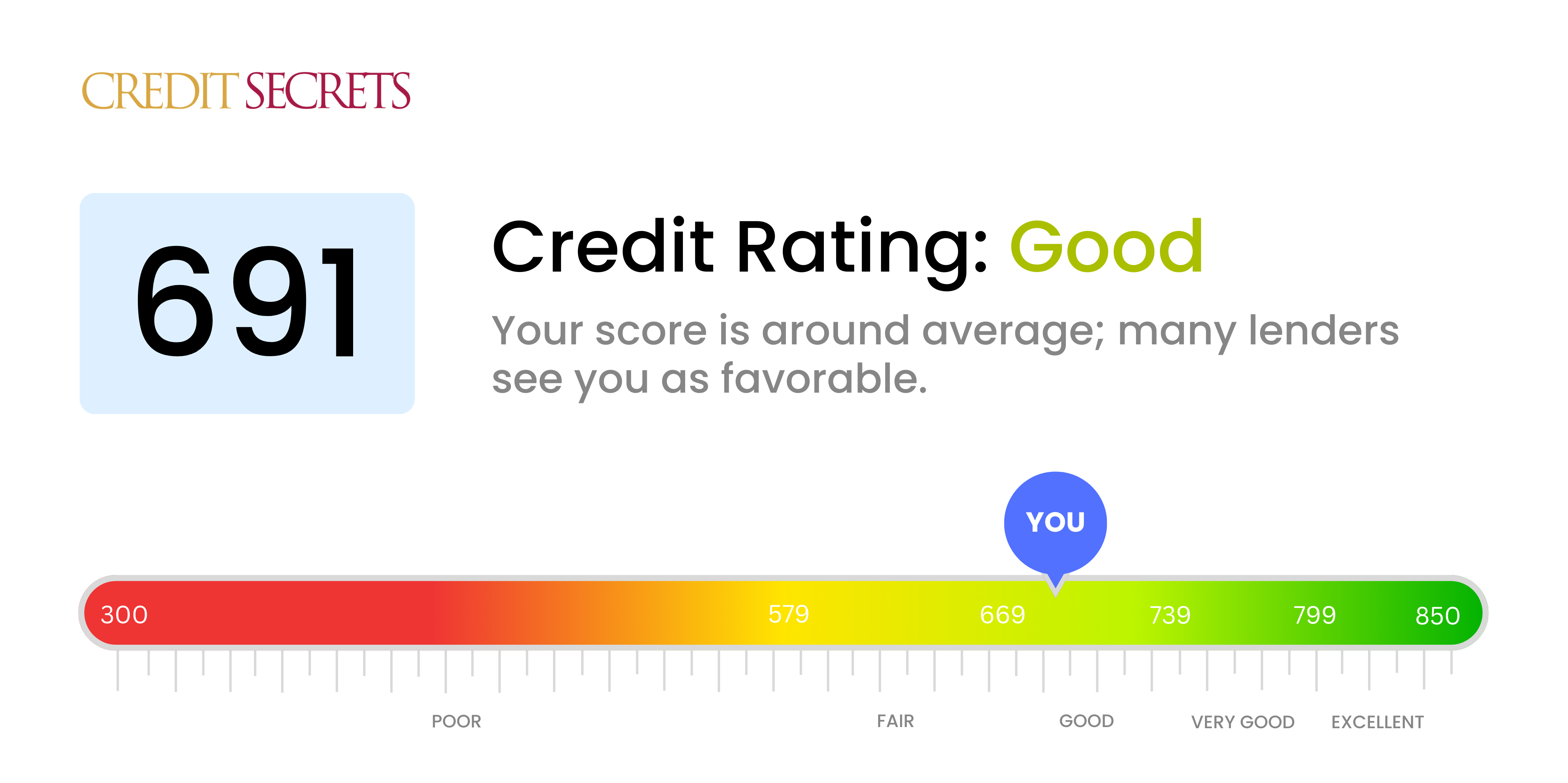

Is 691 a good credit score?

Your credit score of 691 falls into the category of 'Good'. This means you have decent financial responsibility. However, there's always room for improvement to get better interest rates and financial offers.

Expect that some lenders might consider you as a slightly risky borrower compared to those with 'Very Good' or 'Excellent' ratings. But don't worry, with a 'Good' credit score, you still have access to a variety of loans and credit, though you might not get the best interest rates. There are strides that can be taken to improve your credit score, and we're here to guide you through each step in a simple and understandable way.

Can I Get a Mortgage with a 691 Credit Score?

With a credit score of 691, you fall within the fair credit range. While this score doesn't necessarily disqualify you from being approved for a mortgage, it does not guarantee approval either. Lenders take into account more than just your credit score, including income, job stability, and debt-to-income ratio. However, your credit score will influence the type of interest rate you are offered.

