness, however, also depends on the accuracy of information and your commitment to the process.

The term “609 credit repair” refers to a dispute method based on Section 609 of the Fair Credit Reporting Act. While disputing inaccuracies under Section 609 is a legitimate approach, success depends on the validity of the disputes and the response from credit bureaus.

The speed of credit repair varies, but some strategies can expedite the process. These include promptly addressing inaccuracies, paying off outstanding debts, and maintaining responsible credit habits. Taking advantage of credit repair tools and resources can also simplify the process.

Yes, you can take basic DIY credit repair steps on your own at no cost. This includes reviewing your credit reports for errors, disputing inaccuracies, and adopting responsible credit habits. However, educational resources and/or software can make the process much faster and easier.

Determining the “best” credit repair company depends on individual needs. While some companies claim to offer fast results, it’s super important to research their legitimacy and educate yourself with credit repair books and other resources.

Conclusion: Is DisputeBee Legit?

DisputeBee seems to be a credible credit repair solution for both individuals and businesses, boasting a user-friendly interface and a range of features.

Despite lacking BBB accreditation, positive user feedback reinforces its legitimacy in the credit repair industry – The platform also offers educational resources and diverse pricing plans that cater to individual and business needs. DisputeBee is an accessible and inclusive credit repair toolkit.

While the company’s official launch date and affiliation with CreditBeeScore raise minor questions, the positive user experiences make DisputeBee seem to me like a viable choice in the competitive credit repair market.

To get that credit score up fast so you can move forward with your life, check out Credit Secrets and start your journey to better financial health.

Ashley Kimler

What's Trending