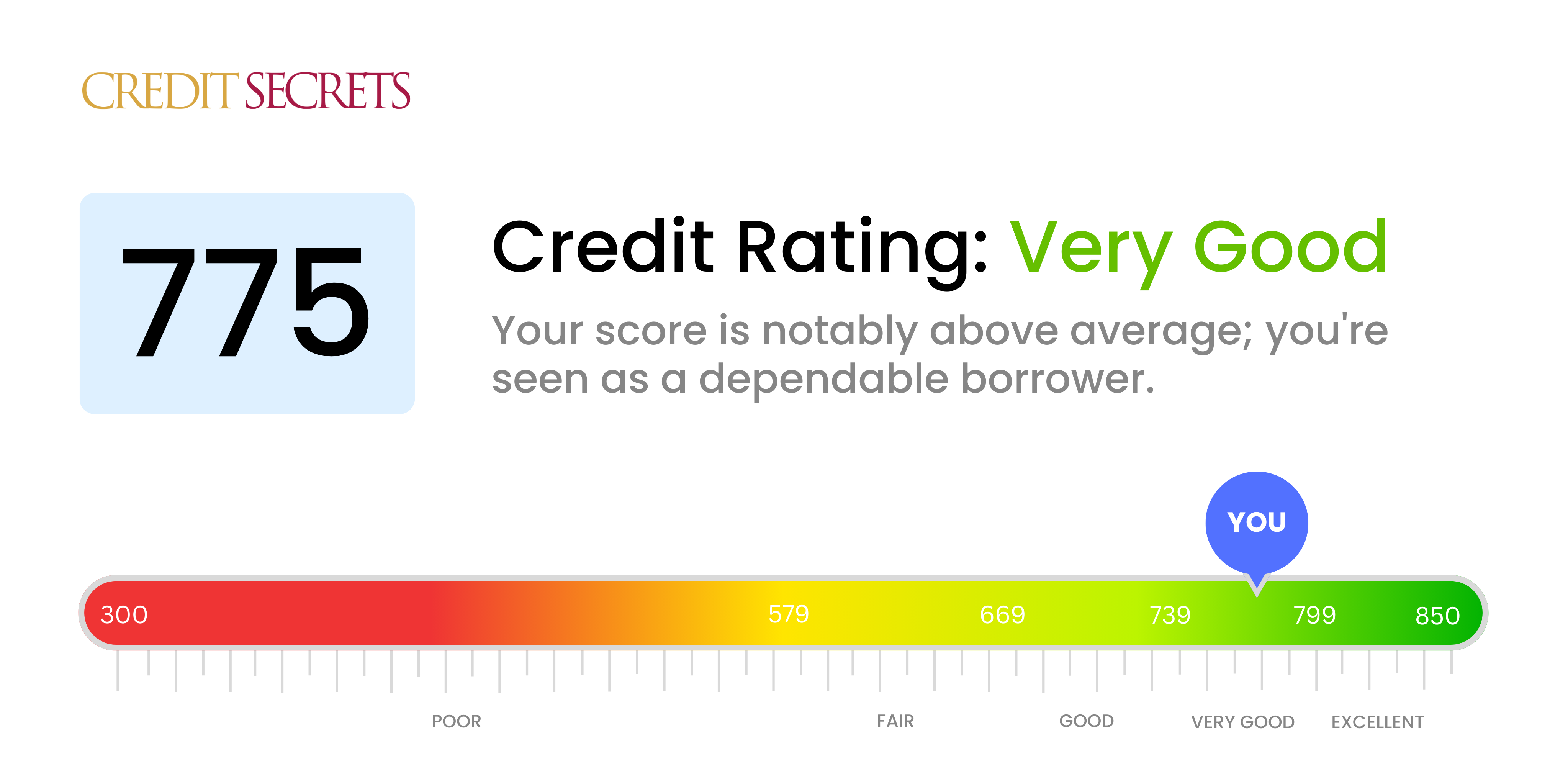

Is 775 a good credit score?

With a credit score of 775, you're in a very healthy financial position. This level of credit health is considered "very good", indicating that you've demonstrated responsible fiscal management and have likely held a consistent, good-standing history with your lenders.

As such, you could expect to have more opportunities available to you compared to those with lower scores, including better interest rates on loans and credit applications, and greater bargaining power with your lenders. Maintaining or improving this score further will continue to open up more financial benefits and opportunities for you.

Can I Get a Mortgage with a 775 Credit Score?

With a credit score of 775, you are likely to be seen as a very reliable borrower by most lenders. This score is well above the average and suggests a strong record of repaying debt on time and managing your financial responsibilities effectively. Therefore, if you're considering applying for a mortgage, chances are high that you'll be approved.