Although approval is not a guarantee, it's not impossible. You may, however, face somewhat higher interest rates compared to individuals with stronger credit scores. Each lender has their own criteria, so don't be discouraged if one turns you down. There are various mortgage options available to people in your situation, such as FHA loans, which are government insured loans that allow for lower credit scores and smaller down payments. This might be a viable path for you to explore.

Can I Get a Credit Card with a 691 Credit Score?

Having a credit score of 691 is generally seen as fair by lenders. You are in the middle range and many credit card issuers may be likely to approve your application. It’s a stepping stone and with a little more attention to money management, this score could easily push over into the good category.

You might find that a wide range of credit cards are available to you, including balance transfer cards and even some rewards cards. However, typically, the most premium cards, which offer substantial rewards or travel perks, could be just out of reach. Whenever applying for new credit, it's a good idea to research the typical credit range of approved applicants to increase your chances of approval. One thing to note though, a card that suits your situation generally means one with a reasonable interest rate. With a score of 691, it's unlikely you'll be offered the lowest rates available.

When it comes to credit scores, a score of 691 falls into what most lenders consider the "fair" range. While it is not the worst score, it may present some challenges when you're trying to secure a personal loan. Lenders might see this score as a sign of moderate risk, which could lead to stricter loan requirements or higher interest rates.

But don't lose hope. Your score of 691 isn't a definitive 'no.' Instead, prepare for a more detailed application process where lenders scrutinize your financial history more than people with higher scores. In such a scenario, factors like your income history and recent payment patterns can play a pivotal role in approval. Be ready to show any trends of improved financial responsibility to strengthen your case. Remember, rates might be higher, but with consistent on-time payments, this loan could even provide an opportunity to boost your credit standing.

Can I Get a Car Loan with a 691 Credit Score?

Having a credit score of 691, you may actually find it easier to get approval for a car loan. Normally, lenders see scores above 660 and think more favorably about those borrowers. With your score of 691, you're comfortably above that threshold and that puts you in a fair credit category. This means that while you're not at the top of the credit range, you're not at the bottom either, which can be a relief.

As you prepare to navigate the car purchasing process, bear in mind the role your credit score plays. A decent credit score like yours may lead to a favorable interest rate. However, it's always wise to remember that the exact interest rate will vary based on the lender and other factors. Nonetheless, your current score places you in a decent position to secure a car loan. Be sure to read all the loan terms carefully and understand what your monthly payments will be before making any final decisions.

What Factors Most Impact a 691 Credit Score?

A credit score of 691 is within the "fair" range, but there's room for improvement to reach a "good" or "excellent" rating. Here are some domains you might want to attend to.

Payment History

While your score suggests that you likely have a fairly solid record of making payments on time, even one or two missed payments can decrease your score.

How to Check: Look carefully at your credit report. Spot any recent late payments that may somewhat blur your otherwise good payment history.

Credit Card Balances

Maintaining high balances on your credit cards can take a toll on your score. Optimally, your utilization rate should be below 30%.

How to Check: Check your credit card balances. Are they close to your credit limits? Strive to reduce these balances.

Length of Credit History

Your length of credit history might be relatively short at this score, impacting the credit age factor.

How to Check: Evaluate your credit report to see when you first opened your credit account. If it's recent, time and a solid payment record will help improve your score.

Credit Mix

A diversified credit mix can be favorable for your score. Having multiple types of credit can illustrate your ability to manage diverse financial responsibilities.

How to Check: Review your credit report. Do you have various types of credit, such as credit cards, auto loans, or mortgage loans?

Inquiries for New Credit

Frequent inquiries for new credit, particularly within a short span, can slightly dip your score.

How to Check: Check your report for recent hard inquiries. If there are many, attempt to limit new credit applications.

How Do I Improve my 691 Credit Score?

With a credit score of 691, you are on the cusp of achieving a good rating. There are specific strategies you can apply directly to your situation to improve your credit worthiness.

1. Review Your Credit Report Regularly

Knowledge is power. Ensure your credit reports from all three credit bureaus are accurate. Mistakes can happen, and these errors could drag down your score. If you spot any discrepancies, submit a dispute immediately.

2. Keep Credit Card Balances Low

A low credit utilization rate contributes positively to your credit score. Aim to use less than 30% of your credit limit. A lower percentage is even better. Making consistent, smaller payments throughout the month can help keep your running balance low.

3. Manage Your Payments

Your payment history carries significant weight in credit score calculation. Never miss a bill payment. Set reminders or automate payments from your bank account to always pay your bills on time.

4. Slow Down on New Credit

Applying for new credit cards or loans can result in a hard inquiry, temporarily lowering your score. If you’ve recently opened a new account, give it some time before applying for additional credit.

5. Maintain Older Credit Lines

The age of your credit history matters. If you have older credit cards that you no longer use, keep them open as long as they don’t carry annual fees or tempt you into overspending. This can bulk up your credit history and potentially raise your score.