What Credit Score Do You Need to Buy a House?

When purchasing a home, the most crucial thing is your credit score. Simply put, a high credit score will make the mortgage payment and interest low.

Because a high credit score = More creditworthiness.

You might wonder what credit score you need to buy a house. The answer is that: It Depends.

There are different types of mortgages, and the credit score needed to buy a house varies based on different factors. The minimum credit score to buy a house is 500 to 700. But you need to know much more to ensure you secure an amazing house according to your credit score.

So, are you ready to learn more about it?

Let’s get started.

Understanding Credit Score Requirements for Homebuying

A credit score is a number that tells the creditworthiness of an individual. It is based on the credit history and financial behavior of a person. When it comes to home buying, the credit score needed to buy a house greatly influences mortgage eligibility.

If you have a high credit score, your chances of qualifying for a mortgage with favorable terms are also high. Let’s look at the average mortgage balance according to FICO® Score☉ ranges Experian Q3 2022:

Let’s understand it better with an example.

Suppose you want to purchase a house, and your credit score is 720. Lenders will view this credit score as responsible financial behavior. It’ll make you eligible for favorable mortgage terms.

But if someone has a lower credit score, such as 620. It is a low credit score but still an acceptable range for some loan approvals. However, the interest rate is high, around 4.5%. With the same home plus a down payment, the monthly mortgage will be approximately $1,013.

Credit Score Requirements by Mortgage Type

Now that you know what credit score you need to buy a house and what a good credit score is, let’s dive deeper and look at all the aspects, including the lowest credit score to buy a home.

- Conventional Loans: The minimum credit score requirement is 620. But the mortgages require a high score. If you’re a borrower with a high score, you can earn a break in the cost of private mortgage insurance. It is required if you make a down payment of less than 20% on a conventional loan.

- FHA Loans: The FHA loans have flexible credit requirements. The official minimum credit score is 500, but a score higher than 589 is usually required because that’s how you qualify for a lower down payment of 3.5%.

- USDA Loans: The minimum credit is 640. The U.S. Department of Agriculture (USDA) offers this loan to low to moderate-income persons so they can purchase a home.

- VA Loans: VA loans have no specific minimum credit score requirements. However, most lenders prioritize borrowers with a credit score of 620 or more. There’s no down payment on this loan.

- Jumbo Loans: You need at least 700 or above to qualify for jumbo loans. It exceeds the conforming loan limit set by Fannie Mae and Freddie Mac, with strict standards and guidelines.

Even though the credit score limit is already set, some lenders may have overlays. These are additional requirements that go beyond the rules specified by government agencies. For example, you know that you need at least a 580 credit score for a FHA loan. However, some lenders may have an internal policy requiring a minimum 620 score. It’s best to shop around and compare offers from different lenders.

How Your Credit Score Affects Mortgage Rates

Lenders use credit scores to assess the risk of lending money to a person. Here’s what you should know.

High credit score → Low risk → Lower interest rate on mortgages

Low credit score → More risk → Higher interest rate on the mortgage

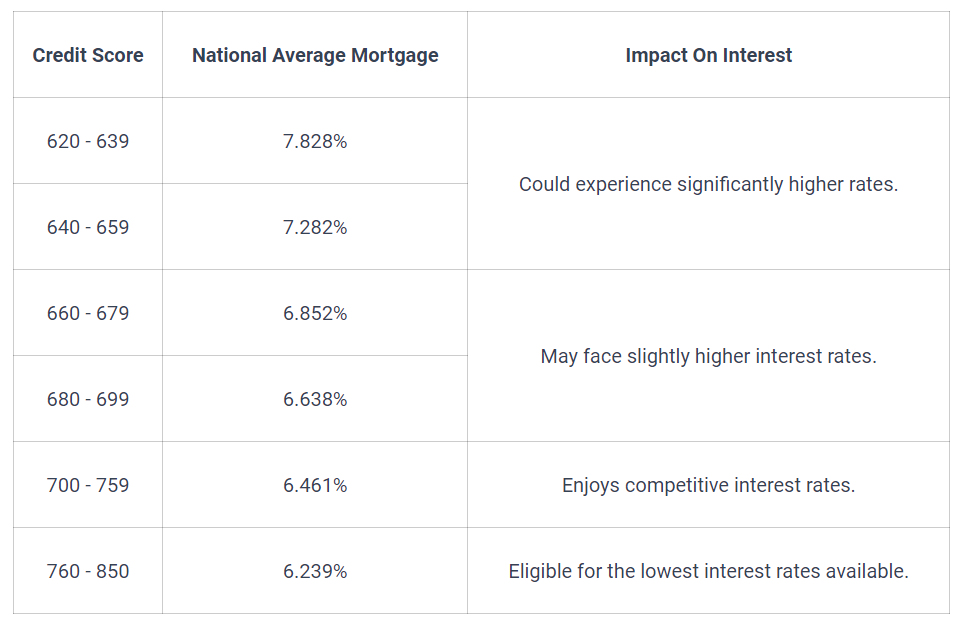

Let’s look at the FICO data regarding credit scores. Here’s the average interest rate based on credit level for a 30-year fixed-rate mortgage of around $300,000. As of January 2024:

But is that all?

No.

Having a high credit score opens doors to many favorable mortgage terms. These borrowers are more likely to qualify for lower down payments, a broader range of mortgage products, and lower fees and closing costs. Now, you know what the lowest credit score you need is in order to buy a home.

Tips for Improving Your Credit Score

For homebuyers, it is crucial to consistently work on improving your credit score. You should check credit reports annually. Ensure your credit balance is lower than your credit limit.

Reduce debts and incorporate healthy financial habits. However, the most important thing is to be patient in the process. Check our comprehensive Credit Secrets book now to gain premium guidance regarding increasing your credit score.

Preparing Your Credit for a Mortgage Application

Remember that lenders use credit scores to check if a person is eligible for home buying. Your approval and loan-securing chances become high if you have a well-prepared credit profile.

You should make a proper plan for balancing credit health. Here’s what you can do to get a good credit score to buy a house.

- Monitor accurate reports.

- Plan milestones.

- Reduce high balances.

- Keep finances stable.

- Seek mortgage advice early.

Navigating the Homebuying Process with Your Credit Score

You’re in a good position if your credit score is 760 or above. You can secure the best interest rate and mortgage terms. Meanwhile, lenders may scrutinize your application more closely if you’ve fair credit, which is around 620-699.

Most people think home buying is impossible if your credit score is below 620.

But that’s not true. It’s challenging but not impossible.

There are many options for you as well. However, before that, you should pay your debt and check for any errors in your credit report. Consistently make on-time payments and maintain healthy habits. You can also get loans such as FHA, USDA, and VA loans.

Conclusion

Now you know about credit scores for buying a house and the strategic plan you should implement. Start with being aware of your credit score and weigh all your options.

Most people are unaware of these complexities and make numerous grave mistakes. If you’re also looking for a way to improve your credit score and seeking mortgage assistance, we have something special for you.

Our team of experts is available to help people like you with mortgage assistance and credit score improvements. We can help you build a good credit score to buy a house. So, reach out to our team of experts today.

Jenn Cartwright

What's Trending