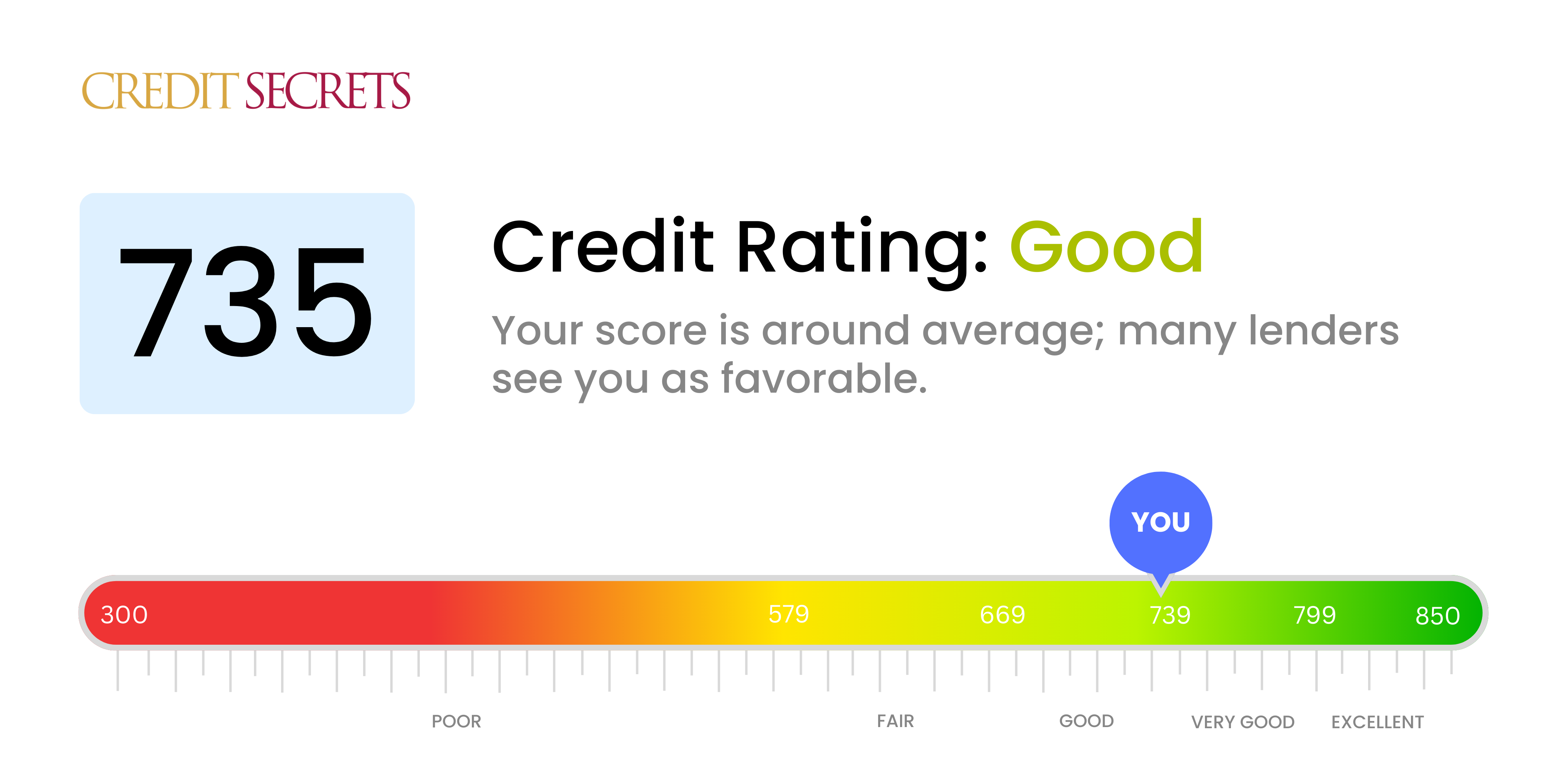

Is 735 a good credit score?

Your credit score of 735 puts you in the 'Good' range, just shy of the 'Very Good' category. With this score, you can generally expect to be approved for loans and credit cards, but you may not receive the best interest rates that those with 'Very Good' or 'Excellent' scores receive. However, this is a strong base to build upon, and by making consistent, on-time payments, and reducing debt, you can improve your score further.

Can I Get a Mortgage with a 735 Credit Score?

Holding a credit score of 735 positions you in a favorable light for mortgage approval, as this score is commonly considered 'good' by most lenders. Your credit score suggests responsible financial behavior, making you a potentially reliable borrower in the eyes of lenders.

