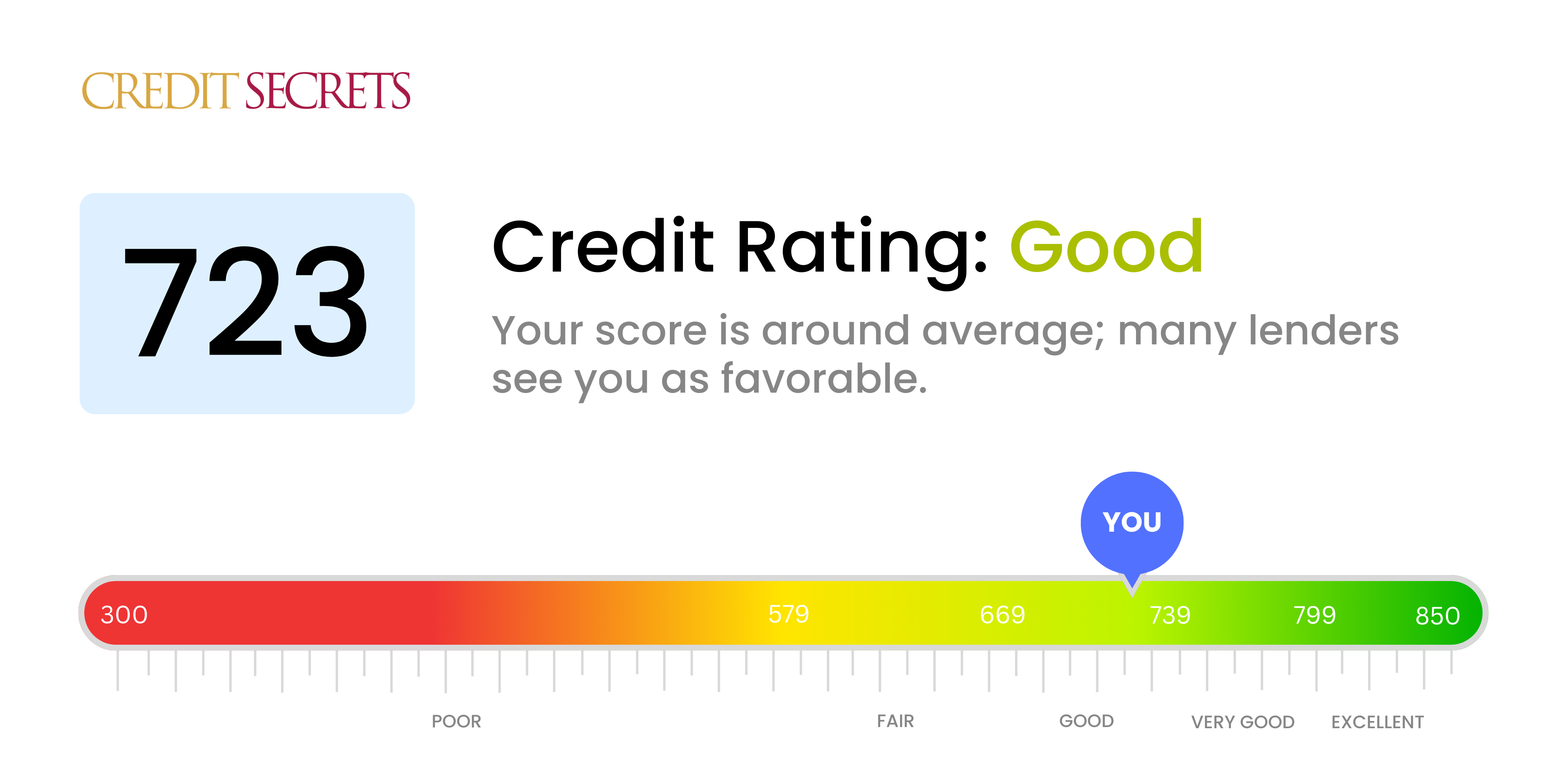

Is 723 a good credit score?

With a credit score of 723, you're doing pretty well - your score falls into the 'Good' category. This score can open up several opportunities for you to access better interest rates and terms on credit cards and loans. Yet, it's also a signal to lenders that, although reliable, you're not performing at the 'Very Good' or 'Excellent' level. There's always scope for improvement, so staying focused on good credit management habits can only benefit you going forward.

It's evident you've made some right choices along your financial journey, and that effort reflects positively in your score. You should be able to get approved for many types of credit, including mortgages, auto loans, and most major credit cards. Continue your attentiveness towards managing your debts and payments, as this could further improve your score and provide you with an even wider variety of financial opportunities.

Can I Get a Mortgage with a 723 Credit Score?

With a credit score of 723, you are in a fairly good position to be approved for a mortgage. A score in this range generally reflects a history of responsible credit management. As you navigate this process, it is important to emphasize that this score doesn't guarantee approval, as lenders consider a variety of factors. However, a score of 723 typically puts you on solid ground.

