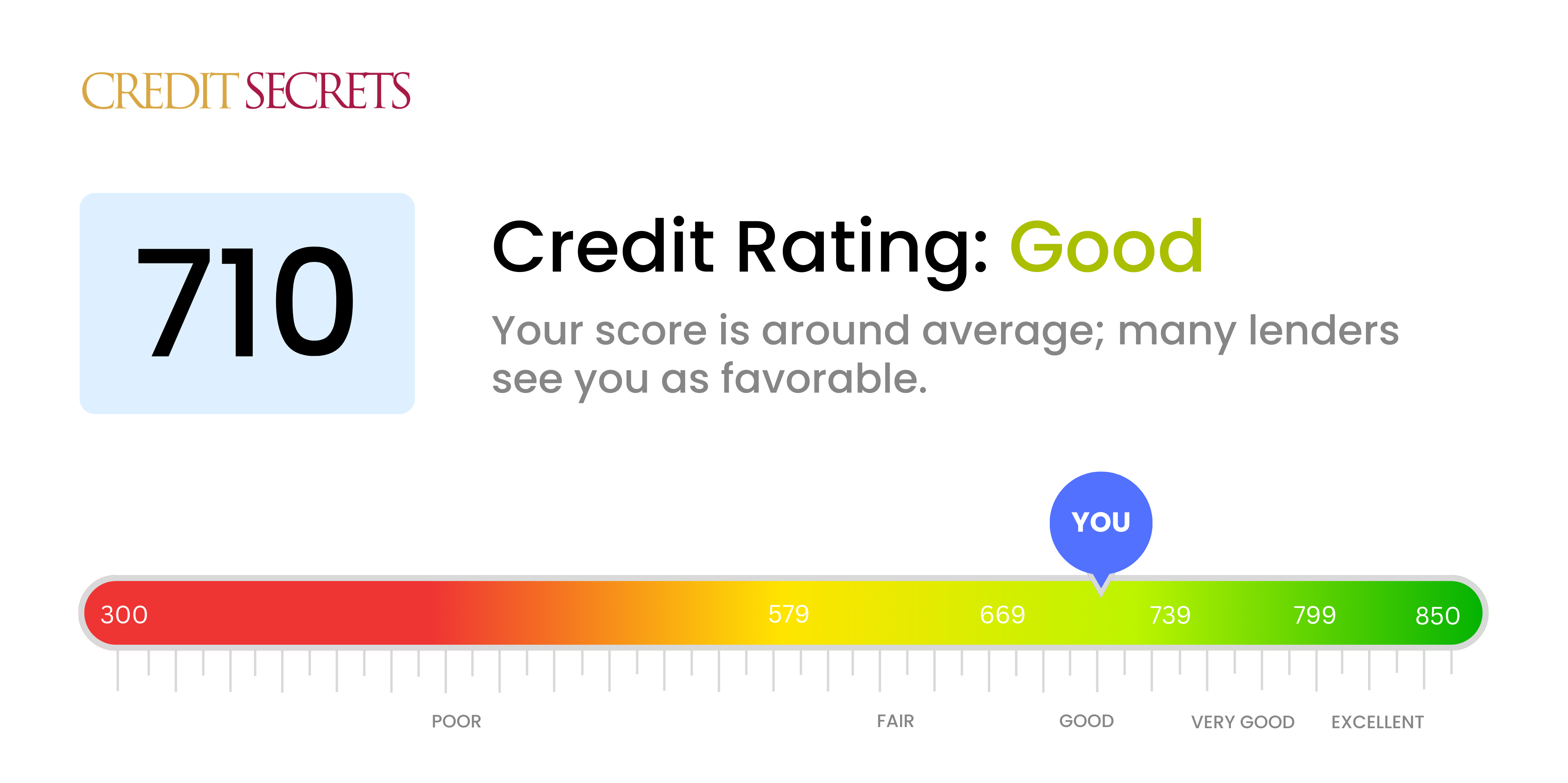

Is 710 a good credit score?

A credit score of 710 is considered a good rating according to the standard credit score range. While not quite making it into the 'very good' category, it still reflects a responsible credit history and can often result in favorable interest rates and lending options from financial institutions.

Being within the 'good' credit score range, you can expect to qualify for a variety of loans and credit cards, but you might not be offered the very best interest rates available. Despite this, keep in mind that everyone's credit situation is unique, and this score provides a solid foundation towards improving your financial future. It's a great starting point towards reaching the 'very good' or even 'excellent' credit score categories.

Can I Get a Mortgage with a 710 Credit Score?

If your credit score is 710, there is a good chance you will be approved for a mortgage. This score is within the good range, meaning it indicates you have a responsible credit history, which lenders favor. However, it's important to remember that while a good credit score increases your chances of mortgage approval, it doesn't guarantee it. Lenders consider other factors like income and level of debt.

