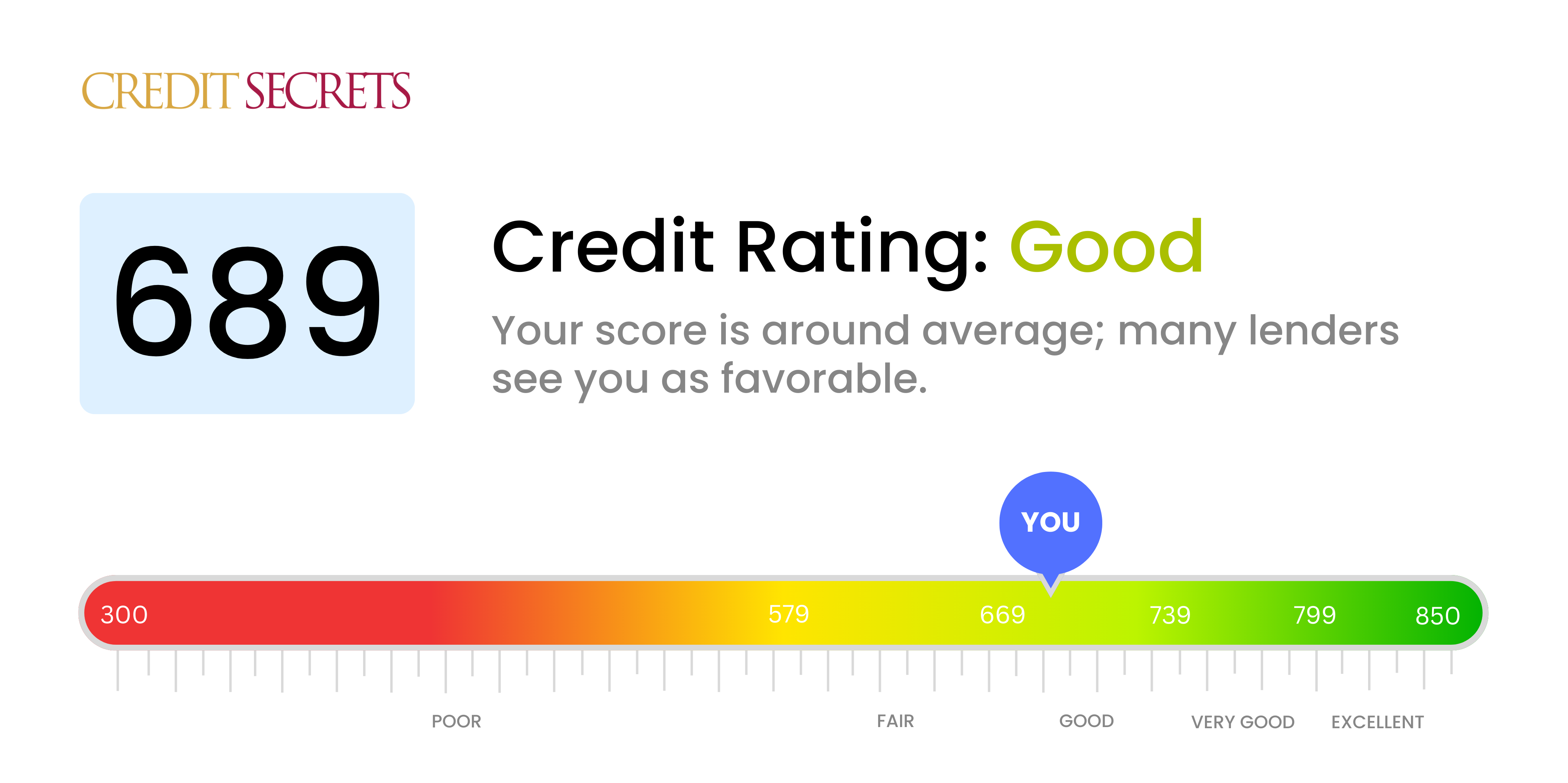

Is 689 a good credit score?

Your credit score of 689 slots into the 'Good' range on the typical credit scoring scale. This means you are generally seen as a lower risk to lenders and may have access to a wider range of credit options than those with lower scores, but you might not get the absolute best rates or terms offered by lenders.

While your current score shows responsible credit behavior, there's still room for improvement on your journey towards financial freedom. Strive to maintain good financial habits such as paying bills on time, keeping balances low, and only opening new credit accounts when necessary. This will help push your score closer to the 'Very Good' or 'Excellent' range over time, opening up even better opportunities for you in the future.

Can I Get a Mortgage with a 689 Credit Score?

If your credit score is around the 689 mark, you're in a position where obtaining a mortgage may be possible but potentially challenging. It's considered a fair credit score, and while it's not far off from being categorized as 'good,' some lenders may still view it as a risk. As a result, it might limit your options among some of the top-tier lenders.

However, it's important not to lose hope. Many lenders provide mortgages to individuals with fair credit scores, but you might face slightly higher interest rates compared to applicants with higher scores. It's crucial to shop around among different lenders to find the most suitable mortgage option for you. Remember, each lender has their unique criteria, and some may be more accommodating than others. Make sure you're prepared for the mortgage process, understanding that it can require detailed financial documentation and sometimes, even a down payment.

