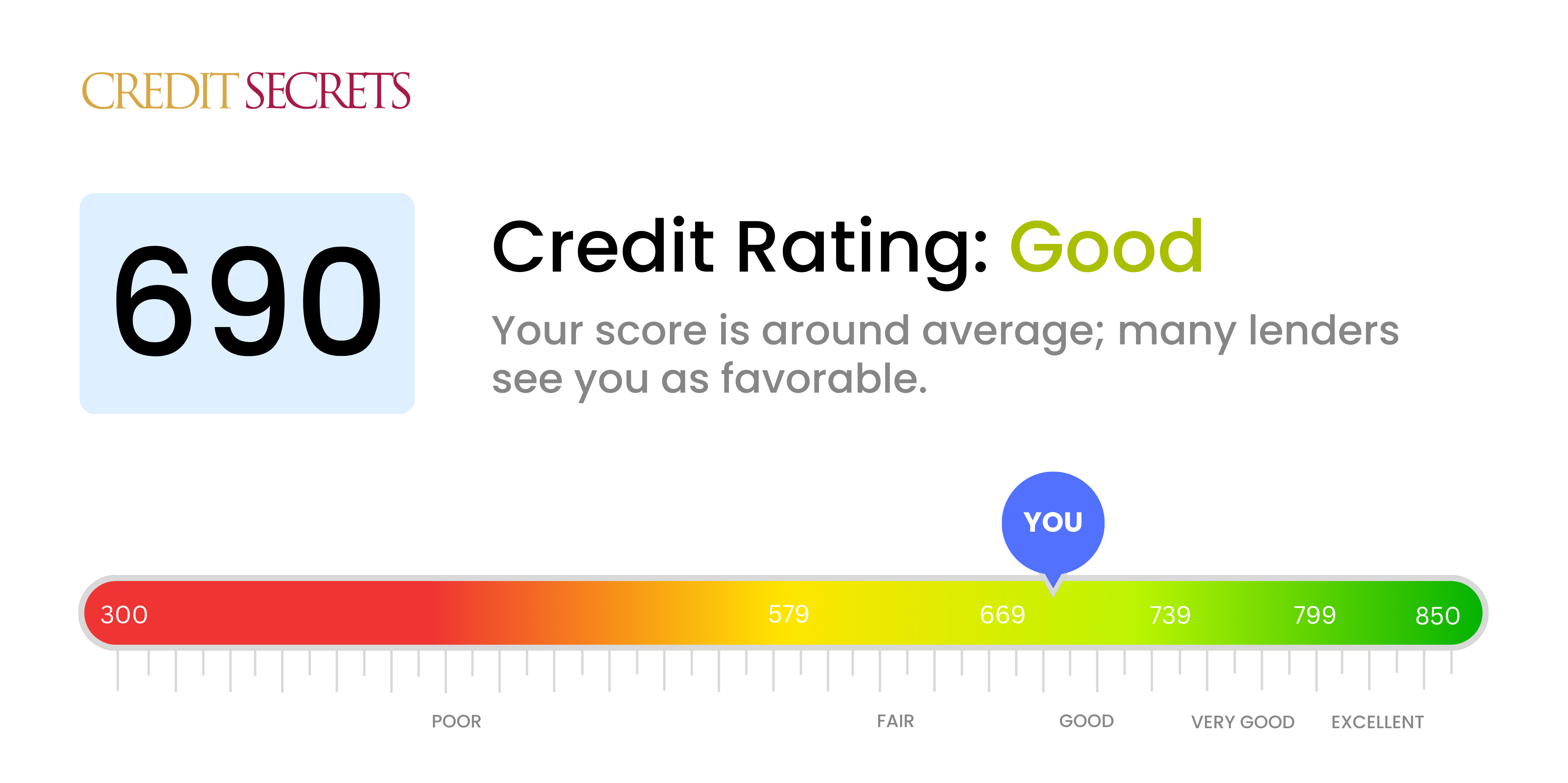

Is 690 a good credit score?

Your credit score of 690 lands in the "Good" category. This score does reflect responsible credit use and bill payment, but you might face some encounters of scrutiny while borrowing large sums, like for home mortgages or auto loans. However, you stand a reasonable chance of attaining credit cards and personal loans with favorable terms.

With a little effort, you can further improve this score and open up even more opportunities. Remember, the journey to a higher credit score involves consistent payments, reducing debt, and promptly addressing and correcting any errors on your credit report. The good news is, you already have a solid foundation, and with a touch more diligence and time, you are pretty close to securing a "Very Good" credit rating.

Can I Get a Mortgage with a 690 Credit Score?

With a credit score of 690, you may be eligible for a mortgage, but it's important to be aware of the finer details. This score is viewed as being on the border between fair and good, and this classification could likely influence the interest rates you're offered. Higher interest rates could result in larger monthly payments, and therefore, a bigger financial commitment.