The mortgage approval process can seem a bit daunting. You will need to gather significant documentation including proof of income and assets. The lender will review these along with your credit history and score to determine loan approval. It’s advised to have a clear understanding of your financial situation before applying. Additionally, while 710 is a good credit score, if you want better mortgage interest rates, you might want to consider boosting your score. Higher credit scores often secure lower interest rates, which can save you substantial money over the life of your mortgage.

Can I Get a Credit Card with a 710 Credit Score?

Having a credit score of 710 generally means you're in a good position to be approved for a credit card. It's not the highest possible score, but lenders typically view this as a sign of responsible financial behavior. This credit status deserves an appreciative nod - it shows that you've been managing your financial obligations well, resulting in lenders seeing you as a lower risk.

Given your decent score, a range of credit cards could be suitable for you. Starter credit cards or rewards cards might be a good option, especially if they offer benefits that match your lifestyle. There's also the potential to consider premium travel cards if you frequently fly or stay in hotels, as these can offer travel-related rewards. It's worth noting that interest rates are usually more favorable for people with a credit score at your level, reflecting the lower risk profile lenders see in you. However, it's still important to assess and compare credit card offers to find one that best fits your needs.

With a credit score of 710, you're situated in a favorable position to be approved for a personal loan. This score indicates a past history of responsible credit management, which lenders appreciate. It signals that you're likely to repay the loan as agreed upon. However, it's important to remember that your credit score isn't the only factor lenders consider. They usually take into account your income and existing debt, among other things.

As you embark on the personal loan application process, you can anticipate a relatively smooth journey given your credit score. However, keep in mind that the specific terms of your loan - like the interest rate and repayment period - can still vary based on the specific lender and your overall financial situation. Shopping around might help you secure better terms. A higher credit score typically translates to lower interest rates, which can save you a significant amount of money in the long run.

Can I Get a Car Loan with a 710 Credit Score?

With a credit score of 710, your chances of being approved for a car loan are quite good. Lenders typically look for credit scores above 660 and your score is well within that range. A score as high as yours indicates to lenders that you are a reliable borrower, which could lead to favorable loan conditions.

When it comes to the car purchasing process, your healthy credit score brings several advantages. You're likely to have more negotiating power when it comes to loan terms, including the interest rate and the repayment period. Additionally, your solid credit score may also give you access to a wider range of lenders, allowing you to shop around and find the deal that suits you best. However, it's still important to review all potential loan offers thoroughly, focusing particularly on the interest rate and repayment terms.

What Factors Most Impact a 710 Credit Score?

Deciphering a score of 710 opens the door to better financial stability. Comprehending the factors leading to this score can set the stage for future financial health. Each financial journey holds unique prospects for growth and development.

Payment Consistency

Regular, on-time payments heavily affect your credit score. If there are missed payments or other irregularities, they could be impacting your score negatively.

How to Check: Scrutinize your credit report for any missed or late payments. Compare these instances against your own understanding of your payment behavior.

Credit Utilization Ratio

Maintaining a sensible proportion between your credit usage and credit limit is crucial for a healthy score. High ratios could be negatively affecting your score.

How to Check: Check your credit card records for high balances. Striving to maintain low balances in relation to your credit limit can be beneficial.

Credit Tenure

Long-standing credit histories can positively influence your score. Recent or short credit histories might be pulling your score down.

How to Check: Go through your credit report to see the tenure of your oldest and most recent accounts, including the average age of all your accounts. Another aspect to consider is any recent new accounts you have opened.

Variety and Recency of Credit

Maintaining a diverse set of credit accounts and managing new credit efficiently are important for a healthy score.

How to Check: Review your credit report for the range of credit accounts you hold like credit cards, retail accounts, installment loans, and mortgage loans. Reflect on how frequently you have applied for new credit.

Public Records

Public records, such as legal judgements or tax liens, can negatively impact your score significantly.

How to Check: Look through your credit report for any public records listed. Resolve any issues you find promptly.

How Do I Improve my 710 Credit Score?

With a 710 credit score, you’re in a good position, but there’s always possibility for improvement. Let’s focus on the most accessible and impactful steps you can take to boost this score further:

1. Monitor Your Credit Report

Staying informed about the details of your credit report can help catch inaccuracies or identity theft early. Review your credit report at least once a year and promptly dispute any errors you spot.

2. Maintain Low Credit Utilization

Avoid maxing out your credit cards. Keeping your credit utilization ratio — the percentage of your credit limit you’re using — under 30% is key. This can reflect positively on your credit score over time.

3. Pay Bills on Time

One late payment can potentially decrease your score considerably. Consistent, on-time payments are critical to maintaining and improving your credit score.

4. Keep Old Credit Accounts Open

Longer credit history can positively impact your credit score. Even if you don’t use them regularly, keeping your oldest credit accounts open can extend your credit age.

5. Limit Hard Inquiries

To make a significant credit decision like providing a loan or credit card, lenders perform a hard credit inquiry which can temporarily lower your credit score. Limit the number of times you apply for new credit to avoid these dings to your credit score.