Can I Get a Credit Card with a 689 Credit Score?

A credit score of 689 can be seen as a mixed bag. It's certainly not the lowest, but there's still some room for improvement. On the bright side, despite being a little on the lower side, it's still very much possible to secure approval for a credit card. You should approach this situation with an understanding mindset and a pinch of realism. A lot rides on this, and being aware of your credit standing is vital even when it throws up some difficult realities.

As for what kind of credit card you can obtain, some might be out of your reach like premium travel cards that often require a higher credit score. However, you should have a decent chance at qualifying for a variety of cards perhaps leaning towards starter cards. These might not have all the bells and whistles of the top-tier cards, but it could be an excellent way to start building a more solid credit history, which in turn may allow for better options in the future. Remember, interest rates on these cards may be a bit higher due to the perceived risk associated to lenders. So, it's important to use such cards responsibly.

With a credit score of 689, your chances of being approved for a personal loan are fair. This score is near the threshold of 'good' as defined by many lenders, but it's not quite there. It's important to remember, though, that while your credit score is a key factor in a lender's decision, it's not the only one. Your income, debts, and other aspects of your financial health will also be considered.

Assuming you meet the other basic qualification requirements, you can certainly apply for a personal loan. The loan application process generally involves a hard credit inquiry, which could temporarily lower your credit score by a few points. Lenders will also review your income and debt-to-income ratio to ensure you can manage the loan repayments. Given your credit score, you may face slightly higher interest rates than someone with an excellent credit history. Nonetheless, you stand a reasonable chance of approval, but it's always a good idea to work on improving your credit score further.

Can I Get a Car Loan with a 689 Credit Score?

With a credit score of 689, the possibilities of acquiring a car loan are relatively good. This score is seen as fair in the eyes of many lenders. While above 660 is generally considered to be within the prime range, at 689, you are well above that marker. Keep in mind that while approval is likely, the terms may not be as favorable as those with scores well into the 700s.

Entering into the car purchasing process, you can expect that lenders might view your 689 credit score with some caution. This means that while you may easily secure a car loan, the interest rates could be slightly higher compared to borrowers with excellent credit scores. Understanding this, you might want to reassess your budget to include potential higher repayments. Remember that successfully paying off your car loan could become an opportunity to improve your credit score for the future.

What Factors Most Impact a 689 Credit Score?

Having a credit score of 689 can be the result of a few key factors that may be affecting your financial health. Addressing these factors can help you progress on your path to better financial standing as every individual's financial landscape offers room for growth and improvement.

Payment Track Record

Consistent on-time payments have a profound effect on credit scores. Any late or missed payments might be the reason for a 689 score.

How to Check: Look at your credit report for any missed or late payments. Consider past instances that your payments were late or unpaid, these might have impacted your score.

Credit Utilization Ratio

A high credit utilization ratio can negatively influence your score. If your credit card balances are near their capacities, this might be why you have a score of 689.

How to Check: Look at your credit card statements. Are the outstanding balances close to the credit limits? Striving to keep balances low in relation to the credit limit is beneficial.

Length of Credit History

Short credit history can lower your score.

How to Check: Check your credit report to determine the age of your oldest and latest accounts and the average age of all your accounts. Consider if you have opened new accounts recently.

Credit Diversification and New Credit

Diversifying your credit types and handling new credit responsibly are crucial for a good credit score.

How to Check: Assess your diversity of credit accounts, like credit cards, retail accounts, installment loans, and house loans. Consider if you have been prudent while applying for new credit.

Public Records

Public records such as bankruptcies or tax liens can significantly lower your score.

How to Check: Review your credit report for any public records. Activities like bankruptcies, foreclosures, lawsuits, wage attachments, liens, and judgments are considered public record and will damage your score.

How Do I Improve my 689 Credit Score?

With a credit score of 689, you’re on the edge of a “good” rating and just a few steps away from an even better one. Here are the best moves to make for maximum impact on your current credit score:

1. Regularly Monitor Your Credit Reports

Regularly review your credit reports from the top three credit bureaus for any inaccuracies. Erroneous information can drag down your score, and by contesting any errors right away, you can see an immediate improvement in your score. Request your free annual credit reports and examine them closely.

2. Work Towards Lower Credit Utilization

The amount of your credit line used, also known as your credit utilization ratio, majorly affects your credit score. Aim to keep your utilization under 30% of your credit limit and prioritize paying off cards with the highest utilization rates. Monitoring your utilization can prevent it from creeping up.

3. Manage Your Current Accounts Diligently

Focus on successfully managing all current lines of credit, including loans or credit cards. Your payment history has the maximum weightage on credit scores, so ensure every bill is paid before the due date. This consistent action over time will gradually improve your score.

4. Don’t Close Unused Credit Cards

Unless a card carries high fees, do not close old or inactive credit card accounts you have. They increase your available credit and can add to your credit history length, important factors in calculating your credit score.

5. Proceed with New Credit Carefully

If considering a car loan, mortgage, or consumer credit, plan strategically. Too many hard inquiries or new accounts can dent your credit score. Spacing out new credit applications can effectively help maintain your current score, while intelligently adding to your overall credit mix.