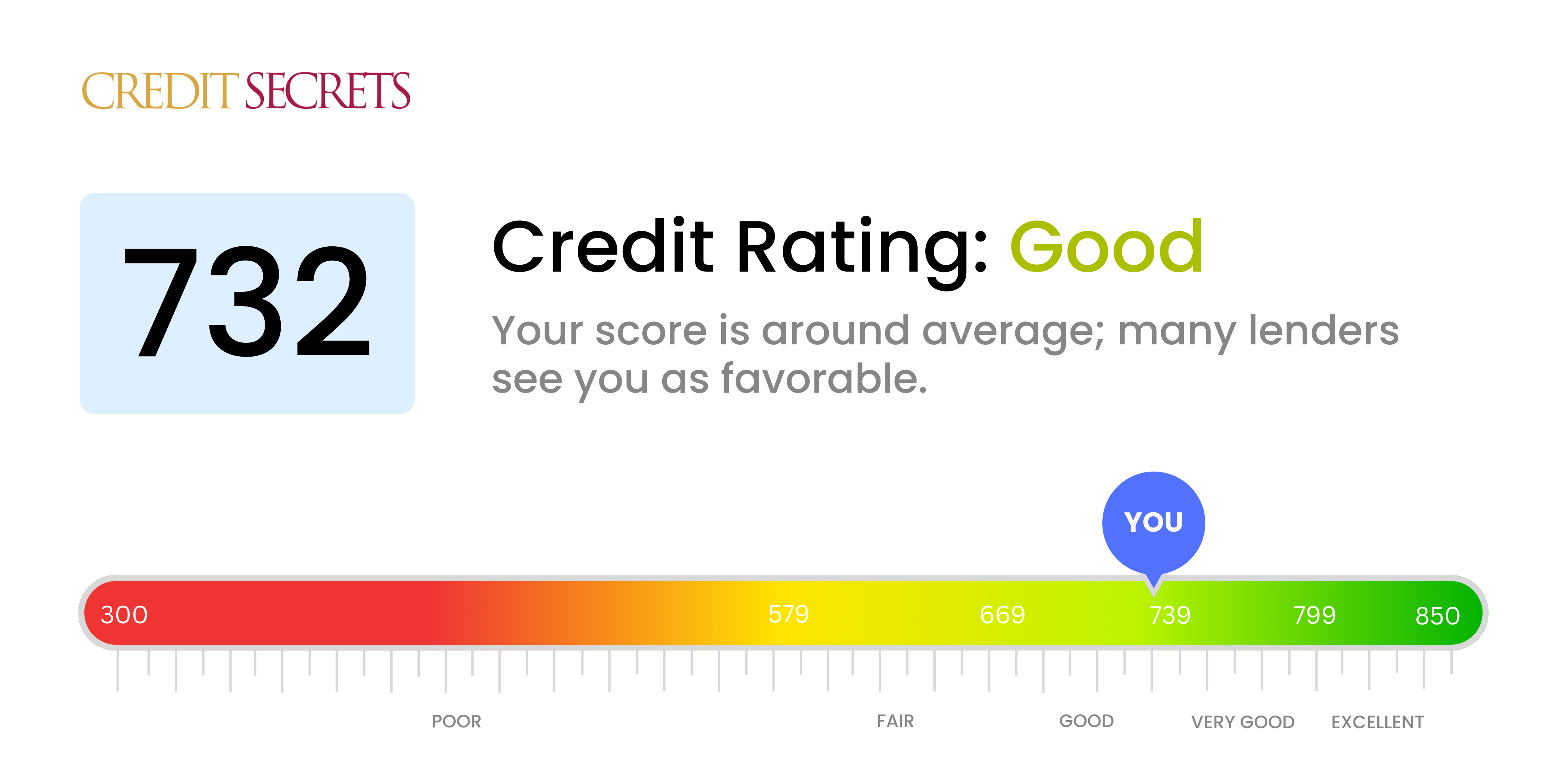

Is 732 a good credit score?

If your credit score is 732, it falls into the 'good' category. This isn't the best score you can have, but it's considerably better than average and it could still avail you reasonable interest rates on loans and credit cards.

With a score of 732, you should be able to get approved for most loans, but you might not get the best interest rates. It's important to understand that while a good score opens up possibilities, it may also require you to negotiate terms to ensure you're getting the best deal. Keep making timely payments and reducing outstanding debt to further improve your score.

Can I Get a Mortgage with a 732 Credit Score?

With a credit score of 732, you stand a solid chance of being approved for a mortgage. This score is deemed good by most lenders and signifies that you have handled credit responsibly in the past. However, remember that a credit score isn't the only requirement for mortgage approval. Other factors such as income, employment stability, and debt-to-income ratio also influence the lender's decision.