Moving forward in the mortgage approval process, be prepared for lenders to closely examine your financial circumstances. This includes your employment history, income, and current debt. Having a credit score of 723 might also help you secure a more favorable interest rate on your mortgage. However, it is always a good idea to shop around. Even slight differences in interest rates can significantly impact the total cost of your mortgage over time. Always be sure to do your homework to ensure you are getting the best deal available to you.

Can I Get a Credit Card with a 723 Credit Score?

Having a credit score of 723 often means you're more likely to get approved for a credit card. This score is considered good and shows lenders that you've managed your credit responsibly in the past. However, it's still crucial to approach your financial situation realistically, and be aware that different lenders have different requirements.

With a credit score in the good range, it's typically easier to get approved for various types of credit cards. Unsecured credit cards are often a good choice, as they don't require a security deposit and usually offer more beneficial terms. Consider researching cards with rewards programs, such as cash back or travel points, to get the most out of your card. Don't forget to consider the interest rate, though, as even with a good credit score, the rate can vary significantly. Always ensure you’re confident in your ability to meet monthly repayments before taking on any new credit.

With a credit score of 723, you're in a good position to secure a personal loan. This score is generally viewed favourably by lenders, indicating a history of responsible borrowing and repayment. Remember though, approval isn't guaranteed solely on your credit score, other factors such as income and debt-to-income ratio are also considered.

When it comes to the application process, having a 723 credit score gives you a strong advantage. You'll likely experience a smoother process with fewer hurdles. Also, with this score, you may qualify for better interest rates since lenders consider you less of a credit risk. This means you could potentially pay less overall for your loan in the long run, saving you valuable money. Even with these benefits, it's crucial that you review all terms and conditions fully before committing to any loan. Remember, every financial decision is a step towards achieving your financial goals.

Can I Get a Car Loan with a 723 Credit Score?

With a score of 723, you're likely to find a variety of car loan options available, as this credit score reflects a good credit history and responsible financial behavior. Lenders view credit scores in this range favorably, making it highly probable that you'll get approved for a car loan.

In terms of the car buying process, your score of 723 can also yield another benefit: potentially lower interest rates. Because a higher credit score implies lower risk to lenders, they may be willing to offer you a car loan with more favorable terms. This means that on top of approval, you could also see lower monthly payments and overall cost of the loan. Remember though, while your credit score plays a critical role, lenders also consider factors like income and debt levels. So, be sure to review all loan terms carefully to ensure you're getting the best deal.

What Factors Most Impact a 723 Credit Score?

Analyzing your credit score of 723 is the first step towards optimizing your financial status. The aspects affecting your score will differ from those with lower scores.

Credit Utilization Rate

Your credit utilization rate has significant bearing on your score. If you are using a high percentage of your available credit, this could be bringing your score down slightly.

How to Check: Scrutinize your current credit consumption in comparison to your credit limit. Strive to keep the balances below 30% of your credit limit for better score results.

Payment Consistency

Inconsistency in paying debt obligations might be a reason your score is not as high as you hoped.

How to Check: Inspect your credit report for any late or missed payments. Even a single late payment can influence your score sharply.

Credit Age

The age of your credit can impact your score. If you only recently started using credit, it may be inhibiting higher scores.

How to Check: Peruse your credit report for the age of your oldest credit account and consider if you've been opening many new accounts recently.

Types of Credit

Having a range of credit types can be favorable for your credit score. Lack of credit diversity might be a hindrance.

How to Check: Look at different credit types you have on your credit report. It’s beneficial to have a mix including credit cards, installment loans, and more.

Credit Inquiries

Multiple hard inquiries on your report could reflect negatively on your score. Therefore, it’s essential to apply for new credit cautiously.

How to Check: View your credit report for any recent hard inquiries. These remain on your record for two years.

How Do I Improve my 723 Credit Score?

With a credit score of 723, you’re in the ‘good’ category, but there are still ways to improve your financial standing. Consider these well-tailored strategies:

1. Check Your Credit Report Regularly

Ensure every detail on your credit report is correct. Any errors can affect your score and should be disputed immediately. Regular checks also help identify any fraudulent activity promptly.

2. Maintain Low Credit Card Balances

Your credit limit utilization plays a crucial role in your score. A lower balance gives a higher score. Always aim to keep your card balances well below 30% of your total limit.

3. Pay Bills Consistently On Time

Timely payment of bills is key for maintaining a good credit score. Even small bills like cell phone or utility payments can have a negative effect if paid late, so stay consistent.

4. Don’t Close Unused Credit Cards

Unless your unused cards charge annual fees, consider keeping them open. The length of your credit history and total available credit affects your score. An unused card can positively impact both of these factors.

5. Limit Inquiries for New Credit

Whenever you apply for credit, a hard inquiry is recorded on your credit report which can lower your score. Try limiting these except when truly necessary, and ensure you’re likely to be accepted before you apply.

Through mindful financial habits, you can continue to build a strong financial future.