While having a 735 credit score does improve your chances of mortgage approval, it's important to understand that other factors, such as income and debt-to-income ratio, will be considered during the approval process. Although you are likely to get approved, getting the best interest rates also hinge upon these factors. A credit score of 735 does not guarantee the lowest interest rates, but it should secure you a competitive rate. Always remember, a strong credit score like yours can be a powerful tool in securing your financial stability and empowering you to reach your goals.

Can I Get a Credit Card with a 735 Credit Score?

Having a credit score of 735 is solid ground to stand on when it comes to applying for a credit card. Lenders typically see this score as manageable, meaning that it indicates reliability and a history of responsibly dealing with credit in the past. Though it may feel confusing at times, understanding your credit status is a powerful step towards effectively managing your financial future.

Given an excellent score like 735, you could explore a variety of credit cards suited to your liking, such as starter cards or even premium travel cards. Both can provide further opportunities to continue building a strong credit history. The interest rates for these will typically be reasonable, reflecting your lower risk status to lenders. Aim for cards with perks that align best with your lifestyle understandings, like travel rewards or cash back. Just remember, while having a good score opens up many opportunities, it's crucial to consistently manage credit wisely to maintain your financial stability and progress.

A credit score of 735 is generally viewed positively by lenders. It suggests that you have been responsible with your past borrowings and indicates a lower level of risk for the prospective lender. This means that you stand a good chance of being approved for a personal loan.

With a credit score of 735, lenders are likely to see you as a reliable borrower. This doesn't mean the application process will be without any scrutiny, though. Lenders still will look at factors such as your income and debt levels. However, your score puts you in a strong position to negotiate better terms, like lower interest rates, compared to those with poorer credit scores. Remember, although your score is solid, it's still vital to shop around and consider different lending options to secure the best deal for your financial situation.

Can I Get a Car Loan with a 735 Credit Score?

Having a credit score of 735 is indeed a strong aspect of your financial profile. Such a score typically positions you well when applying for a car loan. Lenders usually seek scores above 660 to grant favorable loan terms, so your score of 735 surpasses this threshold comfortably. This higher score generally means you are regarded by lenders as less of a risk, resulting in better loan terms and potentially lower interest rates.

As you move forward with the car purchasing process, be prepared for lenders to positively assess your creditworthiness. Owing to your solid credit score of 735, it's likely that multiple lenders will be willing to work with you and provide competitive interest rates. Keep in mind, though, that while a good credit score improves your prospects, it is beneficial to thoroughly compare car loan offers to ensure the best fit for your financial standing. Patience and a meticulous approach often yield the best results.

What Factors Most Impact a 735 Credit Score?

To comprehend a score of 735, it's essential to identify the factors that most likely influence it. Acknowledgement of these elements can help you strategically enhance your financial health.

Credit Utilization

One significant aspect affecting your score could be credit utilization. If your balances are high when compared to your total credit limit, this might be a contributing factor to your 735 score.

How to Check: Review your total balances against your available credit limits in your account statements. Striving for lower balances in relation to your limits might positively impact your credit score.

Length of Credit History

The length of your credit history can also play a role. Having an older credit age can be beneficial to your score.

How to Check: Look over your credit report for the age of your accounts, both oldest and newest, as well as the average age. Be mindful if you've recently opened new accounts.

New Credit and Credit Mix

Managing new credit strategically, along with maintaining a diverse mix of credit types, can also influence your score.

How to Check: Analyze your assortment of credit accounts such as credit cards, retail accounts, installment loans, and mortgage loans. Be cautious of opening multiple new accounts within a short period.

Payment History

Having a solid payment history can significantly help in maintaining a good score. Late payments or defaults could be possible reasons for your 735 score.

How to Check: Check your credit report for missed payments or defaults. Paying bills consistently and on time is key to improve your score.

How Do I Improve my 735 Credit Score?

At a credit score of 735, you’re in good standing, but there’s always room for enhancement. Here’s how to give your score a further boost from this standing:

1. Maintain Credit Utilization

A critical factor for a robust credit score is how much of your obtainable credit you’re using. Try not to exceed 30% of your credit limit and always consider paying off your balances in full each month where possible.

2. Stay Consistent with Payments

Timely bill payments contribute significantly to a good credit score. Carry on with your pattern of consistent repayments, ensuring every account is handled punctually.

3. Review Credit Reports Regularly

Even with a high credit score, errors can surface. Regular checks and dispute of possible inaccuracies in your credit reports can protect your score from unwarranted hits.

4. Limit New Credit Applications

Avoid unnecessary hard inquiries from new credit applications. Each hard inquiry may reduce your credit score slightly and could flag you as a higher risk to lenders.

5. Extend Credit History

Longer credit history usually increases credit scores, so keep old accounts open unless there’s a compelling reason to close them.