During the mortgage approval process, lenders will consider additional factors such as income, employment history, and current debts. While a score of 690 might not garner the most favourable interest rates, it certainly doesn't eliminate the possibility of securing a mortgage. However, take caution when embarking on this financial journey; carefully consider your ability to manage potential higher payments and ensure your finances can comfortably accommodate this commitment.

Can I Get a Credit Card with a 690 Credit Score?

Having a credit score of 690 can seem like you're in a bit of a grey area. It's not a low score by any means, but it's not as high as it could be either. This might leave you feeling unsure about your chances of getting approved for a credit card. But the fact is, your score is likely to be looked upon favorably by many lenders. A score of 690 is typically considered fair and it indicates a reasonable degree of creditworthiness.

Due to this, you could be eligible for a decent range of credit cards. While a premium travel card might still remain slightly out of reach, regular credit cards and rewards cards could be viable options for you. Some companies might also consider you for their beginner cards, which often come with lower credit limits but less stringent approval requirements. Since your score is not in the top tier, remember that the interest rates might be a bit on the higher side. Also, try to regularly check your credit report to be aware of factors that might be holding your score back and make sure to always make your payments on time. Remember, each small step forward is progress on your journey towards improved credit.

A credit score of 690 might offer you some scope to secure a personal loan, but it might not be as straightforward as you'd like. This score is considered an average one, in the borderline category between good and bad. Lenders are inclined to take higher risk with average scores, but the approval is not guaranteed, and the terms may be less than ideal.

When applying for a personal loan, you should anticipate potentially higher interest rates and possibly more restrictive loan terms. This is because lenders see scores in the average range, like 690, as a somewhat higher risk. However, you certainly have a chance at loan approval, and it's important not to lose sight of this. While the process could be a bit more challenging, many have forged this path before you and have been successful. Be prepared for the possibility of more paperwork, the need for proof of stable income, and detailed scrutiny of your financial behaviors.

Can I Get a Car Loan with a 690 Credit Score?

If your credit score is 690, there's a good chance you can breath a sigh of relief when it comes to securing a car loan. Lenders often look for scores above 660 to grant favorable conditions, and with your score slightly above that, it demonstrates to them a lower level of risk. This means you've shown a consistent history of timely repayments and proven financial responsibility in the past.

As you move forward in your car purchasing journey, you're likely to encounter a smooth process. Lower interest rates typically accompany higher credit scores like yours. Therefore, you can expect to be offered reasonable rates on your car loan. However, keep in mind that it's always important to review the terms and conditions of any loan agreement meticulously. This is a winnable quest, don't take it lightly. It will affect your financial stability in the coming years. Go forth confidently, but thoughtfully, on your journey to car ownership.

What Factors Most Impact a 690 Credit Score?

Discovering the influences behind a score of 690 is key to enhancing your credit standing. By recognizing and addressing the factors associated with this score, you're setting the stage for solid financial growth.

Credit Utilization Ratio

Even with a score of 690, your credit utilization could still be affecting your score. When credit usage outweighs the limit excessively, it can lower your score.

How to Check: Assess your credit card report. Are you utilizing a significant portion of your available credit? It's generally advised to keep balances below 30% of your total limit.

Debt-to-Income Ratio

Your debt-to-income ratio may be influencing your score. This ratio measures how much of your income is going towards debt repayment.

How to Check: Calculate your monthly debt payments and compare this to your monthly pre-tax income. A high ratio can negatively affect your score.

Recent Credit Inquiries

Several recent credit inquiries could contribute to a lower score, as it might indicate high-risk behavior to lenders.

How to Check: Review your credit report for any recent hard inquiries, which could potentially lower your score.

Payment History

Although a score of 690 implies a generally good payment history, past financial mistakes or missed payments might still be impacting your score.

How to Check: Examine your credit report for any late payments. Even a single late payment can affect your score.

How Do I Improve my 690 Credit Score?

With a credit score of 690, you’re at the threshold of a good credit score. With measured action, the goal of a better score is attainable. Here are key steps specifically tailored to your circumstances:

1. Correct Errors on Your Credit Report

It’s crucial to regularly review and correct any mistakes on your credit report that may bring down your score. Contact the credit bureau and initiate disputes if you spot inaccuracies. A clean report can have a significant impact on your score.

2. Stay Within Your Credit Limit

Avoid maxing out your credit cards. Maintain a credit utilization ratio under 30%. This is the balance-to-limit ratio, and it should ideally be as low as possible. Consistently paying down debt will greatly benefit your score.

3. Establish Longevity of Credit

Keep your oldest credit card open provided it doesn’t carry an annual fee. Longer credit history can impact your score positively and demonstrate responsible credit management over time.

4. Timely Bill Payments

On-time payments hold considerable influence over your credit score. Setting up automated payments for your bills can ensure that you don’t inadvertently miss any payments.

5. Limit New Credit Applications

Refrequent hard inquiries into your credit can negatively affect your score. Apply for new credit sparingly to maintain your current score and avoid potential drops.