During the mortgage approval process, your high score could largely influence favorable terms, such as lower interest rates. This is due to the fact that lenders tend to reward exceptional credit scores with the most attractive offers. While this is an excellent place to be, remember there are other factors taken into consideration when applying for a mortgage like income and debt-to-income ratio. Your high score, however, is definitely a positive step towards securing affordable housing finance.

Can I Get a Credit Card with a 775 Credit Score?

With a credit score of 775, it's quite likely to get approved for a credit card. This score reflects a robust financial history and smart management of credit, which lenders view positively. Understanding your strong credit position is essential, as it opens up various opportunities to access credit products that can further strengthen your financial situation.

Given your impressive credit score, you're not just limited to basic credit cards. You could consider premium credit cards, travel cards, or rewards cards. These credit cards often come with competitive interest rates and offer perks such as cash back, travel rewards, and other benefits. Remember to always choose a card that suits your lifestyle and financial goals. While the approval process should be straightforward with such a high score, always keeping tabs on responsible spending habits will ensure your score stays high and your financial journey remains empowered.

With a credit score of 775, you have a solid financial standing that is likely to look attractive to lenders, making it probable you would be approved for a personal loan. This score signifies that you have a history of responsible borrowing and timely repayments, which are important factors in the eyes of lenders when considering loan approvals. Thus, your credit score can be an asset in your journey toward financial goals.

In terms of the loan application process, your favorable credit score should help facilitate a more straightforward experience. Having such a high credit score often equates to qualifying for better interest rates, saving you cost over the life of your loan. Personal loans can come with varying terms and conditions, so remember to review these carefully and make sure they align with your financial needs. And while your credit score is a strong factor in loan approval, don't forget that lenders look at other factors too, like your income and job stability, among others.

Can I Get a Car Loan with a 775 Credit Score?

Having a credit score of 775 means you're in a strong position to be approved for a car loan. This score is well above the 660 lenders typically consider favorable, indicating you are seen as a low risk borrower. Your outstanding credit score places you in the prime category, making you an attractive candidate to lenders.

When going through the car purchasing process, your admirable credit score of 775 will likely result in access to competitive interest rates. Due to the confidence in your ability to repay borrowed money, lenders often offer lower interest rates to those with high credit scores. This could translate into significant long-term savings. Remember, while a great credit score can make the process easier and more cost-effective, it's still essential to review all loan terms thoroughly before proceeding. Keep in mind that good credit provides you with a broad choice of lenders and terms, so taking the time to shop around for the best deal is always a smart strategy.

What Factors Most Impact a 775 Credit Score?

A credit score of 775 is an excellent achievement and reflects your financial discipline. However, a few points can bring you closer to a perfect score, which is 850. Let's understand the factors you should pay attention to.

The Total Number of Accounts

A good number of diverse credit accounts indicate that you can manage different types of credit responsibly.

How to Check: Check your credit report to see your number and types of credit accounts.

Maintain Low Credit Balances

Keep your credit balances low to maintain your high score. Even a slight increase might affect your score at this stage.

How to Check: Review your credit card balances regularly and aim to keep balances lower than 30% of your limit.

Zero Late Payments

Ensure you make every payment on time. At this score range, even a single late payment may result in a significant drop in score.

How to Check: Always check your payment due dates, consider setting automatic payments if you haven't already.

Potential for Fraud or Errors

Be vigilant about inaccurate information or potential ID theft as it may lower your score.

How to Check: Regularly review your credit report for any discrepancies. Report any errors immediately.

Avoid Hard Inquiries

Each new loan application involves a hard inquiry which may decrease your score.

How to Check: Keep track of your loan applications and regulate them over a period of time.

How Do I Improve my 775 Credit Score?

A score of 775 is impressive, placing you in the upper echelons of creditworthiness. However, perfection is within reach, with a few targeted steps. Here are the most relevant and impactful steps for your specific situation:

1. Maintain Existing Accounts

Remember the lengths of open credit lines factor into your score. Cancelling your old but unused cards may have a negative impact on your credit score. Keep these accounts active by making small purchases occasionally and paying off the balances immediately.

2. Keep Balances Low

A low credit utilization ratio helps improve your credit score. Keeping the ratio under 10% can make a difference. Promptly pay off your balances to keep this ratio low, ideally, make multiple payments throughout the month.

3. Pay Bills On Time

Timely payment of not just credit card bills, but also rent, utilities, and other recurring bills is crucial. Automatic payments can ensure that you never miss a deadline.

4. Avoid Unnecessary Credit Inquiries

Unnecessary applications for new credit can cause a temporary dip in your credit score because they result in hard inquiries. Avoid this by only applying for credit when it’s essential.

5. Periodically review your credit report

Ensure that all the information on your credit report is accurate and up-to-date. Report any inaccuracies or fraud immediately to the credit bureaus for correction. This can potentially lift your credit score.