Assuming these other aspects are in order, you can anticipate a relatively smooth mortgage approval process. This score may also make you eligible for fairly competitive interest rates, further reducing the long-term cost of your home purchase. Be prepared to provide necessary documentation, such as pay stubs and tax returns, which lenders use to validate your income and other financial details. Ultimately, displaying a disciplined approach towards your finances should help facilitate a successful mortgage application.

Can I Get a Credit Card with a 732 Credit Score?

Having a credit score of 732 puts you in a good position as far as credit card approval is concerned. This score displays to lenders a solid history of financial responsibility and trustworthiness, meaning you're likely to manage your credit card activity diligently. Your odds of getting approved for a credit card with such a credit score are relatively high.

However, being approved for a credit card doesn't mean every kind of card is suitable for your situation. With a 732 credit score, you may want to consider cards with rewards programs or lower interest rates, as these can deliver greater value for your responsible credit use. While premium travel cards may seem attractive, they usually come with higher annual fees, which might not be the best fit unless you're a frequent traveller. A card with lower fees and tailored to your spending habits may provide more profound benefits for your personal financial scenario. And remember, while a good credit score increases your odds, approval also depends on other factors like your income. So, remember to stay responsible with your financial decisions.

If you have a credit score of 732, you're in a good position to receive approval for a personal loan. This score falls within the 'good' credit range and suggests to lenders that you manage credit responsibly and are likely to repay your loan on time. Remember, while this score increases your chances, approval also depends on other factors such as your income and existing debts.

When applying for your personal loan, be prepared to provide proof of your financial stability. Lenders might ask for details like employment history and current income. Also, keep in mind that a higher credit score like yours can often lead to better loan terms, such as lower interest rates. Nevertheless, it's essential to read and understand the loan terms before signing any agreement. Proper planning and understanding can make your loan application journey smoother and less stressful.

Can I Get a Car Loan with a 732 Credit Score?

With a credit score of 732, chances of getting approved for a car loan are quite favorable. Lenders typically look for scores in the range of 660 and beyond to offer the best terms, and with your score sitting comfortably within that range, it definitely paints a positive picture. This score indicates to lenders a responsible borrowing history and a lower risk for them. This trust can often result in lower interest rates and more flexible terms.

While applying for a car loan, keep in mind that your strong score of 732 gives you a bit of an upper hand. It allows you to negotiate for better loan terms, and potentially secure lower interest rates. Your creditworthiness paints a good picture of you to lenders, which can make the car purchasing process smoother. However, don't forget that credit score is not the only deciding factor. Ensure you have all your documents in order, and remember to read and understand all terms before signing any agreement.

What Factors Most Impact a 732 Credit Score?

Grasping the implications of a credit score of 732 can be a critical step in further financial growth. Different factors combine to give you this score, and recognising them can guide you towards better financial health. Remember, each financial journey is a personal one, presenting both challenges and opportunities.

Credit Utilization

Lower credit utilization can contribute to a higher score. Keeping your credit card balances low relative to your limits is a positive factor in your score.

How to Check: Review your credit card statements regularly. Are your balances significantly below their limits? The more distance there is, the better for your credit score.

Length of Credit History

A longer credit history can contribute to a higher credit score as it displays your ability to manage credit over time.

How to Check: Scrutinize your credit report and assess the length of your oldest and newest accounts. Recent openings of new accounts can impact your score negatively.

Credit Diversity

A diverse mix of credit accounts, for example, mortgages, installment loans, credit cards, can lead to a higher credit score.

How to Check: Review your credit report to see what credit accounts you have. Aim for a variety of account types.

Late Payments

Having a record of making payments on time is crucial. Late payments can affect your score negatively.

How to Check: Check your credit report for any late payments. It's important to always make payments when they are due.

Public Records

Public records like bankruptcies or tax liens can significantly impact your score negatively.

How to Check: Review your credit report for any public records. If items are listed, aim to resolve them as quickly as possible.

How Do I Improve my 732 Credit Score?

A credit score of 732 is good, but there’s always room for improvement. Here are the most instrumental and feasible steps you can take to boost your score:

1. Regularly Check Your Credit Report

Regular monitoring of your credit report will help you spot any errors. If errors are spotted, you can dispute them through the credit bureaus. Keeping tabs on your credit report also helps you understand the factors affecting your credit score.

2. Maintain a Low Utilization Rate

Your credit utilization rate — that is, your credit card balance compared to your total credit limit — plays a significant role in your credit score. Aim to keep your utilization rate below 30%. Remember that lower is better.

3. Avoid New Credit Card Applications

Applying for a new credit card can lead to a hard inquiry on your credit report, which could slightly lower your credit score. Consider holding off on any new credit card applications to maintain your current score.

4. Pay Bills on Time

Every late payment can impact your credit score. Your payment history is a crucial factor in credit scoring, so continue to pay your bills on time, every time. Consider setting up automatic payments to avoid any chance of late payments.

5. Keep Longstanding Accounts Open

Older credit accounts contribute positively to your credit history length. Even if an account isn’t regularly used, consider keeping it open. Just ensure you’re not overburdened by annual fees.